Filed by Berry Global Group, Inc.

Pursuant to Rule 425 under the Securities Act

of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Berry Global Group, Inc.

Commission File No.: 001-35672

Kevin All-Employee

Integration Update Message – January 2025

| To: |

All Berry Global Employees |

| |

|

| From: |

Kevin Kwilinski |

| |

|

| Date: |

January 24, 2025 |

| |

|

| Re: |

Update on Berry’s Integration with Amcor |

Team,

As we close out the month, I want to take a moment to update you on

our efforts related to the integration with Amcor.

Last week, a group of colleagues from Amcor and Berry convened in Chicago,

Illinois, USA, to discuss the integration planning process. The focus was to review how we will work together – roles, processes,

tools and timing – to plan for a successful Day 1 and help ensure that the new combined organization starts strong.

This integration planning team, with equal representation from both

companies, will continue to work collaboratively until the closing of our transaction to establish a successful integration and seamless

business delivery for our customers by the new combined organization. Until then, Berry and Amcor will continue to remain separate and

independent companies.

Our Opportunity

Following the planning meetings, my excitement continues to grow as I think about the opportunities that lie ahead as we bring our two

complementary businesses together to create compelling innovation and sustainability capabilities on a global scale.

We have a unique opportunity to re-orient our combined portfolio, footprint

and capabilities towards a higher growth potential that truly transforms our industry and changes the way our customers, and the world,

think about packaging solutions.

In addition, combining the two organizations will allow us to achieve

more together than we could have individually by providing an opportunity-rich environment for each of us and our teams to develop and

grow.

Regulatory Update

In addition to our planning efforts in Chicago, regulatory clearance is progressing as well, and shareholder meetings are scheduled for

Feb. 25, 2025, as shared yesterday via our joint press release with Amcor.

What is Needed from You

I understand that everyone is eager to know more. As we move forward with our integration planning efforts, I will continue to keep you

updated on our progress. Please continue to follow all communication and regulatory guidelines shared as part of the initial announcement

communications.

Assuming regulatory approvals are achieved on the expected timeline,

we are targeting closing the transaction by the middle of this year. Once we reach that milestone, and based on the planning efforts,

we look forward to quickly combining our strengths to innovate and offer more to our customers, communities, employees, and other stakeholders.

In the meantime, the best way you can help our organization continue to grow is to stay safe and focused on serving our Berry customers.

As always, you can find the latest information about the integration

planning efforts on our dedicated merger SharePoint hub. In addition, please send your questions

related to the integration to our anonymous question mailbox link.

Stay safe,

Kevin

Important Information for Investors and Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation

of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

It does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance with

applicable law.

In connection with the proposed transaction between Berry Global Group,

Inc. (“Berry”) and Amcor plc (“Amcor”), on January 13, 2025, Amcor filed with the Securities and Exchange Commission

(the “SEC”) a registration statement on Form S-4, as amended on January 21, 2025, containing a joint proxy statement of Berry

and Amcor that also constitutes a prospectus of Amcor (the “Joint Proxy Statement/Prospectus”). The registration statement

was declared effective by the SEC on January 23, 2025, and Berry and Amcor commenced mailing the Joint Proxy Statement/Prospectus to their

respective shareholders on or about January 23, 2025. This document is not a substitute for the Joint Proxy Statement/Prospectus or any

other document which Berry or Amcor may file with the SEC. INVESTORS AND SECURITY HOLDERS OF BERRY AND AMCOR ARE URGED TO READ THE JOINT

PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION

AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the Joint Proxy Statement/Prospectus

and other documents filed with the SEC by Berry or Amcor through the website maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by Berry are available free of charge on Berry’s website at berryglobal.com under the tab “Investors”

and under the heading “Financials” and subheading “SEC Filings.” Copies of the documents filed with the SEC by

Amcor are available free of charge on Amcor’s website at amcor.com under the tab “Investors” and under the heading “Financial

Information” and subheading “SEC Filings.”

