Marathon Gold Corporation (“Marathon” or the “Company”;

TSX: MOZ) is pleased to report that it has amended and

restated its term loan facility (the “Amended & Restated

Facility” or “Facility”) first entered into on March 31, 2022 with

Sprott Resource Corporation (“Sprott”). Amongst other amendments

described herein, the Facility has been increased to US$225 million

from US$185 million. The proceeds of the Facility are to be used

for the construction, development and working capital requirements

of Marathon’s Valentine Gold Project located in the central region

of Newfoundland and Labrador (the “Project” or “Valentine”).

Matt Manson, President and CEO of Marathon,

commented: “We are very happy to be announcing today this amended

and restated credit facility with Sprott. Since March 2022, when we

announced our initial credit facility, we have received federal and

provincial approvals to proceed to construction, commenced our site

early works, and issued an Updated Feasibility Study describing a

3-pit mine plan with an extended mine life, increased production

profile and updated capital and operating costs. The new credit

facility increases the available credit to Marathon to US$225

million, while keeping the overall cost of borrowing to a rate

consistent with the original agreement. Within this framework, the

new facility bears a reduced interest margin, and a commensurate

increase in the back-ended production linked payment, with no

upfront arrangement or commitment fees.”

Mr. Manson continued: “Sprott has been a

constructive and collaborative partner for the development of

Valentine since we started our financing discussions with them in

2021. Our approach from the start has been to arrange the

appropriate balance of traditional term loan debt and equity,

without excessive leverage. This new credit facility is consistent

with that approach. With the Project’s construction now well

underway, and this significant component of our financing

completed, we are on track with the development of what will be the

largest gold mining operation in Atlantic Canada.”

Greg Caione, Senior Managing Partner, Private

Strategies, Sprott Inc., commented: "As one of the largest

investors and lenders dedicated to the natural resource sector,

Sprott is excited to continue its partnership with Marathon’s

experienced and accomplished management team. The increase of the

Facility amount, and amended terms, is consistent with our strategy

to provide innovative and flexible capital to maximize the value of

exceptional projects and support world-class management teams. We

commend the management team on the progressive milestones achieved

during 2022, culminating in the release of the Updated Feasibility

Study in December 2022. We are confident in Marathon’s ability to

bring the project into production and look forward to successive

accomplishments over the coming years, including additional

exploration success at the Valentine property."

Key Facility Terms

- Senior secured

term loan facility of US$225 million maturing on December 31, 2027

(the “Maturity Date”), with a 6-month extension option available at

Marathon’s discretion.

- US$125 million

of the Facility was funded to a debt proceeds account (the “DPA”)

on March 31, 2022. On January 24, 2023, Marathon requested the

second and final advance of US$100 million to complete the DPA

funding.

- The Facility is

available to the Company up to the end of March 31, 2025 (the

“Release Period”). The first US$50 million in the DPA is available

to Marathon immediately, with subsequent releases available on

satisfaction of a cost-to-complete covenant and certain other

customary terms and conditions.

- The Facility

will bear an interest of 7.0% plus the greater of (i) 3-month

LIBOR, and (ii) 2.50% per annum, payable quarterly. An initial

interest amount of US$4.45 million (the “Initial Interest Amount”)

representing interest on the funds advanced to the DPA since March

31, 2022, as well as 75% of the interest accruing to June 30, 2025,

shall be capitalized.

- US$17/ounce

will be payable on 1.6 million ounces of payable gold produced by

the Project starting on July 31, 2025.

- In connection

with entering into the increased Facility, Marathon will issue to

Sprott 10 million warrants with a strike price of C$1.35 and a term

of 5 years.

- There are no

other commitment or arrangement fees applicable.

- 50% of the

Facility is to be repaid in nine unequal quarterly installments

commencing on September 30, 2025, with the remaining 50% due on the

Maturity Date.

The Facility contains additional terms and

conditions customary for a transaction of this nature, such as

representations, warranties, borrower covenants, permitted

encumbrances, assignment rights and events of default, as well as

voluntary prepayment conditions, including prepayment upon change

of control. A copy of the Facility agreement will be made available

on SEDAR.

