Bitcoin ETFs Surpass 1 Million BTC Holdings In Less Than A Year Since Launch – Details Inside

05 November 2024 - 4:00AM

NEWSBTC

Bitcoin (BTC) exchange-traded funds (ETFs) have collectively

acquired over one million BTC in less than a year since their

launch, reflecting strong demand for the digital asset among

investors. Bitcoin ETFs Surpass One Million BTC Milestone According

to a chart shared by crypto analyst Ali Martinez on X, the

cumulative BTC holdings in Bitcoin ETFs have exceeded one million

BTC within this short period. To recall, after a lot of

deliberation, the US Securities and Exchange Commission (SEC)

approved spot Bitcoin ETFs earlier this year in January. To say

that Bitcoin ETFs have proven to be a resounding success won’t be

an overstatement. Related Reading: Record-Breaking Day: Spot

Bitcoin ETF Trading Exceeds $3 Billion As BTC Eyes Record Peak

Bitcoin ETFs have recorded a cumulative total net inflow of $24.15

billion to date. Martinez added that the total value of BTC held by

these ETFs currently stands at approximately $70 billion. From a

price perspective, BTC has jumped from about $41,900 on January 8

to its current price of $68,941, marking an increase of almost 65%.

During this period, BTC reached an all-time high (ATH) of $73,737

in March. With over a million BTC now held in Bitcoin ETFs, roughly

5% of the total 21 million BTC supply is tied up in these financial

products, reinforcing Bitcoin’s scarcity narrative. Notably, asset

manager BlackRock’s IBIT spot BTC ETF leads the market, holding

approximately $30 billion net assets. Grayscale’s GBTC follows with

$15.22 billion, and Fidelity’s FBTC ranks third with $10.47 billion

in net assets. The growing interest in Bitcoin ETFs is also

highlighted in a recent CoinShares report, which found that digital

asset investment products attracted inflows of over $2.2 billion

last week. CoinShares attributed the recent surge in crypto product

inflows to the possibility of a Republican victory in the upcoming

US presidential election on November 5. Interestingly, higher

inflows were seen at the beginning of the week, while outflows

emerged toward the end as Democratic candidate Kamala Harris’s odds

of winning improved. At the time of writing, decentralized

prediction markets platform Polymarket shows Harris a 41.6% chance

of winning the presidency, while Republican candidate Donald Trump

remains the favorite with a 58.5% chance. Trump Win To Benefit

Crypto, Experts Opine While voter opinion on other policies might

be split more evenly, the overall consensus as far as crypto is

concerned seems to be that a Trump victory may benefit BTC and

other digital assets. Related Reading: Trump’s Vision: America To

Reign As Crypto And Bitcoin Epicenter, Latest Statement Reveals

Earlier this month, JPMorgan stated that retail investors

increasingly view BTC as a ‘debasement trade’ to protect their

assets’ purchasing power amid inflation and that a Trump win could

provide ‘additional upside’ to BTC. That said, Kamala Harris,

Biden’s current vice president, is reportedly taking a fresh

approach to digital assets, in contrast to the current

administration’s perceived cautious stance. Whether this will boost

her popularity among crypto-focused voters remains to be seen. At

press time, Bitcoin is trading at $68,941, up 0.8% in the past 24

hours. According to CoinGecko data, Bitcoin dominance stands at

56.7%. Featured image from Unsplash, Charts from X and

Tradingview.com

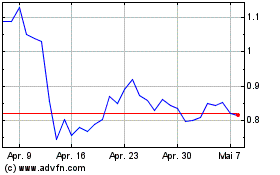

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024