UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2023

Commission File Number: 001-39147

ONECONNECT FINANCIAL TECHNOLOGY CO., LTD.

(Registrant’s Name)

10-14F,

Block A, Platinum Towers

No.1 Tairan 7th Road, Futian District

Shenzhen, Guangdong, 518000

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

| |

OneConnect Financial Technology Co., Ltd. |

| |

|

| |

By: |

/s/ Chongfeng Shen |

| |

Name: |

Chongfeng Shen |

| |

Title: |

Chairman of the Board and Chief Executive Officer |

| Date: September 26, 2023 |

|

|

Exhibit 99.1

Hong Kong Exchanges

and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no

representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from

or in reliance upon the whole or any part of the contents of this announcement.

OneConnect

Financial Technology Co., Ltd.

壹賬通金融科技有限公司

(incorporated

in the Cayman Islands with limited liability)

(Stock

Code: 6638)

(NYSE Stock Ticker: OCFT)

CONTINUING

CONNECTED TRANSACTION UNDER THE INSURANCE SERVICES PURCHASING AGREEMENT

INTRODUCTION

Shenzhen OneConnect,

a consolidated affiliated entity of the Company, has previously entered into the Insurance Services Purchasing Agreement with Ping An

Property & Casualty Branches pursuant to which Ping An Property & Casualty Branches provide property liability insurance

services to Shenzhen OneConnect. The Insurance Services Purchasing Agreement was for a term commencing from January 1, 2023 to December 31,

2023. On September 26, 2023, Shenzhen OneConnect entered into the Insurance Services Purchasing Supplemental Agreement, pursuant

to which the term was extended to December 31, 2024 and the existing annual cap was revised.

LISTING RULES IMPLICATIONS

Ping An (which

through its subsidiaries holds approximately 32.12% of the issued share capital of the Company as at the date of this announcement based

on public information available to the Company) is a controlling shareholder of the Company. Ping An Property & Casualty is

a subsidiary of Ping An and therefore a connected person of the Company for the purpose of the Listing Rules. Accordingly, the transactions

contemplated under the Insurance Services Purchasing Agreement constitute continuing connected transactions of the Company pursuant to

Chapter 14A of the Listing Rules. At the time of entering into the Insurance Services Purchasing Agreement, the applicable percentage

ratios were less than 5% and the annual cap amount was less than HK$3,000,000, the entering into of the Insurance Services Purchasing

Agreement constituted de minimis continuing connected transaction for the Company under the Listing Rules and was not subject to

announcement, reporting and independent Shareholders’ approval requirements.

As the Board anticipates

that the existing annual cap under the Insurance Services Purchasing Agreement would be exceeded, the Company has entered into the Insurance

Services Purchasing Supplemental Agreement and is therefore required to re-comply with the requirements under Chapter 14A of the Listing

Rules.

As the highest

applicable percentage ratio in respect of the proposed annual cap for the Insurance Services Purchasing Supplemental Agreement is more

than 0.1% but less than 5% and the annual cap is more than HK$3,000,000, the transactions contemplated thereunder are subject to reporting,

announcement and annual review requirements but are exempt from the requirement of independent Shareholders’ approval under Chapter

14A of the Listing Rules.

INSURANCE SERVICES PURCHASING AGREEMENT

Principal terms

Shenzhen OneConnect,

a consolidated affiliated entity of the Company, has previously entered into the Insurance Services Purchasing Agreement with Ping An

Property & Casualty Branches pursuant to which Ping An Property & Casualty Branches provide property liability insurance

services to Shenzhen OneConnect. The Insurance Services Purchasing Agreement was for a term commencing from January 1, 2023 to December 31,

2023. On September 26, 2023, Shenzhen OneConnect entered into the Insurance Services Purchasing Supplemental Agreement, pursuant

to which the term was extended to December 31, 2024 and the existing annual cap was revised.

Reasons for the transaction

Purchasing financial

services from the Ping An Group allows our Company to leverage Ping An Group’s core business strengths, which include its reputable

and long-established insurance business in the PRC. Furthermore, the Company has been purchasing a variety of services from various subsidiaries

and associates of Ping An to satisfy its business and operational needs. Owing to the strategic business relationship, Ping An Property &

Casualty has acquired a comprehensive understanding of the Group’s business and operational requirements and established a great

foundation for mutual trust.

Ping An Property &

Casualty has also developed a better understanding of the background of our customers and our business demands through years of cooperation,

thereby reducing the communication costs. On the premise that the terms of purchasing services and products from Ping An Property &

Casualty are fair and reasonable, the Group believes that Ping An Property & Casualty is better equipped in fulfilling the Group’s

demands efficiently with the provision of high-quality and professional insurance services.

