THOR Industries, Inc. (NYSE: THO) today announced financial results

for its fourth fiscal quarter ended July 31, 2024.

“Our teams delivered solid performances as we

continue to navigate the persistent challenges in the industry’s

retail environment. We realized strong margin performance relative

to the current market conditions as our teams executed on strategic

initiatives designed to maximize our operational efficiency. This

long-term focus puts THOR in a strong position for our Fall Open

House event and the coming winter season,” offered Bob Martin,

President and CEO of THOR Industries.

“The macroeconomic challenges facing our

independent dealers and end consumers have been an impediment to

our industry for an extended period of time. THOR’s business model

and discipline allow us to not just adjust to what we’ve referred

to as ‘bouncing along the bottom,’ but to also make internal

efficiency improvements which contributed to improving our fourth

quarter gross profit margin despite the reduction in our net sales.

While challenges persist, we are confident in our ability to

continue to successfully manage our way through them. We will

remain disciplined with production to help our independent dealer

inventories stay fresh and in line with retail demand to protect

margins in this challenging market. Our 44-year history has taught

us that this cautious approach is healthy for our independent

dealers, the industry and for THOR. Our confidence in the

inevitable return of a robust market remains unchanged. It’s not an

‘if’ proposition but a ‘when’ proposition,” added Martin.

Fourth Quarter Financial

Results

Consolidated net sales were $2.53 billion in the

fourth quarter of fiscal 2024, compared to $2.74 billion for the

fourth quarter of fiscal 2023.

Consolidated gross profit margin for the fourth

quarter of fiscal 2024 was 15.8%, an increase of 140 basis points

when compared to the fourth quarter of fiscal 2023, aided in part

by a favorable LIFO inventory adjustment due to reductions in

inventory levels as well as an improved warranty cost

percentage.

Net income attributable to THOR Industries, Inc.

and diluted earnings per share for the fourth quarter of fiscal

2024 were $90.0 million and $1.68, respectively, compared to $90.3

million and $1.68, respectively, for the fourth quarter of fiscal

2023.

THOR’s consolidated results were primarily

driven by the results of its individual reportable segments as

noted below.

Segment Results

North American Towable RVs

| ($ in thousands) |

Three Months Ended July 31, |

|

|

|

|

Fiscal Years Ended July 31, |

|

|

|

|

|

2024 |

|

|

2023 |

|

Change |

|

|

|

2024 |

|

|

2023 |

|

Change |

| Net Sales |

$ |

931,856 |

|

$ |

930,661 |

|

0.1% |

|

|

$ |

3,679,671 |

|

$ |

4,202,628 |

|

(12.4)% |

|

Unit Shipments |

|

28,572 |

|

|

24,563 |

|

16.3% |

|

|

|

112,830 |

|

|

106,504 |

|

5.9% |

| Gross Profit |

$ |

117,375 |

|

$ |

110,770 |

|

6.0% |

|

|

$ |

427,386 |

|

$ |

503,487 |

|

(15.1)% |

|

Gross Profit Margin % |

|

12.6 |

|

|

11.9 |

|

+70 bps |

|

|

|

11.6 |

|

|

12.0 |

|

(40) bps |

| Income Before Income

Taxes |

$ |

50,913 |

|

$ |

55,652 |

|

(8.5)% |

|

|

$ |

169,232 |

|

$ |

237,123 |

|

(28.6)% |

| |

As of July 31, |

|

|

|

($ in thousands) |

|

2024 |

|

|

2023 |

|

Change |

|

Order Backlog |

$ |

552,379 |

|

$ |

756,047 |

|

(26.9)% |

|

|

|

|

|

|

|

|

|

- North American

Towable RV net sales were up 0.1% for the fourth quarter of fiscal

2024 compared to the prior-year period, driven by a 16.3% increase

in unit shipments offset by a 16.2% decrease in the overall net

price per unit. The decrease in the overall net price per unit was

primarily due to the combined impact of a shift in product mix

toward our lower-cost travel trailers along with sales price

reductions compared to the prior-year period.

