Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) is

pleased to announce its financial and operating results for the

three-month period ended September 30, 2023, and the

declaration of its Q4 2023 regular dividend of C$0.375 per share.

All amounts herein are in United States Dollars

(“USD”) unless otherwise stated.

“With our inaugural well in Arauca, I take pride

in our team’s remarkable achievement in drilling the deepest

onshore well in Colombia’s history. This milestone not only serves

as a testament to our operational capability, but also solidifies

Parex’s leading position as an operator capable of confidently

exploiting higher productivity, deeper targets. In addition to

Arauca, we are seeing a series of positive developments from

exploitation and near-field exploration that are driving record

quarterly production, which make us optimistic for the upcoming

fourth quarter and the year ahead,” commented Imad Mohsen,

President & Chief Executive Officer.

Key Highlights

- Generated Q3 2023 funds flow provided by operations (“FFO”)(1)

of $158 million and FFO per share(2)(3) of $1.49.

- Drilled the inaugural well on the Arauca Block (50% W.I.),

Arauca-15, to a total depth of 22,350 feet; it is the deepest

onshore well in Colombia’s history and is expected to commence

production following multi-zone testing.

- Spud the Arauca-8 big ‘E’ exploration well in late Q3 2023,

which is at roughly 17,500 feet and expected to total depth in late

Q4 2023.

- Reached all-time production rates of over 15,000 bbl/d(8) of

heavy crude oil from the Cabrestero Block (100% W.I.), supported by

successful exploration efforts and continued success from

waterflood injection.

- Recently drilled a well at Cabrestero (100% W.I.) that

discovered a new oil pool, which is expected to begin production

imminently.

- Declared a Q4 2023 regular dividend of C$0.375 per share(7) or

C$1.50 per share annualized; current dividend yield is roughly

5.4%(7).

- Repurchased 4.95 million shares YTD 2023, fulfilling

approximately 5% of the public float under the Company’s current

normal course issuer bid (“NCIB”).

- Delivering strong production growth; current rates are

approximately 59,000 boe/d(8).

Q3 2023 Results

- Record quarterly average oil & natural gas production was

54,573 boe/d(6), an increase of 7% from Q3 2022, and a 1% increase

from the prior quarter.

- Increased production per share(3)(7) by 13% compared to Q3

2022, from higher production and the reduction of outstanding

shares through the current NCIB.

- Realized net income of $120 million or $1.13 per share

basic(3).

- Generated quarterly FFO(1) of $158 million, a 24% decrease from

Q3 2022, and FFO per share(2)(3) of $1.49, a 19% decrease from Q3

2022, which was primarily driven by lower crude oil pricing and

increased tax, offset by higher production.

- Increased current taxes by $14 million as the Company moved

from an estimated 10% surtax to a projected 15% surtax with the

appreciation of global oil prices in Q3 2023; Colombia has an

income surtax, which is linked to the historical Brent oil

price.

- Generated an operating netback(2) of $48.97/boe and an FFO

netback(2) of $31.28/boe from an average Brent price of $85.92/bbl.

The FFO netback(2) was impacted by higher current taxes, and

increased production costs from workovers and higher energy input

costs.

- Incurred $157 million of capital expenditures(5) while

participating in the drilling of 16 gross (10.95 net) wells.

Capital expenditures were higher than prior quarters in 2023,

primarily driven by starting activity at Arauca (50% W.I.) where

Parex agreed with its joint venture partner to solely fund the

initial work plan in exchange for a 50% interest in the Arauca and

LLA-38 blocks. Management expects Q4 2023 capital expenditures to

be lower as the Company’s costs associated with drilling at Arauca

revert to a 50% working interest share per the farm-in agreement,

as well as overall corporate activity being reduced with a lower

rig count.

- Working capital deficit(1) was $58 million, which increased by

$55 million from Q2 2023, primarily as a result of the timing of

certain capital expenditures. Management expects working capital in

Q4 2023 to be positive and build throughout 2024, with forecast

production growth, declining capital expenditures and inventory

deployment, subject to commodity prices remaining in line with Q3

2023.

- Paid a C$0.375 per share regular quarterly dividend and

repurchased 1,239,500 shares.

