Mandalay Resources Corporation ("Mandalay" or the "Company") (TSX:

MND, OTCQB: MNDJF) is pleased to announce high-grade drill results

at its True Blue prospect adjacent to the operating Costerfield

gold-antimony mine in Victoria, Australia.

Highlights of True Blue:

- High grades intercepted in upward

extension of 2024’s maiden Inferred Mineral Resource:

- 578.0 g/t gold and 20.5%

antimony over 0.47 m (ETW 0.33 m) in TB031

- 16.8 g/t gold and 2.4 %

antimony over 3.98 m (ETW 2.56 m) in TB027

- Including 172.0 g/t gold and 19.2%

antimony over 0.37 m

- 161.0 g/t gold over 0.19

m (ETW 0.15 m) in TB029

- Drill testing and soil geochemistry

indicate an extensive system with the potential to replicate

Costerfield's Central Corridor which has sustained mining the past

15 years;

- Structural continuity interpreted

on 600 m of strike, leaving 3.4 km of the system yet to be tested;

and

- Follow-up drilling at True Blue has

commenced with now two rigs mobilizing to further define

mineralization and increase deposit confidence.

Frazer Bourchier, President and CEO,

commented:

“Mandalay has been producing gold and antimony

at Costerfield since we acquired the project 15 years ago. We are

excited to see True Blue emerging as a potential new frontier for

Costerfield, marking an exciting new chapter for Mandalay. This

development reinforces our standing position as a growing gold

producer and as the leading Western source of the strategic mineral

antimony. Exploration continues to be a key strategic pillar for

growth, with a minimum of $9 million allocated for the first half

of 2025.”

Chris Davis, VP of Exploration and Operational

Geology, commented:

"Exploration at True Blue has revealed

geological similarities to the mined Central Corridor. These

parallels in host lithology, structural setting, and fluid

transport systems underscore the exceptional potential of True

Blue.

"These results represent a significant

breakthrough, intercepting high-grade mineralization with visible

gold and stibnite (antimony mineral) veins. Mineralization extends

130 metres along strike with strong potential for expansion. The

surface expression of the system lies 300 metres above these

high-grade intercepts, highlighting its significant vertical

extent. Encouragingly, drilling also confirmed down-dip

mineralization at 590 metres depth with further potential. Step-out

drilling of 600 metres to the south uncovered a wide anomalous

mineralized zone of approximately 250 metres, with assays up to 3.8

g/t gold, highlighting the system's continuity and scale.

"Mandalay is committed to unlocking the full

potential of True Blue through an extensive extensional drilling

program. Two rigs will commence follow-up drilling in the coming

weeks, with results expected in the months ahead. Additional drill

metres and drill rig intensity will be determined by staged

assessments, as we work toward building a robust Mineral Resource

to potentially extend Costerfield's mine life.”

Drill Program Details

The True Blue prospect sits approximately 2 km

to the west of the Youle and Shepherd deposits currently being

mined by Mandalay. Mining of gold and antimony in the area began in

1861 and since Mandalay took ownership in December 2009, 577,000

ounces of gold and 65,000 tonnes of antimony have been mined at an

overall grade of 9.1 g/t gold and 3.3 % antimony. This has been

extracted from three major development areas along a 6 km

mineralized “Central Corridor”, from the Augusta mine in the south

to the Youle mine in the north. True Blue has the potential to be

another corridor of production with surface workings and soil

geochemistry anomalism indicating a system spanning 4 kilometres in

strike length (Figure 1).

Figure 1. Map of Costerfield exploration

tenements and mining licence depicting the location of the main

production areas within the central corridor and the True Blue

prospect.

Following the successful commencement of mining

at Youle several years ago, Mandalay has completed a comprehensive

assessment of the Costerfield mineral field. From this assessment,

a number of targets were identified and drilled. With significant

results coming from the initially prioritized Browns and Robinson

deposits, the initial potential of True Blue was not realised until

late 2022 when targeted drilling intercepted antimony

mineralization.

The next phase of drilling was undertaken

through 2023-2024, confirming lower-grade southern structural

continuity and an exceedingly high grade up-dip extension that

displays not only continuity of high antimony endowment but also

the introduction of coarse gold, occurring both within stibnite

(antimony ore) and quartz. Highlights of this drilling include 16.8

g/t gold and 2.4 % antimony over 3.98 m (ETW 2.56 m) in TB027 and

578.0 g/t gold and 20.5% antimony over 0.47 m (ETW 0.33 m) in TB031

located 130m further north (Figure 2).