- North American

Towable RV gross profit margin was 12.6% for the fourth quarter of

fiscal 2024, compared to 11.9% in the prior-year period. The

increase in gross profit margin percentage was primarily due to a

decrease in both the overhead and warranty expense

percentages.

- North American Towable RV income

before income taxes for the fourth quarter of fiscal 2024 was

$50.9 million, compared to $55.7 million in the fourth

quarter of fiscal 2023. This decrease was driven primarily by an

increase in selling, general and administrative costs.

North American Motorized RVs

| ($ in thousands) |

Three Months Ended July 31, |

|

|

|

|

Fiscal Years Ended July 31, |

|

|

|

|

|

2024 |

|

|

2023 |

|

Change |

|

|

|

2024 |

|

|

2023 |

|

Change |

| Net Sales |

$ |

517,319 |

|

$ |

656,128 |

|

(21.2)% |

|

|

$ |

2,445,850 |

|

$ |

3,314,170 |

|

(26.2)% |

| Unit Shipments |

|

3,777 |

|

|

5,041 |

|

(25.1)% |

|

|

|

18,761 |

|

|

24,832 |

|

(24.4)% |

|

Gross Profit |

$ |

65,974 |

|

$ |

56,461 |

|

16.8% |

|

|

$ |

277,840 |

|

$ |

442,715 |

|

(37.2)% |

|

Gross Profit Margin % |

|

12.8 |

|

|

8.6 |

|

+420 bps |

|

|

|

11.4 |

|

|

13.4 |

|

(200) bps |

| Income Before Income

Taxes |

$ |

29,812 |

|

$ |

21,044 |

|

41.7% |

|

|

$ |

126,496 |

|

$ |

255,207 |

|

(50.4)% |

| |

As of July 31, |

|

|

|

($ in thousands) |

|

2024 |

|

|

2023 |

|

Change |

|

Order Backlog |

$ |

776,903 |

|

$ |

1,242,936 |

|

(37.5)% |

|

|

|

|

|

|

|

|

|

- North American

Motorized RV net sales decreased 21.2% for the fourth quarter of

fiscal 2024 compared to the prior-year period. The decrease was

primarily due to a 25.1% reduction in unit shipments, as current

dealer and consumer demand has softened in comparison to the

prior-year period, partially offset by a 3.9% increase in net price

per unit.

- North American

Motorized RV gross profit margin was 12.8% for the fourth quarter

of fiscal 2024, compared to 8.6% in the prior-year period. The

increase in the gross profit margin percentage for the fourth

quarter of fiscal 2024 was primarily driven by decreases in each of

the material, labor and warranty cost percentages, with the

decrease in material percentage largely due to the favorable impact

of a LIFO inventory adjustment as a result of inventory reduction

measures, partially offset by higher sales discounts.

- North American Motorized RV income

before income taxes for the fourth quarter of fiscal 2024 increased

to $29.8 million compared to $21.0 million in the

prior-year period, driven by the increase in gross profit margin

percentage.

