Fourth Quarter Net Sales of $107.4 million,

an Increase of 7.3%

Fourth Quarter Net Income of $11.3 million;

Adjusted Net Income of $20.4 million

Fourth Quarter Adjusted EBITDA of $39.9

million, an Increase of 16.7%

The Duckhorn Portfolio, Inc. (NYSE: NAPA) (the “Company”) today

reported its financial results for the three months and fiscal year

ended July 31, 2024.

Fourth Quarter 2024 Highlights

- Net sales were $107.4 million, an increase of $7.3 million, or

7.3%, versus the prior year. Excluding Sonoma-Cutrer, net sales

declined $13.9 million or 13.9% versus the prior year, due

primarily to the shift in timing of the Kosta Browne Appellation

Series release into Q3 in fiscal 2024 from Q4 in fiscal 2023.

- Gross profit was $51.3 million, a decrease of $4.0 million, or

7.2%, versus the prior year. Gross profit margin was 47.8%, versus

55.2% in the prior year. Excluding Sonoma-Cutrer, gross profit

declined $10.8 million or 19.5% and gross profit margin was

51.6%.

- Adjusted gross profit was $55.0 million, in line with the prior

year. Adjusted gross profit margin was 51.2%, versus 55.1% in the

prior year. Excluding Sonoma-Cutrer, adjusted gross profit declined

$10.3 million or 18.7% and gross profit margin was 52.1%.

- Net income was $11.3 million, or $0.08 per diluted share,

versus $17.8 million, or $0.05 per diluted share, in the prior

year. Adjusted net income was $20.4 million, or $0.14 per diluted

share, versus $16.7 million, or $0.15 per diluted share, in the

prior year.

- Adjusted EBITDA was $39.9 million, an increase of $5.7 million,

or 16.7%, and Adjusted EBITDA margin improved by approximately 300

basis points versus the prior year to a margin of 37.2%.

- Cash was $10.9 million as of July 31, 2024. The Company’s

leverage ratio was 2.0x net debt (net of deferred financing costs),

to trailing twelve months adjusted EBITDA.

Fiscal Year 2024 Highlights

- Net sales were $405.5 million, an increase of $2.8 million, or

0.7%, versus the prior year. Excluding Sonoma-Cutrer, net sales

declined $18.4 million or 4.6% versus the prior year.

- Gross profit was $214.9 million, a decrease of $0.8 million, or

0.4%, versus the prior year. Gross profit margin was 53.0% versus

53.6% for the prior year. Excluding Sonoma-Cutrer, gross profit

declined $7.6 million or 3.5% and gross profit margin was

54.2%.

- Adjusted gross profit was $217.4 million, a decrease of $0.8

million, or 0.4% versus the prior year. Adjusted gross profit

margin was 53.6%, versus 53.7% in the prior year. Excluding

Sonoma-Cutrer, adjusted gross profit declined $9.3 million or 4.3%

and gross profit margin was 53.9%.

- Net income was $56.0 million, or $0.45 per diluted share,

versus $69.3 million, or $0.60 per diluted share, for the prior

year. Adjusted net income was $74.8 million, or $0.60 per diluted

share, decreasing by $2.5 million, or 3.2%, versus $77.3 million,

or $0.67 per diluted share, for the prior year.

- Adjusted EBITDA was $155.1 million, an increase of $10.6

million, or 7.3%, versus the prior year. Adjusted EBITDA margin

improved by approximately 230 basis points versus the prior year,

to a margin of 38.2%.

“We are pleased to conclude fiscal 2024 with a solid fourth

quarter performance,” said Deirdre Mahlan, President, CEO and

Chairperson. “We meaningfully advanced our strategic agenda in

fiscal 2024, delivering strong operating and financial performance

against a dynamic backdrop, including the strategic acquisition of

Sonoma-Cutrer. We believe the successful integration of this

marquee brand, coupled with the continuing execution against our

strategic initiatives positions the business for solid growth and

profitability into fiscal 2025 and beyond.”

