Spectrum Brands Holdings, Inc. (NYSE: SPB), a leading global

branded consumer products and home essentials company focused on

driving innovation and providing exceptional customer service,

announced today that its wholly-owned subsidiary, Spectrum Brands,

Inc. (“Spectrum Brands”), has commenced (i) a cash tender offer

(the “Tender Offer”) of up to an aggregate principal amount of its

outstanding 4.00% Senior Notes due 2026 (the “2026 Notes” or the

“Euro Notes”), 5.00% Senior Notes due 2029 (the “2029 Notes”),

5.50% Senior Notes due 2030 (the “2030 Notes”) and 3.875% Senior

Notes due 2031 (the “2031 Notes” and, together with the 2026 Notes,

the 2029 Notes and the 2030 Notes, the “Notes,” and each, a

“Series”) that may be purchased for a combined aggregate purchase

price of up to $925.0 million (including accrued and unpaid

interest, which also will be paid to, but excluding, the Early

Tender Settlement Date or the Final Settlement Date (each as

defined below), as the case may be, but excluding fees and expenses

relating to the Tender Offer). Spectrum Brands has the discretion

to upsize the Tender Offer.

Concurrently with the Tender Offer, Spectrum Brands is

soliciting consents (the “Consent Solicitation”) (i) from Holders

of the 2026 Notes to certain proposed amendments to the indenture

governing the 2026 Notes, dated as of September 20, 2016, as

supplemented (the “2026 Notes Indenture”), (ii) from Holders of the

2029 Notes to certain proposed amendments to the indenture

governing the 2029 Notes, dated as of September 24, 2019, as

supplemented (the “2029 Notes Indenture”), and (iii) from Holders

of the 2030 Notes to certain proposed amendments to the indenture

governing the 2030 Notes, dated as of June 30, 2020, as

supplemented (the “2030 Notes Indenture”) (such proposed amendments

are collectively referred to as the “Proposed Amendments” and such

consents being solicited are each a “Consent” and collectively, the

“Consents”). Spectrum Brands is not soliciting any Consents from

Holders of the 2031 Notes. The Proposed Amendments, if consummated,

would amend each of the 2026 Notes Indenture, the 2029 Notes

Indenture and the 2030 Notes Indenture, as applicable, to shorten

the notice periods for the redemption of such Notes and eliminate

substantially all of the restrictive covenants and certain events

of default.

Upon the terms and subject to the conditions set forth in the

Offer to Purchase and Consent Solicitation Statement relating to

the Notes (as it may be amended or supplemented from time to time,

the “Notes Statement”), Spectrum Brands will pay to each Holder who

validly tenders (and does not validly withdraw) their Notes and, if

applicable, thereby validly delivers (and does not validly revoke)

Consents prior to 5:00 p.m., New York City time, on June 3, 2024

(the “Early Tender Time”), an amount in cash equal to the “Total

Consideration” (inclusive of the “Early Tender Payment”) specified

in the table below. Tendered Notes may be withdrawn any time prior

to 5:00 p.m., New York City time, on June 3, 2024. Holders who

validly tender (and do not validly withdraw) their Notes prior to

the Early Tender Time will also be entitled to receive the Total

Consideration (inclusive of the Early Tender Payment) specified in

the table below on the Early Tender Settlement Date (as defined

below) if such Notes are accepted for purchase. The “Early Tender

Settlement Date” for the Tender Offer will follow the Early Tender

Time and is expected to be June 18, 2024. Holders who validly

tender (and do not validly withdraw) their Notes after the Early

Tender Time but prior to the Expiration Time (as defined below)

will be entitled to receive the “Tender Offer Consideration”

specified in the table below on the Final Settlement Date (as

defined below) if such Notes are accepted for purchase. The Tender

Offer Consideration is the Total Consideration minus the Early

Tender Payment. Holders will also be paid accrued and unpaid

interest, if any, on their Notes from the last interest payment

date up to, but not including, the Early Tender Settlement Date or

the Final Settlement Date (as the case may be) for all of their

Notes that Spectrum Brands accepts for purchase in the Tender

Offer. The Total Consideration (inclusive of the Early Tender

Payment) and the Tender Offer Consideration for each $1,000

principal amount of the 2031 Notes validly tendered and accepted

for purchase will be determined in the manner described in the

Notes Statement by reference to the Fixed Spread specified in the

table below over the yield to maturity based on the bid-side price

of the Reference Treasury Security specified in the table below, in

accordance with standard market practice at 11:00 a.m., New York

City time, on the business day following the Early Tender Time,

expected to be June 4, 2024.