Figure 2. Longitudinal section of the most

continuous veinset interpreted from the True Blue drilling data.

Note that there is additional drilling of this system up dip,

however this is in a parallel but separate veining network. The

immediately up-dip extension of the vein set in this long section

is untested. Drillholes are annotated with composites over 2.0 g/t

AuEq when diluted to 1.8 m.

The geometry of True Blue is similar to that of

the Youle deposit, consisting of subvertical to west-dipping veins

hosted by the western limb of an anticline (figure 3). Like Youle

and Shepherd, structural continuity of the True Blue mineralized

veins is remarkably consistent over the drill-tested area. This

consistency is attributed to being hosted in the same lithology and

the central corridor.

Interacting fault structures, chiefly the

west-dipping Bearded and Komodo Faults, also play an integral part

in the formation of the typical Costerfield style mineralization

identified at True Blue. Encouragingly the Bearded Fault has been

found to be mineralized, with 161.0 g/t gold over 0.19 m (ETW 0.15

m) recovered in TB029. These west-dipping faults are interpreted to

be contemporaneous with and genetically similar to the highly

mineralized host fault of the Youle deposit. This correlation

allows comparison of True Blue with observations already made

during mining at Youle and enables the acceleration of predictive

modelling for further exploration.

Following predictions based on a Youle-like

model applied to the current understanding of True Blue, a deeper

hole (TB026) was drilled with the aim of testing the Komodo Fault

down-dip of its modelled interaction with vertical mineralization.

Sub-vertical stibnite veins were intercepted at a depth of 590m

below surface with an intercept grading 1.6 g/t gold and 1.7 g/t

gold over 1.16 m (ETW 0.82 m), an exciting result despite the

Komodo Fault being intercepted further down hole than expected

resulting in the targeted geological setting not being fully

tested.

Figure 3. Cross section at 7300N of the True Blue

mineralization as interpreted by drilling to date. Intercepts from

TB027 and TB031 do align with the interpreted veining and appear to

be east and west of the veining, however this is due to off section

effects.

The veining at True Blue is generally

subvertical in nature, often consisting of a cluster of individual

narrow veins concentrated within a 0.5 m-thick zone controlled by

subtle anticline-parallel foliation, however in some areas parallel

mineralized veinlets persist up to 5 m from the main veining

(Figure 4).

Mineralization within these intercepts range

from quartz dominant to stibnite dominant, with gold occurring as

visible grains often in clusters up to 0.4 cm diameter within both

quartz and stibnite (Figure 5 inset). Gold has also been observed

in the form of “veinlets” within stibnite of up to 3 cm in length

and 0.2 mm in width, which is unusual for Costerfield (Figure 6

inset).

Hydrothermal white-mica and carbonate alteration

is widespread within the wall rock and provides further vectoring

potential as exploration continues. Carbonate spotting in

particular is observed at greater intensity than the bulk of other

Costerfield deposits. Fine-grained pyrite and euhedral arsenopyrite

is present proximal to the mineralized veins.

Figure 4. Photograph of True Blue intercept from

TB027 (16.8 g/t gold & 2.4 antimony over 3.98 m (ETW 2.43

m).

Figure 5. Photograph of True Blue intercept

interpreted to be the Bearded Fault from TB029 - 161.0 g/t gold

over 0.19 m (ETW 0.15 m) with inset showing close-up of visible

gold within a quartz matrix at 571.25 m down hole.

Figure 6. Photograph of True Blue intercept from

TB031 – 578.0 g/t gold over 0.47 m (ETW 0.33 m) with inset showing

close-up of visible gold within a stibnite matrix at 525.50 m down

hole.

Applying Costerfield’s Central Corridor as an

analogous model (supported by the numerous structural and

mineralogical similarities observed) to the geochemical footprint

of the True Blue prospect, Mandalay expects that the 4 kilometre

strike of the line has the potential to host several economic

deposits in addition to the zone that is being currently drill

tested.

