Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) is

pleased to announce its financial and operating results for the

three-month period ended June 30, 2024, the declaration of its

Q3 2024 regular dividend of C$0.385 per share, as well as an

operational update. All amounts herein are in United States Dollars

(“USD”) unless otherwise stated.

“In the first half of 2024, we enhanced our free funds flow

profile by roughly 80% year-over-year compared to 2023. These

strong financial results were driven by our core Cabrestero and

LLA-34 assets, as well as reduced capital expenditures,” commented

Imad Mohsen, President & ChiefExecutive Officer.

“For the second half of 2024, we have paused activity at Arauca

due to lower-than-expected results, and reallocated capital to

LLA-32 and Capachos where we are seeing success. Initial results

from these areas support our outlook to grow production into year

end and meet the lower end of our annual production guidance range,

while we actively work on the delivery of our high-impact, big ‘E’

exploration wells at Arantes (LLA-122) and Hidra (VIM-1)."

Key Highlights

- Generated Q2 2024 funds flow provided

by operations ("FFO")(1) of $181 million and FFO per share(2)(3) of

$1.77.

- Successfully drilled an unbooked

stepout from a pre-existing field at LLA-32(4), with the drilling

of up to three more follow-up wells planned for H2 2024.

- Realizing positive results from the

polymer injection pilot at Cabrestero(5), with a full field

expansion currently being designed and evaluated.

- FY 2024 average production guidance of

54,000 to 60,000 boe/d and capital expenditure guidance of $390 to

$430 million are trending toward the lower end of their respective

ranges.

- Declared Q3 2024 regular dividend of

C$0.385 per share(7) or C$1.54 per share annualized.

- Repurchased approximately 2.7 million

shares YTD 2024 under the Company's current normal course issuer

bid ("NCIB").

Q2 2024 Results

- Quarterly average oil & natural gas

production was 53,568 boe/d(8), comparable to Q2 2023 and Q1 2024;

increases in the Northern Llanos were offset by lower production at

LLA-34 and fields in the Southern Llanos.

- Grew production per share(3)(7) by 3%

compared to Q2 2023, from steady production and the reduction of

outstanding shares through the Company's NCIB programs.

- Realized net income of $4 million or

$0.04 per share basic(3).

- Generated quarterly FFO(1) of $181

million and FFO per share(2)(3) of $1.77, a 17% increase and a 22%

increase from Q2 2023, respectively; during the quarter, a $21

million one-time foreign exchange gain was realized related to the

settlement of the Company's 2023 Colombian tax payable.

- Produced an operating netback(2) of

$46.32/boe and an FFO netback(2) of $37.34/boe from an average

Brent price of $85.03/bbl.

- Incurred $98 million of capital

expenditures(6), primarily from activities at Arauca, LLA-34,

LLA-32 and LLA-122.

- Generated $83 million of free funds

flow(6) that was used for return of capital initiatives as well as

$10 million of bank debt repayment; working capital surplus(1) was

$34 million and cash $119 million at quarter end.

- Paid a C$0.385 per share(7) regular

quarterly dividend and repurchased 1,298,300 shares.

(1) Capital management measure. See “Non-GAAP and Other

Financial Measures Advisory.”(2) Non-GAAP ratio. See “Non-GAAP and

Other Financial Measures Advisory.”(3) Per share amounts (with the

exception of dividends) are based on weighted-average common

shares; dividends paid per share are based on the number of common

shares outstanding at each dividend date.(4) 87.5% W.I.(5) 100%

W.I.(6) Non-GAAP financial measure. See “Non-GAAP and Other

Financial Measures Advisory.”(7) Supplementary financial measure.

See "Non-GAAP and Other Financial Measures Advisory."(8) See

"Operational and Financial Highlights" for a breakdown of

production by product type.

