LECTRA: First half 2024: increased revenues and EBITDA, due to

improved Group’s fundamentals and the integration of Launchmetrics.

Confirmation of 2024 objectives.

First half 2024: increased revenues and EBITDA, due to

improved Group’s fundamentals and the integration of Launchmetrics.

Confirmation of 2024 objectives.

- Revenues: 262.3 million euros

(+9%)*

- EBITDA before non-recurring items:

42.2 million euros (+20%)*

*At actual exchange rates

|

|

|

|

|

In millions of euros |

April 1 – June 30 |

January 1 – June 30 |

|

|

2024(1) |

2023 |

2024(1) |

2023 |

|

Revenues |

132.7 |

115.9 |

262.3 |

239.6 |

|

Change at actual exchange rates (in %) |

15% |

|

9% |

|

|

EBITDA before non-recurring items(2) |

21.2 |

15.6 |

42.2 |

35.3 |

|

Change at actual exchange rates (in %) |

36% |

|

20% |

|

EBITDA margin before non-recurring items

(in % of revenues) |

15.9% |

13.4% |

16.1% |

14.7% |

|

Income from operations before non-recurring items |

10.4 |

8.2 |

21.7 |

20.3 |

|

Change at actual exchange rates (in %) |

28% |

|

7% |

|

|

Net income(3) |

4.4 |

6.6 |

11.1 |

13.9 |

|

Free cash flow before non-recurring items |

6.3 |

7.4 |

28.3 |

16.6 |

|

|

|

|

|

|

(1) The 2024 amounts include Launchmetrics since

January 23, 2024

(2) The definition for performance indicators

appears in the Management Discussion of June 30, 2024

(3) In 2023, net income included the impact of

non-recurring income of 2.6 million euros

Paris, July 25, 2024. Today,

Lectra’s Board of Directors, chaired by Daniel Harari, reviewed the

consolidated financial statements for the first half of 2024, which

have been subject to a limited review by the Statutory Auditors. To

facilitate the analysis of the Group's results in its new scope,

the accounts of Lectra excluding Launchmetrics (the "Lectra 2023

scope") and those of Launchmetrics are analyzed separately.

The detailed 2024 vs 2023 comparisons are based

on actual exchange rates, except for the Lectra 2023 scope stated

on a like-for-like basis.

- Q2

2024

The macroeconomic and geopolitical environment

remained particularly degraded in the second quarter but with

heterogeneous situations between different geographical markets and

market sectors. In particular, the manufacturer’s morale has

improved in Asia-Pacific while uncertainty prevailed in Europe and

the United States, due to past or upcoming elections.

This uncertainty resulted in a cautious position

on the part of the Group's customers in their investment decisions,

with a negative effect on orders for new systems but without having

a significant impact on orders for new software subscriptions,

which are considered by the Group’s customers as operating

expenses.

Second quarter results were nonetheless

significantly higher, driven by the improvement in Group’s

fundamentals – growth in recurring revenues, higher gross profits,

stability in overhead costs - and by the integration of

Launchmetrics. Q2 2024 revenues (132.7 million euros) and EBITDA

before non-recurring items (21.2 million euros) significantly

increased (respectively +15% and +36%). The EBITDA margin before

non-recurring items stood at 15.9%.

Launchmetrics contributed 10.8 million

euros to revenues and 1.5 million euros to EBITDA before

non-recurring items, with an EBITDA before non-recurring items

margin of 13.4%.

Lectra 2023 scope

Orders for perpetual software licenses,

equipment and accompanying software, and non-recurring services

(38.7 million euros) are stable compared to Q2 2023.

The annual value of new subscriptions for

software came to 3.0 million euros, up 6% compared to Q2 2023.

Q2 2024 revenues came to 121.9 million euros, up

5% compared Q2 2023. EBITDA before non-recurring items was

19.7 million euros, up 27% and EBITDA margin before

non-recurring items stood at 16.2% (+2.8 percentage

points).

- FIRST HALF

2024

H1 2024 revenues were 262.3 million euros, up

9%.

The gross profit came to 187.5 million euros, up

13% compared to H1 2023, and the gross profit margin to 71.5% up

2.4 percentage points.

EBITDA before non-recurring items totalled 42.2

million euros up 20% and the EBITDA margin before non-recurring

items up 16.1% up 1.4 percentage points.

Consolidated income from operations before

non-recurring items amounted to 21.7 million euros, up 7%. This

included a 11.0 million euros charge for amortization of intangible

assets arising from acquisitions made since 2021, including 4.7

million euros for Launchmetrics.