European RVs

| ($ in thousands) |

Three Months Ended July 31, |

|

|

|

|

Fiscal Years Ended July 31, |

|

|

|

|

|

2024 |

|

|

2023 |

|

Change |

|

|

|

2024 |

|

|

2023 |

|

Change |

|

Net Sales |

$ |

943,424 |

|

$ |

1,019,156 |

|

(7.4)% |

|

|

$ |

3,364,980 |

|

$ |

3,037,147 |

|

10.8% |

| Unit Shipments |

|

14,982 |

|

|

17,548 |

|

(14.6)% |

|

|

|

55,317 |

|

|

55,679 |

|

(0.7)% |

| Gross Profit |

$ |

176,143 |

|

$ |

193,269 |

|

(8.9)% |

|

|

$ |

581,211 |

|

$ |

505,344 |

|

15.0% |

|

Gross Profit Margin % |

|

18.7 |

|

|

19.0 |

|

(30) bps |

|

|

|

17.3 |

|

|

16.6 |

|

+70 bps |

| Income Before Income

Taxes |

$ |

87,171 |

|

$ |

101,677 |

|

(14.3)% |

|

|

$ |

231,377 |

|

$ |

179,625 |

|

28.8% |

| |

As of July 31, |

|

|

|

($ in thousands) |

|

2024 |

|

|

2023 |

|

Change |

| Order Backlog |

$ |

1,950,793 |

|

$ |

3,549,660 |

|

(45.0)% |

| |

|

|

|

|

|

|

|

- European RV net

sales decreased 7.4% for the fourth quarter of fiscal 2024 compared

to the prior-year period, driven by a 14.6% decrease in unit

shipments offset in part by a 7.2% increase in the overall net

price per unit due to the total combined impact of changes in

product mix and price. The overall increase in net price per unit

of 7.2% includes a 1.0% decrease due to the impact from foreign

currency exchange rate changes.

- European RV

gross profit margin was 18.7% of net sales for the fourth quarter

of fiscal 2024 compared to 19.0% in the prior-year period,

primarily due to slight increases in material and overhead cost

percentages due to increased sales discounting, partially offset by

an improved direct labor percentage.

- European RV income before income

taxes for the fourth quarter of fiscal 2024 was $87.2 million

compared to $101.7 million during the fourth quarter of fiscal

2023, with the decrease driven primarily by the decreased net sales

and increased sales discounting compared to the prior-year

period.

Management Commentary

“Our performance during the fourth quarter of

our fiscal year 2024 was marked by a strong margin performance

relative to current market conditions, as we saw an improvement in

our gross margin percentage of 140 basis points over the fourth

quarter of fiscal year 2023. The drivers for this improvement

include our success in managing cost inputs, reduced warranty

costs, optimizing our production processes and remaining

disciplined with our production and inventory levels, as the

reduction in inventories during the fourth quarter generated a

favorable LIFO inventory adjustment. Our bottom line benefited from

our successful execution of these strategies, as we saw our fourth

quarter net income before income taxes as a percentage of sales

increase 20 basis points compared to the prior-year period despite

a 7.4% reduction in our consolidated net sales. For the full fiscal

year, our top line declined by 9.7% while our gross profit margin

percentage improved 10 basis points. Our focus in the current

market is to continue to improve what we can control and to

maximize our performance,” said Todd Woelfer, Senior Vice President

and Chief Operating Officer.

“Given the current market environment, we were

pleased with our fourth quarter performance. In our North American

Towable segment, we saw flat net sales in our fourth quarter of

fiscal year 2024 when compared to the fourth quarter of fiscal year

2023 but improved gross profit margin by 70 basis points on a

similar sales volume. During the fourth quarter of fiscal year

2024, our Towable unit volumes increased by over 16% when compared

to the prior-year fourth quarter as consumers continued to manifest

a strong desire for the RV lifestyle despite macroeconomic

conditions, albeit in smaller, more moderately-priced units. During

the quarter, our warranty expense improved as we continued to focus

on quality initiatives across the organization. In our North

American Motorized segment, we saw sales drop over 21% when

compared to the same period from the prior year. Affordability

continues to be a challenge in the motorized segment as consumers

navigate the current economic cycle. Despite the challenges at the

retail and wholesale levels, we continue to improve our material,

labor and employee benefit costs as well as our warranty costs

which contributed to our gross profit margin improvement. Our North

American Motorized segment gross profit margin percentage also

benefited from the favorable impact of a LIFO inventory adjustment

as a result of inventory reduction measures,” offered Woelfer.

“Down markets like the one we are currently

experiencing in North America provide a great reconfirmation of our

variable operating model. As it has consistently proven through

such shifting cycles, our operating model is once again

establishing itself to be ideal for our business. Unlike prior down

cycles, we are experiencing in this down cycle the benefits of

long-term strategic initiatives designed to drive stronger margins

even in challenging conditions. These strategies include our

disciplined production planning, our continued efforts to maximize

operating efficiencies as we leverage our variable cost model, and

our steadfast focus on improved quality. During the fiscal fourth

quarter, we managed to have flat year-over-year diluted EPS

performance despite a reduction in our consolidated top line of

7.4%. As we look ahead, we will continue to execute strategic

initiatives designed to drive margin improvement while also working

to best position our products to realize relative retail success in

current market conditions,” added Woelfer.