(1) Capital management measure. See “Non-GAAP and

Other Financial Measures Advisory.” (2) Non-GAAP ratio. See

“Non-GAAP and Other Financial Measures Advisory.” (3) Based on

weighted-average basic shares for the period. (4) See “Operational

and Financial Highlights” for a breakdown of production by product

type. (5) Non-GAAP financial measure. See “Non-GAAP and Other

Financial Measures Advisory.” (6) See “Operational and Financial

Highlights” for a breakdown of production by product type. (7)

Supplementary financial measure. See “Non-GAAP and Other Financial

Measures Advisory.” (8) Estimated average production for the

six-day period of November 1, 2023 to November 6, 2023.

|

Operational and Financial Highlights |

Three Months Ended |

Nine Months Ended |

|

|

(unaudited) |

Sep. 30, |

|

Sep. 30, |

|

Jun. 30, |

|

Sep. 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2023 |

|

|

Operational |

|

|

|

|

|

Average daily production |

|

|

|

|

|

Light Crude Oil and Medium Crude Oil (bbl/d) |

8,837 |

|

6,903 |

|

7,982 |

|

7,984 |

|

|

Heavy Crude Oil (bbl/d) |

44,779 |

|

43,063 |

|

45,644 |

|

44,624 |

|

|

Crude Oil (bbl/d) |

53,616 |

|

49,966 |

|

53,626 |

|

52,608 |

|

|

Conventional Natural Gas (mcf/d) |

5,742 |

|

6,750 |

|

2,964 |

|

4,470 |

|

|

Oil & Gas (boe/d)(1) |

54,573 |

|

51,091 |

|

54,120 |

|

53,353 |

|

|

|

|

|

|

|

|

Operating netback ($/boe) |

|

|

|

|

|

Reference price - Brent ($/bbl) |

85.92 |

|

97.70 |

|

77.84 |

|

81.98 |

|

|

Oil & natural gas sales(4) |

75.98 |

|

88.13 |

|

67.26 |

|

70.96 |

|

|

Royalties(4) |

(13.72 |

) |

(17.92 |

) |

(11.15 |

) |

(12.38 |

) |

|

Net revenue(4) |

62.26 |

|

70.21 |

|

56.11 |

|

58.58 |

|

|

Production expense(4) |

(9.73 |

) |

(7.40 |

) |

(9.14 |

) |

(9.25 |

) |

|

Transportation expense(4) |

(3.56 |

) |

(3.35 |

) |

(3.51 |

) |

(3.39 |

) |

|

Operating netback ($/boe)(2) |

48.97 |

|

59.46 |

|

43.46 |

|

45.94 |

|

|

|

|

|

|

|

|

Funds flow provided by operations netback

($/boe)(2) |

31.28 |

|

45.07 |

|

31.86 |

|

32.44 |

|

|

|

|

|

|

|

|

Financial ($000s except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

Net income |

119,736 |

|

65,632 |

|

101,415 |

|

325,526 |

|

|

Per share - basic(6) |

1.13 |

|

0.59 |

|

0.95 |

|

3.05 |

|

|

|

|

|

|

|

|

Funds flow provided by

operations(5) |

157,839 |

|

206,412 |

|

154,842 |

|

474,405 |

|

|

Per share - basic(2)(6) |

1.49 |

|

1.85 |

|

1.45 |

|

4.44 |

|

|

|

|

|

|

|

|

Capital expenditures(3) |

156,747 |

|

127,353 |

|

121,309 |

|

391,924 |

|

|

|

|

|

|

|

|

Free funds flow(3) |

1,092 |

|

79,059 |

|

33,533 |

|

82,481 |

|

|

|

|

|

|

|

|

EBITDA(3) |

221,271 |

|

185,911 |

|

139,881 |

|

539,711 |

|

|

|

|

|

|

|

|

Other long-term asset

expenditures(long-lead material & equipment

inventory) |

(374 |

) |

65,725 |

|

20,903 |

|

40,296 |

|

|

|

|

|

|

|

|

Dividends paid |

29,239 |

|

20,042 |

|

30,101 |

|

89,171 |

|

|

Per share - Cdn$(4) |

0.375 |

|

0.25 |

|

0.375 |

|

1.125 |

|

|

|

|

|

|

|

|

Shares repurchased |

24,273 |

|

72,363 |

|

25,474 |

|

82,615 |

|

|

Number of shares repurchased (000s) |

1,240 |

|

4,489 |

|

1,260 |

|

4,408 |

|

|

|

|

|

|

|

|

Outstanding shares (end of period) (000s) |

|

|

|

|

|

Basic |

105,014 |

|

109,323 |

|

106,194 |

|

105,014 |

|

|

Weighted average basic |

105,621 |

|

111,631 |

|

106,830 |

|

106,872 |

|

|

Diluted(8) |

105,722 |

|

110,159 |

|

106,962 |

|

105,722 |

|

|

|

|

|

|

|

|

Working capital (deficit)

