Hersha Hospitality Trust (NYSE: HT) (“Hersha” or the “Company”),

owner of luxury and lifestyle hotels in coastal gateway and resort

markets, and KSL Capital Partners, LLC (“KSL”), a leading investor

in travel and leisure businesses, today announced a definitive

merger agreement, entered into on August 27, 2023, under which

affiliates of KSL will acquire all of the outstanding common shares

of Hersha for $10.00 per share in an all-cash transaction valued at

approximately $1.4 billion. The purchase price represents a premium

of approximately 60% over Hersha’s closing share price on August

25, 2023, the last full trading day prior to this announcement.

Mr. Jay H. Shah, Hersha’s Executive Chairman,

stated: “This transaction provides our shareholders with immediate

and certain value at a substantial premium to our public valuation.

Following a multi-year comprehensive review by the independent

Transaction Committee of Hersha’s Board of Trustees, the Board and

management team are confident this step will allow us to deliver

value for our shareholders while refocusing on growing the business

over a longer period of time.”

Mr. Neil H. Shah, Hersha’s Chief Executive

Officer, added: “We are proud of the work our team has done to

build on Hersha’s culture and capabilities and make the company

what it is today. This transaction is a result of our deliberate

actions to focus on key gateway markets and lifestyle and leisure

properties, as well as our work to create a concentrated portfolio

consisting of some of the highest quality hotels in their

respective markets.”

Mr. Marty Newburger, Partner at KSL, stated:

“Hersha and its team have built an impressive, curated portfolio of

experiential luxury and lifestyle hotels and resorts in strategic

markets. With KSL’s extensive track record investing in

high-quality assets in dynamic metropolitan markets across North

America and around the world, we are uniquely suited to position

the business for further success over the long term.”

Transaction Details

Under the terms of the merger agreement, which

has been unanimously recommended by the independent Transaction

Committee of Hersha’s Board of Trustees and unanimously approved by

Hersha’s full Board of Trustees, Hersha shareholders will receive

$10.00 in cash for each common share they own, and holders of

Hersha’s 6.875% Series C Cumulative Redeemable Preferred Shares,

6.50% Series D Cumulative Redeemable Preferred Shares and 6.50%

Series E Cumulative Redeemable Preferred Shares will receive $25.00

in cash, plus any accrued and unpaid dividends to which they are

entitled, for each preferred share they own. The transaction is

expected to close in the fourth quarter of 2023, subject to

customary closing conditions, including approval by the holders of

a majority of Hersha’s outstanding common shares as set forth in

the merger agreement. Certain members of Hersha’s executive

management team and certain of their affiliated trusts have signed

separate voting agreements under which they agreed to vote certain

Hersha shares controlled by each of them in support of the proposed

transaction. Subject to and upon completion of the transaction,

Hersha’s common shares and preferred shares will no longer be

listed on any public securities exchange.

Advisors

Goldman Sachs & Co. LLC is serving as

exclusive financial advisor and Latham and Watkins LLP and Venable

LLP are serving as legal advisors to the Transaction Committee of

Hersha’s Board of Trustees. Hunton Andrews Kurth LLP is serving as

legal advisor to Hersha. Wells Fargo and Citigroup are serving as

financial advisors and Simpson Thacher & Bartlett LLP and Miles

and Stockbridge P.C. are serving as legal advisors to KSL.

Additionally, Wells Fargo and Citigroup provided a debt financing

commitment to KSL in connection with the transaction.

About Hersha Hospitality

TrustHersha Hospitality Trust (HT) is a self-advised real

estate investment trust in the hospitality sector, which owns and

operates luxury and lifestyle hotels in coastal gateway and resort

markets. The Company’s 25 hotels totaling 3,811 rooms are located

in New York, Washington, DC, Boston, Philadelphia, South Florida,

and California. The Company’s common shares are traded on The New

York Stock Exchange under the ticker “HT.” For more information on

the Company, and the Company’s hotel portfolio, please visit the

Company's website at www.hersha.com.

About KSL Capital PartnersKSL

Capital Partners is a private equity firm specializing in travel

and leisure enterprises in five primary sectors: hospitality,

recreation, clubs, real estate and travel services. KSL has offices

in Denver, Colorado; New York City; Stamford, Connecticut; and

London, England. Since 2005, KSL has raised in excess of $21

billion of capital across its equity, credit and tactical

opportunities funds. KSL’s current and past portfolio contains some

of the premier properties in travel and leisure. For more

information, please visit www.kslcapital.com.

