APA Corporation Announces Launch of Private Notes Offering

07 Januar 2025 - 2:35PM

APA Corporation (“APA”) (Nasdaq: APA) announced today that it

intends to offer, subject to market and other conditions, a series

of senior notes due 2035 and a series of senior notes due 2055

(collectively, the “Notes”) in a private offering (the “Private

Offering”) that is exempt from the registration requirements of the

Securities Act of 1933, as amended (the “Securities Act”).

APA intends to use the net proceeds from the

proposed offering to purchase certain outstanding senior

indebtedness issued by Apache Corporation, a Delaware corporation

and a wholly-owned subsidiary of APA (“Apache”) in cash tender

offers with respect to several series of its outstanding notes,

which commenced on December 3, 2024, with a maximum aggregate

purchase price of $869 million (including accrued and unpaid

interest) (the “Tender Offers”). Any remaining net proceeds will be

used for general corporate purposes, which may include further

purchases of Apache’s outstanding notes. The settlement date of the

Tender Offers and the concurrent offers to exchange certain

outstanding senior indebtedness issued by Apache for new notes to

be issued by APA is expected to be January 10, 2025 (the “Tender

Settlement Date”).

The Notes will be initially guaranteed by

Apache, until the first time that the aggregate principal amount of

indebtedness under senior notes and debentures outstanding under

Apache’s existing indentures is less than $1 billion, provided that

if the aggregate principal amount of such indebtedness is less than

$1 billion as of the Tender Settlement Date, then the reason

for such guarantees would have ceased to exist and no guarantees

would be issued with respect to the Notes.

The Notes will be offered and sold only to

persons reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act and to certain

non-U.S. persons in transactions outside the United States in

reliance on Regulation S under the Securities Act. The Notes have

not been registered under the Securities Act or the securities laws

of any state or other jurisdiction, and the Notes may not be

offered or sold in the United States without registration or an

applicable exemption from the registration requirements of the

Securities Act and applicable state securities or blue sky laws and

foreign securities laws.

This press release shall not constitute an offer

to sell, or the solicitation of an offer to buy any securities, nor

shall there be any sales of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

About APA

APA Corporation owns consolidated subsidiaries

that explore for and produce oil and natural gas in the United

States, Egypt and the United Kingdom and that explore for oil and

natural gas offshore Suriname and elsewhere.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements can be identified by words such as “anticipates,”

“intends,” “plans,” “seeks,” “believes,” “continues,” “could,”

“estimates,” “expects,” “goals,” “guidance,” “may,” “might,”

“outlook,” “possibly,” “potential,” “projects,” “prospects,”

“should,” “will,” “would,” and similar references to future

periods, but the absence of these words does not mean that a

statement is not forward-looking. These statements include, but are

not limited to, statements about future plans, expectations, and

objectives for operations, including statements about our capital

plans, drilling plans, production expectations, asset sales, and

monetizations. While forward-looking statements are based on

assumptions and analyses made by us that we believe to be

reasonable under the circumstances, whether actual results and

developments will meet our expectations and predictions depend on a

number of risks and uncertainties which could cause our actual

results, performance, and financial condition to differ materially

from our expectations. All of the forward-looking statements are

qualified in their entirety by reference to the factors discussed

under “Forward-Looking Statements and Risk” and “Risk Factors” in

APA’s Annual Report on Form 10-K for the year ended December 31,

2023, and in its Quarterly Reports on Form 10-Q for the quarterly

periods ended March 31, 2024, June 30, 2024, and September 30, 2024

and similar sections in any subsequent filings, which describe

risks and factors that could cause results to differ materially

from those projected in those forward-looking statements. Any

forward-looking statement made in this news release speaks only as

of the date on which it is made. Factors or events that could cause

our actual results to differ may emerge from time to time, and it

is not possible for us to predict all of them. APA and its

subsidiaries undertake no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future development or otherwise, except as may be required by

law.

Contacts

|

Investor: |

(281) 302-2286 |

Ben Rodgers |

|

|

|

|

|

Media: |

(713) 296-7276 |

Alexandra Franceschi |

|

|

|

|

|

Website: |

www.apacorp.com |

|

|

|

APA-F

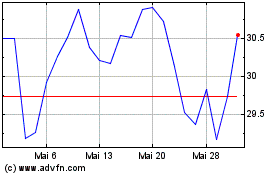

APA (NASDAQ:APA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

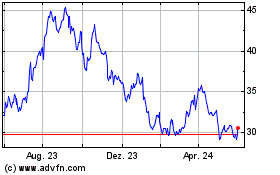

APA (NASDAQ:APA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025