The Tender Offer and Consent Solicitation are scheduled to

expire at 5:00 p.m., New York City time, on June 18, 2024, unless

extended, earlier terminated or (in the case of the Consent

Solicitation) earlier expired by Spectrum Brands in its sole

discretion (the “Expiration Time”). The “Final Settlement Date” for

the Tender Offer will promptly follow the Expiration Time and is

expected to be June 21, 2024. Other information relating to the

Tender Offer is listed in the table below.

Title of Security

Security

Identifiers(1)

Principal Amount of Notes

Outstanding

Acceptance Priority

Level

Reference Treasury

Security

Bloomberg Reference

Page

Fixed Spread (bps)

Tender Offer

Consideration(2)

Early Tender

Payment(3)

Total Consideration(4)

4.00% Senior Notes due 2026

ISIN No. XS1493295874 /

XS1493296500

Common Code

149329587/

149329650

€425,000,000

1

N/A

N/A

N/A

€950.00

€50.00

€1,000.00

5.00% Senior Notes due 2029

CUSIP No. 84762L AV7 / U84569

AK5, ISIN No. US84762LAV71 / USU84569AK55

$289,089,000

2

N/A

N/A

N/A

$950.00

$50.00

$1,000.00

5.50% Senior Notes due 2030

CUSIP No. 84762L AW5 / U84569

AL3, ISIN No. US84762LAW54 / USU84569AL39

$155,719,000

3

N/A

N/A

N/A

$950.00

$50.00

$1,000.00

3.875% Senior Notes due 2031

CUSIP No. 84762L AX3 / U84569 AM1

ISIN No. US84762LAX38 / USU84569AM12

$413,715,000

4

4.25% U.S. Treasury due February

28, 2031

FIT6

+0

N/A

$50.00

N/A

____________________

(1)

No representation is made as to

the correctness or accuracy of the security identifiers listed in

this table or printed on the Notes. They are provided solely for

the convenience of Holders of the Notes.

(2)

Per $1,000 or €1,000 principal

amount of Notes (as applicable) validly tendered and accepted for

purchase for each Series, and not validly withdrawn at or prior to

the Expiration Time. Excludes accrued and unpaid interest, which

also will be paid to, but excluding, the Final Settlement Date.

(3)

Per $1,000 or €1,000 principal

amount of Notes (as applicable) validly tendered and accepted for

purchase for each Series, and not validly withdrawn at or prior to

the Early Tender Time.

(4)

Per $1,000 or €1,000 principal

amount of Notes (as applicable) validly tendered and accepted for

purchase for each Series, and not validly withdrawn at or prior to

the Early Tender Time. Includes the Early Tender Payment, but

excludes accrued and unpaid interest, which also will be paid to,

but excluding, the Early Tender Settlement Date.

General Information

Spectrum Brands’ obligations to complete the Tender Offer and

Consent Solicitation are subject to and conditioned upon the

satisfaction or waiver by Spectrum Brands of certain conditions,

including the General Conditions, the Supplemental Indenture

Conditions and the Total Consideration Condition (each as described

in the Notes Statement), as applicable to a Series of Notes. There

can be no assurance that either of the Tender Offer or Consent

Solicitation will be consummated. Spectrum Brands may amend, extend

or terminate the Tender Offer and Consent Solicitation, in its sole

discretion.

Subject to the Maximum Tender Offer Amount, the Notes accepted

for purchase on the Early Tender Settlement Date or the Final

Settlement Date, as applicable, will be accepted in accordance with

their respective Acceptance Priority Levels (in numerical order

with “1” being the highest Acceptance Priority Level) as set forth

in the table above. Subject to the Maximum Tender Offer Amount, all

Notes validly tendered and not validly withdrawn at or prior to the

Early Tender Time will be accepted for purchase in priority to

Notes validly tendered after the Early Tender Time but at or prior

to the Expiration Time, even if such Notes validly tendered after

the Early Tender Time but at or prior to the Expiration Time have a

higher Acceptance Priority Level than the Notes validly tendered

and not validly withdrawn at or prior to the Early Tender Time.