In 2024, Mandalay drilled 2 step-out holes south

of the known True Blue vein system. One intercepted a very wide

mineralized zone, containing arrays of mineralized veins over a

down hole length of approximately 250 m, with individual assays

reaching up to 3.8 g/t gold and 2.3% antimony. Although these

results are lower grade and disseminated throughout the drill hole,

such intercepts are unprecedented at Costerfield and the presence

of this highly anomalous mineralization is strong evidence for the

system being able to generate economic mineralization along the

entire strike length of the anomaly corridor.

Figure 7. Plan view illustrating the potential of

the True Blue system. Illustrated on the map is the latest

geological interpretation, Geochemical analysis of soils and

location of recent drilling.

Although still at an early stage of testing,

True Blue has significant potential and exploration of the corridor

is made easier by the observed structural and mineralogical

similarity to Costerfield’s highly profitable central corridor.

Since 2022 exploration success at Costerfield has been achieved by

effectively testing geological models based on knowledge gained

through the past two decades of mining. During 2025 the extensional

and step out drilling programmes will continue as we seek to

confirm mineral resources along the corridor.

Drilling and Assaying

All diamond drill core was logged and sampled by

Costerfield geologists or contracted geologists with significant

industry experience who worked under Costerfield geologist’s

oversight. All samples were sent to On Site Laboratory Services

(OSLS) in Bendigo, Victoria, Australia, for sample preparation and

analysis by fire assay for gold, and Atomic Absorption Spectroscopy

(AAS) for antimony. Site geological and metallurgical personnel

have implemented a QA/QC procedure that includes systematic

submission of standard reference materials and blanks within

batches of drill and face samples submitted for assay. Costerfield

specific reference materials produced from Costerfield ore have

been prepared and certified by Geostats Pty Ltd., a specialist

laboratory quality control consultancy. See Technical Report

entitled “Costerfield Operation, Victoria, Australia NI 43-101

Report” dated March 28, 2024, available on SEDAR (www.sedar.com)

for a complete description of drilling, sampling, and assaying

procedures.

Qualified Person:

Chris Davis, Vice President of Operational

Geology and Exploration at Mandalay Resources, is a Chartered

Professional of the Australasian Institute of Mining and Metallurgy

(MAusIMM CP(Geo)), as well as a Member of the Australian Institute

of Geoscientists (MAIG) and a Qualified Person as defined by NI

43-101. He has reviewed and approved the technical and scientific

information provided in this release.

For Further Information

Frazer Bourchier Director, President and Chief Executive

Officer

Edison NguyenDirector, Business Valuations and Investor

Relations

Contact:647.258.9722

About Mandalay Resources Corporation

Mandalay Resources is a Canadian-based resource

company with producing assets in Australia (Costerfield

gold-antimony mine) and Sweden (Björkdal gold mine). The Company is

focused on growing its production and reducing costs to generate

significant positive cashflow. Mandalay is committed to operating

safely and in an environmentally responsible manner, while

developing a high level of community and employee engagement.

Mandalay’s mission is to create shareholder

value through the profitable operation and successful exploration

at its Costerfield and Björkdal mines. Currently, the Company’s

main objectives at Costerfield are to continue mining the

high-grade Youle and Shepherd veins, and to extend Mineral

Resources. At Björkdal, the Company will aim to increase production

from Aurora and Eastern zones and other higher-grade areas in the

coming years in order to maximize profit margins from the mine.

Forward-Looking Statements:

This news release contains "forward-looking

statements" within the meaning of applicable securities laws,

including statements regarding the exploration and development

potential of the True Blue deposit (Costerfield). Readers are

cautioned not to place undue reliance on forward-looking

statements. Actual results and developments may differ materially

from those contemplated by these statements depending on, among

other things, changes in commodity prices and general market and

economic conditions. The factors identified above are not intended

to represent a complete list of the factors that could affect

Mandalay. A description of additional risks that could result in

actual results and developments differing from those contemplated

by forward-looking statements in this news release can be found

under the heading “Risk Factors” in Mandalay’s annual information

form dated March 28, 2024, a copy of which is available under

Mandalay’s profile at www.sedar.com. In addition, there can be no

assurance that any inferred resources that are discovered as a

result of additional drilling will ever be upgraded to proven or

probable reserves. Although Mandalay has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking statements.