Additional Information and Where to Find

It

In connection with the proposed transaction, the

Company plans to file relevant materials with the SEC, including a

proxy statement on Schedule 14A. Promptly after filing its

definitive proxy statement with the SEC, the Company will mail the

definitive proxy statement and a proxy card to each shareholder

entitled to vote at the special meeting relating to the proposed

transaction. INVESTORS AND SECURITY HOLDERS OF THE COMPANY ARE

URGED TO CAREFULLY READ THE PROXY STATEMENT (INCLUDING ANY

AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY

REFERENCE THEREIN) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION

WITH THE TRANSACTION THAT THE COMPANY WILL FILE WITH THE SEC WHEN

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE

TRANSACTION. The definitive proxy statement, the preliminary proxy

statement, and any other relevant materials in connection with the

transaction (when they become available) and any other documents

filed by the Company with the SEC, may be obtained free of charge

at the SEC’s website at www.sec.gov or by accessing the Investor

Relations section of the Company’s website at

https://www.hersha.com.

Participants in the

Solicitation

The Company and its trustees and certain of its

executive officers may be deemed, under SEC rules, to be

participants in the solicitation of proxies from the Company’s

shareholders with respect to the proposed transaction. Information

about the Company’s trustees and executive officers and their

interests in the Company’s securities is set forth in the Company’s

proxy statement on Schedule 14A for its 2023 annual meeting of

shareholders, filed with the SEC on April 13, 2023, and subsequent

documents filed with the SEC.

Additional information regarding the identity of

participants in the solicitation of proxies, and a description of

their direct or indirect interests in the proposed transaction, by

security holdings or otherwise, will be set forth in the proxy

statement and other materials to be filed with the SEC in

connection with the proposed transaction when they become

available.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, including, without limitation, statements

containing the words, “believe,” “expect,” “anticipate,”

“estimate,” “plan,” “continue,” “intend,” “should,” “may,” “could,”

“will,” “would,” “forecast,” “project,” “potential,” “likely,” or

the negative of these words and words of similar import. Such

forward-looking statements relate to future events, the Company’s

plans, strategies, prospects and future financial performance, and

involve known and unknown risks that are difficult to predict,

uncertainties and other factors that are, in some cases, beyond the

Company’s control and which could materially affect its actual

results, performance or achievements or industry results to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Readers should specifically consider the various

factors identified in this press release and other reports filed by

the Company with the SEC, including, but not limited to those

discussed in the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Conditions and Results of

Operations” of the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022 and the Company’s subsequent periodic

reports filed with the SEC that could cause actual results to

differ.

Statements regarding the following subjects are

forward-looking by their nature: the Company’s business or

investment strategy; the Company’s projected operating results; the

Company’s ability to generate positive cash flow from operations;

the Company’s distribution policy; the Company’s liquidity and

management’s plans with respect thereto; completion of the proposed

transaction; the Company’s ability to maintain existing financing

arrangements, including compliance with covenants and its ability

to obtain future financing arrangements or refinance or extend the

maturity of existing financing arrangements as they come due; the

Company’s ability to negotiate with lenders; the Company’s

understanding of its competition; market trends; projected capital

expenditures; the impact of inflation and the change in interest

rates; the potential effects of a pandemic or epidemic; the supply

and demand factors in the Company’s markets or sub-markets, or a

potential recessionary environment; the Company’s access to capital

on the terms and timing expected; the restoration of public

confidence in domestic and international travel; permanent

structural changes in demand for conference centers by business and

leisure clientele; and the Company’s ability to dispose of selected

hotel properties on the terms and timing expected, if at all.

Forward-looking statements are based on the

Company’s beliefs, assumptions, projections and expectations,

taking into account all information currently available. These

beliefs, assumptions, projections and expectations are subject to

numerous known and unknown risks, uncertainties, assumptions and

changes in circumstances, many of which are beyond the Company’s

control, and which can change as a result of many possible events

or factors, not all of which are known to the Company. If a change

occurs, the Company’s business, financial condition, liquidity and

results of operations may vary materially from those expressed in

forward-looking statements. Readers should not place undue reliance

on forward-looking statements.

Important factors that the Company thinks could

cause actual results to differ materially from expected results are

summarized below. New factors emerge from time to time, and it is

not possible for the Company to predict which factors will arise.

In addition, the Company cannot assess the impact of each factor on

its business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements.