Fourth Quarter and Fiscal Year 2024 Results

Three months ended July

31,

Fiscal year ended July

31,

2024

2023

2024

2023

Net sales growth

7.3

%

28.3

%

0.6

%

8.2

%

Volume contribution

23.7

%

10.6

%

3.1

%

5.6

%

Price / mix contribution

(16.4

)%

17.7

%

(2.5

)%

2.6

%

Three months ended July

31,

Fiscal year ended July

31,

2024

2023

2024

2023

Wholesale – Distributors

78.3

%

65.1

%

69.8

%

67.9

%

Wholesale – California direct to trade

14.8

15.9

16.3

17.1

DTC

6.9

19.0

13.9

15.0

Net sales

100.0

%

100.0

%

100.0

%

100.0

%

Fourth Quarter 2024 Financial Information

Net sales were $107.4 million, an increase of $7.3 million, or

7.3%, versus $100.1 million for the prior year. The increase in net

sales was driven by 23.7% volume growth with the introduction of

our recently acquired Sonoma-Cutrer winery. The negative price/mix

contributed 16.4%, as our higher-priced Kosta Browne release

shifted to the third quarter versus a fourth quarter release in the

prior year. The introduction of Sonoma-Cutrer which is

substantially comprised of white varietals which traditionally sell

at a lower price point than red varietals also impacted the

price/mix contributed for the quarter.

Gross profit was $51.3 million, a decrease of $4.0 million, or

7.2%, versus the prior year. Gross profit margin was 47.8%,

declining 740 basis points versus the prior year. Adjusted gross

profit which excludes approximately $3.3 million in purchase

accounting adjustments from inventory acquired in the acquisition

of Sonoma-Cutrer was $55.0 million, approximately in line with the

prior year. Adjusted gross profit margin was 51.2% declining 390

basis points versus the prior year, as a result of the shift in

timing of the release of higher-margin Kosta Browne to the third

quarter of fiscal 2024. A return to more normalized trade spend

also contributed to a reduction in gross margin versus the prior

year.

Total selling, general and administrative expenses were $30.6

million, an increase of $0.2 million, or 0.7%, versus $30.4 million

in the prior year. As a percentage of net sales, SG&A declined

190 basis points due to active operating expense management.

Net income was $11.3 million, or $0.08 per diluted share, versus

$17.8 million, or $0.05 per diluted share, in the prior year.

Adjusted net income was $20.4 million, or $0.14 per diluted share,

versus $16.7 million, or $0.15 per diluted share, in the prior

year.

Adjusted EBITDA was $39.9 million, an increase of $5.7 million,

or 16.7%, versus $34.2 million in the prior year. Adjusted EBITDA

margin improved 300 basis points versus the prior year. The

increase was driven by higher net sales and profitability,

partially offset by higher cost of goods sold.

Conference Call and Webcast

The Company will no longer host its earnings conference call and

webcast previously scheduled for today, Monday, October 7, 2024, at

4:30 p.m. EST.

About The Duckhorn Portfolio, Inc.

The Duckhorn Portfolio is North America’s premier luxury wine

company, with eleven wineries, ten state-of-the-art winemaking

facilities, eight tasting rooms and over 2,200 coveted acres of

vineyards spanning 38 Estate properties. Established in 1976, when

vintners Dan and Margaret Duckhorn founded Napa Valley’s Duckhorn

Vineyards, today, our portfolio features some of North America’s

most revered wineries, including Duckhorn Vineyards, Decoy,

Sonoma-Cutrer, Kosta Browne, Goldeneye, Paraduxx, Calera,

Migration, Postmark, Canvasback and Greenwing. Sourcing grapes from

our own Estate vineyards and fine growers in Napa Valley, Sonoma

County, Anderson Valley, California’s North and Central coasts,

Oregon and Washington State, we offer a curated and comprehensive

portfolio of acclaimed luxury wines with price points ranging from

$20 to $230 across more than 15 varietals. Our wines are available

throughout the United States, on five continents, and in more than

50 countries around the world. To learn more, visit us at:

https://www.duckhornportfolio.com/. Investors can access

information on our investor relations website at:

https://ir.duckhorn.com.