Certain Information Regarding Participants

Berry, Amcor and their respective directors and

executive officers may be considered participants in the solicitation of proxies from the shareholders of Berry and Amcor in connection

with the proposed transaction. Information about the directors and executive officers of Berry is set forth in its Annual Report on Form 10-K

for the year ended September 28, 2024, which was filed with the SEC on November 26, 2024, and its proxy statement for its 2025

annual meeting, which was filed with the SEC on January 7, 2025. Information about the directors and executive officers of Amcor

is set forth in its Annual Report on Form 10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024, its

proxy statement for its 2024 annual meeting, which was filed with the SEC on September 24, 2024 and its Current Report on Form 8-K, which

was filed with the SEC on January 6, 2025. To the extent holdings of Berry’s or Amcor’s securities by its directors or executive

officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of

Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors

and executive officers of Berry and Amcor, including a description of their direct or indirect interests, by security holdings or otherwise,

and other information regarding the potential participants in the proxy solicitations, which may be different than those of Berry’s

stockholders and Amcor’s shareholders generally, are contained in the Joint Proxy Statement/Prospectus and other relevant materials

to be filed with the SEC regarding the proposed transaction. You may obtain these documents free of charge through the website maintained

by the SEC at http://www.sec.gov and from Berry’s or Amcor’s website as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains certain statements that are “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Some of these

forward-looking statements can be identified by words like “anticipate,” “approximately,” “believe,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,” the

negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the anticipated

benefits of the proposed transaction, the impact of the proposed transaction on Berry’s and Amcor’s business and future financial

and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and scope of the expected

financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the closing

of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates, assumptions and projections

of the management of Berry and Amcor, and are qualified by the inherent risks and uncertainties surrounding future expectations generally,

all of which are subject to change. Actual results could differ materially from those currently anticipated due to a number of risks and

uncertainties, many of which are beyond Berry’s and Amcor’s control. None of Berry, Amcor or any of their respective directors,

executive officers, or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied

in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results

of operations or financial condition of Berry or Amcor. Should any risks and uncertainties develop into actual events, these developments

could have a material adverse effect on Berry’s and Amcor’s businesses, the proposed transaction and the ability to successfully

complete the proposed transaction and realize its expected benefits. Risks and uncertainties that could cause results to differ from expectations

include, but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination of

the merger agreement; the risk that the conditions to the completion of the proposed transaction (including shareholder and regulatory

approvals) are not satisfied in a timely manner or at all; the risks arising from the integration of the Berry and Amcor businesses; the

risk that the anticipated benefits of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs

or expenses resulting from the proposed transaction; the risk of litigation related to the proposed transaction; the risks related to

disruption of management’s time from ongoing business operations as a result of the proposed transaction; the risk that the proposed

transaction may have an adverse effect on the ability of Berry and Amcor to retain key personnel and customers; general economic, market

and social developments and conditions; the evolving legal, regulatory and tax regimes under which Berry and Amcor operate; potential

business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction that could

affect Berry’s and/or Amcor’s financial performance; and other risks and uncertainties identified from time to time in Berry’s

and Amcor’s respective filings with the SEC, including the Joint Proxy Statement/Prospectus to be filed with the SEC in connection

with the proposed transaction. While the list of risks presented here is, and the list of risks presented in the Joint Proxy Statement/Prospectus

will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties,

and other risks may present significant additional obstacles to the realization of forward-looking statements. Forward-looking statements

included herein are made only as of the date hereof and neither Berry nor Amcor undertakes any obligation to update any forward-looking

statements, or any other information in this communication, as a result of new information, future developments or otherwise, or to correct

any inaccuracies or omissions in them which become apparent. All forward-looking statements in this communication are qualified in their

entirety by this cautionary statement.

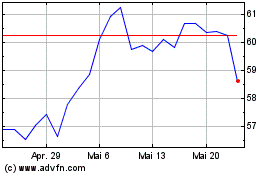

Berry Global (NYSE:BERY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

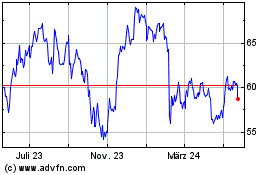

Berry Global (NYSE:BERY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025