Pricing basis

The services and

products fees to be paid by us to Ping An Property & Casualty Branches under the Insurance Services Purchasing Agreement will

be determined either 1) through bidding procedures according to the internal rules and procedures of the Company, whereby our Company

will compare the fees rates offered by Independent Third Parties as well as assessing our business needs and the relevant qualifications/experience

of the bidders in providing such services before determining the service fee rate for the transactions under the Insurance Services Purchasing

Agreement; or 2) if no tendering and bidding process is required under our internal rules, through arm’s length negotiations between

the relevant parties taking into account factors such as nature, transaction amount and term of the services and products, and shall

be in line with fees offered by Ping An Property & Casualty Branches to their independent third parties for similar services

and products. The services and products fees to be paid by us will be determined on the basis of arm’s length negotiations between

the relevant parties, which shall be in line with prevailing market rates and with reference to the applicable prices of the services

and products to ensure that the terms of purchasing services and products from Ping An Property & Casualty Branches are fair

and reasonable.

Historical amounts

The transaction

amounts with Ping An Property & Casualty in respect of the above purchase of services for each of the three years ended December 31,

2022 were RMB0.55 million, nil and RMB2.51 million, respectively.

Annual cap and basis of cap

The revised annual

cap of the services fees payable by Shenzhen OneConnect under the Insurance Services Purchasing Supplemental Agreement will be RMB10

million and RMB20 million for the year ending December 31, 2023 and the year ending December 31, 2024, respectively. The revised

annual cap is determined with reference to (i) the expected growth in our operational scale in 2023, which requires an expansion

of insurance coverage, (ii) our increase in demand for insurance services to limit the business risks arising from the new customer

service projects which commenced in 2023, and (iii) the continual expansion of our product and service offerings, which leads to

an increase in demand for product liability insurances services for the protection of our newly added systems, network security, computer

room and other fixed assets that support the daily operation of our Company, as well as to respond to the potential losses caused by

occasional risk events related to network security.

INFORMATION ON THE PARTIES

The Group is a

technology-as-a-service provider for the financial services industry in China with an expanding international presence. The Company provides

integrated technology solutions to financial institutional customers, including digital banking solutions and digital insurance solutions.

The Company also provides digital infrastructure for financial institutions through the Gamma Platform. The Company’s solutions

and platform help financial institutions expedite their digital transformation and ensure their sustainability.

The Company has

established long-term cooperation relationships with financial institutions to address their needs of digital transformation. The Company

has also expanded its services to other participants in the value chain to support the digital transformation of financial services ecosystem.

In addition, the Company has successfully served overseas financial institutions with its technology solutions.

Shenzhen OneConnect

is a consolidated affiliated entity of the Company. It is a limited liability company established in the PRC, and its principal business

activities are software and technology services.

Ping An Property &

Casualty is a limited liability company established in the PRC and its principal business activity is property and casualty liability

insurance. Ping An Property & Casualty is a subsidiary of Ping An, a joint-stock limited company established in the PRC with

limited liability, the shares of which have been listed on the Main Board of the Stock Exchange since 2004, and on the Shanghai Stock

Exchange since 2007. Ping An Group is a financial services group which holds a full suite of financial services licenses and its operations

span across insurance, banking, asset management and technology businesses.

OPINION FROM THE BOARD

The Directors (including

the independent non-executive Directors) are of the view that the terms of the Insurance Services Purchasing Agreement and/or the Insurance

Services Purchasing Supplemental Agreement were determined after arm’s length negotiation, and the transactions contemplated thereunder

(including the annual cap for the years ending December 31, 2023 and December 31, 2024) are conducted in the ordinary and usual

course of business of the Group and are on normal commercial terms, and are fair and reasonable and in the interests of the Company and

the Shareholders as a whole.

Ms. Sin Yin

Tan (a non-executive Director of the Company and an executive director of Ping An) and Ms. Xin Fu (a non-executive Director of the

Company and the chief operating officer and director of the strategic development center of Ping An Group) have abstained from voting

on the Board resolutions approving the Insurance Services Purchasing Agreement and/or the Insurance Services Purchasing Supplemental

Agreement and the transactions contemplated thereunder. Save and except for the aforesaid, none of the other Directors has any material

interest in the transactions contemplated under the Insurance Services Purchasing Agreement and/or the Insurance Services Purchasing

Supplemental Agreement.

LISTING RULES IMPLICATIONS

Ping An (which

through its subsidiaries holds approximately 32.12% of the issued share capital of the Company as at the date of this announcement based

on public information available to the Company) is a controlling shareholder of the Company. Ping An Property & Casualty is

a subsidiary of Ping An and therefore a connected person of the Company for the purpose of the Listing Rules. Accordingly, the transactions

contemplated under the Insurance Services Purchasing Agreement constitute continuing connected transactions of the Company pursuant to

Chapter 14A of the Listing Rules. At the time of entering into the Insurance Services Purchasing Agreement, the applicable percentage

ratios were less than 5% and the annual cap was less than HK$3,000,000, the entering into of the Insurance Services Purchasing Agreement

constituted de minimis continuing connected transaction for the Company under the Listing Rules and was not subject to announcement,

reporting and independent Shareholders’ approval requirements.

As the Board anticipates

that the existing annual cap under the Insurance Services Purchasing Agreement would be exceeded, the Company has entered into the Insurance

Services Purchasing Supplemental Agreement and is therefore required to re-comply with the requirements under Chapter 14A of the Listing

Rules.

