0001019849FALSE00010198492023-12-052023-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| |

| Date of Report (Date of Earliest Event Reported): | December 5, 2023 |

Penske Automotive Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 1-12297 | | 22-3086739 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | |

2555 Telegraph Road, | | | | |

Bloomfield Hills, Michigan | | | | 48302 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | |

| Registrant’s telephone number, including area code: | | 248-648-2500 |

| | |

| | Not Applicable | | |

Former name or former address, if changed since last report |

| | | | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Voting Common Stock, par value $0.0001 per share | PAG | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 5, 2023, Penske Automotive Group, Inc. (the “Company”) amended its revolving credit agreement among its subsidiaries in the U.K. (the “U.K. subsidiaries”), National Westminster Bank Plc and BMW Financial Services (GB) Limited (“BMW Financial”) (the “U.K. credit agreement”) to increase permitted capital expenditures under the facility from £100.0 million to £150.0 million per year.

The U.K. credit agreement provides up to a £200.0 million revolving line of credit to be used for working capital, acquisitions, capital expenditures, investments and general corporate purposes. The revolving loans bear interest between defined Sterling Overnight Index Average (“SONIA”) plus 1.10% and defined SONIA plus 2.10%. In addition, the U.K. credit agreement includes a £100.0 million “accordion” feature which allows the U.K. subsidiaries to request up to an additional £100.0 million of facility capacity, subject to certain limitations. The lenders may agree to provide additional capacity, and, if not, the U.K. subsidiaries may add an additional lender, if available, to the facility to provide such additional capacity. The U.K. credit agreement expires in January 2027, provided that the U.K. subsidiaries may request an extension of the term of the U.K. credit agreement by an additional year, with the effectiveness of such extension subject to lender approval. The U.K. credit agreement is guaranteed by the holding company of a majority of our international subsidiaries, PAG International Ltd.

The U.K. credit agreement is fully and unconditionally guaranteed on a joint and several basis by our U.K. subsidiaries, and contains a number of significant covenants that, among other things, limit the ability of our U.K. subsidiaries to pay dividends, dispose of assets, incur additional indebtedness, repay other indebtedness, create liens on assets, make investments or acquisitions and engage in mergers or consolidations. In addition, our U.K. subsidiaries are required to comply with defined ratios and tests, including: a ratio of earnings before interest, taxes, amortization, and rental payments (“EBITAR”) to interest plus rental payments, a measurement of maximum capital expenditures, and a debt to EBITDA ratio. A breach of these requirements would give rise to certain remedies under the U.K. credit agreement, the most severe of which is the termination of the agreement and acceleration of any amounts owed.

The U.K. credit agreement also contains typical events of default, including change of control and non-payment of obligations and cross-defaults to other material indebtedness of our U.K. subsidiaries. Substantially all of our U.K. subsidiaries’ assets are subject to security interests granted to the lenders under the U.K. credit agreement.

The Company purchases motor vehicles from affiliates of BMW Financial, a lender under the U.K. credit agreement, for sale at certain of its dealerships and BMW Financial and its affiliates also provide the Company and certain of its dealerships with mortgage, “floor-plan” and consumer financing.

The foregoing description of the U.K. credit agreement is qualified in its entirety by references to the U.K. credit agreement, a copy of which is filed as an exhibit to the Company’s Form 8-K filed with the Securities and Exchange Commission on February 3, 2023, and the amendment to the U.K. credit agreement, a copy of which is filed as an exhibit to this Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On December 11, 2023, the Company announced that it has signed an agreement to acquire Rybrook Group Limited, consisting of 15 premium dealerships in the United Kingdom. The acquisition is expected to close in January 2024, subject to customary conditions. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in Item 7.01 of this Current Report shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | |

| | |

| Exhibit No. | | Description |

| 4.1 | | | |

| 99.1 | | | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | Penske Automotive Group, Inc. |

| | |

| December 11, 2023 | | By: | /s/ Shane M. Spradlin |

| | | Name: Shane M. Spradlin |

| | | Title: Executive Vice President |

EXHIBIT 4.1

NATIONAL WESTMINSTER BANK PLC

as Agent under the Facility Agreement (as defined below)