Use of Non-GAAP Financial Information

In addition to the Company’s results, which are determined in

accordance with generally accepted accounting principles in the

United States (“GAAP”), the Company believes the following non-GAAP

measures presented in this press release and discussed on the

related teleconference call are useful in evaluating its operating

performance: adjusted gross profit, adjusted selling, general and

administrative expenses, adjusted EBITDA, adjusted net income and

adjusted EPS. Certain of these non-GAAP measures exclude

depreciation and amortization, non-cash equity-based compensation

expense, purchase accounting adjustments, impairment losses,

inventory write-downs, changes in the fair value of derivatives,

and certain other items, net of the tax effects of all such

adjustments, which are not related to the Company’s core operating

performance. The Company believes that these non-GAAP financial

measures are provided to enhance the reader’s understanding of our

past financial performance and our prospects for the future. The

Company’s management team uses these non-GAAP financial measures to

evaluate business performance in comparison to budgets, forecasts

and prior period financial results. The non-GAAP financial

information is presented for supplemental informational purposes

only and should not be considered a substitute for financial

information presented in accordance with GAAP, and may be different

from similarly titled non-GAAP measures used by other companies. A

reconciliation is provided herein for each non-GAAP financial

measure to the most directly comparable financial measure stated in

accordance with GAAP. Readers are encouraged to review the related

GAAP financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measures.

Forward-Looking Statements

This press release includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “plan,” “could,” “may,”

“will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and

other words of similar meaning. These forward-looking statements

address various matters including statements regarding the timing

or nature of future operating or financial performance or other

events. For example, all statements The Duckhorn Portfolio makes

relating to its estimated and projected financial results or its

plans and objectives for future operations, growth initiatives or

strategies are forward-looking statements. Each forward-looking

statement contained in this press release is subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statement. Applicable risks

and uncertainties include, among others, the Company’s ability to

manage the growth of its business; the Company’s reliance on its

brand name, reputation and product quality; the effectiveness of

the Company’s marketing and advertising programs, including the

consumer reception of the launch and expansion of our product

offerings; general competitive conditions, including actions the

Company’s competitors may take to grow their businesses; overall

decline in the health of the economy and the impact of inflation on

consumer discretionary spending and consumer demand for wine; the

occurrence of severe weather events (including fires, floods and

earthquakes), catastrophic health events, natural or man-made

disasters, social and political conditions, war or civil unrest;

risks associated with disruptions in the Company’s supply chain for

grapes and raw and processed materials, including corks, glass

bottles, barrels, winemaking additives and agents, water and other

supplies; risks associated with the disruption of the delivery of

the Company’s wine to customers; disrupted or delayed service by

the distributors and government agencies the Company relies on for

the distribution of its wines outside of California; the Company’s

ability to successfully execute its growth strategy; risks

associated with our acquisition of Sonoma-Cutrer Vineyards, Inc.;

decreases in the Company’s wine score ratings by wine rating

organizations; quarterly and seasonal fluctuations in the Company’s

operating results; the Company’s success in retaining or

recruiting, or changes required in, its officers, key employees or

directors; the Company’s ability to protect its trademarks and

other intellectual property rights, including its brand and

reputation; the Company’s ability to comply with laws and

regulations affecting its business, including those relating to the

manufacture, sale and distribution of wine; the risks associated

with the legislative, judicial, accounting, regulatory, political

and economic risks and conditions specific to both domestic and to

international markets; claims, demands and lawsuits to which the

Company is, and may in the future, be subject and the risk that its

insurance or indemnities coverage may not be sufficient; the

Company’s ability to operate, update or implement its IT systems;

the Company’s ability to successfully pursue strategic acquisitions

and integrate acquired businesses; the Company’s potential ability

to obtain additional financing when and if needed; the Company’s

substantial indebtedness and its ability to maintain compliance

with restrictive covenants in the documents governing such

indebtedness; the Company’s largest shareholders’ significant

influence over the Company; the potential liquidity and trading of

the Company’s securities; the future trading prices of the

Company’s common stock and the impact of securities analysts’

reports on these prices; and the risks identified in the Company’s

other filings with the SEC. The Company cautions investors not to

place considerable reliance on the forward-looking statements

contained in this press release. You are encouraged to read the

Company’s filings with the SEC, available at www.sec.gov, for a

discussion of these and other risks and uncertainties. The

forward-looking statements in this press release speak only as of

the date of this document, and the Company undertakes no obligation

to update or revise any of these statements. The Company’s business

is subject to substantial risks and uncertainties, including those

referenced above. Investors, potential investors, and others should

give careful consideration to these risks and uncertainties.

