IGT Signs New Credit Facility - Analyst Blog

19 April 2011 - 7:39PM

Zacks

A leading global designer, developer and manufacturer of gaming

machines and systems products, International Game

Technology (IGT) signed a new five-year credit facility

with a syndicate of banks worth $750.0 million.

The credit facility replaces IGT’s existing facility of $1.24

billion. It also carries a lower interest rate than the existing

one. As of April 14, 2011, there were no outstanding borrowings

under the existing credit facility.

Initially, IGT will be charged a rate equal to LIBOR plus 122.5

basis points on borrowings and facility fee equal to 27.5 basis

points, at the Baa2/BBB pricing level.

Later, the facility fee and interest rate will be adjusted

according to IGT’s debt rating of senior unsecured debt or Net

Funded Debt to EBITDA, whichever is more favorable to the

company.

IGT expects to extend the size of the credit facility by $250.0

million during its five-year tenure.

Premier Banks including Wells Fargo Securities, a division of

Wells Fargo & Company (WFC) and RBS Securities

Inc. of Royal Bank of Scotland Group plc (RBC)

acted as Joint Lead Arrangers and Joint Book Runners for the

transaction.

IGT’s balance sheet remains highly leveraged. As of December 31,

2010, long-term debt was $1.57 billion versus $1.67 billion in the

prior quarter. Debt-to-total capital ratio was 40.0%.

With a net debt position (debt less cash) of $4.40 per share,

the investment risk remains high for the company.

We believe substantial indebtedness and higher cost of borrowing

may limit the company’s ability to raise funds going forward.

As a result of high debt, IGT curtailed its share repurchase

program in 2009 and 2010; although it continues to have 7.7 million

shares under the existing share repurchase authorization.

Recommendation

We maintain our Neutral rating over the long term (6-12 months).

We believe IGT is focused on reducing its dependence on the

domestic machine replacement cycle.

We consider this a prudent strategy for bringing consistency to

its top-line growth and increasing earnings visibility going

forward. The current product pipeline reflects strong growth

expectations from non-machine revenues in systems; intellectual

property and new games/software.

However, top-line growth remains elusive and we believe that

lack of visibility in replacement sales, very few new openings,

higher debt levels and increasing competition, especially from

Scientific Games Corp. (SGMS) will remain primary

growth headwinds for 2011.

Currently, International Game Technology has a Zacks #3 Rank,

which implies a Hold rating on a short-term basis.

INTL GAME TECH (IGT): Free Stock Analysis Report

REGAL BELOIT (RBC): Free Stock Analysis Report

SCIENTIFIC GAME (SGMS): Free Stock Analysis Report

WELLS FARGO-NEW (WFC): Free Stock Analysis Report

Zacks Investment Research

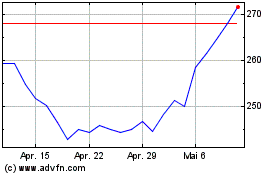

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

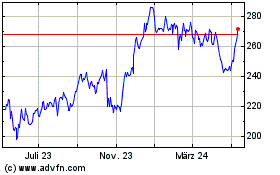

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024