“In our fourth quarter, our European team

outperformed expectations. We have reported publicly that the

benefit of dealer restocking that was realized over the first half

of fiscal 2024 would dissipate in the latter half of the fiscal

year. Our European segment generated gross profit margin of 18.7%,

down just 30 basis points from the same period last year despite a

top line decrease of 7.4% which was largely attributable to the

moderation and then completion of the restocking cycle with

European independent dealers. As we have reported previously, our

European management team has improved the institutional margin

profile of our European business such that, relative to any given

market condition, our European operations will outpace historical

gross profit margin performance in similar market conditions.

Importantly, our European operation has grown its market share for

the six months ended June 30, 2024, adding 3.5% of total market

share year over year and becoming the overall European market

leader. Fiscal year 2024 was another strong year for our European

operation as our strategy to create geographic diversification

continues to drive value,” explained Woelfer.

“During the quarter, we generated approximately

$338.0 million of cash from operations, and for the full fiscal

year, we generated approximately $545.5 million. As we’ve outlined

in the past, we take a balanced approach to capital allocation.

That was evident again this year as we returned earnings to

shareholders through dividends, made significant payments on our

debt, supported capital expenditures and repurchased shares of THOR

stock,” added Colleen Zuhl, Senior Vice President and CFO.

“We paid down approximately $116.8 million in

total debt during the fourth quarter. During the full fiscal year,

we paid down approximately $224.2 million in total debt, including

principal payments of approximately $213.0 million on our term

loans subsequent to our November 2023 debt modification, along with

approximately $11.2 million in payments related to our other debt

facilities. Additionally, during fiscal 2024, we both extended the

maturities on our Term Loan B and Asset Based Loan facilities and

lowered the interest rates on our USD and Euro term loans.

“During the quarter we also repurchased 266,367

shares of our outstanding stock for $25.4 million, bringing our

full fiscal year total stock repurchases to 720,997 shares for

$68.4 million.

“Capital expenditures in the fourth fiscal

quarter totaled $33.6 million, bringing our total for fiscal year

2024 to approximately $139.6 million, well under our original

capital expenditure plan as we adjusted non-critical spend due to

market conditions.

“Our liquidity remains a unique strength within

the industry. On July 31, 2024, we had liquidity of approximately

$1.32 billion, including approximately $501.3 million in cash on

hand and approximately $814.0 million available under our

asset-based revolving credit facility. As we continue to navigate a

challenging and dynamic market, our financial strength, robust cash

generation profile and balanced approach to capital allocation

continues to provide us the ability to execute on our long-term

strategic plan,” said Zuhl.

Outlook

“Our fiscal 2024 was a year in which many of our

strategic initiatives favorably impacted our performance in a

difficult market. Our choice to remain prudent through the soft

North American market has translated to better consolidated margin

performance. The talk of a softer market is beginning to sound like

a broken record, but we remained focused on managing through it

with increasing efficiency. The strength of THOR, founded in our

operating companies’ outstanding and experienced teams and the

well-known brands they provide to the market, is our strong balance

sheet and robust independent dealer relationships. These

differentiate us from our competition as our ability to manage

through extended retail downturns is unmatched. As we exit our

fiscal 2024 and begin our fiscal 2025, we remain mindful that our

focus is to continue to improve how we operate the Company in not

only the current cycle but also prepare ourselves for the robust

market that we all know to be on the horizon,” said Martin.

“Our current view of fiscal year 2025 is in line

with the recent RVIA industry-wide forecast which projected

approximately 324,100 wholesale unit shipments for calendar 2024

and 346,100 unit shipments at the median of its range for calendar

2025. We believe the RVIA forecast for calendar 2025 is slightly

aggressive and see potential for a range closer to 335,000 units.

Our base assumption for forecasting will be that the macro

challenges will persist through our fiscal year 2025, which runs

from August 1, 2024 through July 31, 2025. In North America, we

expect discounting in fiscal 2025 to remain elevated in our

Motorized segment, while we expect discounts to slightly moderate

in our Towable segment. In Europe, as we have exhausted the dealer

restocking opportunity fully, we expect fiscal 2025 to present more

challenges at both the top line and the gross profit margin line

when compared to the record results of our European segment in

fiscal 2024,” added Woelfer.