THE DUCKHORN PORTFOLIO,

INC.

CONSOLIDATED BALANCE

SHEETS

(Unaudited, in thousands,

except shares and per share data)

July 31, 2024

July 31, 2023

ASSETS

Current assets:

Cash

$

10,872

$

6,353

Accounts receivable trade, net

52,262

48,706

Due from related party

10,845

—

Inventories

448,967

322,227

Prepaid expenses and other current

assets

14,594

10,244

Total current assets

537,540

387,530

Property and equipment, net

568,457

323,530

Operating lease right-of-use assets

27,130

20,376

Intangible assets, net

192,467

184,227

Goodwill

483,879

425,209

Other assets

7,555

6,810

Total assets

$

1,817,028

$

1,347,682

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

5,774

$

4,829

Accrued expenses

34,164

38,246

Accrued compensation

11,386

16,460

Current operating lease liabilities

2,869

3,787

Current maturities of long-term debt

9,721

9,721

Due to related party

1,714

—

Other current liabilities

1,116

1,417

Total current liabilities

66,744

74,460

Revolving line of credit, net

101,000

13,000

Long-term debt, net of current maturities

and debt issuance costs

200,734

210,619

Operating lease liabilities

24,286

16,534

Deferred income taxes

151,104

90,216

Other liabilities

705

445

Total liabilities

544,573

405,274

Stockholders’ equity:

Common stock, $0.01 par value; 500,000,000

shares authorized; 147,073,614 and 115,316,308 issued and

outstanding at July 31, 2024, and July 31, 2023, respectively

1,471

1,153

Additional paid-in capital

1,011,265

737,557

Retained earnings

259,135

203,122

Total The Duckhorn Portfolio, Inc.

stockholders’ equity

1,271,871

941,832

Non-controlling interest

584

576

Total stockholders’ equity

1,272,455

942,408

Total liabilities and stockholders’

equity

$

1,817,028

$

1,347,682

THE DUCKHORN PORTFOLIO,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited, in thousands,

except shares and per share data)

Three months ended July

31,

Fiscal year ended July

31,

2024

2023

2024

2023

Sales

$

108,965

$

101,362

$

410,966

$

408,442

Excise tax

1,570

1,267

5,485

5,446

Net sales

107,395

100,095

405,481

402,996

Cost of sales

56,083

44,813

190,555

187,307

Gross profit

51,312

55,282

214,926

215,689

Selling, general and administrative

expenses

30,614

30,404

120,083

109,711

Income from operations

20,698

24,878

94,843

105,978

Interest expense

5,068

3,882

18,103

11,721

Other expense (income), net

2,087

(3,597

)

(84

)

(212

)

Total other expenses, net

7,155

285

18,019

11,509

Income before income taxes

13,543

24,593

76,824

94,469

Income tax expense

2,247

6,825

20,803

25,183

Net income

11,296

17,768

56,021

69,286

Net loss (income) attributable to

non-controlling interest

—

1

(8

)

12

Net income attributable to The Duckhorn

Portfolio, Inc.

$

11,296

$

17,769

$

56,013

$

69,298

Earnings per share of common

stock:

Basic

$0.08

$0.15

$0.45

$0.60

Diluted

$0.08

$0.15

$0.45

$0.60

Weighted average shares of common stock

outstanding:

Basic

147,060,134

115,173,211

123,436,717

115,233,324

Diluted

147,077,828

115,376,739

123,549,109

115,407,624

THE DUCKHORN PORTFOLIO,

INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited, in

thousands)

Fiscal year ended July

31,

2024

2023

Cash flows from operating

activities

Net income

$

56,021

$

69,286

Adjustments to reconcile net income to net

cash provided by operating activities:

Deferred income taxes

30

(267

)

Depreciation and amortization

37,168

27,768

Loss on disposal of assets

981

157

Change in fair value of derivatives

716

34

Amortization of debt issuance costs

775

975

Impairment loss

1,200

—

Equity-based compensation

7,319

6,290

Inventory reserve adjustments

479

722

Change in operating assets and

liabilities; net of acquisition:

Accounts receivable trade, net

(3,554

)

(11,679

)

Due from related party

(10,845

)

—

Inventories

(61,863

)

(33,894

)

Prepaid expenses and other current

assets

(2,773

)