2nd Floor

250 Bishopsgate

London

England

EC2M 4AA

Attention: Jamie Miller

Date: 5 December 2023

Dear Sirs

£200,000,000 REVOLVING FACILITY AGREEMENT – CONSENT & AMENDMENT LETTER

1.BACKGROUND

1.1We refer to the £200,000,000 revolving facility agreement originally dated 16 December 2011 and made between, amongst others (1) PAG International Limited as Parent, (2) Sytner Group Limited as Company and Original Borrower (the “Company”), (3) the companies listed in part 1 of schedule 1 therein as Original Guarantors, (4) National Westminster Bank plc and BMW Financial Services (GB) Limited as Mandated Lead Arrangers, (5) the financial institutions listed in parts 2 and 3 of the schedule 1 therein as Original Lenders, (6) National Westminster Bank plc as Agent and (7) National Westminster Bank plc as Security Agent (the “Facility Agreement” and such expression shall include the Facility Agreement as amended and/or amended and restated from time to time including, but not limited to, on 10 January 2012, 19 December 2014, 2 April 2015, 28 September 2016, 12 December 2018, 18 December 2019 and 31 January 2023).

1.2We write to you to request certain amendments to the Facility Agreement.

1.3Following discussions between the Company, the Agent and the Lenders, the Majority Lenders have agreed to make certain amendments to the Facility Agreement to reflect an increase in the Group’s annual capex covenant.

1.4This letter reflects the commercial agreement between the parties to the Facility Agreement to such amendments.

1.5The Company hereby requests that the Lenders approve the various matters detailed in this letter and that by countersigning this letter, this letter constitutes an amendment as contemplated by clause 38 (Amendments and Waivers) of the Facility Agreement.

1.6This letter is supplemental to and amends the Facility Agreement.

1.7This letter is entered into by Sytner Group Limited as the Company and as Obligors’ Agent.

2.DEFINITIONS AND INTERPRETATION

2.1Definitions

| | |

RRO/RRO/UKM/130273408.1 1 |

In this letter terms defined in, or construed for the purposes of, the Facility Agreement have the same meanings when used in this letter (unless the same are otherwise defined in this letter).

2.2Continuing obligations

Subject to the provisions of this letter:

2.2.1the Facility Agreement (other than as amended in accordance with the terms of this letter) and all other Finance Documents shall remain in full force and effect;

2.2.2the Company on behalf of each Obligor confirms its knowledge and acceptance of this letter;

2.2.3the Facility Agreement shall be read and construed as one document with this letter;

2.2.4the Company on behalf of each Obligor confirms that with effect from the Effective Date (as defined below), each Obligor shall be bound by the terms of the Facility Agreement as amended by the terms of this letter;

2.2.5the Company on behalf of each Obligor confirms that the guarantee and indemnity given by each Obligor pursuant to Clause 20 (Guarantee and indemnity) of the Facility Agreement and all Security given by each Obligor pursuant to the Facility Agreement shall continue in full force and effect notwithstanding the amendment of the Facility Agreement in accordance with the terms of this letter; and

2.2.6except as expressly provided in paragraph 4 (Amendments to Facility Agreement) nothing in this letter shall constitute or be construed as an amendment, waiver, consent or release of any provisions of, or any right or remedy of the Finance Parties under, the Finance Documents, nor otherwise prejudice any right or remedy of a Finance Party under the Facility Agreement or any other Finance Document.

3.EFFECTIVE DATE

The amendments in paragraph 4 shall be effective on the date (the “Effective Date”) upon which the Agent gives written confirmation to the Company that it has received:

3.2.1an original of this letter countersigned by the Company by which the Company (on behalf of itself and each of the Obligors) acknowledges and agrees to the terms of this letter; and

3.2.2a copy of the resolutions of the directors of the Company authorising it to agree to the terms of this letter and perform its obligations under it, in form and substance satisfactory to the Agent.

4.AMENDMENTS TO FACILITY AGREEMENT

With effect from the Effective Date, the Facility Agreement shall be amended as follows:

1.1clause 23.2.3(b) (Capital Expenditure) shall be deleted and replaced with the following:

(b) shall not exceed £150,000,000 in respect of any other Financial Year.

5.REPRESENTATIONS AND RELIANCE

| | |

RRO/RRO/UKM/130273408.1 2 |

5.1Representations

The Company makes the Repeating Representations to each Finance Party at the date of this letter, on the date this letter is countersigned by the Agent and on the Effective Date by reference to the facts and circumstances existing at such dates respectively but as if references to the "Facility Agreement" include this letter and the Facility Agreement as amended by the terms of this letter.

