Suncor to record impairment charge on White Rose assets

04 Januar 2021 - 11:50PM

Suncor today advised that it will record in the fourth quarter of

2020 a non-cash after-tax impairment charge of approximately $425

million on its share of the White Rose asset and West White Rose

Project.

While the asset is currently producing, the West

White Rose Project was intended to access 200 million barrels

(gross) of crude oil and extend the life of the White Rose field by

approximately 14 years. However, the recent acquisition of the

operator has cast significant doubt on the future of the West White

Rose Project. Discussions are ongoing with the operator and various

levels of government to determine the future of the project. The

Government of Newfoundland and Labrador has agreed to provide some

support for the West White Rose Project in 2021.

Suncor’s 2021 guidance remains unchanged as the

White Rose field will remain on line producing as expected and

Suncor’s guidance did not include any major capital spend on the

West White Rose Project in 2021.

The White Rose asset joint venture owners are

Cenovus (operator, 72.5%,) and Suncor (27.5%). The West White Rose

Project joint venture owners are Cenovus (operator, 69%), Suncor

(26%) and Nalcor (5%).

Legal Advisory – Forward-Looking

Information

This news release contains certain forward-looking

information and forward-looking statements (collectively referred

to herein as “forward-looking statements”) within the meaning of

applicable Canadian and U.S. securities laws. Forward-looking

statements in this news release include: statements regarding the

future of the West White Rose Project, including the belief that

the Government of Newfoundland and Labrador will provide support

for it in 2021; Suncor's expectation that the White Rose field will

remain on line producing as expected in 2021 and will not require

any major capital spend; and similar statements.

Forward-looking statements are based on Suncor’s current

expectations, estimates, projections and assumptions that were made

by the company in light of its information available at the time

the statement was made and consider Suncor’s experience and its

perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves estimates; the

current and potential adverse impacts of the COVID-19 pandemic,

including the status of the pandemic and future waves and any

associated policies around current business restrictions,

shelter-in-place orders or gatherings of individuals; commodity

prices and interest and foreign exchange rates; the performance of

assets and equipment; capital efficiencies and cost savings;

applicable laws and government policies; future production rates;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour, services

and infrastructure; the satisfaction by third parties of their

obligations to Suncor; the development and execution of projects;

and the receipt, in a timely manner, of regulatory and third-party

approvals. Some of the forward-looking statements may be

identified by words like “will”, “expected”, “estimated”,

“intend”, “believe” and similar expressions.

Forward-looking statements are not guarantees of

future performance and involve a number of risks and uncertainties,

some that are similar to other oil and gas companies and some that

are unique to Suncor. Suncor’s actual results may differ materially

from those expressed or implied by its forward-looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor’s Annual Information Form and Annual Report

to Shareholders, each dated February 26, 2020, Form 40-F dated

February 27, 2020, Management's Discussion and Analysis for the

third quarter of 2020 dated October 28, 2020 (the MD&A) and

other documents Suncor files from time to time with securities

regulatory authorities describe the risks, uncertainties, material

assumptions and other factors that could influence actual results

and such factors are incorporated herein by reference. Copies of

these documents are available without charge from Suncor at 150 6th

Avenue S.W., Calgary, Alberta T2P 3E3, by calling 1-800-558-9071,

or by email request to invest@suncor.com or by referring to the

company’s profile on SEDAR at sedar.com or EDGAR at sec.gov. Except

as required by applicable securities laws, Suncor disclaims any

intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. Suncor Energy is Canada's leading

integrated energy company. Suncor's operations include oil sands

development and upgrading, offshore oil and gas production,

petroleum refining, and product marketing under the Petro-Canada

brand. A member of Dow Jones Sustainability indexes, FTSE4Good and

CDP, Suncor is working to responsibly develop petroleum resources

while also growing a renewable energy portfolio. Suncor is listed

on the UN Global Compact 100 stock index. Suncor's common shares

(symbol: SU) are listed on the Toronto and New York stock

exchanges.

For more information about Suncor, visit our web

site at suncor.com, follow us on Twitter @Suncor

Media inquiries: 1-833-296-4570

media@suncor.com

Investor inquiries: 800-558-9071

invest@suncor.com

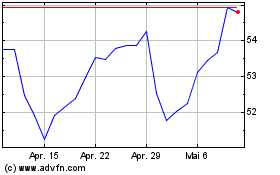

Suncor Energy (TSX:SU)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Suncor Energy (TSX:SU)

Historical Stock Chart

Von Jan 2024 bis Jan 2025