|

Operational and Financial Highlights |

Three Months Ended |

Six Months Ended |

|

|

(unaudited) |

Jun. 30, |

|

Jun. 30, |

|

Mar. 31, |

|

Jun. 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2024 |

|

|

Operational |

|

|

|

|

|

Average daily production |

|

|

|

|

|

Light Crude Oil and Medium Crude Oil (bbl/d) |

9,541 |

|

7,982 |

|

7,237 |

|

8,389 |

|

|

Heavy Crude Oil (bbl/d) |

43,229 |

|

45,644 |

|

45,543 |

|

44,386 |

|

|

Crude Oil (bbl/d) |

52,770 |

|

53,626 |

|

52,780 |

|

52,775 |

|

|

Conventional Natural Gas (mcf/d) |

4,788 |

|

2,964 |

|

3,348 |

|

4,068 |

|

|

Oil & Gas (boe/d)(1) |

53,568 |

|

54,120 |

|

53,338 |

|

53,453 |

|

|

|

|

|

|

|

|

Operating netback ($/boe) |

|

|

|

|

|

Reference price - Brent ($/bbl) |

85.03 |

|

77.84 |

|

81.87 |

|

83.42 |

|

|

Oil & gas sales(4) |

75.21 |

|

67.13 |

|

70.80 |

|

73.03 |

|

|

Royalties(4) |

(12.54 |

) |

(11.15 |

) |

(11.21 |

) |

(11.88 |

) |

|

Net revenue(4) |

62.67 |

|

55.98 |

|

59.59 |

|

61.15 |

|

|

Production expense(4) |

(12.95 |

) |

(9.14 |

) |

(12.64 |

) |

(12.79 |

) |

|

Transportation expense(4) |

(3.40 |

) |

(3.51 |

) |

(3.40 |

) |

(3.40 |

) |

|

Operating netback ($/boe)(2) |

46.32 |

|

43.33 |

|

43.55 |

|

44.96 |

|

|

|

|

|

|

|

|

Funds flow provided by operations netback

($/boe)(2) |

37.34 |

|

31.86 |

|

31.32 |

|

34.37 |

|

|

|

|

|

|

|

|

Financial ($000s except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

Net income |

3,845 |

|

101,415 |

|

60,093 |

|

63,938 |

|

|

Per share - basic(6) |

0.04 |

|

0.95 |

|

0.58 |

|

0.62 |

|

|

|

|

|

|

|

|

Funds flow provided by

operations(5) |

180,952 |

|

154,842 |

|

148,307 |

|

329,259 |

|

|

Per share - basic(2)(6) |

1.77 |

|

1.45 |

|

1.43 |

|

3.20 |

|

|

|

|

|

|

|

|

Capital expenditures(3) |

97,797 |

|

121,309 |

|

85,421 |

|

183,218 |

|

|

|

|

|

|

|

|

Free funds flow(3) |

83,155 |

|

33,533 |

|

62,886 |

|

146,041 |

|

|

|

|

|

|

|

|

EBITDA(3) |

195,940 |

|

139,881 |

|

192,078 |

|

388,018 |

|

|

Adjusted EBITDA(3) |

230,547 |

|

191,584 |

|

188,228 |

|

418,775 |

|

|

|

|

|

|

|

|

Long-term inventory expenditures |

9,817 |

|

20,903 |

|

3,843 |

|

13,660 |

|

|

|

|

|

|

|

|

Dividends paid |

28,528 |

|

30,101 |

|

28,531 |

|

57,059 |

|

| Per share

- Cdn$(4) |

0.385 |

|

0.375 |

|

0.375 |

|

0.760 |

|

|

|

|

|

|

|

|

Shares repurchased |

21,367 |

|

25,474 |

|

15,291 |

|

36,658 |

|

| Number of

shares repurchased (000s) |

1,298 |

|

1,260 |

|

920 |

|

2,218 |

|

|

|

|

|

|

|

|

Outstanding shares (end of period) (000s) |

|

|

|

|

|

Basic |

101,616 |

|

106,194 |

|

102,914 |

|

101,616 |

|

|

Weighted average basic |

102,259 |

|

106,830 |

|

103,474 |

|

102,866 |

|

|

Diluted(8) |

102,528 |

|

106,962 |

|

103,829 |

|

102,528 |

|

|

|

|

|

|

|

|

Working capital surplus

(deficit)(5) |

34,156 |

|

(2,957 |

) |

55,901 |

|

34,156 |

|

|

Bank debt(7) |

50,000 |

|

— |

|

60,000 |

|

50,000 |

|

|

Cash |

119,468 |

|

133,375 |

|

61,052 |

|

119,468 |

|

(1) Reference to crude oil or natural gas in the

above table and elsewhere in this press release refer to the light

and medium crude oil and heavy crude oil and conventional natural

gas, respectively, product types as defined in National Instrument

51-101 - Standards of Disclosure for Oil and Gas Activities.(2)

Non-GAAP ratio. See “Non-GAAP and Other Financial Measures

Advisory”.(3) Non-GAAP financial measure. See "Non-GAAP and Other

Financial Measures Advisory".(4) Supplementary financial measure.