2,281

Other assets

(1,810

)

(917

)

Accounts payable

(1,239

)

1,549

Accrued expenses

(11,143

)

7,002

Accrued compensation

(5,350

)

3,567

Deferred revenue

13

(6

)

Due to related party

1,714

—

Other current and non-current

liabilities

(3,679

)

(2,776

)

Net cash provided by operating

activities

4,160

70,092

Cash flows from investing

activities

Purchases of property and equipment

(27,967

)

(72,843

)

Proceeds from sales of property and

equipment

307

271

Acquisition of business, net of cash

acquired

(49,614

)

—

Net cash used in investing

activities

(77,274

)

(72,572

)

Cash flows from financing

activities

Payments under line of credit

(47,000

)

(121,000

)

Borrowings under line of credit

135,000

24,000

Issuance of long-term debt

—

225,833

Payments of long-term debt

(10,000

)

(120,166

)

Proceeds from employee stock purchase

plan

247

350

Taxes paid related to net share settlement

of equity awards

(496

)

(680

)

Payment of equity issuance costs

(118

)

—

Debt issuance costs

—

(2,671

)

Net cash provided by financing

activities

77,633

5,666

Net increase in cash

4,519

3,186

Cash - Beginning of year

6,353

3,167

Cash - End of year

$

10,872

$

6,353

Supplemental cash flow

information

Interest paid, net of amount

capitalized

$

18,273

$

10,393

Income taxes paid

$

34,110

$

11,562

Non-cash investing and financing

activities

Property and equipment additions in

accounts payable and accrued expenses

$

8,547

$

3,360

Consideration payable for the acquisition

of Sonoma-Cutrer in due to related party

$

1,342

$

—

Value of shares issued related to the

acquisition of Sonoma-Cutrer

$

267,072

$

—

THE DUCKHORN PORTFOLIO, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Adjusted gross profit, adjusted selling, general and

administrative expenses, adjusted net income, adjusted EBITDA and

adjusted EPS, collectively referred to as “Non-GAAP Financial

Measures,” are commonly used in the Company’s industry and should

not be construed as an alternative to net income or earnings per

share as indicators of operating performance (as determined in

accordance with GAAP). These Non-GAAP Financial Measures may not be

comparable to similarly titled measures reported by other

companies. The Company has included these Non-GAAP Financial

Measures because it believes the measures provide management and

investors with additional information to evaluate business

performance in comparison to budgets, forecasts and prior year

financial results.

Non-GAAP Financial Measures are adjusted to exclude certain

items that affect comparability. The adjustments are itemized in

the tables below. You are encouraged to evaluate these adjustments

and the reason the Company considers them appropriate for

supplemental analysis. In evaluating adjustments, you should be

aware that in the future the Company may incur expenses that are

the same as or similar to some of the adjustments set forth below.

The presentation of Non-GAAP Financial Measures should not be

construed as an inference that future results will be unaffected by

unusual or recurring items.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that the Company

calculates as net income before interest, taxes, depreciation and

amortization, non-cash equity-based compensation expense, purchase

accounting adjustments, transaction expenses, acquisition

integration expenses, changes in the fair value of derivatives and

certain other items which are not related to our core operating

performance. Adjusted EBITDA is a key performance measure the

Company uses in evaluating its operational results. The Company

believes adjusted EBITDA is a helpful measure to provide investors

an understanding of how management regularly monitors the Company’s

core operating performance, as well as how management makes

operational and strategic decisions in allocating resources. The

Company believes adjusted EBITDA also provides management and

investors consistency and comparability with the Company’s past

financial performance and facilitates period to period comparisons

of operations, as it eliminates the effects of certain variations

unrelated to its overall performance.

Adjusted EBITDA has certain limitations as an analytical tool,

and you should not consider it in isolation or as a substitute for

analysis of the Company’s results as reported under GAAP. Some of

these limitations include:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and adjusted EBITDA does not reflect cash capital

expenditure requirements for such replacements or for new capital

expenditure requirements;

- adjusted EBITDA does not reflect changes in, or cash

requirements for, the Company’s working capital needs;

- adjusted EBITDA does not reflect the significant interest

expense, or the cash requirements necessary to service interest or

principal payments, on the Company’s debt;

- adjusted EBITDA does not reflect income tax payments that may

represent a reduction in cash available to the Company; and

- other companies, including companies in the Company’s industry,

may calculate adjusted EBITDA differently, which reduce their

usefulness as comparative measures.

