A stronger business model for new

developments

Continued strong growth momentum in 2023

- Revenue doubled to €82.5 million

- Solid backlog1 at €37.5 million

Outstanding financial performance in 2023

- EBITDA triples to €12.9 million, vs. €4.2 million in 2022

- Consolidated EBITDA rate of 15.7%, significantly improved

compared to 2022 (10.2%) and outperforming the target of 14%

- Net result 2023 increased sharply to €7.6 million, vs. €2.2

million in 2022

A stronger business model

- Successful launch of the new trackers range

- Major multi-year customer commitments in the industry/local

authorities business line

- Signing of the first agrisolar contract

Short and medium terms financial targets confirmed

- 2024: revenue above €110 million and EBITDA rate over 16%

- 2026: revenue of €175 million and EBITDA rate of about 20%

Regulatory News:

Groupe OKWIND (FR0013439627 – ALOKW), which is

specialized in the design, manufacture and sale of smart energy

generation and management systems dedicated to self-consumption,

today announces its consolidated 2023 results and its revenue for

the first quarter of 2024, as approved by the Board of Directors on

April 23, 2024.

Louis MAURICE, Founder and Chairman of Groupe OKWIND,

comments: “During the 2023 financial year, Groupe OKWIND delivered

a solid commercial and financial performance, reflecting the

relevance of its positioning in favor of individual and collective

energy self-consumption. As part of our ongoing development

strategy, in early 2024, we secured major multi-year commitments in

the industry/local authorities business line. Thanks to these

achievements, the Group now has the organization and resources

needed to tackle the new phase of growth that is ahead and has

confirmed all its financial targets set for 2024 and 2026".

Simplified income statement

in €million

12/2023

12/2022

Change in %

Revenue

82.5

41.8

+97%

of which BtoB

75.2

37.1

+103%

of which BtoC

7.2

4.7

+54%

Other operating income

1.4

2.4

-39%

Purchases consumed

(40.0)

(21.4)

+87%

Personnel costs

(14.1)

(9.3)

+52%

Other operating expenses

(16.4)

(8.9)

+84%

Taxes

(0.4)

(0.3)

+39%

EBITDA

12.9

4.2

+204%

Net changes in depreciation and

amortization

(2.5)

(1.2)

+118%

Operating profit

10.4

3.1

+237%

Financial expenses and income

(0.4)

(0.5)

-26%

Non-recurring expenses and income

(0.1)

(0.1)

+38%

Income tax

(2.4)

(0.3)

n.s.

Net income (group share)

7.6

2.2

+244%

2023 financial year marked by sustained business level and a

significant improvement in profitability

Over the course of the 2023 financial year, Groupe OKWIND

experienced strong growth in revenue, partly benefiting from the

extremely tight environment affecting electricity prices at the end

of 2022/2023. The Groupe recorded historical growth in sales in the

three strategic business lines (farms, industry/local authorities,

and individuals) and a significant improvement in profitability

compared to 2022.

The 2023 revenue set at €82.5 million, up +97% compared with

2022 and breaks down as follows:

- 91% of revenue from the BtoB segment: €75.2

million, up +103%, - 9% of revenue from the BtoC segment: €7.2

million, improving by +54%.

The strong growth in revenue was coupled with tight control over

purchasing, and improved productivity, enabling the Group to

deliver a gross margin of 51.1%. EBITDA for 2023 surges to €12.9

million, compared with €4.2 million in 2022. This improvement,

mainly driven by the BtoB segment, enables the Group to post a

consolidated EBITDA rate of 15.7%, up 5.5 points on 2022 (10.2%),

outperforming the target of 14%.

Groupe OKWIND’s consolidated net profit for 2023 came to €7.6

million, compared with €2.2 million in 2022, after taking into

account income tax of €2.4 million, compared with €0.3 million in

2022.

Financing and cash position as of December 31, 2023

Groupe OKWIND subscribed to a syndicated credit facility for a

total of €25 million, consisting of a €10 million revolving credit

facility to finance working capital requirements. To date, €8.1

million of this facility has been drawn down. The Group has also a

medium-term credit facility of €15 million, which has not been

drawn down at the date of publication of this press release.

Furthermore, as of December 31, 2023, Groupe OKWIND has

available cash 2of €14 million to finance the development of its

business.

First quarter 2024 activity

in €million

03/2024

03/2023

Change in %

Revenue

15.1

17.5

-14%

of which BtoB

13.5

15.0

-10%

of which BtoC

1.6

2.5

-36%

As of March 31, 2024, Groupe OKWIND recorded revenue of €15.1

million, compared with €17.5 million at end of March 2023. Firm

order intake amounted to €16.7 million, compared with €30 million

as of March 31, 2023. As a reminder, the first quarter of 2023 had

seen particularly sustained and non-standard momentum, in a context

of electricity prices reaching historically high levels. In

addition, the one-off slowdown in the farm business was caused by

two phenomena: the economic and social crisis affecting this

sector, and particularly adverse weather conditions. The backlog

stood at €36.9 million as of March 31, 2024.