See "Non-GAAP and Other Financial Measures Advisory".(5) Capital

management measure. See "Non-GAAP and Other Financial Measures

Advisory".(6) Per share amounts (with the exception of dividends)

are based on weighted average common shares. Dividends paid per

share are based on the number of common shares outstanding at each

dividend record date.(7) Syndicated bank credit facility borrowing

base of $200.0 million as at June 30, 2024. (8) Diluted shares

as stated include common shares and stock options outstanding at

period end; June 30, 2024 closing price was C$21.92 per

share.

Operational Update

Cabrestero and LLA-34(1)(2)

The Cabrestero and LLA-34 blocks had average production of over

42,000 bbl/d of heavy crude oil (net) combined in Q2 2024. At both

blocks, weather-associated flooding in June 2024 adversely affected

production, which has since normalized.

At LLA-34, secondary recovery from the initial waterflood

injection patterns is performing strongly, with two additional

patterns planned forH2 2024.

At Cabrestero, the waterflood patterns are fully implemented,

with the Company focused on continuing to ramp-up injection rates.

Parex is also monitoring its polymer injection pilot that is

showing positive results, with a full field expansion currently

being designed and evaluated.(1) Cabrestero: 100% W.I.(2) LLA-34:

55% W.I.

LLA-32 - Exploitation Update(1)

Near the end of Q2 2024, the Company successfully drilled an

unbooked stepout well from a pre-existing field at LLA-32. Parex

has since drilled a follow-up appraisal well, which is being used

to determine the areal extent of the oil field. Based on success to

date, development runway on the block is emerging, with multiple

appraisal and development wells that can be drilled.(1) 87.5%

W.I.

Northern Llanos - Arauca & Capachos Update(1)(2)

Following strong initial production from the Arauca Block via

the Arauca-8 well, water intrusion from an upper, non-producing

formation reduced oil production. A workover focused on best

restoring and optimizing production is planned for Q3 2024.

The Arauca-81 well is expected to be onstream in late Q3 2024.

Following the drilling and completion of this well, the rig will

move to execute the required workover at the Arauca-8 well. Once

the workover is completed, the rig is expected to be released.

The Arauca-15 sidetrack came online in late Q2 2024, producing

at lower-than-expected average rates of roughly 1,100 bbl/d of

light crude oil (gross) in June 2024(3). Following the completion

of this well, the rig was relocated to Capachos, where it started a

three-well campaign with the first well spud in late Q2 2024. This

move allows Parex time to analyze Arauca's initial results before

proceeding with the drilling of the Arauca-12 well, expected in

2025.

The Company expects the Arauca field to produce 2,000 to 4,000

bbl/d of light crude oil (gross) in H2 2024. With underperformance

to date, Parex is reallocating current year Arauca capital to

LLA-32(4) and Capachos drilling.(1) Arauca: Business Collaboration

Agreement with Ecopetrol S.A. (Parex 50% Participating Share);

Ecopetrol S.A. currently holds 100% of the working interest in the

Convenio Arauca while the assignment procedure is pending.(2)

Capachos: 50% W.I.(3) Short-term production rate. See "Oil &

Gas Matters Advisory."(4) 87.5% W.I.

Big 'E' Exploration - High-Impact Targets with Transformational

Potential

The drilling of Parex's first well in the high-potential

Colombian Foothills, Arantes at LLA-122(1), continues to progress.

Although the timeline has been extended due to previous mechanical

issues and a revised total depth based on recalibrated seismic

analysis, the well is currently at roughly 16,500 feet, with a

target depth of approximately 19,500 feet. The well is expected to

reach total depth in late Q3 2024.

Parex continues to progress the pre-drill work for the Hidra

well at VIM-1(1), which is roughly 15 kilometers from the Company's

La Belleza discovery. The well is expected to spud in Q3 2024.

As the drilling rig has moved out of the Arauca Block and

adjacent LLA-38 Block, Parex plans to replace the drilling of the

Berillo Oeste prospect with an exploration well at Capachos, which

is expected to spud by year end(1)(2).

(1) 50% W.I.

(2) Subject to partner approval.

Production Outlook and 2024 Corporate

Guidance

The Company is positioned to grow production into year-end by

executing a workover at Arauca-8, bringing online new wells at

Arauca and Capachos, in addition to multiple planned appraisal and

development wells at LLA-32.

