Filed by Amcor plc

Pursuant to Rule 425 of the Securities Act of 1933

and

deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Berry Global Group, Inc.

Commission File No.: 333-284248

Explanatory Note: The following e-mail was sent by Amcor plc to its

employees on January 23, 2025.

| · | Targeted publishing date: Jan. 23, 2025 (after SEC declaration press

release) |

| · | From: Kirby Losch |

| · | To: All Amcor colleagues |

| · | Channels: email, OneAmcor, The Pod |

| · | Subject: Update on the Amcor-Berry combination |

Dear Colleagues,

Our announced combination with

Berry Global is a rare opportunity to bring two exceptional and complementary companies together to transform the packaging industry

and to become a global leader in consumer and healthcare packaging solutions. I am happy to share some of the progress we’ve made

on this exciting journey.

We kicked off our integration planning activities by bringing together

teams from both Amcor and Berry to plan for integration and how we will work effectively to ensure a successful start as a unified company post-closing. More

than 50 colleagues from across the globe gathered over the course of two weeks in Miami and Deerfield to form global workstreams and align

on roles, resources, processes, tools and timing. Each workstream is co-led by one Amcor and one Berry colleague to facilitate smooth

collaboration, easy alignment and seamless information flow. As we move forward, regional integration leads will join the team, and planning

will continue regularly until the official integration.

The team’s energy during the workshops was very inspiring as

they explored how to combine the best of both worlds, create value and map out a plan to accelerate what’s possible.

As we move forward, key milestones are already taking shape. Regulatory

review is progressing, and shareholder meetings are scheduled for Feb. 25, 2025 <LINK TO PRESS RELEASE>. We expect to officially

combine into one organization by midyear. Until then, it’s important to remember that Amcor and Berry Global will continue to operate

as two independent companies.

We understand you may have questions

and seek guidance along the way. To provide easy access to the latest information, we have created the Amcor-Berry combination

SharePoint site. Here, you will find the most current FAQs, dos and don’ts and helpful information about Berry Global. I encourage

you to familiarize yourself with the information provided.

This is a very exciting time for Amcor colleagues as we prepare to

bring together the best of both organizations. Each of us plays a vital role in ensuring the success of this combination. The best way

to contribute right now is by staying focused on our base business, delivering excellence to our customers and continuing to prioritize

the health and safety of our teams worldwide.

Thank you for being an invaluable part of this journey.

Kirby Losch

Senior Vice President, Integration Management Office

Important Information for Investors and Shareholders

This communication does not constitute an offer

to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction.

It does not constitute a prospectus or prospectus equivalent document. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

In connection with the proposed transaction between

Amcor plc (“Amcor”) and Berry Global Group (“Berry”), on January 13, 2025, Amcor filed with the

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4, as amended on January 21, 2025,

containing a joint proxy statement of Amcor and Berry that also constitutes a prospectus of Amcor. The registration statement was declared

effective by the SEC on January 23, 2025 and Amcor and Berry commenced mailing the definitive joint proxy statement/prospectus to their

respective shareholders on or about January 23, 2025. INVESTORS AND SECURITY HOLDERS OF AMCOR AND BERRY ARE URGED TO READ THE DEFINITIVE

JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE

THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement

and the definitive joint proxy statement/prospectus and other documents filed with the SEC by Amcor or Berry through the website maintained

by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Amcor are available free of charge on Amcor’s website

at amcor.com under the tab “Investors” and under the heading “Financial Information” and subheading “SEC

Filings.” Copies of the documents filed with the SEC by Berry are available free of charge on Berry’s website at berryglobal.com

under the tab “Investors” and under the heading “Financials” and subheading “SEC Filings.”

Certain Information Regarding Participants

Amcor, Berry, and their respective directors and

executive officers may be considered participants in the solicitation of proxies from the shareholders of Amcor and Berry in connection

with the proposed transaction. Information about the directors and executive officers of Amcor is set forth in its Annual Report on Form

10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024, its proxy statement for its 2024 annual meeting,

which was filed with the SEC on September 24, 2024, and its Current Report on Form 8-K, which was filed with the SEC on January 6, 2025.

Information about the directors and executive officers of Berry is set forth in its Annual Report on Form 10-K for the year ended September

28, 2024, which was filed with the SEC on November 26, 2024, and its proxy statement for its 2025 annual meeting, which was filed with

the SEC on January 7, 2025. Information about the directors and executive officers of Amcor and Berry and other information

regarding

the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or

otherwise, are contained in the definitive joint proxy statement/prospectus filed with the SEC and other relevant materials filed with

or to be filed with the SEC regarding the proposed transaction when they become available. To the extent holdings of Amcor’s or

Berry’s securities by its directors or executive officers have changed since the amounts set forth in the definitive joint proxy

statement/prospectus, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements

of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through

the website maintained by the SEC at http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This communication

contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,”

“approximately,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “possible,”

“predict,” “project,” “target,” “seek,” “should,” “will,” or “would,”

the negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the

anticipated benefits of the proposed transaction, the impact of the proposed transaction on Amcor’s and Berry’s business and

future financial and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and

scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company

following the closing of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates,

assumptions and projections of the management of Amcor and Berry, and are qualified by the inherent risks and uncertainties surrounding

future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties,

many of which are beyond Amcor’s and Berry’s control. None of Amcor, Berry or any of their respective directors, executive

officers, or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any

forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results of operations

or financial condition of Amcor or Berry. Should any risks and uncertainties develop into actual events, these developments could

have a material adverse effect on Amcor’s and Berry’s businesses, the proposed transaction and the ability to successfully

complete the proposed transaction and realize its expected benefits. Risks and uncertainties that could cause results to differ from expectations

include, but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination

of the merger agreement; the risk that the conditions to the completion of the proposed transaction (including shareholder and regulatory

approvals) are not satisfied in a timely manner or at all; the risks arising from the integration of the Amcor and Berry businesses; the

risk that the anticipated benefits of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs

or expenses resulting from the proposed transaction; the risk of litigation related to the proposed transaction; the risks related to

disruption of management’s time from ongoing business operations as a result of the proposed transaction; the risk that the proposed

transaction may have an adverse effect on the ability of Amcor and Berry to retain key personnel and customers; and those risks discussed

in Amcor’s and Berry’s respective filings with the SEC. Forward looking statements included herein are made only as of the

date hereof and neither Amcor nor Berry undertakes any obligation to update any forward-looking statements, or any other information in

this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions in them

which become apparent. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

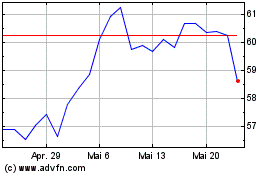

Berry Global (NYSE:BERY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

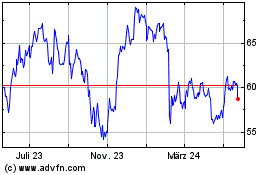

Berry Global (NYSE:BERY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025