“Although the near-term environment remains

challenging, we continue to be very optimistic about global

consumer interest in the RV lifestyle and long-term demand for our

products. We remain confident that our strong financial position

and status as the global leader in the RV industry enables THOR to

meet the challenges of the current market and positions the Company

for success in the longer term,” Martin concluded.

Fiscal 2025 Guidance

“In planning for our fiscal year 2025, we

anticipate that the RV market will continue to be challenging

throughout our fiscal year which ends on July 31, 2025. While we

acknowledge that a positive inflection in the macroeconomic

conditions could occur before the end of our fiscal year 2025 that

could favorably impact our financial performance, we do not

currently model such an inflection beyond the normal seasonal lift

we anticipate in the spring. As mentioned above, we anticipate that

we will face market headwinds that will impact our full-year

performance in both our North American Motorized and European

segments. With a bias towards being conservative, the Company

continues to be cautious on the global economic outlook and

associated impacts on consumer demand and appetite for sizeable

discretionary purchases. In Europe, we anticipate a reduction in

our European segment net sales in fiscal 2025 compared to their

record sales in fiscal 2024, which included restocking European

independent dealer lots back to normalized levels. In North

America, the Company’s operating plan for fiscal 2025 reflects an

industry wholesale shipment range of between 330,000 and 345,000

units with wholesale shipments matching retail demand in total, but

we are expecting that dealers will hold off as long as possible on

stocking for the spring selling season to keep inventory levels low

over the winter months. As we forecast the continuation of the

softer market in fiscal year 2025, we will continue to manage the

Company to maximize our performance in the current environment as

we position products in the market that address the affordability

concerns of independent dealers and consumers and continue to lower

the average sales price of our units. Given our expectations

surrounding overall market volumes in both North America and

Europe, the Company is introducing its initial guidance for fiscal

2025,” commented Woelfer.

For fiscal 2025, the Company’s full-year

guidance includes:

- Consolidated net

sales in the range of $9.0 billion to $9.8 billion

- Consolidated

gross profit margin in the range of 14.7% to 15.2%

- Diluted earnings per share in the

range of $4.00 to $5.00

“As we look beyond our fiscal 2025, we expect to

see a stronger retail environment in the latter half of calendar

2025 and the beginning of our fiscal 2026. Our operating companies

are well positioned to leverage the capacity of THOR to realize the

financial benefits of the coming return of a robust retail

environment. We anticipate that in a more robust retail

environment, THOR will seize market share and meaningfully grow

diluted EPS as it has after previous down cycles,” concluded

Woelfer.

Supplemental Earnings Release

Materials

THOR Industries has provided a comprehensive

question and answer document, as well as a PowerPoint presentation,

relating to its quarterly results and other topics.

To view these materials, go to

http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating

companies which, combined, represent the world’s largest

manufacturer of recreational vehicles.

For more information on the Company and its

products, please go to www.thorindustries.com.

Forward-Looking Statements

This release includes certain statements that

are “forward-looking” statements within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are made based on management’s current expectations and

beliefs regarding future and anticipated developments and their

effects upon THOR, and inherently involve uncertainties and risks.

These forward-looking statements are not a guarantee of future

performance. We cannot assure you that actual results will not

differ materially from our expectations. Factors which could cause

materially different results include, among others: the impact of

inflation on the cost of our products as well as on general

consumer demand; the effect of raw material and commodity price

fluctuations, and/or raw material, commodity or chassis supply

constraints; the impact of war, military conflict, terrorism and/or

cyber-attacks, including state-sponsored or ransom attacks; the

impact of sudden or significant adverse changes in the cost and/or

availability of energy or fuel, including those caused by

geopolitical events, on our costs of operation, on raw material

prices, on our suppliers, on our independent dealers or on retail

customers; the dependence on a small group of suppliers for certain

components used in production, including chassis; interest rates

and interest rate fluctuations and their potential impact on the

general economy and, specifically, on our independent dealers and

consumers and our profitability; the ability to ramp production up

or down quickly in response to rapid changes in demand while also

managing costs and market share; the level and magnitude of

warranty and recall claims incurred; the ability of our suppliers

to financially support any defects in their products; the financial

health of our independent dealers and their ability to successfully

manage through various economic conditions; legislative, regulatory

and tax law and/or policy developments including their potential

impact on our independent dealers, retail customers or on our

suppliers; the costs of compliance with governmental regulation;