Parex's FY 2024 average production guidance of 54,000 to 60,000

boe/d and capital expenditure guidance of $390 to $430 million are

trending toward the lower end of their respective ranges.

Lower production primarily reflects underperformance at Arauca

as well as previously disclosed temporary shut-ins in the Northern

Llanos, while lower capital reflects reduced spending at Arauca and

LLA-38, with some offset from increased spending at LLA-32, LLA-122

and Capachos.

Return of Capital Update

Q3 2024 Dividend

Parex’s Board of Directors have approved a Q3 2024 regular

dividend of C$0.385 per share to be paid on September 16, 2024, to

shareholders of record on September 9, 2024. The Company first

initiated a regular quarterly dividend at C$0.125 per share in

2021.

This regular dividend payment to shareholders is designated as

an “eligible dividend” for purposes of the Income Tax Act

(Canada).

Active Share Buyback Program Under Current Normal Course Issuer

Bid

As at July 30, 2024, Parex has repurchased approximately 2.7

million shares under its current NCIB at an average price of

C$22.15 per share, for total consideration of roughly C$59

million.

Q2 2024 Results - Conference Call & Video

Webcast

Parex will host a conference call and video webcast to discuss

its Q2 2024 results on Thursday, August 1, 2024, beginning at

9:30 am MT (11:30 am ET). To participate in the conference call or

video webcast, please see the access information below:

|

Conference ID:Participant Toll-Free Dial-In Number:Participant Toll

Dial-In Number:Webcast: |

1 335

3351-888-550-55841-646-960-0157https://events.q4inc.com/attendee/542316564 |

About Parex Resources Inc.

Parex is the largest independent oil and gas company in

Colombia, focusing on sustainable, conventional production. The

Company’s corporate headquarters are in Calgary, Canada, with an

operating office in Bogotá, Colombia. Parex shares trade on the

Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital

Markets & Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations &

Communications AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED

STATES

Non-GAAP and Other Financial Measures

Advisory

This press release uses various “non-GAAP financial measures”,

“non-GAAP ratios”, “supplementary financial measures” and “capital

management measures” (as such terms are defined in NI 52-112),

which are described in further detail below. Such measures are not

standardized financial measures under IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. Investors are cautioned that non-GAAP financial measures

should not be construed as alternatives to or more meaningful than

the most directly comparable GAAP measures as indicators of Parex's

performance.

These measures facilitate management’s comparisons to the

Company’s historical operating results in assessing its results and

strategic and operational decision-making and may be used by

financial analysts and others in the oil and natural gas industry

to evaluate the Company’s performance. Further, management believes

that such financial measures are useful supplemental information to

analyze operating performance and provide an indication of the

results generated by the Company's principal business

activities.

Set forth below is a description of the non-GAAP financial

measures, non-GAAP ratios, supplementary financial measures and

capital management measures used in this press release.

Non-GAAP Financial Measures

Capital expenditures, is a non-GAAP financial

measure which the Company uses to describe its capital costs

associated with oil and gas expenditures. The measure considers

both property, plant and equipment expenditures and exploration and

evaluation asset expenditures which are items in the Company’s

statement of cash flows for the period.

| |

For the three months ended |

|

For the six monthsended |

| |

Jun. 30, |

|

Jun. 30, |

|

Mar. 31, |

|

Jun. 30, |

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

Property, plant and equipment expenditures |

$ |

49,214 |

|

$ |

82,999 |

|

$ |

40,831 |

|

$ |

90,045 |

|

Exploration and evaluation expenditures |

|

48,583 |

|

|

38,310 |

|

|

44,590 |

|

|

93,173 |

|

Capital expenditures |

$ |

97,797 |

|

$ |

121,309 |

|

$ |

85,421 |

|

$ |

183,218 |

Free funds flow, is a non-GAAP financial

measure that is determined by funds flow provided by (used in)

operations less capital expenditures. The Company considers free

funds flow to be a key measure as it demonstrates Parex’s ability

to fund return of capital, such as the NCIB and dividends, without

accessing outside funds and is calculated as follows:

| |

|

|

|

| |

For the three months ended |

|

For the six monthsended |

| |

|

Jun. 30, |

|

|

Jun. 30, |

|

|

Mar. 31, |

|

Jun. 30, |

|

($000s) |

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2024 |

|

Cash provided by (used in) operating activities |

$ |

222,782 |

|

$ |

(36,612 |

) |

|

$ |

97,412 |

|

$ |

320,194 |

|

Net change in non-cash working capital |

|

(41,830 |

) |

|

191,454 |

|

|

|

50,895 |

|

|

9,065 |

|

Funds flow provided by operations |

|

180,952 |

|

|

154,842 |

|

|

|

148,307 |

|

|

329,259 |

| Capital

expenditures |

|

97,797 |

|

|

121,309 |

|

|

|

85,421 |

|

|

183,218 |

|

Free funds flow |

|

83,155 |

|

|

33,533 |

|

|

|

62,886 |

|

|

146,041 |

EBITDA, is a non-GAAP financial measure that is

defined as net income adjusted for finance income and expenses,

income tax expense (recovery) and depletion, depreciation and

amortization.

Adjusted EBITDA, is a non-GAAP financial

measure defined as EBITDA adjusted for non-cash impairment charges,

unrealized foreign exchange gains (losses), unrealized gains

(losses) on risk management contracts and share-based compensation

expense.

The Company considers EBITDA and Adjusted EBITDA to be key

measures as they demonstrates Parex’s profitability before finance

income and expenses, taxes, depletion, depreciation and

amortization and other non-cash items. A reconciliation from net

income to EBITDA and Adjusted EBITDA is as follows:

| |

For the three months ended |

For the six months ended |

|

|

|

Jun. 30, |

|

|

Jun. 30, |

|

|

Mar. 31, |

|

|

Jun. 30, |

|

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

| Net

income |

$ |

3,845 |

|

$ |

101,415 |

|

$ |

60,093 |

|

$ |

63,938 |

|

| Adjustments to reconcile net

income to EBITDA: |

|

|

|

|

| Finance income |

|

(1,097 |

) |

|

(5,106 |

) |

|

(1,257 |

) |

|

(2,354 |

) |

| Finance expense |

|

5,421 |

|

|

4,253 |

|

|

5,194 |

|

|

10,615 |

|

| Income tax expense

(recovery) |

|

130,888 |

|

|

(6,308 |

) |

|

75,817 |

|

|

206,705 |

|

|

Depletion, depreciation and amortization |

|

56,883 |

|

|

45,627 |

|

|

52,231 |

|

|

109,114 |

|

|

EBITDA |

$ |

195,940 |

|

$ |

139,881 |

|

$ |

192,078 |

|

$ |

388,018 |

|

|

Non-cash impairment charges |

|

4,661 |

|

|

55,021 |

|

|

— |

|

|

4,661 |

|

| Share-based compensation

expense |

|

5,770 |

|

|

7,497 |

|

|

(2,463 |

) |

|

3,307 |

|

|

Unrealized foreign exchange loss (gain) |

|

24,176 |

|

|

(10,815 |

) |

|

(1,387 |

) |

|

22,789 |

|

|

Adjusted EBITDA |

$ |

230,547 |

|

$ |

191,584 |

|

$ |

188,228 |

|

$ |

418,775 |

|

Non-GAAP Ratios

Operating netback per boe, is a non-GAAP ratio

that the Company considers to be a key measure as it demonstrates

Parex’ profitability relative to current commodity prices. Parex

calculates operating netback per boe as operating netback

(calculated as oil and natural gas sales from production, less

royalties, operating, and transportation expense) divided by the

total equivalent sales volume including purchased oil volumes for

oil and natural gas sales price and transportation expense per boe

and by the total equivalent sales volume excluding purchased oil

volumes for royalties and operating expense per boe.

Funds flow provided by operations netback per boe or FFO

netback per boe, is a non-GAAP ratio that includes all

cash generated from operating activities and is calculated before

changes in non-cash working capital, divided by produced oil and

natural gas sales volumes. The Company considers funds flow

provided by operations netback per boe to be a key measure as it

demonstrates Parex’s profitability after all cash costs relative to

current commodity prices.

Basic funds flow provided by operations per share or FFO

per share, is a non-GAAP ratio that is calculated by

dividing funds flow provided by operations by the weighted average

number of basic shares outstanding. Parex presents basic funds flow

provided by operations per share whereby per share amounts are

calculated using weighted-average shares outstanding, consistent

with the calculation of earnings per share.The Company considers

basic funds flow provided by operations per share or FFO per share

to be a key measure as it demonstrates Parex’s profitability after

all cash costs relative to the weighted average number of basic

shares outstanding.

