The Schwab Mortgage-Backed Securities ETF (SMBS) Starts Trading

19 November 2024 - 3:00PM

Business Wire

Schwab Asset Management®, the asset management arm of The

Charles Schwab Corporation, announced the Schwab Mortgage-Backed

Securities ETF (NYSE Arca: SMBS) began trading today.

With an expense ratio of 0.03%, the Schwab Mortgage-Backed

Securities ETF is priced in line with the lowest-priced peer ETFs

based on the U.S. Mortgage Lipper category1. The ETF provides

access to investment-grade mortgage-backed securities issued and/or

guaranteed by U.S. government agencies.

The goal of the Schwab Mortgage-Backed Securities ETF is to

track as closely as possible, before fees and expenses, the total

return of the Bloomberg US MBS Float Adjusted Total Return Index.

The ETF invests in mortgage-backed pass-through securities

guaranteed by the Government National Mortgage Association (Ginnie

Mae), the Federal National Mortgage Association (Fannie Mae), and

the Federal Home Loan Mortgage Corporation (Freddie Mac) that are

backed by pools of mortgages.

The launch of the Schwab Mortgage-Backed Securities ETF occurs

when Schwab Asset Management is celebrating 15 years since entering

the ETF space. Since that time, Schwab Asset Management has become

the fifth-largest provider of ETFs2 and is known for its commitment

to low costs and taking a thoughtful approach to growing its

lineup. To learn more visit

www.schwabassetmanagement.com/about.

About Schwab Asset Management

One of the industry’s largest and most experienced asset

managers, Schwab Asset Management offers a focused lineup of

competitively priced ETFs, mutual funds and separately managed

account strategies designed to serve the central needs of most

investors. By operating through clients’ eyes, and putting them at

the center of our decisions, we aim to deliver exceptional

experiences to investors and the financial professionals who serve

them. As of September 30, 2024, Schwab Asset Management managed

approximately $1.3 trillion on a discretionary basis and $40.7

billion on a non-discretionary basis.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter/X, Facebook, and LinkedIn.

Disclosures:

Investors should consider carefully information contained in

the prospectus, or if available, the summary prospectus, including

investment objectives, risks, charges and expenses. You can obtain

a prospectus, or if available, a summary prospectus by visiting

https://www.schwabassetmanagement.com/prospectus. Please read it

carefully before investing.

Investment returns will fluctuate and are subject to market

volatility, so that an investor’s shares, when redeemed or sold,

may be worth more or less than their original cost. Unlike mutual

funds, shares of ETFs are not individually redeemable directly with

the ETF. Shares of ETF are bought and sold at market price, which

may be higher or lower than the net asset value (NAV).

Diversification and asset allocation strategies do not ensure a

profit and do not protect against losses in declining markets.

Fixed income securities are subject to increased loss of

principal during periods of rising interest rates. Fixed-income

investments are subject to various other risks including changes in

credit quality, market valuations, liquidity, prepayments, early

redemption, corporate events, tax ramifications and other

factors.

Mortgage-backed securities (MBS) may be more sensitive to

interest rate changes than other fixed income investments. They are

subject to extension risk, where borrowers extend the duration of

their mortgages as interest rates rise, and prepayment risk, where

borrowers pay off their mortgages earlier as interest rates fall.

These risks may reduce returns.

Certain U.S. government securities that the fund invests in are

not backed by the full faith and credit of the U.S. government,

which means they are neither issued nor guaranteed by the U.S.

Treasury. There can be no assurance that the U.S. government will

provide financial support to securities of its agencies and

instrumentalities if it is not obligated to do so under law. Also,

any government guarantees on securities the fund owns do not extend

to the shares of the fund itself.

Schwab Asset Management® is the dba name for Charles Schwab

Investment Management, Inc., the investment adviser for Schwab

Funds, Schwab ETFs, and separately managed account strategies.

Schwab Funds are distributed by Charles Schwab & Co, Inc.

(Schwab), Member SIPC. Schwab ETFs are distributed by SEI

Investments Distribution Co. (SIDCO). Schwab Asset Management and

Schwab are separate but affiliated companies and subsidiaries of

The Charles Schwab Corporation, and are not affiliated with

SIDCO.

__________________ 1 Source: Lipper, September 30, 2024. 2

Source: ETF.com, ETF League Table, November 8, 2024.

1124-5531

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119907055/en/

Christine Underhill Charles Schwab 415-961-3790

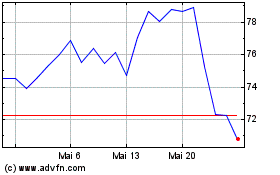

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

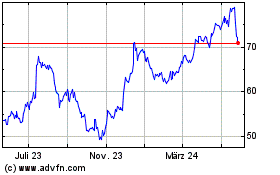

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

Von Dez 2023 bis Dez 2024