surplus(5) |

(57,511 |

) |

229,763 |

|

(2,957 |

) |

(57,511 |

) |

|

Bank debt(7) |

— |

|

— |

|

— |

|

— |

|

|

Cash |

34,548 |

|

353,025 |

|

133,375 |

|

34,548 |

|

(1) Reference to crude oil or natural gas in the

above table and elsewhere in this press release refer to the light

and medium crude oil and heavy crude oil and conventional natural

gas, respectively, product types as defined in National Instrument

51-101 - Standards of Disclosure for Oil and Gas Activities. (2)

Non-GAAP ratio. See “Non-GAAP and Other Financial Measures

Advisory”. (3) Non-GAAP financial measure. See “Non-GAAP and Other

Financial Measures Advisory”. (4) Supplementary financial measure.

See “Non-GAAP and Other Financial Measures Advisory”. (5) Capital

management measure. See “Non-GAAP and Other Financial Measures

Advisory”. (6) Per share amounts (with the exception of dividends)

are based on weighted average common shares. Dividends paid per

share are based on the number of common shares outstanding at each

dividend record date. (7) Syndicated bank credit facility borrowing

base of $200.0 million as at September 30, 2023. (8) Diluted

shares as stated include common shares and stock options

outstanding at period end; September 30, 2023 closing price

was C$25.49 per share.

Operational Update

Parex’s estimated average production in October

2023 was 57,900 boe/d and November month-to-date is approximately

59,000 boe/d.

Building on strong current production, the Company

is positioned to bring online three key wells over the remainder of

Q4 2023: Arauca-15 (50% W.I.); Cabrestero near-field (100% W.I.);

and a horizontal well at LLA-34 (55% W.I.).

Northern Llanos Update

Arauca-15 Well (50% W.I.)

- Arauca-15 was drilled to a total depth of 22,350 feet, which

encountered three prospective zones and is expected to commence

production following testing.

- Once the rig on Arauca-15 has finished completion and initial

testing, it will move to an adjacent development well, Arauca-11,

to begin drilling.

Arauca-8 (Big ‘E’) Well (50% W.I.)

- Arauca-8 is a multi-zone, high-impact exploration prospect

targeting light crude oil that was spud in late Q3 2023 and is at

roughly 17,500 feet.

- The well is expected to reach total depth in late Q4 2023, with

preliminary results expected in early 2024.

Capachos (50% W.I.)

- Following the previously announced shut-ins in H1 2023,

production ramp-up has been slower than expected and remediation

steps have been taken, including optimizing the workover program,

in order to continue the production build up.

- During Q3 2023, the facility expansion from 15,000 to 25,000

bbl/d of fluid handling capacity was completed on time and on

budget.

Southern Llanos, Foothills and LLA-34 Update

Southern Llanos - Cabrestero (100% W.I.)

- Supported by successful exploration efforts and continued

success from the waterflood injection program, the block has

reached all-time production rates of over 15,000 bbl/d of heavy

crude oil.

- Recently drilled a well that discovered a new pool in the

Mirador formation that is expected to begin production

imminently.

- Continuing to ramp up total injected volume for pressure

maintenance with a plan to commence a polymer flooding pilot by

year-end 2023 to increase sweep efficiency.

Southern Llanos - LLA-81 (100% W.I.)

- Successfully drilled a follow-up horizontal well to maximize

recovery from oil discovered in the Carbonera 7 (“C7”)

reservoir.

- The well was brought on stream in early October 2023 and has

since averaged production of roughly 2,100 bbl/d of light &

medium crude oil.

Llanos Foothills - LLA-122 - Arantes (Big ‘E’)

(50% W.I.)

- Arantes is the first well within the Ecopetrol memorandum of

understanding coverage (“MOU”), targeting gas and condensate.

- This is the first well to be drilled by Parex within the

high-potential Foothills trend and is expected to spud in Q4

2023.

LLA-34 (55% W.I.)

- The first three horizontal wells are demonstrating strong

performance and in aggregate are currently producing approximately

4,800 bbl/d of heavy crude oil (gross).