Capital Management Measures

Funds flow provided by operations, is a capital

management measure that includes all cash generated from operating

activities and is calculated before changes in non-cash working

capital. The Company considers funds flow provided by operations to

be a key measure as it demonstrates Parex’s profitability after all

cash costs. A reconciliation from cash provided by (used in)

operating activities to funds flow provided by operations is as

follows:

| |

For the three months ended |

|

For the six monthsended |

|

|

|

Jun. 30, |

|

|

Jun. 30, |

|

|

Mar. 31, |

|

|

Jun. 30, |

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

Cash provided by (used in) operating activities |

$ |

222,782 |

|

$ |

(36,612 |

) |

$ |

97,412 |

|

$ |

320,194 |

| Net

change in non-cash working capital |

|

(41,830 |

) |

|

191,454 |

|

|

50,895 |

|

|

9,065 |

| Funds

flow provided by operations |

$ |

180,952 |

|

$ |

154,842 |

|

$ |

148,307 |

|

$ |

329,259 |

| |

|

|

|

|

|

|

|

|

|

|

|

Working capital surplus (deficit), is a capital

management measure which the Company uses to describe its liquidity

position and ability to meet its short-term liabilities. Working

capital surplus (deficit) defined as current assets less current

liabilities.

| |

For the three months ended |

|

For the six monthsended |

| |

|

Jun. 30, |

|

|

Jun. 30, |

|

|

Mar. 31, |

|

Jun. 30, |

|

($000s) |

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2024 |

|

Current assets |

$ |

281,846 |

|

$ |

322,146 |

|

|

$ |

276,113 |

|

$ |

281,846 |

| Current

liabilities |

|

247,690 |

|

|

325,103 |

|

|

|

220,212 |

|

|

247,690 |

|

Working capital surplus (deficit) |

$ |

34,156 |

|

$ |

(2,957 |

) |

|

$ |

55,901 |

|

$ |

34,156 |

Supplementary Financial Measures

"Oil and natural gas sales per boe" is

determined by sales revenue excluding risk management contracts, as

determined in accordance with IFRS, divided by total equivalent

sales volume including purchased oil volumes.

"Royalties per boe" is comprised of royalties,

as determined in accordance with IFRS, divided by the total

equivalent sales volume and excludes purchased oil volumes.

"Net revenue per boe" is comprised of net

revenue, as determined in accordance with IFRS, divided by the

total equivalent sales volume and excludes purchased oil

volumes.

"Production expense per boe" is comprised of

production expense, as determined in accordance with IFRS, divided

by the total equivalent sales volume and excludes purchased oil

volumes.

"Transportation expense per boe" is comprised

of transportation expense, as determined in accordance with IFRS,

divided by the total equivalent sales volumes including purchased

oil volumes.

"Dividends paid per share" is comprised of

dividends declared, as determined in accordance with IFRS, divided

by the number of shares outstanding at the dividend record

date.

"Production per share growth" is comprised of

the Company's total oil and natural gas production volumes divided

by the weighted average number of basic shares outstanding. Parex

presents production per share whereby per share amounts are

calculated using weighted-average shares outstanding, consistent

with the calculation of earnings per share. Growth is determined in

comparison to the comparative period.

Oil & Gas Matters Advisory

The term "Boe" means a barrel of oil equivalent on the basis of

6 Mcf of natural gas to 1 barrel of oil ("bbl"). Boe’s may be

misleading, particularly if used in isolation. A boe conversation

ratio of 6 Mcf: 1 Bbl is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. Given the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf: 1 Bbl may be

misleading as an indication of value.

This press release contains a number of oil and gas metrics,

including, operating netbacks and FFO netbacks. These oil and gas

metrics have been prepared by management and do not have

standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics have been included herein to provide readers with

additional measures to evaluate the Company's performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods and therefore such metrics should

not be unduly relied upon. Management uses these oil and gas

metrics for its own performance measurements and to provide

security holders with measures to compare the Company's operations

over time. Readers are cautioned that the information provided by

these metrics, or that can be derived from the metrics presented in

this news release, should not be relied upon for investment or

other purposes.

Any reference in this press release to short-term production

rates are useful in confirming the presence of hydrocarbons,

however such rates are not determination of the rates at which such

wells will continue production and decline thereafter and readers

are cautioned not to place reliance on such rates in calculating

the aggregate production of Parex.

