California Resources Corporation Announces Private Offering of Additional 8.250% Senior Unsecured Notes due 2029

08 August 2024 - 2:53PM

Business Wire

California Resources Corporation (NYSE: CRC) (the “Company”)

announced today that, subject to market and other conditions, it

intends to offer and sell to eligible purchasers $200 million in

aggregate principal amount of its 8.250% senior unsecured notes due

2029 (the “Notes”). The Notes are being offered as additional notes

under the indenture dated as of June 5, 2024, as may be

supplemented from time to time (the “Indenture”), pursuant to which

the Company previously issued $600 million aggregate principal

amount of 8.250% Senior Notes (the “Existing Notes”). The Notes

will have substantially identical terms, other than the issue date

and issue price, as the Existing Notes, and the Notes and the

Existing Notes will be treated as a single series of securities

under the Indenture and will vote together as a single class.

Except with respect to Notes offered pursuant to Regulation S under

the Securities Act of 1933, as amended (the “Securities Act”), the

Notes will have the same CUSIP and ISIN numbers as, and will be

fungible with, the Existing Notes immediately upon issuance.

Concurrently with this offering, the Company commenced a tender

offer (the “Tender Offer”) to purchase for cash up to $200 million

aggregate principal amount of its 7.125% senior notes due 2026 (the

“2026 Notes”). The Tender Offer is made only by and pursuant to the

terms of the Offer to Purchase, dated August 8, 2024. The Tender

Offer is conditioned on the consummation of this offering, but this

offering is not conditioned on the completion of the Tender

Offer.

The Company intends to use the net proceeds from this offering,

together with cash on hand, (i) to fund the Tender Offer for a

portion of its 2026 Notes, including all accrued interest, fees and

premiums thereon, (ii) for the reduction of outstanding

indebtedness, and (iii) for general corporate purposes.

The Notes have not been, and will not be, registered under the

Securities Act, or any state securities laws and may not be offered

or sold in the United States except pursuant to an exemption from,

or in a transaction not subject to, the registration requirements

of the Securities Act and the rules promulgated thereunder and

applicable state securities laws. The Notes will be offered only to

persons reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act and non-U.S. persons

in transactions outside the United States in reliance on Regulation

S under the Securities Act.

This press release does not and shall not constitute an offer to

sell or the solicitation of an offer to buy any Notes, nor shall

there be any offer, solicitation or sale of Notes in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. Additionally,

this press release shall not constitute an offer to purchase or the

solicitation of an offer to sell any 2026 Notes in the Tender

Offer, nor does it constitute a notice of redemption under the

indenture governing the 2026 Notes.

Forward-Looking Statement

Disclosure

All statements, except for statements of historical fact, made

in this release regarding activities, events or developments the

Company expects, believes or anticipates will or may occur in the

future, such as statements regarding the proposed offering and the

intended use of proceeds, including the Tender Offer, are

forward-looking statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act of

1934, as amended. All forward-looking statements speak only as of

the date of this release. Although the Company believes that the

plans, intentions and expectations reflected in or suggested by the

forward-looking statements are reasonable, there is no assurance

that these plans, intentions or expectations will be achieved.

Therefore, actual outcomes and results could materially differ from

what is expressed, implied or forecast in such statements. Except

as required by law, the Company expressly disclaims any obligation

to and does not intend to publicly update or revise any

forward-looking statements.

The Company cautions you that these forward-looking statements

are subject to all of the risks and uncertainties incident to the

Company’s business, most of which are difficult to predict and many

of which are beyond the Company’s control. These risks include, but

are not limited to, the risks described under the heading “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023 and its subsequently filed Quarterly

Reports on Form 10-Q.

About California Resources

Corporation

California Resources Corporation (CRC) is an independent energy

and carbon management company committed to energy transition. CRC

is committed to environmental stewardship while safely providing

local, responsibly sourced energy. CRC is also focused on

maximizing the value of its land, mineral ownership, and energy

expertise for decarbonization by developing carbon capture and

storage and other emissions-reducing projects.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808312543/en/

Joanna Park (Investor Relations) 818-661-3731

Joanna.Park@crc.com

Richard Venn (Media) 818-661-6014 Richard.Venn@crc.com

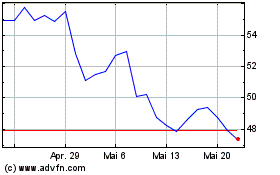

California Resources (NYSE:CRC)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

California Resources (NYSE:CRC)

Historical Stock Chart

Von Feb 2024 bis Feb 2025