- The fourth horizontal well initiated testing in early November

2023 and is currently producing approximately 2,500 bbl/d of heavy

crude oil (gross).

- The fifth horizontal well is drilling and expected to commence

production in Q4 2023.

Corporate Guidance

Parex’s 2023 average production guidance of 54,000

to 57,000 boe/d and capital expenditure guidance of $450 to $475

million remain unchanged. Building on strong current production,

Parex expects its Q4 2023 average production to exceed 60,000

boe/d.

The Company expects to release its 2024 formal

guidance in January 2024, alongside an updated three-year

outlook.

Return of Capital Update

Q4 2023 Dividend Parex’s Board of Directors has

approved a Q4 2023 regular quarterly dividend of C$0.375 per share

to be paid on December 29, 2023, to shareholders of record on

December 15, 2023. The Company first initiated a regular quarterly

dividend at C$0.125 per share in 2021.

This quarterly dividend payment to shareholders is

designated as an “eligible dividend” for purposes of the Income Tax

Act (Canada).

Active Share Buyback Program Under Current Normal

Course Issuer Bids

As at November 6, 2023, Parex has repurchased 4.95

million shares year-to-date under its current NCIB at an average

price of C$25.00 per share, for total consideration of roughly

C$124 million.

From Q4 2017 to Q3 2023, the Company has reduced

the fully diluted outstanding shares by 36%.

Q3 2023 Results - Conference Call &

Video Webcast

Parex will host a conference call and video

webcast to discuss the Q3 2023 results on Wednesday,

November 8, 2023, beginning at 9:30 am MT (11:30 am ET). To

participate in the conference call or video webcast, please see the

access information below:

| Conference

ID: |

1 335 335 |

| Participant Toll-Free Dial-In Number: |

1-888-550-5584 |

| Participant Toll Dial-In Number: |

1-646-960-0157 |

| Webcast: |

https://events.q4inc.com/attendee/210615525 |

| |

|

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex is a

member of the S&P/TSX Composite ESG Index and its shares trade

on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike Kruchten Senior Vice

President, Capital Markets & Corporate Planning Parex Resources

Inc. 403-517-1733 investor.relations@parexresources.com

Steven Eirich Investor Relations

& Communications Advisor Parex Resources Inc. 587-293-3286

investor.relations@parexresources.com

NOT FOR DISTRIBUTION OR FOR DISSEMINATION

IN THE UNITED STATES

Non-GAAP and Other Financial Measures

Advisory

This press release uses various “non-GAAP

financial measures”, “non-GAAP ratios”, “supplementary financial

measures” and “capital management measures” (as such terms are

defined in NI 52-112), which are described in further detail below.

Such measures are not standardized financial measures under IFRS

and might not be comparable to similar financial measures disclosed

by other issuers. Investors are cautioned that non-GAAP financial

measures should not be construed as alternatives to or more

meaningful than the most directly comparable GAAP measures as

indicators of Parex’s performance.

These measures facilitate management’s comparisons

to the Company’s historical operating results in assessing its

results and strategic and operational decision-making and may be

used by financial analysts and others in the oil and natural gas

industry to evaluate the Company’s performance. Further, management

believes that such financial measures are useful supplemental

information to analyze operating performance and provide an

indication of the results generated by the Company’s principal

business activities.

Set forth below is a description of the non-GAAP

financial measures, non-GAAP ratios, supplementary financial

measures and capital management measures used in this press

release.

Non-GAAP Financial Measures

Capital expenditures, is a

non-GAAP financial measure which the Company uses to describe its

capital costs associated with oil and gas expenditures. The measure

considers both property, plant and equipment expenditures and

exploration and evaluation asset expenditures which are items in

the Company’s statement of cash flows for the period.

| |

For the

three months ended |

|

For the nine

months ended |

| |

Sep.

30, |

|

Sep. 30, |

|

Jun. 30, |

|

Sep.

30, |

|

($000s) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

Property, plant and equipment expenditures |

$ |

93,957 |

|

$ |

101,253 |

|

$ |

82,999 |

|

$ |

260,180 |

|

Exploration and evaluation expenditures |

|

62,790 |

|

|

26,100 |

|

|

38,310 |

|

|

131,744 |

|

Capital expenditures |

$ |

156,747 |

|

$ |

127,353 |

|

$ |

121,309 |

|

$ |

391,924 |

Free funds flow, is a non-GAAP

financial measure that is determined by funds flow provided by

operations less capital expenditures. The Company considers free

funds flow to be a key measure as it demonstrates Parex’s ability

to fund return of capital, such as the NCIB and dividends, without

accessing outside funds and is calculated as follows:

| |

For the

three months ended |

|

For the nine

months ended |

| |

Sep.