Distribution Advisory

The Company's future shareholder distributions, including but

not limited to the payment of dividends and the acquisition by the

Company of its shares pursuant to an NCIB, if any, and the level

thereof is uncertain. Any decision to pay further dividends on the

common shares (including the actual amount, the declaration date,

the record date and the payment date in connection therewith and

any special dividends) or acquire shares of the Company will be

subject to the discretion of the Board of Directors of Parex and

may depend on a variety of factors, including, without limitation

the Company's business performance, financial condition, financial

requirements, growth plans, expected capital requirements and other

conditions existing at such future time including, without

limitation, contractual restrictions and satisfaction of the

solvency tests imposed on the Company under applicable corporate

law. Further, the actual amount, the declaration date, the record

date and the payment date of any dividend are subject to the

discretion of the Board. There can be no assurance that the Company

will pay dividends or repurchase any shares of the Company in the

future.

Advisory on Forward Looking Statements

Certain information regarding Parex set forth in this document

contains forward-looking statements that involve substantial known

and unknown risks and uncertainties. The use of any of the words

"plan", "expect", “prospective”, "project", "intend", "believe",

"should", "anticipate", "estimate", “forecast”, "guidance",

“budget” or other similar words, or statements that certain events

or conditions "may" or "will" occur are intended to identify

forward-looking statements. Such statements represent Parex's

internal projections, estimates or beliefs concerning, among other

things, future growth, results of operations, production, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, plans for and

results of drilling activity, environmental matters, business

prospects and opportunities. These statements are only predictions

and actual events or results may differ materially. Although the

Company’s management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee

future results, levels of activity, performance or achievement

since such expectations are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause Parex's actual results

to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this

document include, but are not limited to, statements with respect

to: the Company’s focus, plans, priorities and strategies; Parex's

plan for three follow-up appraisal wells at the LLA-32 block for H2

2024; average production guidance and capital expenditure guidance;

additional planned waterflood injection patterns at the LLA-34

block for H2 2024; drilling plans at the LLA-32 block; Parex's

planned workover at the Arauca-8 well and expectations related

thereto; that the Arauca-81 well is expected to be onstream in Q3

2024 and plans for the applicable rig; expectations with respect to

the drilling of the Arauca-12 well and production from the Arauca

field in H2 2024; anticipated timing of results from Arantes at the

LLA-122 block; timing expectations for spudding the Hidra well at

the VIM-1 block and the Northern Llanos exploration well; that the

Company is positioned to grow production into year-end by executing

workovers at the Arauca block, bringing online new wells at the

Arauca and Capachos blocks, in addition to multiple appraisal and

development wells at the LLA-32 block; the anticipated terms of the

Company's Q3 2024 regular quarterly dividend, including its

expectation that it will be designated as an "eligible dividend";

and the anticipated date and time of Parex's conference call to

discuss Q2 2024 results.

These forward-looking statements are subject to numerous risks

and uncertainties, including but not limited to, the impact of

general economic conditions in Canada and Colombia; prolonged

volatility in commodity prices; industry conditions including

changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; determinations by

OPEC and other countries as to production levels; competition; lack

of availability of qualified personnel; the results of exploration

and development drilling and related activities; obtaining required

approvals of regulatory authorities in Canada and Colombia; the

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities; volatility in market prices for oil; fluctuations in

foreign exchange or interest rates; environmental risks; changes in

income tax laws or changes in tax laws and incentive programs

relating to the oil industry; changes to pipeline capacity; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under contracts; the risk that

Brent oil prices may be lower than anticipated; the risk that

Parex's evaluation of its existing portfolio of development and

exploration opportunities may not be consistent with its

expectations; the risk that Parex may not have sufficient financial

resources in the future to provide distributions to its

shareholders; the risk that the Board may not declare dividends in

the future or that Parex's dividend policy changes; the risk that

Parex may not be responsive to changes in commodity prices; the

risk that Parex may not meet its production guidance for the year

ended December 31, 2024; the risk that Parex's 2024 capital

expenditures may be greater than anticipated; the risk that plans

and expectations related to Parex's drilling program as disclosed

herein do not materialize as expected and/or at all; the risk that

Parex may not be able to increase production into year end; and

other factors, many of which are beyond the control of the

Company.