5.2Reliance

The Company on behalf of each Obligor acknowledges that the Agent has entered into this letter in full reliance on the representations and warranties made by it in the terms stated in this paragraph 5.

6.FURTHER ASSURANCE

The Company shall, at the request of the Agent and at its own expense, do all such acts and things necessary or desirable to give effect to the amendments effected or to be effected pursuant to this letter.

7.MISCELLANEOUS

7.1Incorporation of terms

The provisions of clauses 38 (Amendments and waivers) and 34 (Notices) of the Facility Agreement shall apply to this letter as if set out in full in this letter and as if references in those clauses to "this Agreement" or "the Finance Documents" are references to this letter.

| | |

RRO/RRO/UKM/130273408.1 3 |

7.2Counterparts

This letter may be executed in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of this letter. Delivery of a counterpart of this letter by e-mail attachment or telecopy shall be an effective mode of delivery.

7.3Third party rights

Unless expressly provided to the contrary in a Finance Document a person who is not a party to this letter has no right under the Contracts (Rights of Third Parties) Act 1999 to enforce or enjoy the benefit of any term of this letter.

7.4Finance Document

The Agent and the Company designate this letter a Finance Document.

8.GOVERNING LAW/ENFORCEMENT

8.1Governing law

This letter and any non-contractual obligations arising out of or in connection with it shall be governed by English law.

8.2Jurisdiction of English courts

8.2.1The courts of England have exclusive jurisdiction to settle any dispute arising out of or in connection with this letter (including a dispute relating to the existence, validity or termination of this letter or any non-contractual obligation arising out of or in connection with this letter) (a "Dispute").

8.2.2The parties to this letter agree that the courts of England are the most appropriate and convenient courts to settle Disputes and accordingly no party to this Letter will argue to the contrary.

Please confirm your agreement to the above by signing and returning the enclosed copy of this letter.

Yours faithfully

/s/ Simon Moorhouse

For and on behalf of

SYTNER GROUP LIMITED

as Company and Obligors' Agent

| | |

RRO/RRO/UKM/130273408.1 4 |

ON COPY

To: Sytner Group Limited

We acknowledge, agree and accept the terms of the above letter.

Signed by /s/Jamie Miller

For and on behalf of NATIONAL WESTMINSTER BANK PLC as Agent on behalf of the Lenders (acting on the instruction of the Majority Lenders)

Dated: 5 December 2023

| | |

RRO/RRO/UKM/130273408.1 5 |

FOR IMMEDIATE RELEASE

PENSKE AUTOMOTIVE GROUP TO EXPAND PRESENCE

IN THE UNITED KINGDOM

Signs Agreement to Acquire 15 Premium Dealerships Representing

Estimated Annualized Revenue of $1 Billion

BLOOMFIELD HILLS, MI, December 11, 2023 -- Penske Automotive Group, Inc. (NYSE: PAG), a diversified international transportation services company and one of the world's premier automotive and commercial truck retailers, today announced that it has agreed to acquire Rybrook Group Limited consisting of 15 premium dealerships in the United Kingdom, including four BMW dealerships, four MINI dealerships, four Volvo dealerships, two Land Rover dealerships and one Porsche dealership. Additionally, three of the BMW locations also retail BMW Motorrad motorcycles.

Commenting on the transaction, Darren Edwards, CEO of the Company’s Sytner Group subsidiary in the U.K., said, “We are delighted to announce this transaction. The Rybrook dealerships represent exceptional brands with a strong commitment to providing exceptional customer service. We look forward to continuing this legacy and welcoming these franchises to our team.”

The dealerships to be acquired represent estimated annualized revenues of $1 billion. The Company has received certain regulatory approvals. The acquisition is anticipated to be funded using the Company’s existing liquidity and is expected to close in January 2024, subject to customary conditions.

About Penske Automotive

Penske Automotive Group, Inc., (NYSE: PAG) headquartered in Bloomfield Hills, Michigan, is a diversified international transportation services company and one of the world's premier automotive and commercial truck retailers. PAG operates dealerships in the United States, the United Kingdom, Canada, Germany, Italy, and Japan and is one of the largest retailers of commercial trucks in North America for Freightliner. PAG also distributes and retails commercial vehicles, diesel and gas engines, power systems, and related parts and services principally in Australia and New Zealand. PAG employs over 28,000 people worldwide. Additionally, PAG owns 28.9% of Penske Transportation Solutions ("PTS"), a business that employs over 44,000 people worldwide, manages one of the largest, most

comprehensive and modern trucking fleets in North America with over 442,000 trucks, tractors, and trailers under lease, rental, and/or maintenance contracts and provides innovative transportation, supply chain, and technology solutions to its customers. PAG is a member of the Fortune 500, Russell 1000, Russell 3000 index and S&P 400 Mid Cap Indexes. For additional information, including the Company's 2023 Corporate Responsibility Report highlighting its ESG strategies, activities, and certain metrics, visit the Company's website at www.penskeautomotive.com.