30, |

|

Sep. 30, |

|

|

Jun. 30, |

|

|

Sep.

30, |

|

($000s) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

|

2023 |

|

Cash provided by (used in) operating activities |

$ |

87,568 |

|

$ |

250,643 |

|

|

$ |

(36,612 |

) |

|

$ |

182,229 |

|

Net change in non-cash working capital |

|

70,271 |

|

|

(44,231 |

) |

|

|

191,454 |

|

|

|

292,176 |

|

Funds flow provided by operations |

|

157,839 |

|

|

206,412 |

|

|

|

154,842 |

|

|

|

474,405 |

|

Capital expenditures |

|

156,747 |

|

|

127,353 |

|

|

|

121,309 |

|

|

|

391,924 |

|

Free funds flow |

$ |

1,092 |

|

$ |

79,059 |

|

|

$ |

33,533 |

|

|

$ |

82,481 |

EBITDA, is a non-GAAP financial

measure that is defined as net income adjusted for interest, taxes,

depletion, depreciation and amortization. The Company considers

EBITDA to be a key measure as it demonstrates Parex’ profitability

before interest, taxes, depletion, depreciation and amortization. A

reconciliation from net income to EBITDA is as follows:

| |

For the

three months ended |

|

For the nine

months ended |

|

| |

Sep.

30, |

|

|

Sep. 30, |

|

|

Jun. 30, |

|

|

Sep.

30, |

|

|

($000s) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2023 |

|

|

Net income |

$ |

119,736 |

|

|

$ |

65,632 |

|

|

$ |

101,415 |

|

|

$ |

325,526 |

|

| Adjustments

to reconcile net income to EBITDA: |

|

|

|

|

|

|

|

|

Finance income |

|

(2,496 |

) |

|

|

(2,235 |

) |

|

|

(5,106 |

) |

|

|

(12,246 |

) |

|

Finance expense |

|

5,219 |

|

|

|

931 |

|

|

|

4,253 |

|

|

|

13,176 |

|

|

Income tax expense (recovery) |

|

49,995 |

|

|

|

85,413 |

|

|

|

(6,308 |

) |

|

|

76,859 |

|

|

Depletion, depreciation and amortization |

|

48,817 |

|

|

|

36,170 |

|

|

|

45,627 |

|

|

|

136,396 |

|

|

EBITDA |

$ |

221,271 |

|

|

$ |

185,911 |

|

|

$ |

139,881 |

|

|

$ |

539,711 |

|

Non-GAAP Ratios

Operating netback per boe, is a

non-GAAP ratio that the Company considers to be a key measure as it

demonstrates Parex’ profitability relative to current commodity

prices. Parex calculates operating netback per boe as operating

netback (calculated as oil and natural gas sales from production,

less royalties, operating, and transportation expense) divided by

the total equivalent sales volume including purchased oil volumes

for oil and natural gas sales price and transportation expense per

boe and by the total equivalent sales volume excluding purchased

oil volumes for royalties and operating expense per boe.

Funds flow provided by operations

netback or FFO netback, is a non-GAAP ratio that includes

all cash generated from operating activities and is calculated

before changes in non-cash working capital, divided by produced oil

and natural gas sales volumes. The Company considers funds flow

provided by operations netback per boe to be a key measure as it

demonstrates Parex’s profitability after all cash costs relative to

current commodity prices.

Basic funds flow provided by operations

per share or FFO per share, is a non-GAAP ratio that is

calculated by dividing funds flow provided by operations by the

weighted average number of basic shares outstanding. Parex presents

basic funds flow provided by operations per share whereby per share

amounts are calculated using weighted-average shares outstanding,

consistent with the calculation of earnings per share. The Company

considers basic and diluted funds flow provided by operations per

share or FFO per share to be a key measure as it demonstrates

Parex’ profitability after all cash costs relative to the weighted

average number of basic and diluted shares outstanding.

Capital Management Measures

Funds flow provided by

operations, is a capital management measure that includes

all cash generated from operating activities and is calculated

before changes in non-cash working capital. The Company considers

funds flow provided by operations to be a key measure as it

demonstrates Parex’s profitability after all cash costs. A

reconciliation from cash provided by (used in) operating activities

to funds flow provided by operations is as follows:

| |

For the

three months ended |

|

For the nine

months ended |

| |

Sep.

