HSBC Report Shows Venture Ecosystem Recalibrates for Economic Growth While Private Companies Contend with Exit Backlog and Investor Shift to AI

16 Dezember 2024 - 3:00PM

Business Wire

The “Agentic Age” begins, says HSBC Innovation

Banking Q4 2024 Innovation Outlook Report

HSBC Innovation Banking published today its latest quarterly

outlook for the U.S. technology sector, exploring major trends

shaping startup development, venture activity, and big tech

strategies in the age of AI.

The report identifies three defining themes:

- A growing concentration of venture activity within AI,

with U.S. venture investment in AI companies nearing the scale of

capital allocated to the rest of the venture market

- Massive R&D spending from Mag7 companies, totaling

more than all dollars invested in U.S. startups in 2024

- Innovation create new waves of growth and tailwinds for

returns, with faster company formation, expanded capabilities

and potential deregulation

“Venture capital has always gravitated toward transformative

industries, but the level of consolidation we’re seeing within one

category is unprecedented,” said HSBC U.S. Innovation Banking Head

Dave Sabow. “The radical change this investment will fuel places us

in the dawn of ‘The Agentic Age,’ an era where autonomous

artificial intelligence capabilities fundamentally redefine how we

communicate, work, and interface with digital and physical worlds.

When a technological advancement alters modern life to this degree,

it becomes one of those rare moments that demands its own chapter

in history.”

The report also highlights different forces weighing on the

entire U.S.-based tech startup ecosystem.

- Further build-up in an already crowded $1 trillion backlog

of non-AI unicorns that are primed for exits, due to investors

and traditional acquirers narrowing focus on AI

- With unicorn exits down by 80% compared to late 2010s, the

venture capital flywheel has slowed as investor capital is tied

up for longer periods of time, creating a liquidity crunch

- The looming shadow of economic volatility and the

uncertain impact of a forecasted increase in debt-to-GDP ratio, the

normalization of which may require some combination of federal

spending cuts and investments in technologies supporting private

sector growth

- The onset of a potential mitigating factor to these trends: the

expectation of more permissive acquisition market, deregulation

as a catalyst for growth, and fiscal policies that stimulate

economic activity.

Download the full report here.

Learn more about HSBC Innovation Banking.

About HSBC

HSBC Holdings plc, the parent company of HSBC, is

headquartered in London. HSBC serves customers worldwide from

offices in 60 countries and territories. With assets of US $3,099bn

at 30 September 2024, HSBC is one of the world’s largest banking

and financial services organizations.

HSBC Bank USA, National Association (HSBC Bank USA, N.A.)

serves customers through Wealth and Personal Banking, Commercial

Banking, Private Banking, Global Banking, and Markets and

Securities Services. Deposit products are offered by HSBC Bank USA,

N.A., Member FDIC. It operates Wealth Centers in: California;

Washington, D.C.; Florida; New Jersey; New York; Virginia; and

Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC

USA Inc., a wholly-owned subsidiary of HSBC North America Holdings

Inc. HSBC Innovation Banking is a business division with services

provided in the United States by HSBC Bank USA, N.A

For more information, visit: HSBC in the USA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216302330/en/

Media enquiries to: Matt Kozar Vice President of External

Communications Matt.Kozar@us.hsbc.com

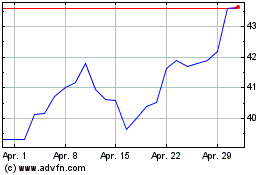

HSBC (NYSE:HSBC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

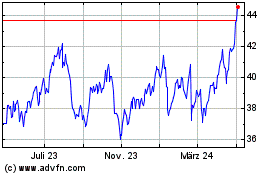

HSBC (NYSE:HSBC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024