Appendix

Table 1. Significant Intercepts from drilling

program.

|

Drill Hole ID |

From (m) |

Depth To (m) |

Drill Width

(m) |

True Thick (m) |

Au Grade (g/t) |

Sb Grade (%) |

Au equivalent (g/t) over

min.1.8m Mining width |

Vein Name |

|

TB014 |

385.01 |

388.37 |

3.36 |

1.93 |

1.7 |

0.0 |

1.7 |

Associated Vein |

|

TB014 |

626.06 |

628 |

1.94 |

1.49 |

1.4 |

0.2 |

1.6 |

Main Vein |

|

TB015 |

275.87 |

281.96 |

6.09 |

3.49 |

1.9 |

0.6 |

3.3 |

Associated Vein |

|

TB015W1 |

578.65 |

578.91 |

0.26 |

0.21 |

15.2 |

16.6 |

6.4 |

Main Vein |

|

TB017 |

417.87 |

418.09 |

0.22 |

0.16 |

10.7 |

5.2 |

2.0 |

Associated Vein |

|

TB017 |

425.44 |

429.06 |

3.62 |

2.08 |

1.0 |

0.2 |

1.5 |

Associated Vein |

|

TB018 |

587.63 |

588.35 |

0.72 |

0.58 |

1.4 |

1.2 |

1.3 |

Main Vein |

|

TB019 |

443.84 |

446.48 |

4.09 |

2.35 |

0.8 |

0.1 |

1.1 |

Associated Vein |

|

TB020 |

481.98 |

483.42 |

1.44 |

1.43 |

1.5 |

0.0 |

1.2 |

Associated Vein |

|

TB022 |

230.31 |

232.47 |

2.16 |

1.87 |

1.0 |

0.3 |

1.6 |

Associated Vein |

|

TB022 |

461.85 |

464.25 |

2.40 |

1.85 |

1.3 |

0.0 |

1.3 |

Associated Vein |

|

TB022 |

471.86 |

474.24 |

2.38 |

2.00 |

2.6 |

0.0 |

2.6 |

Associated Vein |

|

TB026 |

716.56 |

717.72 |

1.16 |

0.82 |

1.6 |

1.7 |

2.6 |

Associated Vein |

|

TB026 |

730.65 |

731.1 |

0.45 |

0.41 |

0.5 |

2.6 |

1.5 |

Associated Vein |

|

TB027 |

551.55 |

551.83 |

0.28 |

0.21 |

2.0 |

8.7 |

2.7 |

Associated Vein |

|

TB027 |

577.57 |

581.55 |

3.98 |

2.56 |

16.8 |

2.4 |

22.5 |

Main Vein |

|

Including |

577.57 |

577.94 |

0.37 |

0.24 |

172.0 |

19.2 |

28.7 |

Main Vein |

|

TB029 |

538.32 |

538.7 |

0.38 |

0.22 |

9.9 |

3.7 |

2.3 |

Main Vein |

|

TB029 |

571.15 |

571.34 |

0.19 |

0.15 |

161.0 |

0.0 |

13.6 |

Bearded Fault |

|

TB029W1 |

538.07 |

538.28 |

0.21 |

0.12 |

1.8 |

16.5 |

2.8 |

Main Vein |

|

TB031 |

519.27 |

519.77 |

0.50 |

0.32 |

1.2 |

2.0 |

1.1 |

Associated Vein |

|

TB031 |

525.01 |

525.48 |

0.47 |

0.33 |

578.0 |

20.5 |

115.6 |

Main Vein |

| |

|

|

|

|

|

|

|

|

Notes1. The AuEq (gold

equivalent) grade is calculated using the following formula:

|

|

AuEq g per t = Au g per t =Sb% x |

Sb price per 10kg x Sb processing recovery |

|

|

|

Au price per g x Au processing recovery |

|

|

|

|

|

|

Prices and recoveries used: Au $/oz = 2,100; Sb

$/t = 16,000; Au Recovery = 93% and; Sb Recovery =

92%2. Composites that are not interpreted to be

connected to a named vein and are below 1 g/t AuEq when diluted to

1.8m are not considered significant and are not recorded here.