30, |

|

Sep. 30, |

|

|

Jun. 30, |

|

|

Sep.

30, |

|

($000s) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

|

2023 |

|

Cash provided by (used in) operating activities |

$ |

87,568 |

|

$ |

250,643 |

|

|

$ |

(36,612 |

) |

|

$ |

182,229 |

|

Net change in non-cash working capital |

|

70,271 |

|

|

(44,231 |

) |

|

|

191,454 |

|

|

|

292,176 |

|

Funds flow provided by operations |

$ |

157,839 |

|

$ |

206,412 |

|

|

$ |

154,842 |

|

|

$ |

474,405 |

Working capital (deficit) surplus, is a capital

management measure which the Company uses to describe its liquidity

position and ability to meet its short-term liabilities. Working

capital (deficit) surplus is defined as current assets less current

liabilities.

| |

For the

three months ended |

|

For the nine

months ended |

|

| |

Sep.

30, |

|

|

Sep. 30, |

|

Jun. 30, |

|

|

Sep.

30, |

|

|

($000s) |

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2023 |

|

|

Current assets |

$ |

240,559 |

|

|

$ |

613,900 |

|

$ |

322,146 |

|

|

$ |

240,559 |

|

|

Current liabilities |

|

298,070 |

|

|

|

384,137 |

|

|

325,103 |

|

|

|

298,070 |

|

|

Working capital (deficit) surplus |

$ |

(57,511 |

) |

|

$ |

229,763 |

|

$ |

(2,957 |

) |

|

$ |

(57,511 |

) |

Supplementary Financial Measures

“Oil and natural gas sales per boe” is

determined by sales revenue excluding risk management contracts, as

determined in accordance with IFRS, divided by total equivalent

sales volume including purchased oil volumes.

“Royalties per boe” is

comprised of royalties, as determined in accordance with IFRS,

divided by the total equivalent sales volume and excludes purchased

oil volumes.

“Net revenue per boe” is

comprised of net revenue, as determined in accordance with IFRS,

divided by the total equivalent sales volume and excludes purchased

oil volumes.

“Production expense per

boe” is comprised of production expense, as

determined in accordance with IFRS, divided by the total equivalent

sales volume and excludes purchased oil volumes.

“Transportation expense per

boe” is comprised of transportation expense, as

determined in accordance with IFRS, divided by the total equivalent

sales volumes including purchased oil volumes.

“Dividends paid per

share” is comprised of dividends declared, as

determined in accordance with IFRS, divided by the number of shares

outstanding at the dividend record date.

“Dividend yield” is defined

as annualized dividends per share dividend by Parex’s share

price.

“Production per share

growth” is comprised of the Company’s total oil and

natural gas production volumes divided by the weighted average

number of basic shares outstanding. Parex presents production per

share whereby per share amounts are calculated using

weighted-average shares outstanding, consistent with the

calculation of earnings per share. Growth is determined in

comparison to the comparative year.

Oil & Gas Matters

Advisory

The term “Boe” means a barrel of oil equivalent on

the basis of 6 Mcf of natural gas to 1 barrel of oil (“bbl”). Boe’s

may be misleading, particularly if used in isolation. A boe

conversation ratio of 6 Mcf: 1 Bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf:

1 Bbl may be misleading as an indication of value.

This press release contains a number of oil and

gas metrics, including, operating netbacks and FFO netbacks. These

oil and gas metrics have been prepared by management and do not

have standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics have been included herein to provide readers with

additional measures to evaluate the Company’s performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods and therefore such metrics should

not be unduly relied upon. Management uses these oil and gas

metrics for its own performance measurements and to provide

security holders with measures to compare the Company’s operations

over time. Readers are cautioned that the information provided by

these metrics, or that can be derived from the metrics presented in

this news release, should not be relied upon for investment or

other purposes.