Readers are cautioned that the foregoing list of factors is not

exhaustive. Additional information on these and other factors that

could affect Parex's operations and financial results are included

in reports on file with Canadian securities regulatory authorities

and may be accessed through the SEDAR+ website

(www.sedarplus.ca).

Although the forward-looking statements contained in this

document are based upon assumptions which Management believes to be

reasonable, the Company cannot assure investors that actual results

will be consistent with these forward-looking statements. With

respect to forward-looking statements contained in this document,

Parex has made assumptions regarding, among other things: current

and anticipated commodity prices and royalty regimes; availability

of skilled labour; timing and amount of capital expenditures;

future exchange rates; the price of oil, including the anticipated

Brent oil price; the impact of increasing competition; conditions

in general economic and financial markets; availability of drilling

and related equipment; effects of regulation by governmental

agencies; receipt of partner, regulatory and community approvals;

royalty rates; future operating costs; uninterrupted access to

areas of Parex's operations and infrastructure; recoverability of

reserves and future production rates; the status of litigation;

timing of drilling and completion of wells; on-stream timing of

production from successful exploration wells; operational

performance of non-operated producing fields; pipeline capacity;

that Parex will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that Parex's

conduct and results of operations will be consistent with its

expectations; that Parex will have the ability to develop its oil

and gas properties in the manner currently contemplated; that

Parex's evaluation of its existing portfolio of development and

exploration opportunities is consistent with its expectations;

current or, where applicable, proposed industry conditions, laws

and regulations will continue in effect or as anticipated as

described herein; that the estimates of Parex's production and

reserves volumes and the assumptions related thereto (including

commodity prices and development costs) are accurate in all

material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that Parex will have sufficient financial

resources to pay dividends and acquire shares pursuant to its NCIB

in the future; that Parex is able to execute its plans with respect

to the Company's drilling program as disclosed herein; and other

matters.

Management has included the above summary of assumptions and

risks related to forward-looking information provided in this

document in order to provide shareholders with a more complete

perspective on Parex's current and future operations and such

information may not be appropriate for other purposes. Parex's

actual results, performance or achievement could differ materially

from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurance can be given that any of

the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do, what benefits Parex will

derive. These forward-looking statements are made as of the date of

this document and Parex disclaims any intent or obligation to

update publicly any forward-looking statements, whether as a result

of new information, future events or results or otherwise, other

than as required by applicable securities laws.

This press release contains information that may be considered a

financial outlook under applicable securities laws about the

Company's potential financial position, including, but not limited

to; Parex's 2024 capital expenditure guidance; and the anticipated

terms of the Company's Q3 2024 regular quarterly dividend including

its expectation that it will be designated as an "eligible

dividend", all of which are subject to numerous assumptions, risk

factors, limitations and qualifications, including those set forth

in the above paragraphs. The actual results of operations of the

Company and the resulting financial results will vary from the

amounts set forth in this press release and such variations may be

material. This information has been provided for illustration only

and with respect to future periods are based on budgets and

forecasts that are speculative and are subject to a variety of

contingencies and may not be appropriate for other purposes.

Accordingly, these estimates are not to be relied upon as

indicative of future results. Except as required by applicable

securities laws, the Company undertakes no obligation to update

such financial outlook. The financial outlook contained in this

press release was made as of the date of this press release and was

provided for the purpose of providing further information about the

Company's potential future business operations. Readers are

cautioned that the financial outlook contained in this press

release is not conclusive and is subject to change.

The following abbreviations used in this press release have the

meanings set forth below:

|

bblbblsbbl/dboeboe/dmcfmcf/dW.I. |

one barrelbarrelsbarrels per daybarrels of oil equivalent of

natural gas; one barrel of oil or natural gas liquids for six

thousand cubic feet of natural gasbarrels of oil equivalent of

natural gas per daythousand cubic feetthousand cubic feet per

dayworking interest |

PDF

available:http://ml.globenewswire.com/Resource/Download/35cb5995-b2de-4e33-9f67-2adccc737573

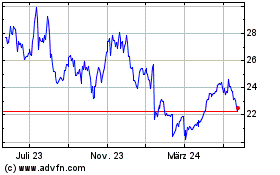

Parex Resources (TSX:PXT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

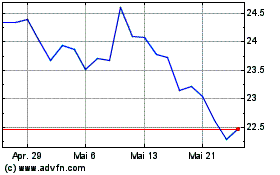

Parex Resources (TSX:PXT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024