Titan Mining Corporation (TSX: TI) (“

Titan”

or the “

Company”) announces the results for the

quarter ended March 31, 2024. (All amounts are in U.S. dollars

unless otherwise stated)

Don Taylor, President and Chief Executive

Officer of Titan, commented, “We are pleased to announce that the

Empire State Mine has been recognized by MSHA for its outstanding

safety performance in 2023 with two ‘Certificates of Achievement in

Safety’. In addition to the outstanding safety performance ESM

continues to meet or exceed production goals remaining on track to

produce an estimated 56-60 million pounds of payable zinc during

2024. The management and workforce at ESM have established a firm

foundation for both production and safety as we contemplate the

Turnpike expansion project and development of the Kilbourne

graphite project.”

Q1 2024 HIGHLIGHTS:

- Produced 14.7 million pounds of

payable zinc

- Advanced the exploration of the

Kilbourne graphite trend, an extensively drill tested

graphite-bearing trend located on permitted lands

- Drilling totaled 6,870 ft in 19

holes

- Highlights include 174 ft at 3.75

graphitic carbon

- An initial bulk sample was

identified and collected in January 2024

TABLE 1 Financial and Operating Highlights

|

|

Q1 2024 |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

|

Operating |

|

Payable Zinc Produced |

mlbs |

14.7 |

13.9 |

18.3 |

15.0 |

13.8 |

|

Payable Zinc Sold |

mlbs |

14.4 |

13.9 |

18.3 |

15.0 |

14.8 |

|

Average Realized Zinc Price |

$/lb |

1.11 |

1.13 |

1.10 |

1.15 |

1.42 |

|

|

|

Financial |

|

Revenue |

$m |

11.73 |

10.91 |

15.50 |

8.95 |

16.74 |

|

Net Income (loss) before tax |

$m |

(2.63) |

(6.96) |

0.50 |

(4.84) |

1.10 |

|

Earnings (loss) per share - basic |

$/sh |

(0.02) |

(0.05) |

0.00 |

(0.03) |

0.01 |

|

Cash Flow from Operating Activities before changes in non-cash

working capital |

$m |

0.26 |

(1.36) |

4.21 |

(0.11) |

3.35 |

|

|

|

Financial Position |

31-Mar 24 |

31-Dec-23 |

30-Sep-23 |

30-Jun-23 |

31-Mar-23 |

|

Cash and Cash Equivalents |

$m |

4.18 |

5.03 |

4.32 |

2.90 |

7.41 |

|

Net Debt 1 |

$m |

32.44 |

30.75 |

32.93 |

33.43 |

23.34 |

1 Net Debt is a non-GAAP measure. This term

is not a standardized financial measure under IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. See Non-GAAP Performance Measures below for additional

information.

OPERATIONS REVIEW

Mining efforts in the first quarter of 2024

focused on the Mahler, New Fold, and Mud Pond zones. Mining

activities remain suspended in the N2D zone in response to lower

zinc prices. Deepening of the lower Mahler ramp system provided

access to high-grade ore in the Lower Mahler mining zone which

supported above budget grades and metal production. It is expected

that ore from this zone will continue to support head grade at

planned levels in the coming year. Redesign of access and mining

methods has allowed continued mining in the New Fold Zone. Mining

is expected to continue in the same zones in the second quarter of

2024.

Work on projects, including the Turnpike

project, has been limited since Q2 of 2023 to preserve cash in

response to lower zinc prices. Rod mill liners were received and

will be installed in the second quarter of 2024.

EXPLORATION UPDATE

Kilbourne Graphite Project:

The Company began Phase 1 of Kilbourne

exploration in the fourth quarter of 2023 with surface trenching

and surface diamond drilling. In the first quarter of 2024 a total

of 19 surface drill holes totalling 6,870 ft (2,093 m) were

completed. All drill holes intercepted the Kilbourne Host unit,

with graphite confirmed through assay in the first 15 holes of the

program (please refer to the Company’s press release dated April 9,

2024 titled “Titan Mining Provides Initial Drill Results On The

Kilbourne Graphite Project, Results Include 173.5 Ft At 3.75%

Graphitic Carbon”). The Company is currently awaiting the results

on the remaining four holes. Results from both trenching and

drilling have returned an average graphitic carbon grade of 3.2%.

Based on the positive results, Phase II drilling at Kilbourne will

commence in the second quarter of 2024.

In February of 2024, bulk, representative

samples from the upper and lower graphitic host units were

delivered to Forte Analytical in Wheat Ridge, Colorado for

metallurgical analysis and floatation testing. Results from this

program are expected in the second quarter of 2024.

Underground:

Drill programs in the first quarter of 2024

targeted the Lower Mahler, New Fold, and Fowler zones. Underground

drilling completed nine drillholes totalling 2,609 ft (795 m). All

underground drilling was completed with Company-owned underground

drills by Company employees.