About Marathon

Marathon (TSX:MOZ) is a Toronto based gold

company advancing its 100%-owned Valentine Gold Project located in

the central region of Newfoundland and Labrador, one of the top

mining jurisdictions in the world. The Project comprises a

series of five mineralized deposits along a 32-kilometre system. A

December 2022 Updated Feasibility Study outlined an open pit mining

and conventional milling operation producing 195,000 ounces of gold

a year for 12 years within a 14.3-year mine life. The Project was

released from federal and provincial environmental assessment in

2022 and construction commenced in October 2022. The Project has

estimated Proven Mineral Reserves of 1.43 Moz (23.36 Mt at 1.89

g/t) and Probable Mineral Reserves of 1.27 Moz (28.22 Mt at 1.40

g/t). Total Measured Mineral Resources (inclusive of the Mineral

Reserves) comprise 2.06 Moz (29.23 Mt at 2.19 g/t) with Indicated

Mineral Resources (inclusive of the Mineral Reserves) of 1.90 Moz

(35.40 Mt at 1.67 g/t). Additional Inferred Mineral Resources are

1.10 Moz (20.75 Mt at 1.65 g/t Au). Please see the NI 43-101

Technical Report “Valentine Gold Project, NI 43-101 Technical

Report and Feasibility Study” effective November 30, 2022,

Marathon’s Annual Information Form for the year ended December 31,

2021 and other filings made with Canadian securities regulatory

authorities available at www.sedar.com for further details and

assumptions relating to the Valentine Gold Project.

About Sprott

Sprott is an alternative asset manager and

global leader in mining and real asset investments. Through its

subsidiaries in Canada, the US and Asia, Sprott is dedicated to

providing investors with best in-class investment strategies that

include Exchange Listed Products, Alternative Asset Management and

Private Resource Investments. The Corporation also operates

Merchant Banking and Brokerage business in both Canada and the US.

Sprott is based in Toronto with offices in New York, Carlsbad, and

Vancouver and the shares of its parent company, Sprott Inc., are

listed on the New York Stock Exchange under the symbol (NYSE:SII)

and Toronto Stock Exchange under the symbol (TSX:SII).

For more information, please

contact:

|

Amanda MalloughManager, Investor RelationsTel: 416

855-8202amallough@marathon-gold.com |

Matt MansonPresident & CEOmmanson@marathon-gold.com |

Julie RobertsonCFOjrobertson@marathon-gold.com |

To find out more information on Marathon Gold

Corporation and the Valentine Gold Project, please visit

www.marathon-gold.com.

Cautionary Statement Regarding

Forward-Looking Information

Certain information contained in this news

release, constitutes forward-looking information within the meaning

of Canadian securities laws (“forward-looking statements”). All

statements in this news release, other than statements of

historical fact, which address events, results, outcomes or

developments that Marathon expects to occur are forward-looking

statements. Forward-looking statements include statements that are

predictive in nature, depend upon or refer to future events or

conditions, or include words such as “expects”, “anticipates”,

“plans”, “believes”, “estimates”, “considers”, “intends”,

“targets”, or negative versions thereof and other similar

expressions, or future or conditional verbs such as “may”, “will”,

“should”, “would” and “could”. We provide forward-looking

statements for the purpose of conveying information about our

current expectations and plans relating to the future, and readers

are cautioned that such statements may not be appropriate for other

purposes. More particularly and without restriction, this news

release contains forward-looking statements and information about

the FS and the results therefrom (including IRR, NPV5%, Capex, FCF,

AISC and other financial metrics and economic analysis), the

realization of mineral reserve and mineral resource estimates, the

future financial or operating performance of the Company and the

Project, capital and operating costs, the ability of the Company to

obtain all government approvals, permits and third-party consents

in connection with the Company’s exploration, development and

operating activities, the potential impact of COVID-19 on the

Company, the Company’s ability to successfully advance the Project

and anticipated benefits thereof, economic analyses for the

Valentine Gold Project, processing and recovery estimates and

strategies, future exploration and mine plans, objectives and

expectations and corporate planning of Marathon, future

environmental impact statements and the timetable for completion

and content thereof and statements as to management's expectations

with respect to, among other things, the matters and activities

contemplated in this news release.