Because of these limitations, you should consider adjusted

EBITDA alongside other financial performance measures, including

net income and the Company’s other GAAP results. In evaluating

adjusted EBITDA, you should be aware that in the future the Company

may incur expenses that are the same as or similar to some of the

adjustments in this presentation. The Company’s presentation of

adjusted EBITDA should not be construed as an inference that the

Company’s future results will be unaffected by the types of items

excluded from the calculation of adjusted EBITDA.

Adjusted Gross Profit

Adjusted gross profit is a non-GAAP financial measure that the

Company calculates as gross profit excluding the impact of purchase

accounting adjustments (including depreciation and amortization

related to purchase accounting), non-cash equity-based compensation

expense, and certain inventory charges. We believe adjusted gross

profit is a useful measure to us and our investors to assist in

evaluating our operating performance because it provides

consistency and direct comparability with our past financial

performance between fiscal periods, as the metric eliminates the

effects of non-cash or other expenses unrelated to our core

operating performance that would result in fluctuations in a given

metric for reasons unrelated to overall continuing operating

performance. Adjusted gross profit should not be considered a

substitute for gross profit or any other measure of financial

performance reported in accordance with GAAP.

Adjusted Net Income and Adjusted Selling, General and

Administrative Expenses

Adjusted net income is a non-GAAP financial measure that the

Company calculates as net income excluding the impact of non-cash

equity-based compensation expense, purchase accounting adjustments,

transaction expenses, acquisition integration expenses, changes in

the fair value of derivatives and certain other items unrelated to

core operating performance, as well as the estimated income tax

impacts of all such adjustments included in this non-GAAP

performance measure. We believe adjusted net income assists us and

our investors in evaluating our performance period-over-period. In

calculating adjusted net income, we also calculate the following

non-GAAP financial measures which adjust each GAAP-based financial

measure for the relevant portion of each adjustment to reach

adjusted net income:

- Adjusted SG&A – calculated as selling, general, and

administrative expenses excluding the impacts of purchase

accounting, transaction expenses, acquisition integration expenses,

equity-based compensation; and

- Adjusted income tax – calculated as the tax effect of all

adjustments to reach adjusted net income based on the applicable

blended statutory tax rate for the period.

Adjusted net income should not be considered a substitute for

net income or any other measure of financial performance reported

in accordance with GAAP.

Adjusted EPS

Adjusted EPS is a non-GAAP financial measure that the Company

calculates as adjusted net income divided by diluted share count

for the applicable period. We believe adjusted EPS is useful to us

and our investors because it improves the comparability of results

of operations from period to period. Adjusted EPS should not be

considered a substitute for net income per share or any other

measure of financial performance reported in accordance with

GAAP.

THE DUCKHORN PORTFOLIO,

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(Unaudited, in thousands,

except per share data)

Three months ended July 31,

2024

Net sales

Gross profit

SG&A

Adjusted EBITDA

Income tax

Net income

Diluted EPS

GAAP results

$

107,395

$

51,312

$

30,614

$

11,296

$

2,247

$

11,296

$

0.08

Percentage of net sales

47.8

%

28.5

%

10.5

%

Interest expense

5,068

Income tax expense

2,247

Depreciation and amortization expense

143

(1,902

)

10,470

EBITDA

$

29,081

Purchase accounting adjustments

3,320

3,320

551

2,769

0.02

Transaction expenses

(739

)

739

56

683

—

Acquisition integration costs

(307

)

307

51

256

—

Change in fair value of derivatives

2,433

404

2,029

0.01

Equity-based compensation

226

(1,894

)

2,120

328

1,792

0.01

Impairment loss

(1,200

)

1,200

199

1,001

0.01

Loss on property and equipment

(710

)

710

118

592

—

Non-GAAP results

$

107,395

$

55,001

$

23,862

$

39,910

$

3,954

$

20,418

$

0.14

Percentage of net sales

51.2

%

22.2

%

37.2

%

Three months ended July 31,

2023

Net sales

Gross profit

SG&A

Adjusted EBITDA

Income tax

Net income

Diluted EPS

GAAP results

$

100,095

$

55,282

$

30,404

$

17,769

$

6,825

$

17,769

$

0.15

Percentage of net sales

55.2

%

30.4

%

17.8

%

Interest expense

3,882

Income tax expense

6,825

Depreciation and amortization expense

114

(2,105

)

