The Schwab Center for Financial Research (SCFR), which provides

top-quality research, timely market insights and practical guidance

for investors, today released its annual market outlook, Schwab

Market Perspective: 2025 Outlook, which highlights the most

important economic and market trends that investors should consider

for the year ahead.

The Schwab Market Perspective: 2025 Outlook provides

perspectives on U.S. stocks and the U.S. economy, fixed income,

corporate bonds, municipal bonds, and a global outlook. SCFR also

released its 2025 Planning and Wealth Management Outlook, which

provides guidance on how to stay on track in 2025 to help reach

your financial goals.

2025 U.S. Stocks and Economy

Outlook

“There will likely be myriad

economic crosscurrents at play in 2025, stemming from uncertainty

around tariff, immigration, and tax policies. On the pro-growth

side, the prospect of less-stringent regulations and lower taxes

are at odds with the prospect of aggressive hikes in tariffs on

imported goods and a major reduction in the labor force. For U.S.

equities, the upside is that momentum and breadth are strong

heading into the new year; but that doesn’t rule out more

volatility at the index level, which we think is much more likely

given the increased likelihood of stickier inflation and more

wobbles in the labor market.”

Liz Ann Sonders, Chief Investment

Strategist, and Kevin Gordon, Senior Investment Strategist, Charles

Schwab & Co., Inc.

2025 Fixed Income

Outlook

“It looks like another bumpy ride

is in store for fixed income investors in 2025, with a wide range

of potential outcomes. The bond market is caught between the

Federal Reserve's plans to cut interest rates, and the risks to

higher inflation and debt levels in 2025 from potential policy

decisions made in Washington D.C. We are taking a cautious approach

to duration and credit risk but recognize that periods of high

volatility and rising yields can provide an opportunity for

investors looking to capture more income over the long run.”

Kathy Jones, Chief Fixed Income

Strategist, Charles Schwab & Co., Inc.

2025 Corporate Bond

Outlook

“Our 2025 corporate bond outlook

in a nutshell: Strong fundamentals, rich valuations. Like the

resilient economy, corporations generally remain strong as profits

grow and cash balances rise. That's been a key driver of the

outperformance so far this year, as falling credit spreads have

pulled up corporate bond prices relative to Treasuries. That

performance will be tough to replicate because spreads are so

tight, but we still have a favorable view on corporate bond

investments given the strong economic backdrop.”

Collin Martin, Fixed Income

Strategist, Charles Schwab & Co., Inc.

2025 Municipal Bond

Outlook

“We expect the muni market to be

characterized by a tale of two half-years in 2025. Changes to tax

policy will likely dominate the first half of the year and then

munis should adjust over the second half of the year. We're

cautious about longer-term bonds and lower-rated issuers going into

2025. The outcome of the election has raised the probability that

inflation and yields move higher. Credit conditions for most

issuers are favorable and many issuers are entering 2025 with

strong reserves that they can tap into if there's a slowdown in

revenues.”

Cooper Howard, Fixed Income

Strategist, Charles Schwab & Co., Inc.

2025 Global Outlook

“2025 may bring hurdles for

stocks in the form of uncertain trade policy, tighter fiscal

policy, and slower than average growth in the global economy and

corporate earnings. All these may drive volatility. But improving

growth, along with a rise in stock valuations, may support solid

returns overall for international stocks in 2025, with differing

opportunities by region.”

Jeffrey Kleintop, Chief Global

Investment Strategist, Charles Schwab & Co., Inc.

2025 Planning and Wealth

Management Outlook

“With a new administration in

Washington that could bring changes to tax policy and influence

some economic factors, 2025 will likely be a year of 'shifting

gears' for investors. Perhaps that is a gradual shift, for example,

in how investors plan for taxes and manage concerns about

inflation. As a result, it’s our view that some investors may

choose to make small adjustments to their wealth management plans

in 2025, but in general, investors should keep in mind that the

most effective plans take the long view.”

Rob Williams, Managing Director

of Financial Planning, Retirement Income, and Wealth Management,

Charles Schwab & Co., Inc.

Learn more about the Schwab Center for Financial Research’s 2025

Market Outlook here and 2025 Planning and Wealth Management Outlook

here.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter/X, Facebook, and LinkedIn.

Disclosures:

The information here is for general informational purposes only

and should not be considered an individualized recommendation or

personalized investment advice. The type of securities and

investment strategies mentioned may not be suitable for everyone.

Each investor needs to review a security transaction for his or her

own particular situation.

Past performance is no guarantee of future results and the

opinions presented cannot be viewed as an indicator of future

performance.

Investing involves risk, including loss of principal.

International investments involve additional risks, which include

differences in financial accounting standards, currency

fluctuations, geopolitical risk, foreign taxes and regulations, and

the potential for illiquid markets. Investing in emerging markets

may accentuate these risks.

Fixed income securities are subject to increased loss of

principal during periods of rising interest rates. Fixed income

investments are subject to various other risks including changes in

credit quality, market valuations, liquidity, prepayments, early

redemption, corporate events, tax ramifications, and other factors.

Lower rated securities are subject to greater credit risk, default

risk, and liquidity risk.

Tax-exempt bonds are not necessarily a suitable investment for

all persons. Information related to a security's tax-exempt status

(federal and in-state) is obtained from third parties, and Charles

Schwab & Co., Inc. does not guarantee its accuracy. Tax-exempt

income may be subject to the Alternative Minimum Tax (AMT). Capital

appreciation from bond funds and discounted bonds may be subject to

state or local taxes. Capital gains are not exempt from federal

income tax.

The policy analysis provided by the Charles Schwab & Co.,

Inc., does not constitute and should not be interpreted as an

endorsement of any political party.

Diversification and asset allocation strategies do not ensure a

profit and cannot protect against losses in a declining market.

Forecasts contained herein are for illustrative purposes only,

may be based upon proprietary research and are developed through

analysis of historical public data.

All expressions of opinion are subject to change without notice

in reaction to shifting market conditions.

The information and content provided herein is general in nature

and is for informational purposes only. It is not intended, and

should not be construed, as a specific recommendation,

individualized tax, legal, or investment advice. Tax laws are

subject to change, either prospectively or retroactively. Where

specific advice is necessary or appropriate, individuals should

contact their own professional tax and investment advisors or other

professionals (CPA, Financial Planner, Investment Manager) to help

answer questions about specific situations or needs prior to taking

any action based upon this information.

The Schwab Center for Financial Research is a division of

Charles Schwab & Co., Inc.

The Charles Schwab Corporation provides a full range of

brokerage, banking and financial advisory services through its

operating subsidiaries. Its broker-dealer subsidiary, Charles

Schwab & Co. Inc. (Member SIPC), and its affiliates offer

investment services and products. Its banking subsidiary, Charles

Schwab Bank, SSB (member FDIC and an Equal Housing Lender),

provides deposit and lending services and products.

1224-B54M

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217126340/en/

Kaitlyn Campisi Charles Schwab 929-318-7957

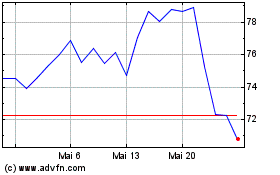

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

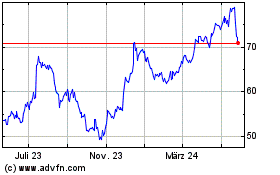

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025