Distribution Advisory

The Company’s future shareholder distributions,

including but not limited to the payment of dividends and the

acquisition by the Company of its shares pursuant to an NCIB, if

any, and the level thereof is uncertain. Any decision to pay

further dividends on the common shares (including the actual

amount, the declaration date, the record date and the payment date

in connection therewith and any special dividends) or acquire

shares of the Company will be subject to the discretion of the

Board of Directors of Parex and may depend on a variety of factors,

including, without limitation the Company’s business performance,

financial condition, financial requirements, growth plans, expected

capital requirements and other conditions existing at such future

time including, without limitation, contractual restrictions and

satisfaction of the solvency tests imposed on the Company under

applicable corporate law. Further, the actual amount, the

declaration date, the record date and the payment date of any

dividend are subject to the discretion of the Board. There can be

no assurance that the Company will pay dividends or repurchase any

shares of the Company in the future.

Advisory on Forward Looking

Statements

Certain information regarding Parex set forth in

this document contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words “plan”, “expect”, “prospective”, “project”,

“intend”, “believe”, “should”, “anticipate”, “estimate”,

“forecast”, “guidance”, “budget” or other similar words, or

statements that certain events or conditions “may” or “will” occur

are intended to identify forward-looking statements. Such

statements represent Parex’s internal projections, estimates or

beliefs concerning, among other things, future growth, results of

operations, production, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These

statements are only predictions and actual events or results may

differ materially. Although the Company’s management believes that

the expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex’s actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In particular, forward-looking statements

contained in this document include, but are not limited to,

statements with respect to: the Company’s focus, plans, priorities

and strategies; Parex’s expectations that two of the prospective

zones at the Arauca block have exploration upside; the anticipated

timing of when production will commence at the Arauca-15 well; the

anticipated timing of when the Arauca-8 big ‘E’ exploration well

will reach total depth; Parex’s expectations that its capital

expenditures will be lower in the fourth quarter; Parex’s

forecasted increases in working capital, forecasted production

growth, declining capital expenditures and inventory deployment and

the anticipated timing thereof; Parex’s anticipated average

production at the Capachos block in the fourth quarter; the

anticipated timing of when Parex will start a polymer flooding

pilot project at the Cabrestero block and the anticipated benefits

to be derived therefrom; the anticipated benefits to be derived

from Parex’s follow-up horizontal well at block LLA-81; the

anticipated timing of when the Arantes well will spud; the

anticipated timing of when the fourth and fifth horizontal wells at

block LLA-34 will reach total depth; Parex’s 2023 average

production guidance and capital expenditure guidance; Parex’s

anticipated average production in Q4 2023; the anticipated timing

of when Parex will release its 2024 formal guidance and updated

three-year outlook; the anticipated terms of the Company’s Q4 2023

regular quarterly dividend including its expectation that it will

be designated as an “eligible dividend”; and the anticipated date

and time of Parex’s conference call to discuss third quarter 2023

results.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

prolonged volatility in commodity prices; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; determinations by

OPEC and other countries as to production levels; competition; lack

of availability of qualified personnel; the results of exploration

and development drilling and related activities; obtaining required

approvals of regulatory authorities in Canada and Colombia; the

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities; volatility in market prices for oil; fluctuations in

foreign exchange or interest rates; environmental risks; changes in

income tax laws or changes in tax laws and incentive programs

relating to the oil industry; changes to pipeline capacity; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under contracts; the risk that

Brent oil prices may be lower than anticipated; the risk that

Parex’s evaluation of its existing portfolio of development and

exploration opportunities may not be consistent with its

expectations; the risk that Parex may not have sufficient financial

resources in the future to provide distributions to its

shareholders; the risk that the Board may not declare dividends in

the future or that Parex’s dividend policy changes; the risk that

Parex may not be responsive to changes in commodity prices; the

risk that Parex may not meet its production guidance for the year

ended December 31, 2023; the risk that Parex’s 2023 capital

expenditures may be greater than anticipated; the risk that working

capital does not increase and/or production growth does not occur

as forecasted, or at all; the risk that the Arauca block may have

less prospective zones with exploration upside than anticipated;

the risk that production may not commence at the Arauca-15 well

when anticipated, or at all; the risk that the Arauca-8 big ‘E’

exploration well may not reach total depth when anticipated, or at

all; the risk that Parex’s average production at the Capachos block

in the fourth quarter may be less than anticipated; the risk that

Parex may not start a polymer flooding pilot project at the

Cabrestero block when anticipated, or at all; the risk that the

Arantes well may not spud when anticipated, or at all; the risk

that the fourth and fifth horizontal wells at block LLA-34 may not

reach total depth when anticipated, or at all; and other factors,

many of which are beyond the control of the Company.Readers are

cautioned that the foregoing list of factors is not exhaustive.