7,240

EBITDA

$

35,716

Purchase accounting adjustments

19

19

5

14

—

Transaction expenses

(256

)

256

71

185

—

Change in fair value of derivatives

(2,909

)

(807

)

(2,102

)

(0.02

)

Equity-based compensation

140

(1,212

)

1,352

321

1,031

0.01

Lease income, net

(364

)

(364

)

(141

)

(223

)

(62

)

(161

)

—

Non-GAAP results

$

99,731

$

55,191

$

26,690

$

34,211

$

6,353

$

16,736

$

0.15

Percentage of net sales

55.1

%

26.7

%

34.2

%

Note: Sum of individual amounts may not

recalculate due to rounding.

THE DUCKHORN PORTFOLIO,

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(Unaudited, in thousands,

except per share data)

Fiscal year ended July 31,

2024

Net sales

Gross profit

SG&A

Adjusted EBITDA

Income tax

Net income

Diluted EPS

GAAP results

$

405,481

$

214,926

$

120,083

$

56,013

$

20,803

$

56,013

$

0.45

Percentage of net sales

53.0

%

29.6

%

13.8

%

Interest expense

18,103

Income tax expense

20,803

Depreciation and amortization expense

469

(10,463

)

37,168

EBITDA

$

132,087

Purchase accounting adjustments

3,379

3,379

915

2,464

0.02

Transaction expenses

(9,963

)

9,963

834

9,129

0.07

Acquisition integration costs

(923

)

923

250

673

0.01

Change in fair value of derivatives

716

194

522

—

Equity-based compensation

806

(5,614

)

6,420

1,589

4,831

0.04

Impairment loss

(1,200

)

1,200

325

875

0.01

Loss on property and equipment

(710

)

710

192

518

—

Lease income, net

(2,176

)

(2,176

)

(1,862

)

(314

)

(85

)

(229

)

—

Non-GAAP results

$

403,305

$

217,404

$

89,348

$

155,084

$

25,017

$

74,796

$

0.60

Percentage of net sales

53.6

%

22.0

%

38.2

%

Fiscal year ended July 31,

2023

Net sales

Gross profit

SG&A

Adjusted EBITDA

Income tax

Net income

Diluted EPS

GAAP results

$

402,996

$

215,689

$

109,711

$

69,298

$

25,183

$

69,298

$

0.60

Percentage of net sales

53.5

%

27.2

%

17.2

%

Interest expense

11,721

Income tax expense

25,183

Depreciation and amortization expense

476

(7,815

)

27,768

EBITDA

$

133,970

Purchase accounting adjustments

350

350

93

257

—

Transaction expenses

(4,051

)

4,051

982

3,069

0.03

Change in fair value of derivatives

34

9

25

—

Equity-based compensation

420

(5,042

)

5,462

1,299

4,163

0.04

Debt refinancing costs

865

231

634

0.01

Lease income, net

(364

)

(364

)

(141

)

(223

)

(59

)

(164

)

—

Non-GAAP results

$

402,632

$

216,571

$

92,662

$

144,509

$

27,738

$

77,282

$

0.67

Percentage of net sales

53.7

%

23.0

%

35.9

%

Note: Sum of individual amounts may not

recalculate due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241007005375/en/

Investor Contact Ben Avenia-Tapper ir@duckhorn.com

707-339-9232

Media Contact Jessica Liddell, ICR DuckhornPR@icrinc.com

203-682-8200

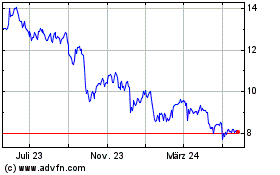

Duckhorn Portfolio (NYSE:NAPA)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

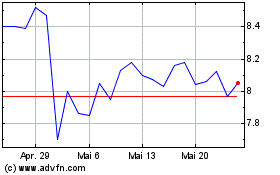

Duckhorn Portfolio (NYSE:NAPA)

Historical Stock Chart

Von Apr 2024 bis Apr 2025