As the highest

applicable percentage ratio in respect of the proposed annual cap for the Insurance Services Purchasing Supplemental Agreement is more

than 0.1% but less than 5% and the annual cap is more than HK$3,000,000, the transactions contemplated thereunder are subject to reporting,

announcement and annual review requirements but are exempt from the requirement of independent Shareholders’ approval under Chapter

14A of the Listing Rules.

DEFINITIONS

In this announcement,

unless the context otherwise requires, the following terms shall have the following meanings.

| “associate(s)” |

|

has the meaning ascribed to it under the Listing Rules |

| |

|

|

| “Board” |

|

the board of Directors of the Company |

| |

|

|

| “Company” |

|

OneConnect Financial Technology Co., Ltd. (壹賬通金融科技有限公司), a limited liability company incorporated in the Cayman Islands listed on the New York Stock Exchange (stock ticker: OCFT) and the Hong Kong Stock Exchange (stock code: 6638) |

| |

|

|

| “connected person(s)” |

|

has the meaning ascribed to it under the Listing Rules |

| |

|

|

| “controlling shareholder” |

|

has the meaning ascribed to it under the Listing Rules |

| |

|

|

| “Directors” |

|

the directors of the Company |

| |

|

|

| “Group” |

|

the Company and its subsidiaries and consolidated affiliated entities |

| |

|

|

| “Hong Kong” |

|

the Hong Kong Special Administrative Region of the PRC |

| |

|

|

| “HK$” |

|

Hong Kong dollar(s), the lawful currency of Hong Kong |

| |

|

|

| “Independent Third Parties” |

|

parties that are not a connected person within the meaning of the Listing Rules |

| |

|

|

| “Insurance Services Purchasing Agreement” |

|

the insurance services purchasing agreement dated January 1, 2023 entered into between Shenzhen OneConnect and Ping An Property & Casualty Branches |

| |

|

|

| “Insurance Services Purchasing Supplemental Agreement” |

|

the supplemental agreement to the Insurance Services Purchasing Agreement entered into between Shenzhen OneConnect and Ping An Property & Casualty Branches on September 26, 2023 |

| |

|

|

| “Listing Rules” |

|

the Rules Governing the Listing of Securities on the Stock Exchange |

| “Ping An” |

|

Ping An Insurance (Group) Company of China, Ltd. (中國平安保險(集團)股份有限公司), a company established as a joint stock company under the laws of PRC listed on the Shanghai Stock Exchange (stock code: 601318) and the Stock Exchange (stock code: 2318), and a controlling shareholder of the Company |

| |

|

|

| “Ping An Group” |

|

Ping An and its subsidiaries |

| |

|

|

| “Ping An Property & Casualty” |

|

Ping An Property & Casualty Insurance Company of China, Ltd. (中國平安財產保險股份有限公司), a company established under the laws of PRC, which is a subsidiary of Ping An |

| |

|

|

| “Ping An Property & Casualty Branches” |

|

Shanghai Yangpu branch and Tianjin Binhai branch of Ping An Property & Casualty |

| |

|

|

| “PRC” or “China” |

|

the People’s Republic of China and, for the purpose of this announcement only, excludes Hong Kong, the Macau Special Administrative Region and Taiwan |

| |

|

|

| “RMB” |

|

Renminbi, the lawful currency of the PRC |

| |

|

|

| “Share(s)” |

|

ordinary share(s) in the share capital of the Company |

| |

|

|

| “Shareholder(s)” |

|

the holder(s) of the Shares |

| |

|

|

| “Shenzhen OneConnect” |

|

Shenzhen OneConnect Smart Technology Co., Ltd. (深圳壹賬通智能科技有限公司), a limited liability company established under the laws of the PRC on September 15, 2017 and a consolidated affiliated entity of the Company |

| |

|

|

| “Stock Exchange” or “Hong Kong Stock Exchange” |

|

The Stock Exchange of Hong Kong Limited |

| |

|

|

| “subsidiaries” |

|

has the meaning as ascribed to it under the Listing Rules |

| |

|

|

| % |

|

per cent |

| |

By order of the Board |

| |

OneConnect Financial Technology Co., Ltd. |

| |

Mr. Chongfeng Shen |

| |

Chairman of the Board and Chief Executive Officer |

Hong Kong, September 26, 2023

As at the date

of this announcement, the board of directors of the Company comprises Mr. Chongfeng Shen and Ms. Rong Chen as the executive

directors, Ms. Sin Yin Tan, Ms. Xin Fu, Mr. Wenwei Dou, Ms. Wenjun Wang and Mr. Min Zhu as the non-executive

directors and Dr. Yaolin Zhang, Mr. Tianruo Pu, Mr. Wing Kin Anthony Chow and Mr. Koon Wing Ernest Ip as the independent

non-executive directors.

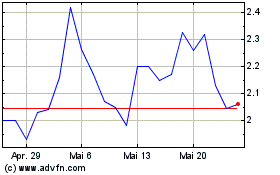

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024