Additional information on these and other factors that could affect

Parex’s operations and financial results are included in reports on

file with Canadian securities regulatory authorities and may be

accessed through the SEDAR+ website (www.sedarplus.ca).

Although the forward-looking statements contained

in this document are based upon assumptions which Management

believes to be reasonable, the Company cannot assure investors that

actual results will be consistent with these forward-looking

statements. With respect to forward-looking statements contained in

this document, Parex has made assumptions regarding, among other

things: current and anticipated commodity prices and royalty

regimes; availability of skilled labour; timing and amount of

capital expenditures; future exchange rates; the price of oil,

including the anticipated Brent oil price; the impact of increasing

competition; conditions in general economic and financial markets;

availability of drilling and related equipment; effects of

regulation by governmental agencies; receipt of partner, regulatory

and community approvals; royalty rates; future operating costs;

uninterrupted access to areas of Parex’s operations and

infrastructure; recoverability of reserves and future production

rates; the status of litigation; timing of drilling and completion

of wells; on-stream timing of production from successful

exploration wells; operational performance of non-operated

producing fields; pipeline capacity; that Parex will have

sufficient cash flow, debt or equity sources or other financial

resources required to fund its capital and operating expenditures

and requirements as needed; that Parex’s conduct and results of

operations will be consistent with its expectations; that Parex

will have the ability to develop its oil and gas properties in the

manner currently contemplated; that Parex’s evaluation of its

existing portfolio of development and exploration opportunities is

consistent with its expectations; current or, where applicable,

proposed industry conditions, laws and regulations will continue in

effect or as anticipated as described herein; that initial findings

from the Arauca-15 well are an accurate reflection of future

results; that the estimates of Parex’s production and reserves

volumes and the assumptions related thereto (including commodity

prices and development costs) are accurate in all material

respects; that Parex will be able to obtain contract extensions or

fulfill the contractual obligations required to retain its rights

to explore, develop and exploit any of its undeveloped properties;

that Parex will have sufficient financial resources to pay

dividends and acquire shares pursuant to its NCIB in the future;

and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this document in order to provide shareholders with a

more complete perspective on Parex’s current and future operations

and such information may not be appropriate for other purposes.

Parex’s actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

This press release contains information that may

be considered a financial outlook under applicable securities laws

about the Company’s potential financial position, including, but

not limited to: Parex’s expectations that its capital expenditures

will be lower in the fourth quarter; Parex’s 2023 capital

expenditure guidance; and the anticipated terms of the Company’s Q4

2023 regular quarterly dividend including its expectation that it

will be designated as an "eligible dividend", all of which are

subject to numerous assumptions, risk factors, limitations and

qualifications, including those set forth in the above paragraphs.

The actual results of operations of the Company and the resulting

financial results will vary from the amounts set forth in this

press release and such variations may be material. This information

has been provided for illustration only and with respect to future

periods are based on budgets and forecasts that are speculative and

are subject to a variety of contingencies and may not be

appropriate for other purposes. Accordingly, these estimates are

not to be relied upon as indicative of future results. Except as

required by applicable securities laws, the Company undertakes no

obligation to update such financial outlook. The financial outlook

contained in this press release was made as of the date of this

press release and was provided for the purpose of providing further

information about the Company’s potential future business

operations. Readers are cautioned that the financial outlook

contained in this press release is not conclusive and is subject to

change.

The following abbreviations used in this press

release have the meanings set forth below:

| bbl |

one

barrel |

| bbls |

barrels |

| bbl/d |

barrels per day |

| boe |

barrels of oil equivalent of natural gas; one barrel of oil or

natural gas liquids for six thousand cubic feet of natural gas |

| boe/d |

barrels of oil equivalent of natural gas per day |

| mcf |

thousand cubic feet |

| mcf/d |

thousand cubic feet per day |

| W.I. |

working interest |

| |

|

PDF

available: http://ml.globenewswire.com/Resource/Download/b8128b8d-f9af-4fcb-b930-788eb9b3d252

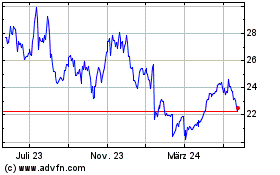

Parex Resources (TSX:PXT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

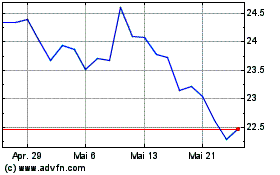

Parex Resources (TSX:PXT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024