The following non-exclusive list of factors

could also cause actual results to vary from our forward-looking

statements: the ability to complete the proposed transaction on the

proposed terms or on the anticipated timeline, or at all, including

risks and uncertainties related to securing the Company’s

shareholder approval and satisfaction of other closing conditions

to consummate the proposed transaction; the occurrence of any

event, change or other circumstance that could give rise to the

termination of the merger agreement relating to the proposed

transaction; risks that the proposed transaction disrupts the

Company’s current plans and operations or diverts the attention of

the Company’s management or employees from ongoing business

operations; the risk of potential difficulties with the Company’s

ability to retain and hire key personnel and maintain relationships

with third parties as a result of the proposed transaction; the

failure to realize the expected benefits of the proposed

transaction; the risk that the proposed transaction may involve

unexpected costs and/or unknown or inestimable liabilities; the

risk that the Company’s business may suffer as a result of

uncertainty surrounding the proposed transaction; the risk that

shareholder litigation in connection with the proposed transaction

may affect the timing or occurrence of the proposed transaction or

result in significant costs of defense, indemnification and

liability; effects relating to the announcement of the transaction

or any further announcements or the consummation of the transaction

on the market price of the Company’s common shares; general

volatility of the capital markets and the market price of the

Company’s common shares; changes in the Company’s business or

investment strategy; availability, terms and deployment of capital;

changes in the Company’s industry and the market in which it

operates, interest rates, or the general economy; decreased

international travel because of geopolitical events, including

terrorism and current U.S. government policies such as immigration

policies, border closings, and travel bans related to COVID-19;

widespread adoption of teleconference and virtual meeting

technologies could reduce the number of in person business meetings

and demand for travel and the Company’s services; uncertainty

surrounding the financial stability of the United States, Europe

and China; the degree and nature of competition; financing risks,

including (i) the risk of leverage and the corresponding risk of

default on the Company’s mortgage loans and other debt, including

default with respect to applicable covenants, (ii) potential

inability to obtain waivers of covenants or refinance or extend the

maturity of existing indebtedness and (iii) the Company’s ability

to negotiate with lenders; levels of spending in the business,

travel and leisure industries, as well as consumer confidence;

declines in occupancy, average daily rate and RevPAR and other

hotel operating metrics; hostilities, including future terrorist

attacks, or fear of hostilities that affect travel; financial

condition of, and relationships with, the Company’s joint venture

partners, third-party property managers, and franchisors; increased

interest rates and operating costs and the impact of inflation;

ability to complete development and redevelopment projects; risks

associated with potential dispositions of hotel properties;

availability of and the Company’s ability to retain qualified

personnel; decreases in tourism due to pandemics, geopolitical

instability or changes in foreign exchange rates; the Company’s

failure to maintain its qualification as a real estate investment

trust, under the Internal Revenue Code of 1986, as amended;

environmental uncertainties and risks related to natural disasters

and increases in costs to insure against those risks; changes in

real estate and zoning laws and increases in real property tax

rates; the uncertainty and economic impact of pandemics, epidemics,

or other public health emergencies or fear of such events, and the

measures that international, federal, state and local governments,

agencies and/or health authorities may implement to address such

events, which may have adverse effects on the Company’s financial

conditions, results of operations, cash flows, and performance for

an indefinite period of time; world events impacting the ability or

desire of people to travel, which may lead to a decline in demand

for hotels; and the factors discussed in Item 1A of the Company’s

Annual Report on Form 10-K for the year ended December 31, 2022

under the headings “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and in

other reports the Company files with the SEC from time to time.

These factors are not necessarily all of the

important factors that could cause our actual results, performance

or achievements to differ materially from those expressed in or

implied by any of our forward-looking statements. Other unknown or

unpredictable factors, many of which are beyond our control, also

could harm our results, performance or achievements.

All forward-looking statements contained in this

press release are expressly qualified in their entirety by the

cautionary statements set forth above. Forward-looking statements

speak only as of the date they are made, and the Company disclaims

any obligation to update publicly any of these statements to

reflect actual results, new information, or future events, changes

in assumptions or changes in other factors affecting

forward-looking statements, except to the extent required by

applicable laws. If the Company updates one or more forward-looking

statements, no inference should be drawn that the Company will make

additional updates with respect to those or other forward-looking

statements.

Contacts

Hersha Hospitality TrustFGS GlobalStephen

Pettibone / Claire Keyte hersha@fgsglobal.com

KSL Capital Partners Jon Keehner / Kate

Thompson / Erik CarlsonJoele Frank, Wilkinson Brimmer

KatcherKSL-JF@joelefrank.com+1 (212) 355-4449

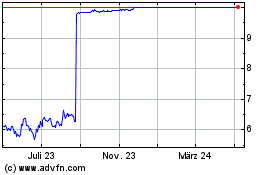

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Hersha Hospitality (NYSE:HT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025