Considering the amortization of Launchmetrics

intangible assets, the increase in financial expenses and an income

tax expense of 5.7 million euros, net income totalled

11.1 million euros. Net income for H1 2023 (13.9 million

euros) included the impact of a non-recurring income of

2.6 million euros in Q2 2023.

Free cash flow before non-recurring items came

to 28.3 million euros, up sharply compared to 2023

(16.6 million euros in the first half of 2023).

As of June 30, 2024, the Group has a

particularly robust balance sheet, with a consolidated

shareholders' equity of 333.6 million euros, a negative

working capital requirement of 10.3 million euros and net

financial debt of 59.0 million euros, consisting in financial

debt of 118.2 million euros and cash of 59.2 million

euros, after paying in full the first tranche of the acquisition of

Launchmetrics, i.e. 77.0 million euros.

Lectra 2023 scope

In H1 2024, orders for perpetual software

licenses, equipment and accompanying software, and non-recurring

services (74.2 million euros) were stable compared to H1 2023. The

annual value of new software subscription orders came to 5.4

million euros, stable compared to H1 2023.

Revenues amounted 243.2 million euros, up 2% compared to H1

2023.

EBITDA before non-recurring items was 39.7

million euros, up 14% and the EBITDA margin before non-recurring

items came to 16.3%, up 1.8 percentage points, compared to

2023.

- BUSINESS

TRENDS AND OUTLOOK

In its financial report on the fourth quarter

and full year 2023, published on February 14, 2024, Lectra

reiterated its long-term vision, as well as the objectives of its

2023-2025 strategic roadmap and its ambitions for 2025: revenues of

600 million euros, of which 400 million euros in recurring

revenues, including 90 million euros in SaaS revenues, and an

EBITDA margin before non-recurring items exceeding 20%.

The Group also stated that while the substantial

improvement in the fundamentals of the Group's business model in

2023 would have a positive impact on 2024 results, persistent

macroeconomic and geopolitical uncertainties could continue to

weigh on investment decisions by its customers.

While business in H1 remained subdued, the

increase in EBITDA before non-recurring items - which exceeded

growth in revenues -confirms the improved fundamentals of Lectra’s

business model.

2024 financial objectives

confirmed

On February 14, the Group reported its

objectives for 2024, before including the Launchmetrics acquisition

(i.e., for the Lectra 2023 scope): to achieve revenues in the range

of 480 to 530 million euros (+2% to +12%) and EBITDA before

non-recurring items in the range of 85 to 107 million euros (+10%

to +40%).

The Group also reported that Launchmetrics

revenues (for the consolidation period from January 23 to December

31, 2024) were projected to be in the range of 42 to 46 million

euros, with an EBITDA margin before non-recurring items of more

than 15%.

These scenarios were prepared on the basis of

the closing exchange rates on December 29, 2023, and particularly

$1.10/€1.

The results for H1 2024 confirm the 2024

objectives. At this stage, full-year results however would be at

the lower end of the indicated ranges.

The 2023 Annual Financial Report, as well as the Management

Discussion and Analysis of Financial Conditions and Results of

Operations and the financial statements for H1 2024 are available

on lectra.com. Q3 and the first nine months of 2024 earnings will

be published on October 30, 2024.

As a major player in

the fashion, automotive and furniture markets, Lectra contributes

to the Industry 4.0 revolution with boldness and passion by

providing best-in-class technologies. The Group offers

industrial intelligence solutions - software, equipment, data and

services - that facilitate the digital transformation of the

companies it serves. In doing so, Lectra helps its customers push

boundaries and unlock their potential. The Group is proud to state

that its 3,000 employees are driven by three core values: being

open-minded thinkers, trusted partners and passionate

innovators. Founded in 1973, Lectra reported revenues of 478

million euros in 2023. The company is listed on Euronext, where it

is included in the following indices: SBF 120, CAC Mid 60, CAC

Mid&Small, CAC All Shares, CAC All-Tradable, CAC Technology, EN

Tech Leaders and ENT PEA-PME 150. For more information,

visit www.lectra.com

Lectra – World Headquarters: 16–18, rue Chalgrin • 75016 Paris •

France

Tel. +33 (0)1 53 64 42 00 – www.lectra.com

A French Société Anonyme with capital of €37,832,965 • RCS Paris B

300 702 305

- Lectra_Press_Release_H12024

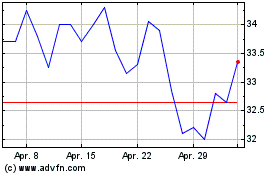

Lectra (EU:LSS)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Lectra (EU:LSS)

Historical Stock Chart

Von Nov 2023 bis Nov 2024