Caution Concerning Forward Looking Statements

Statements in this press release may involve forward-looking statements, including forward-looking statements regarding Penske Automotive Group, Inc.'s acquisitions and growth plans. Actual results may vary materially because of risks and uncertainties that are difficult to predict. These risks and uncertainties include, among others, our ability to successfully complete the acquisition and satisfy the closing conditions, our ability to successfully integrate the acquired dealerships into our existing operations and obtain certain contemplated synergies, those risks and uncertainties related to macro-economic, geo-political and industry conditions and events, including their impact on new and used vehicle sales, the availability of consumer credit, changes in consumer demand, consumer confidence levels, fuel prices, personal discretionary spending levels, interest rates, and unemployment rates; our ability to obtain vehicles and parts from our manufacturers, especially in light of supply chain disruptions due to natural disasters, the shortage of vehicle components, the war in Ukraine, challenges in sourcing labor, or labor strikes or work stoppages, or other disruptions; changes in the retail model either from direct sales by manufacturers, a transition to an agency model of sales, sales by online competitors, or from the expansion of electric vehicles; the effects of a pandemic on the global economy, including our ability to react effectively to changing business conditions in light of any pandemic; the rate of inflation, including its impact on vehicle affordability; changes in interest rates and foreign currency exchange rates; with respect to PTS, changes in the financial health of its customers, labor strikes or work stoppages by its employees, a reduction in PTS' asset utilization rates, continued availability from truck manufacturers and suppliers of vehicles and parts for its fleet, potential decreases in the resale value of used vehicles which may affect PTS' ability to sell its used

vehicles after the expiration of its customers' leases or at the end of its holding period for rental vehicles, which may affect PTS' profitability and regulatory risks and related compliance costs; our ability to realize returns on our significant capital investment in new and upgraded dealership facilities; our ability to navigate a rapidly changing automotive and truck landscape; our ability to respond to new or enhanced regulations in both our domestic and international markets relating to automotive and commercial truck dealerships and vehicles sales, including those related to the sales process or emissions standards, as well as changes in consumer sentiment relating to commercial truck sales that may hinder our or PTS' ability to maintain, acquire, sell, or operate trucks; the success of our distribution of commercial vehicles, engines, and power systems; natural disasters; recall initiatives or other disruptions that interrupt the supply of vehicles or parts to us; the outcome of legal and administrative matters, and other factors over which management has limited control. These forward-looking statements should be evaluated together with additional information about Penske Automotive Group's business, markets, conditions, risks, and other uncertainties, which could affect Penske Automotive Group's future performance. The risks and uncertainties discussed above are not exhaustive and additional risk and uncertainties are addressed in Penske Automotive Group's Form 10-K for the year ended December 31, 2022, its Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023, September 30, 2023 and its other filings with the Securities and Exchange Commission. This press release speaks only as of its date, and Penske Automotive Group disclaims any duty to update the information herein.

Inquiries should contact:

| | | | | |

| |

| Shelley Hulgrave | Anthony Pordon |

| Executive Vice President and | Executive Vice President Investor Relations |

| Chief Financial Officer | and Corporate Development |

| Penske Automotive Group, Inc. | Penske Automotive Group, Inc. |

| 248-648-2812 | 248-648-2540 |

| shulgrave@penskeautomotive.com | tpordon@penskeautomotive.com |

# # # # #

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

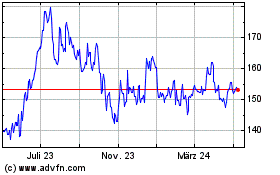

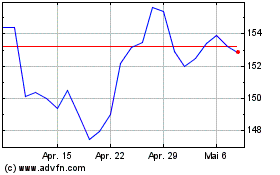

Penske Automotive (NYSE:PAG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Penske Automotive (NYSE:PAG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024