Furthermore, if Spectrum Brands purchases the Maximum Tender Offer

Amount of Notes on the Early Tender Settlement Date, Holders who

validly tender Notes after the Early Tender Time but on or before

the Expiration Time will not have any of their Notes accepted for

purchase. The Tender Offer may be subject to proration if the

aggregate purchase price (including principal and premium and

accrued and unpaid interest) of the Notes that are validly tendered

and not validly withdrawn is greater than the amount of Notes that

may be purchased for the Maximum Tender Offer Amount.

Spectrum Brands intends to fund the Total Consideration

(inclusive of the Early Tender Payment) and the Tender Offer

Consideration (including, in each case, accrued and unpaid interest

paid), plus all related fees and expenses, using cash on hand,

including proceeds from asset sales, proceeds from the liquidation

of short-term investments, and, if necessary, borrowings under its

revolving facility under its Amended and Restated Credit Agreement,

dated June 30, 2020, as amended through the date hereof. Notes that

are tendered and accepted in the Tender Offer will cease to be

outstanding and will be cancelled.

The terms and conditions of the Tender Offer are described in

the Notes Statement.

If less than all of the 2026 Notes, the 2029 Notes and the 2030

Notes are validly tendered and accepted for purchase in the Tender

Offer or Spectrum Brands does not receive sufficient consents to

effect the proposed amendments to the indentures governing such

Series, Spectrum Brands may be required to make subsequent offers

(“Asset Sale Offers”) pursuant to the requirements of the

“Limitation on Asset Sales” covenant in the respective indentures

governing such Series at a purchase price of 100.0% of the

principal amount of such Notes plus accrued and unpaid interest

using the net proceeds of the divestiture of Spectrum Brands’

Hardware and Home Improvement segment, completed on June 20, 2023,

that remain available for such Asset Sale Offers, if they are

required to be made.

Depending on the outcome of the Tender Offer for the 2026 Notes,

the 2029 Notes and the 2030 Notes, all or a significant amount of

the 2031 Notes may remain outstanding following the completion of

the Tender Offer. However, whether or not Spectrum Brands would be

required to make an Asset Sale Offer for the 2031 Notes, or the

2026 Notes, the 2029 Notes or the 2030 Notes, depends on the amount

of Notes tendered in the Tender Offer and any other actions that

Spectrum Brands may take before an Asset Sale Offer is required to

be made pursuant to the terms of the governing indenture, including

defeasance of the covenants applicable to the 2031 Notes pursuant

to the terms of the governing indenture, or the satisfaction and

discharge of the indenture governing the 2031 Notes.

Spectrum Brands and its affiliates reserve the right, in their

sole discretion, to redeem any of the Notes that remain

outstanding after the completion of the Tender Offer in accordance

with the terms of the respective indentures governing the Notes, to

repurchase any such Notes in open market purchases, privately

negotiated transactions or otherwise, upon such terms and at such

prices as they may determine, which in each case may be more or

less than the price to be paid pursuant to the Tender Offer, to

defease the covenants of the Notes, including the covenant on the

“Limitation on Asset Sales,” or to satisfy and discharge Spectrum

Brands’ obligations pursuant to the indentures governing such

Notes.

Spectrum Brands has retained RBC Capital Markets, LLC, J.P.

Morgan Securities LLC (with respect to the 2029 Notes, the 2030

Notes and the 2031 Notes, collectively, the “USD Notes”), J.P.

Morgan Securities plc (with respect to the Euro Notes) and UBS

Securities LLC to serve as the Dealer Managers for the Tender Offer

and Solicitation Agents for the Consent Solicitation. Requests for

documents may be directed to D.F. King, the Information and Tender

Agent at (800) 549-6864 (toll-free) or +44 (0) 20 7920 9700 (for

the Euro Notes). Questions regarding the Tender Offer may be

directed to RBC Capital Markets, LLC at (877) 381-2099 (toll-free)

or (212) 618-7843 (collect) (for the USD Notes) and at +44 20 7029

7529 (for the Euro Notes), to J.P. Morgan Securities LLC at (866)

834-4666 (toll-free) or (212) 834-7489 (collect) (for the USD

Notes), J.P. Morgan Securities plc (for the Euro Notes) at +44 20

7134 4353, or UBS Securities LLC at (833) 690-0971 (toll-free) or

(212) 882-5723 (collect).

