The Charles Schwab Corporation released its Monthly Activity

Report today. Company highlights for the month of November 2024

include:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241213004830/en/

- Core net new assets brought to the company by new and existing

clients totaled $28.8 billion. Net new assets excluding mutual fund

clearing totaled $24.1 billion.

- Total client assets equaled $10.31 trillion as of month-end

November, up 26% from November 2023 and up 5% compared to October

2024.

- Transactional sweep cash ended November at $393.7 billion – or

flat versus the prior month.

- Driven primarily by equity volumes, November daily average

trades increased by 20% month-over-month to 6.6 million.

- Full-year 2024 net revenue is currently expected to grow by

3.0% to 3.5% versus the prior year, reflecting a combination of

increased investor engagement, post-election equity market

strength, and the continued stabilization of client transactional

sweep cash balances. This represents an improvement from the 2.0%

to 3.0% revenue growth range previously communicated at the Fall

Business Update in October.

Forward-Looking Statements

This press release contains forward-looking statements relating

to 2024 net revenue. These forward-looking statements reflect

management’s expectations as of the date hereof. Achievement of

these expectations and objectives is subject to risks and

uncertainties that could cause actual results to differ materially

from the expressed expectations. Important factors that may cause

such differences are described in the company’s most recent reports

on Form 10-K and Form 10-Q, which have been filed with the

Securities and Exchange Commission and are available on the

company’s website (https://www.aboutschwab.com/financial-reports)

and on the Securities and Exchange Commission’s website

(https://www.sec.gov). The company makes no commitment to update

any forward-looking statements.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 36.2 million active brokerage

accounts, 5.4 million workplace plan participant accounts, 2.0

million banking accounts, and $10.31 trillion in client assets as

of November 30, 2024. Through its operating subsidiaries, the

company provides a full range of wealth management, securities

brokerage, banking, asset management, custody, and financial

advisory services to individual investors and independent

investment advisors. Its broker-dealer subsidiary, Charles Schwab

& Co., Inc. (member SIPC, https://www.sipc.org), and its

affiliates offer a complete range of investment services and

products including an extensive selection of mutual funds;

financial planning and investment advice; retirement plan and

equity compensation plan services; referrals to independent,

fee-based investment advisors; and custodial, operational and

trading support for independent, fee-based investment advisors

through Schwab Advisor Services. Its primary banking subsidiary,

Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender),

provides banking and lending services and products. More

information is available at https://www.aboutschwab.com.

The Charles Schwab Corporation Monthly Activity Report For

November 2024

2023

2024

Change Nov Dec

Jan Feb Mar

Apr May Jun

Jul Aug Sep

Oct Nov Mo.

Yr. Market Indices (at month

end) Dow Jones Industrial Average®

35,951

37,690

38,150

38,996

39,807

37,816

38,686

39,119

40,843

41,563

42,330

41,763

44,911

8%

25%

Nasdaq Composite®

14,226

15,011

15,164

16,092

16,379

15,658

16,735

17,733

17,599

17,714

18,189

18,095

19,218

6%

35%

Standard & Poor’s® 500

4,568

4,770

4,846

5,096

5,254

5,036

5,278

5,460

5,522

5,648

5,762

5,705

6,032

6%

32%

Client Assets (in billions of dollars)

Beginning Client Assets

7,653.4

8,180.6

8,516.6

8,558.1

8,879.5

9,118.4

8,847.5

9,206.3

9,407.5

9,572.1

9,737.7

9,920.5

9,852.0

Net New Assets (1)

19.2

42.1

14.8

31.7

41.7

10.0

31.0

33.2

29.0

31.5

30.3

22.7

25.5

12%

33%

Net Market Gains (Losses)

508.0

293.9

26.7

289.7

197.2

(280.9

)

327.8

168.0

135.6

134.1

152.5

(91.2

)

427.9

Total Client Assets (at month end)

8,180.6

8,516.6

8,558.1

8,879.5

9,118.4

8,847.5

9,206.3

9,407.5

9,572.1

9,737.7

9,920.5

9,852.0

10,305.4

5%

26%

Core Net New Assets (1,2)

21.7

43.1

17.2

33.4

45.0

1.0

31.1

29.1

29.0

32.8

33.5

24.6

28.8

17%

33%

Receiving Ongoing Advisory Services (at month end)

Investor Services

557.0

581.4

584.1

601.8

618.5

602.2

624.0

632.9

649.1

663.7

675.1

665.6

688.9

4%

24%

Advisor Services (3)

3,604.4

3,757.4

3,780.4

3,902.5

4,009.5

3,893.9

4,027.3

4,090.0

4,185.4

4,268.1

4,343.8

4,303.3

4,489.2

4%

25%

Client Accounts (at month end, in thousands)

Active Brokerage Accounts

34,672

34,838

35,017

35,127

35,301

35,426

35,524

35,612

35,743

35,859

35,982

36,073

36,222

-

4%

Banking Accounts

1,825

1,838

1,856

1,871

1,885

1,901

1,916

1,931

1,937

1,940

1,954

1,967

1,980

1%

8%

Workplace Plan Participant Accounts (4)