Table 2. Drill Hole Collar Details

|

DRILL HOLE ID |

NORTHING |

EASTING |

ELEVATION |

DEPTH |

DIP |

AZIMUTH |

DATE COMPLETE |

|

TB014 |

301496 |

5916260 |

217 |

670.7 |

-50 |

256.37 |

30-Mar-23 |

|

TB015 |

301389 |

5916369 |

222 |

738.9 |

-63 |

240.37 |

20-Jun-23 |

|

TB015W1 |

301389 |

5916369 |

222 |

665.4 |

-63 |

240.37 |

3-Apr-23 |

|

TB015W2 |

301389 |

5916369 |

222 |

950.7 |

-63 |

240.37 |

5-Jul-23 |

|

TB016 |

301496 |

5916259 |

217 |

639.8 |

-44 |

243.37 |

26-Apr-23 |

|

TB017 |

301389 |

5916370 |

221 |

622.6 |

-60 |

278.37 |

10-May-23 |

|

TB018 |

301496 |

5916260 |

217 |

635.6 |

-50 |

258.37 |

17-May-23 |

|

TB019 |

301421 |

5916495 |

224 |

917.8 |

-60 |

254.37 |

23-Aug-23 |

|

TB020 |

301420 |

5916495 |

224 |

707.3 |

-56 |

272.37 |

10-Oct-23 |

|

TB020W1 |

301420 |

5916495 |

224 |

578.8 |

-56 |

272.37 |

25-Oct-23 |

|

TB021 |

301496 |

5916258 |

217 |

737.4 |

-50 |

243.37 |

28-Nov-23 |

|

TB022 |

301689 |

5915593 |

209 |

899.2 |

-41 |

257.37 |

1-Feb-24 |

|

TB023 |

301496 |

5916257 |

217 |

893.4 |

-42 |

233.37 |

2-Feb-24 |

|

TB024 |

301772 |

5915180 |

204 |

695.9 |

-29 |

262.37 |

8-Mar-24 |

|

TB024W1 |

301772 |

5915180 |

204 |

850.7 |

-29 |

262.37 |

24-Apr-24 |

|

TB025 |

301562 |

5916174 |

215 |

900 |

-44 |

238.37 |

15-Apr-24 |

|

TB026 |

300768 |

5916491 |

237 |

1100.5 |

-63 |

129.37 |

31-Jul-24 |

|

TB027 |

300769 |

5916490 |

237 |

710.6 |

-40 |

132.37 |

1-Oct-24 |

|

TB027W1 |

300769 |

5916490 |

237 |

664 |

-40 |

132.37 |

2/12/2024 |

|

TB028 |

300769 |

5916491 |

237 |

749.4 |

-48 |

109.37 |

21-Oct-24 |

|

TB029 |

300769 |

5916490 |

237 |

820.9 |

-39 |

124.87 |

18-Nov-24 |

|

TB029W1 |

300769 |

5916490 |

237 |

699.5 |

-39 |

124.87 |

19-Dec-24 |

|

TB030 |

300660 |

5916506 |

243 |

930.8 |

-60 |

136.37 |

11-Nov-24 |

|

TB031 |

300767 |

5916506 |

237 |

599 |

-40.5 |

116.87 |

4-Dec-24 |

Notes:

- Coordinate

System: MGA2020

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/9f2edb84-0a13-4e38-8b93-2d8a0842080e

https://www.globenewswire.com/NewsRoom/AttachmentNg/1b179d43-e450-4c93-83f7-18c5ab928d0b

https://www.globenewswire.com/NewsRoom/AttachmentNg/5bc0d33b-aa5b-4f31-bb67-7f63fcaf6535

https://www.globenewswire.com/NewsRoom/AttachmentNg/db2b06b4-6161-4f9a-81ea-4afaeecaed6f

https://www.globenewswire.com/NewsRoom/AttachmentNg/c1e2259c-3aa4-4412-8d2d-1628b7b08083

https://www.globenewswire.com/NewsRoom/AttachmentNg/7ddea0db-79f9-4a1e-955d-c01096d9d44b

https://www.globenewswire.com/NewsRoom/AttachmentNg/fffdb231-15ac-45be-96da-91acc84c33b1

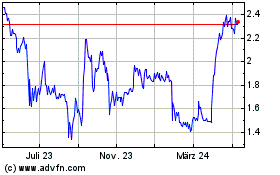

Mandalay Resources (TSX:MND)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

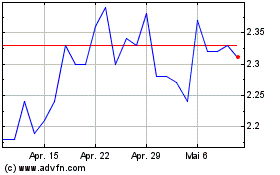

Mandalay Resources (TSX:MND)

Historical Stock Chart

Von Jan 2024 bis Jan 2025