Surface:

No surface drilling was undertaken on district

zinc targets in the first quarter of 2024. Plans are underway to

continue the surface exploration program in H2 2024.

Qualified Person

The scientific and technical information

contained in this news release and the sampling, analytical and

test data underlying the scientific and technical information has

been reviewed, verified and approved by Donald R. Taylor, MSc., PG,

President and Chief Executive Officer of the Company, a qualified

person for the purposes of NI 43-101. Mr. Taylor has more than 25

years of mineral exploration and mining experience and is a

Registered Professional Geologist through the SME (registered

member #4029597). The data was verified using data validation and

quality assurance procedures under high industry standards.

Non-GAAP Performance

Measures

This document includes non-GAAP performance

measures, discussed below, that do not have a standardized meaning

prescribed by IFRS. The performance measures may not be comparable

to similar measures reported by other issuers. The Company believes

that these performance measures are commonly used by certain

investors, in conjunction with conventional GAAP measures, to

enhance their understanding of the Company's performance. The

Company uses these performance measures extensively in internal

decision-making processes, including to assess how well the Empire

State Mine is performing and to assist in the assessment of the

overall efficiency and effectiveness of the mine site management

team. The tables below provide a reconciliation of these non-GAAP

measures to the most directly comparable IFRS measures as contained

within the Company's issued financial statements.

Net Debt

Net debt is calculated as the sum of the current

and non-current portions of long-term debt, net of the cash and

cash equivalent balance as at the balance sheet date. A

reconciliation of net debt is provided below.

|

|

Three months endedMarch 31,

2024 |

|

Year

endedDecember 31, 2023 |

|

|

|

|

|

|

|

|

Current portion of debt |

$ |

36,619 |

|

|

$ |

35,779 |

|

|

Non-current portion of debt |

|

- |

|

|

|

- |

|

|

Total debt |

$ |

36,619 |

|

|

$ |

35,779 |

|

|

Less: Cash and cash equivalents |

|

(4,176 |

) |

|

|

(5,031 |

) |

|

Net debt |

$ |

32,443 |

|

|

$ |

30,748 |

|

About Titan Mining

Corporation

Titan is an Augusta Group company which produces

zinc concentrate at its 100%-owned Empire State Mine located in New

York state. Titan is built for growth, focused on value and

committed to excellence. For more information on the Company,

please visit our website at www.titanminingcorp.com

Contact

For further information, please contact: Investor

Relations: Email: info@titanminingcorp.com

Cautionary Note Regarding

Forward-Looking Information

Certain statements and information contained in

this new release constitute "forward-looking statements", and

"forward-looking information" within the meaning of applicable

securities laws (collectively, "forward-looking statements"). These

statements appear in a number of places in this news release and

include statements regarding our intent, or the beliefs or current

expectations of our officers and directors, including that it is

expected that ore from the Lower Mahler mining zone will support

head grade at planned levels for the remainder of the year;

production guidance; planned mining zones; rod mill liners were

received and will be installed in the second quarter of 2024;

future exploration plans; and timing of results of metallurgical

results and flotation testing. When used in this news release words

such as “to be”, "will", "planned", "expected", "potential", and

similar expressions are intended to identify these forward-looking

statements. Although the Company believes that the expectations

reflected in such forward-looking statements and/or information are

reasonable, undue reliance should not be placed on forward-looking

statements since the Company can give no assurance that such

expectations will prove to be correct. These statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results or events to vary materially from those

anticipated in such forward-looking statements, including the

risks, uncertainties and other factors identified in the Company's

periodic filings with Canadian securities regulators. Such

forward-looking statements are based on various assumptions,

including assumptions made with regard to the ability to advance

exploration efforts at ESM; the results of such exploration

efforts; the ability to secure adequate financing (as needed); the

Company maintaining its current strategy and objectives; and the

Company’s ability to achieve its growth objectives. While the

Company considers these assumptions to be reasonable, based on

information currently available, they may prove to be incorrect.

Except as required by applicable law, we assume no obligation to

update or to publicly announce the results of any change to any

forward-looking statement contained herein to reflect actual

results, future events or developments, changes in assumptions or

changes in other factors affecting the forward-looking statements.

If we update any one or more forward-looking statements, no

inference should be drawn that we will make additional updates with

respect to those or other forward-looking statements. You should

not place undue importance on forward-looking statements and should

not rely upon these statements as of any other date. All

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

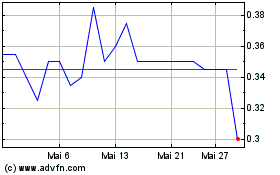

Titan Mining (TSX:TI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Titan Mining (TSX:TI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024