Forward-looking statements involve known and

unknown risks, uncertainties and assumptions and accordingly,

actual results and future events could differ materially from those

expressed or implied in such statements. You are hence cautioned

not to place undue reliance on forward-looking statements. In

respect of the forward-looking statements concerning the

interpretation of exploration results and the impact on the

Project’s mineral resource estimate, the Company has provided such

statements in reliance on certain assumptions it believes are

reasonable at this time, including assumptions as to the continuity

of mineralization between drill holes. A mineral resource that is

classified as “inferred” or “indicated” has a great amount of

uncertainty as to its existence and economic and legal feasibility.

It cannot be assumed that any or part of an “inferred mineral

resource” or an “indicated mineral resource” will ever be upgraded

to a higher category of mineral resource. Investors are cautioned

not to assume that all or any part of mineral deposits in these

categories will ever be converted into proven and probable mineral

reserves.

By its nature, this information is subject to

inherent risks and uncertainties that may be general or specific

and which give rise to the possibility that expectations,

forecasts, predictions, projections or conclusions will not prove

to be accurate, that assumptions may not be correct and that

objectives, strategic goals and priorities will not be achieved.

Factors that could cause future results or events to differ

materially from current expectations expressed or implied by the

forward-looking statements include risks and uncertainties relating

to the interpretation of drill results, the geology, grade and

continuity of mineral deposits and conclusions of economic

evaluations; uncertainty as to estimation of mineral resources;

inaccurate geological and metallurgical assumptions (including with

respect to the size, grade and recoverability of mineral

resources); the potential for delays or changes in plans in

exploration or development projects or capital expenditures, or the

completion of feasibility studies due to changes in logistical,

technical or other factors; the possibility that future

exploration, development, construction or mining results will not

be consistent with the Company’s expectations; risks related to the

ability of the current exploration program to identify and expand

mineral resources; risks relating to possible variations in grade,

planned mining dilution and ore loss, or recovery rates and changes

in project parameters as plans continue to be refined; operational

mining and development risks, including risks related to accidents,

equipment breakdowns, labour disputes (including work stoppages and

strikes) or other unanticipated difficulties with or interruptions

in exploration and development; risks related to the inherent

uncertainty of production and cost estimates and the potential for

unexpected costs and expenses; risks related to commodity and power

prices, foreign exchange rate fluctuations and changes in interest

rates; the uncertainty of profitability based upon the cyclical

nature of the mining industry; risks related to failure to obtain

adequate financing on a timely basis and on acceptable terms or

delays in obtaining governmental or other stakeholder approvals or

in the completion of development or construction activities; risks

related to environmental regulation and liability, government

regulation and permitting; risks relating to the Company’s ability

to attract and retain skilled staff; risks relating to the timing

of the receipt of regulatory and governmental approvals for

continued operations and future development projects; political and

regulatory risks associated with mining and exploration; risks

relating to the potential impacts of the COVID-19 pandemic on the

Company and the mining industry; changes in general economic

conditions or conditions in the financial markets; and other risks

described in Marathon’s documents filed with Canadian securities

regulatory authorities, including the Annual Information Form for

the year ended December 31, 2021.

You can find further information with respect to

these and other risks in Marathon’s Annual Information Form for the

year ended December 31, 2021 and other filings made with Canadian

securities regulatory authorities available at www.sedar.com. Other

than as specifically required by law, Marathon undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances after the date on which such statement is

made, or to reflect the occurrence of unanticipated events, whether

as a result of new information, future events or results

otherwise.

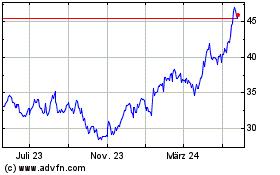

Sprott (NYSE:SII)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

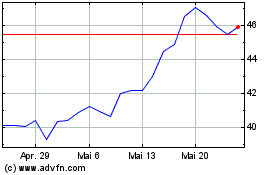

Sprott (NYSE:SII)

Historical Stock Chart

Von Jan 2024 bis Jan 2025