the impact of an adverse outcome or conclusion related to current

or future litigation or regulatory investigations; public

perception of and the costs related to environmental, social and

governance matters; legal and compliance issues including those

that may arise in conjunction with recently completed transactions;

lower consumer confidence and the level of discretionary consumer

spending; the impact of exchange rate fluctuations; restrictive

lending practices which could negatively impact our independent

dealers and/or retail consumers; management changes; the success of

new and existing products and services; the ability to maintain

strong brands and develop innovative products that meet consumer

demands; the ability to efficiently utilize existing production

facilities; changes in consumer preferences; the risks associated

with acquisitions, including: the pace and successful closing of an

acquisition, the integration and financial impact thereof, the

level of achievement of anticipated operating synergies from

acquisitions, the potential for unknown or understated liabilities

related to acquisitions, the potential loss of existing customers

of acquisitions and our ability to retain key management personnel

of acquired companies; a shortage of necessary personnel for

production and increasing labor costs and related employee benefits

to attract and retain production personnel in times of high demand;

the loss or reduction of sales to key independent dealers, and

stocking level decisions of our independent dealers; disruption of

the delivery of units to independent dealers or the disruption of

delivery of raw materials, including chassis, to our facilities;

increasing costs for freight and transportation; the ability to

protect our information technology systems from data breaches,

cyber-attacks and/or network disruptions; asset impairment charges;

competition; the impact of losses under repurchase agreements; the

impact of the strength of the U.S. dollar on international demand

for products priced in U.S. dollars; general economic, market,

public health and political conditions in the various countries in

which our products are produced and/or sold; the impact of changing

emissions and other related climate change regulations in the

various jurisdictions in which our products are produced, used

and/or sold; changes to our investment and capital allocation

strategies or other facets of our strategic plan; and changes in

market liquidity conditions, credit ratings and other factors that

may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are

discussed more fully in Item 1A of our Annual Report on Form 10-K

for the year ended July 31, 2024.

We disclaim any obligation or undertaking to

disseminate any updates or revisions to any forward-looking

statements contained in this release or to reflect any change in

our expectations after the date hereof or any change in events,

conditions or circumstances on which any statement is based, except

as required by law.

|

|

|

THOR INDUSTRIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|

FOR THE THREE MONTHS AND FISCAL YEARS ENDED JULY 31, 2024

AND 2023 |

|

($000’s except share and per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended July 31,