This press release is for informational purposes only. The

Tender Offer and Consent Solicitation are being made solely by the

Notes Statement. This press release does not constitute an offer to

sell or the solicitation of an offer to buy any securities and

shall not constitute an offer, solicitation or sale in any

jurisdiction in which, or to any persons to whom, such offering,

solicitation or sale would be unlawful. Any offers of concurrently

offered securities will be made only by means of a private offering

memorandum. The Tender Offer and Consent Solicitation are not being

made to Holders of Notes in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. In any jurisdiction in

which the securities laws or blue sky laws require the Tender Offer

or Consent Solicitation to be made by a licensed broker or dealer,

the Tender Offer and Consent Solicitation will be deemed to be made

on behalf of Spectrum Brands by the Dealer Managers and

Solicitation Agents, or one or more registered brokers or dealers

that are licensed under the laws of such jurisdiction.

None of Spectrum Brands, the Information and Tender Agent, the

Dealer Managers and Solicitation Agents or any of their respective

affiliates makes any recommendation as to whether Holders should

tender or refrain from tendering their Notes, and no person or

entity has been authorized by any of them to make such a

recommendation. Holders must make their own decision as to whether

to tender Notes and, if so, the principal amount of the Notes to

tender

About Spectrum Brands Holdings, Inc. and Spectrum Brands,

Inc.

Spectrum Brands Holdings is a home-essentials company with a

mission to make living better at home. We focus on delivering

innovative products and solutions to consumers for use in and

around the home through our trusted brands. We are a leading

supplier of specialty pet supplies, lawn and garden and home pest

control products, personal insect repellents, shaving and grooming

products, personal care products, and small household appliances.

Helping to meet the needs of consumers worldwide, Spectrum Brands

offers a broad portfolio of market-leading, well-known and widely

trusted brands including Tetra®, DreamBone®, SmartBones®, Nature’s

Miracle®, 8-in-1®, FURminator®, Healthy-Hide®, Good Boy®, Meowee!®,

OmegaOne®, Spectracide®, Cutter®, Repel®, Hot Shot®, Rejuvenate®,

Black Flag®, Liquid Fence®, Remington®, George Foreman®, Russell

Hobbs®, BLACK + DECKER®, PowerXL®, Emeril Lagasse®, and Copper

Chef®. For more information, please visit www.spectrumbrands.com.

Spectrum Brands – A Home Essentials Company™.

Forward-looking Statements

We have made or implied certain forward-looking statements in

this document and may make additional oral forward-looking

statements from time to time. All statements, other than statements

of historical facts included or incorporated by reference in this

document, including, without limitation, statements or expectations

regarding our business strategy, future operations, financial

condition, estimated revenues, projected costs, inventory

management, earnings power, projected synergies, prospects, plans

and objectives of management, outcome of any litigation and

information concerning expected actions of third parties are

forward-looking statements. When used in this document, the words

future, anticipate, pro forma, seek, intend, plan, envision,

estimate, believe, belief, expect, project, forecast, outlook,

earnings framework, goal, target, could, would, will, can, should,

may and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain such identifying words. Since these

forward-looking statements are based upon our current expectations

of future events and projections and are subject to a number of

risks and uncertainties, many of which are beyond our control and

some of which may change rapidly, actual results or outcomes may

differ materially from those expressed or implied herein, and you

should not place undue reliance on these statements. Important

factors that could cause our actual results to differ materially

from those expressed or implied herein include, without limitation:

(1) the economic, social and political conditions or civil unrest,

terrorist attacks, acts of war, natural disasters, other public

health concerns or unrest in the United States (“U.S.”) or the

international markets impacting our business, customers, employees

(including our ability to retain and attract key personnel),

manufacturing facilities, suppliers, capital markets, financial

condition and results of operations, all of which tend to aggravate

the other risks and uncertainties we face; (2) the impact of a

number of local, regional and global uncertainties could negatively

impact our business; (3) the negative effect of the Russia-Ukraine

war and the Israel-Hamas war and their impact on those regions and

surrounding regions, including the Middle East, and on our

operations and those operations of our customers, suppliers and

other stakeholders; (4) our increased reliance on third-party

partners, suppliers and distributors to achieve our business

objectives; (5) the impact of expenses resulting from the

implementation of new business strategies, divestitures or current

and proposed restructuring and optimization activities, including

changes in inventory and distribution center changes which are

complicated and involve coordination among a number of

stakeholders, including our suppliers and transportation and

logistics handlers; (6) the impact of our indebtedness and

financial leverage position on our business, financial condition

and results of operations; (7) the impact of restrictions in our

debt instruments on our ability to operate our business, finance

our capital needs or pursue or expand business strategies; (8) any

failure to comply with financial covenants and other provisions and

restrictions of our debt instruments; (9) the effects of general

economic conditions, including the impact of, and changes to

tariffs and trade policies, inflation, recession or fears of a

recession, depression or fears of a depression, labor costs and

stock market volatility or monetary or fiscal policies in the

countries where we do business; (10) the impact of fluctuations in

transportation and shipment costs, fuel costs, commodity prices,

costs or availability of raw materials or terms and conditions

available from suppliers, including suppliers’ willingness to

advance credit; (11) interest rate fluctuations; (12) changes in

foreign currency exchange rates that may impact our purchasing

power, pricing and margin realization within international

jurisdictions; (13) the loss of, significant reduction in or

dependence upon, sales to any significant retail customer(s),

including their changes in retail inventory levels and management

thereof; (14) competitive promotional activity or spending by

competitors, or price reductions by competitors; (15) the

introduction of new product features or technological developments

by competitors and/or the development of new competitors or

competitive brands; (16) changes in consumer spending preferences

and demand for our products, particularly in light of economic

stress; (17) our ability to develop and successfully introduce new

products, protect intellectual property and avoid infringing the

intellectual property of third parties; (18) our ability to

successfully identify, implement, achieve and sustain productivity

improvements, cost efficiencies (including at our manufacturing and

distribution operations) and cost savings; (19) the seasonal nature

of sales of certain of our products; (20) the impact weather

conditions may have on the sales of certain of our products; (21)

the effects of climate change and unusual weather activity as well

as our ability to respond to future natural disasters and pandemics

and to meet our environmental, social and governance goals; (22)

the cost and effect of unanticipated legal, tax or regulatory

proceedings or new laws or regulations (including environmental,

public health and consumer protection regulations); (23) public

perception regarding the safety of products that we manufacture and

sell, including the potential for environmental liabilities,

product liability claims, litigation and other claims related to

products manufactured by us and third parties; (24) the impact of

existing, pending or threatened litigation, government regulation

or other requirements or operating standards applicable to our

business; (25) the impact of cybersecurity breaches or our actual

or perceived failure to protect company and personal data,

including our failure to comply with new and increasingly complex

global data privacy regulations; (26) changes in accounting

policies applicable to our business; (27) our discretion to adopt,

conduct, suspend or discontinue any share repurchase program or

conduct any debt repayments, redemptions, repurchases or

refinancing transactions (including our discretion to conduct

purchases or repurchases, if any, in a variety of manners including

open-market purchases, privately negotiated transactions, tender

offers, redemptions, or otherwise); (28) our ability to utilize net

operating loss carry-forwards to offset tax liabilities; (29) our

ability to separate the Company's Home and Personal Care (“HPC”)

business and create an independent Global Appliances business on

expected terms, and within the anticipated time period, or at all,

and to realize the potential benefits of such business; (30) our

ability to create a pure play consumer products company composed of

our Global Pet Care ("GPC") and Home & Garden (“H&G”)

business and to realize the expected benefits of such creation, and

within the anticipated time period, or at all; (31) our ability to

successfully implement, and realize the benefits of, acquisitions

or dispositions and the impact of any such transactions on our

financial performance; (32) the impact of actions taken by

significant shareholders; (33) the unanticipated loss of key

members of senior management and the transition of new members of

our management teams to their new roles; and (34) the other risk

factors set forth in the securities filings of Spectrum Brands

Holdings, Inc. and SB/RH Holdings, LLC, including the 2023 Annual

Report and subsequent Quarterly Reports on Form 10-Q. Some of the

above-mentioned factors are described in further detail in the

sections entitled Risk Factors in our annual and quarterly reports,

as applicable. You should assume the information appearing in this

document is accurate only as of the date hereof, or as otherwise

specified, as our business, financial condition, results of

operations and prospects may have changed since such date. Except

as required by applicable law, including the securities laws of the

U.S. and the rules and regulations of the United States Securities

and Exchange Commission , we undertake no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise, to reflect actual

results or changes in factors or assumptions affecting such

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240519588701/en/

Investor/Media Contact: Joanne Chomiak

608-275-4458

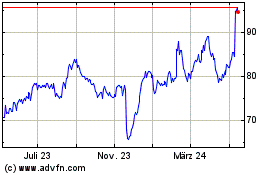

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

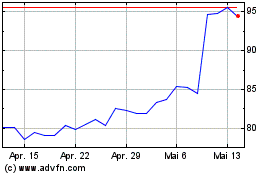

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025