Strengthening of the model and strategic positioning to

pursue growth

Shift in business mix

Groupe OKWIND has continued to develop its activities in line

with its strategic orientations, especially through developments in

the industry/local authority business line. This business segment

is characterized by larger-scale projects and multi-year customer

commitments.

In 2024, the Group's sales momentum will evolve towards a more

balanced sector mix, breaking down as follows: farms at 60% (vs.

83% in 2023), industry/local authorities (including water and

sanitation) at 30% (vs. 8% in 2023) and business with individuals

should remain stable at 10%, unchanged from 2023.

Continued CSR commitments: sharp reduction in greenhouse gas

emissions

In 2023, the Group has continued to reducing its greenhouse gas

emissions (decarbonation strategy) in line with the objectives of

the CSRD and the SBTi trajectory. Groupe OKWIND has thus reduced

its carbon intensity by around -39% (Scope 1 and 2) and has carried

out the Scope 3 assessment.

Thanks to a structured and rigorous approach, the carbon

footprint of kWh produced by OKWIND trackers (TREA 40000) is now

the lowest on the photovoltaic market (at 24.4gCO2e/kWh), almost

twice as low as the French photovoltaic average (ADEME average:

43.9gCO2e/kWh).

2024 outlook confirmed

Groupe OKWIND should step up its order intake over the next few

quarters, particularly in the industry/local authority and

agrisolar markets. In the farm sector, the Group expects sales

momentum to pick up from the second quarter of 2024 onwards.

The Group will continue to invest in R&D to consolidate its

technological leadership, as demonstrated by the successful launch

at the end of 2023 of its new range of trackers (TREA 40000) with

enhanced performance. In 2024, Groupe OKWIND will continue to

develop its product range with the first ESS (Energy Storage

System) installations.

Groupe OKWIND confirms all its short and medium terms financial

targets, with the achievement of revenue above €110 million and a

consolidated EBITDA rate above 16% in 2024. The Groupe also

confirms that it will achieve its 2026 targets, with revenue of

€175 million and consolidated EBITDA rate of around 20%.

Availability of 2023 financial report

The annual statements were approved by the Board of Directors

and reviewed on April 23, 2024. The 2023 annual financial report

will be available no later than April 30, 2024 on the Investor

Relations website (www.okwind-finance.com), in the “Documentation”

section.

Next financial events:

- Annual General Meeting: June 18, 2024

- Publication of 2024 Second Quarter and First-Half revenue,

on July 24, 2024 (after market close)

About Groupe OKWIND

Founded in 2009 by Louis Maurice, Chairman and CEO, Groupe

OKWIND develops solutions for the production and consumption of

green energy in short supply chains. Our comprehensive approach,

combining energy generation and management, aims to strengthen

energy autonomy and thus accelerate the ecological transition.

Thanks to its unique technological ecosystem, Groupe OKWIND enables

self-consumption to assert itself as a new avenue for energy. A

solution that can be quickly deployed, managed in real time and at

a competitive price, without subsidies. Every day, we work to

deploy local, low-carbon, fixed-cost energy for professionals and

individuals. In 2023, Groupe OKWIND generated consolidated revenue

of €82.5 million and today has 220 employees, with more than 3,700

installations throughout France.

For more information: www.okwind.fr

1 The backlog corresponds to orders for which a purchase

order has been signed, some of which are invoiced on delivery and

the remainder on commissioning of the trackers.

2 Cash and cash equivalents include available cash, bank

overdrafts and short-term marketable securities as of December 31,

2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423651795/en/

Groupe OKWIND Investor Relations investors@okwind.fr

NewCap Thomas Grojean/Aurélie Manavarere Investor

Relations okwind@newcap.eu T.: +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations okwind@newcap.eu

T.: +331 44 71 94 98

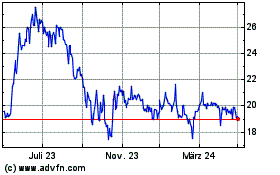

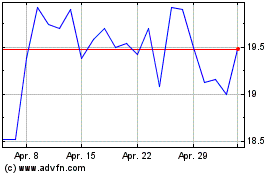

Groupe Okwind (EU:ALOKW)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Groupe Okwind (EU:ALOKW)

Historical Stock Chart

Von Mai 2023 bis Mai 2024