(Unaudited) |

|

Fiscal Years Ended July 31, |

| |

|

|

2024 |

% NetSales (1) |

|

|

2023 |

% NetSales (1) |

|

|

2024 |

% NetSales (1) |

|

|

2023 |

|

% NetSales (1) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

2,534,167 |

|

|

$ |

2,738,066 |

|

|

$ |

10,043,408 |

|

|

$ |

11,121,605 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

401,331 |

15.8 |

% |

|

$ |

394,305 |

14.4 |

% |

|

$ |

1,451,962 |

14.5 |

% |

|

$ |

1,596,353 |

|

14.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

|

230,995 |

9.1 |

% |

|

|

209,643 |

7.7 |

% |

|

|

895,531 |

8.9 |

% |

|

|

870,054 |

|

7.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of intangible

assets |

|

|

35,420 |

1.4 |

% |

|

|

35,277 |

1.3 |

% |

|

|

132,544 |

1.3 |

% |

|

|

140,808 |

|

1.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

18,410 |

0.7 |

% |

|

|

22,645 |

0.8 |

% |

|

|

88,666 |

0.9 |

% |

|

|

97,447 |

|

0.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

10,512 |

0.4 |

% |

|

|

5,173 |

0.2 |

% |

|

|

13,623 |

0.1 |

% |

|

|

11,309 |

|

0.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

|

127,018 |

5.0 |

% |

|

|

131,913 |

4.8 |

% |

|

|

348,844 |

3.5 |

% |

|

|

499,353 |

|

4.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax provision |

|

|

35,554 |

1.4 |

% |

|

|

40,631 |

1.5 |

% |

|

|

83,444 |

0.8 |

% |

|

|

125,113 |

|

1.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

91,464 |

3.6 |

% |

|

|

91,282 |

3.3 |

% |

|

|

265,400 |

2.6 |

% |

|

|

374,240 |

|

3.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net loss attributable to

non-controlling interests |

|

|

1,449 |

0.1 |

% |

|

|

995 |

— |

% |

|

|

92 |

— |

% |

|

|

(31 |

) |

— |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to

THOR Industries, Inc. |

|

$ |

90,015 |

3.6 |

% |

|

$ |

90,287 |

3.3 |

% |

|

$ |

265,308 |

2.6 |

% |

|

$ |

374,271 |

|

3.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.70 |

|

|

$ |

1.69 |

|

|

$ |

4.98 |

|

|

$ |

7.00 |

|

|

| Diluted |

|

$ |

1.68 |

|

|

$ |

1.68 |

|

|

$ |

4.94 |

|

|

$ |

6.95 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-avg. common shares

outstanding – basic |

|

|

53,066,642 |

|

|

|

53,310,842 |

|

|

|

53,248,488 |

|

|

|

53,478,310 |

|

|

| Weighted-avg. common shares

outstanding – diluted |

|

|

53,524,397 |

|

|

|

53,868,996 |

|

|

|

53,687,377 |

|

|

|

53,857,143 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Percentages

may not add due to rounding differences |

|

SUMMARY CONDENSED CONSOLIDATED BALANCE SHEETS

($000’s) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

July 31,2024 |

|

July 31,2023 |

|

|

|

July 31,2024 |

|

July 31,2023 |

|

Cash and equivalents |

|

$ |

501,316 |

|

$ |

441,232 |

|

Current liabilities |

|

$ |

1,567,022 |

|

$ |

1,716,482 |

| Accounts receivable, net |

|

|

700,895 |

|

|

643,219 |

|

Long-term debt, net |

|

|

1,101,265 |

|

|

1,291,311 |

| Inventories, net |

|

|

1,366,638 |

|

|

1,653,070 |

|

Other long-term

liabilities |

|

|

278,483 |

|

|

269,639 |

| Prepaid income taxes, expenses

and other |

|

|

81,178 |

|

|

56,059 |

|

Stockholders’ equity |

|

|

4,074,053 |

|

|

3,983,398 |

|

Total current assets |

|

|

2,650,027 |

|

|

2,793,580 |

|

|

|

|

|

|

| Property, plant &

equipment, net |

|

|

1,390,718 |

|

|

1,387,808 |

|

|

|

|

|

|

| Goodwill |

|

|

1,786,973 |

|

|

1,800,422 |

|

|

|

|

|

|

| Amortizable intangible assets,

net |

|

|

861,133 |

|

|

996,979 |

|

|

|

|

|

|

| Equity investments and other,

net |

|

|

331,972 |

|

|

282,041 |

|

|

|

|

|

|

| Total |

|

$ |

7,020,823 |

|

$ |

7,260,830 |

|

|

|

$ |

7,020,823 |

|

$ |

7,260,830 |

Contact:

Jeff Tryka, CFALambert

Global616-295-2509jtryka@lambert.com

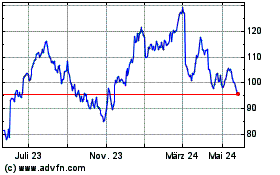

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

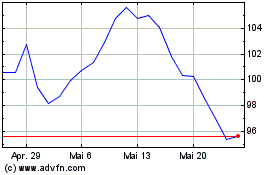

Thor Industries (NYSE:THO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024