5,212

5,221

5,226

5,268

5,277

5,282

5,345

5,363

5,382

5,373

5,388

5,407

5,393

-

3%

Client Activity

New Brokerage Accounts (in thousands)

286

340

366

345

383

361

314

310

327

324

321

331

357

8%

25%

Client Cash as a Percentage of Client Assets (5)

10.7

%

10.5

%

10.5

%

10.2

%

10.0

%

10.2

%

9.9

%

9.7

%

9.6

%

9.5

%

9.5

%

9.8

%

9.5

%

(30) bp

(120) bp

Derivative Trades as a Percentage of Total Trades

23.1

%

21.8

%

21.8

%

22.2

%

21.9

%

22.1

%

21.9

%

21.3

%

21.2

%

20.8

%

21.5

%

21.4

%

19.7

%

(170) bp

(340) bp

Selected Average Balances (in millions of dollars)

Average Interest-Earning Assets (6)

439,118

446,305

443,694

434,822

431,456

423,532

415,950

417,150

417,379

420,191

420,203

422,327

425,789

1%

(3%)

Average Margin Balances

61,502

62,309

61,368

63,600

66,425

68,827

67,614

69,730

73,206

73,326

72,755

74,105

76,932

4%

25%

Average Bank Deposit Account Balances (7)

94,991

95,518

95,553

92,075

90,774

88,819

86,844

85,195

83,979

82,806

82,336

83,261

84,385

1%

(11%)

Mutual Fund and Exchange-Traded Fund Net Buys (Sells)

(8,9) (in millions of dollars) Equities

6,099

7,903

8,182

7,624

10,379

3,472

5,734

3,379

10,908

5,609

5,217

7,176

13,226

Hybrid

(1,466

)

(1,596

)

(501

)

(1,330

)

(439

)

(703

)

(558

)

(843

)

(1,155

)

(1,377

)

(432

)

(1,397

)

(329

)

Bonds

255

6,104

7,510

9,883

7,561

5,949

5,854

6,346

8,651

10,919

11,015

10,442

7,473

Net Buy (Sell) Activity (in millions of dollars) Mutual

Funds (8)

(9,267

)

(7,406

)

(966

)

(1,348

)

(1,607

)

(4,818

)

(5,544

)

(4,254

)

(4,679

)

(4,003

)

(1,261

)

(4,905

)

(4,492

)

Exchange-Traded Funds (9)

14,155

19,817

16,157

17,525

19,108

13,536

16,574

13,136

23,083

19,154

17,061

21,126

24,862

Money Market Funds

11,670

7,745

11,717

10,129

9,085

(2,357

)

9,790

3,858

9,110

8,048

9,672

11,032

9,172

Note: Certain supplemental details related

to the information above can be found at:

https://www.aboutschwab.com/financial-reports.

(1)

Unless otherwise noted, differences

between net new assets and core net new assets are net flows from

off-platform Schwab Bank Retail CDs. 2024 also includes an inflow

of $10.3 billion from a mutual fund clearing services client in

April and outflows from a large international relationship of $0.1

billion in August, $0.3 billion in October, and $0.6 billion in

November. 2023 also includes outflows from a large international

relationship of $5.4 billion in November, and $0.6 billion in

December.

(2)

Net new assets before significant one-time

inflows or outflows, such as acquisitions/divestitures or

extraordinary flows (generally greater than $10 billion) relating

to a specific client, and activity from off-platform Schwab Bank

Retail CDs. These flows may span multiple reporting periods.

(3)

Excludes Retirement Business Services.

(4)

Includes accounts in Stock Plan Services,

Designated Brokerage Services, and Retirement Business Services;

Participants may be enrolled in services in more than one Workplace

business.

(5)

Schwab One®, certain cash equivalents,

bank deposits, third-party bank deposit accounts, and money market

fund balances as a percentage of total client assets; client cash

excludes brokered CDs issued by Charles Schwab Bank.

(6)

Represents average total interest-earning

assets on the Company's balance sheet.

(7)

Represents average clients’ uninvested

cash sweep account balances held in deposit accounts at third-party

financial institutions.

(8)

Represents the principal value of client

mutual fund transactions handled by Schwab, including transactions

in proprietary funds. Includes institutional funds available only

to Investment Managers. Excludes money market fund

transactions.

(9)

Represents the principal value of client

ETF transactions handled by Schwab, including transactions in

proprietary ETFs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241213004830/en/

MEDIA: Mayura Hooper Charles Schwab Phone:

415-667-1525

INVESTORS/ANALYSTS: Jeff Edwards Charles Schwab Phone:

817-854-6177

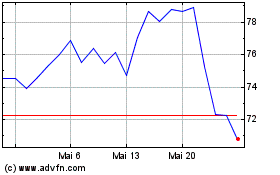

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

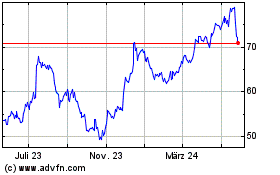

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025