Form 8-K - Current report

05 Oktober 2023 - 12:32PM

Edgar (US Regulatory)

0001360604False00013606042023-10-052023-10-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 5, 2023 (October 5, 2023)

Healthcare Realty Trust Incorporated

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | | | | |

| Maryland | | 001-35568 | | 20-4738467 | |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3310 West End Avenue, Suite 700 | Nashville, | Tennessee | 37203 | | | | (615) | 269-8175 | | | |

| (Address of Principal Executive Office and Zip Code) | | | (Registrant’s telephone number, including area code) | | |

| | | | | | | |

| | |

www.healthcarerealty.com |

| (Internet address) |

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | | HR | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter): If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

Investor Presentation

On October 5, 2023, Healthcare Realty Trust Incorporated (the “Company”) posted to its website (www.healthcarerealty.com) an investor presentation to provide an update on some key leasing and financial metrics and its investment strategy for the remainder of 2023.

Additionally, the Company issued a press release providing an update on its year-to-date disposition and new leasing activity. A copy of this press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. | | | | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | | | | |

|

| | | |

| | Healthcare Realty Trust Incorporated | |

| Date: October 5, 2023 | By: | /s/ J. Christopher Douglas | |

| | | Name: J. Christopher Douglas | |

| | | Title: Executive Vice President - Chief Financial Officer | |

Ron Hubbard

Vice President, Investor Relations

P: 615.269.8290

News Release

HEALTHCARE REALTY TRUST PUBLISHES INVESTOR DAY PRESENTATION AND PROVIDES UPDATE ON ASSET SALES AND NEW LEASING MOMENTUM

NASHVILLE, Tennessee, October 5, 2023 - Healthcare Realty Trust Incorporated (NYSE:HR) today published a presentation in advance of an investor event in Raleigh, NC on October 5, 2023. The event will include property tours and a presentation from senior management. The presentation is available at the investor relations section of the Company’s website at http://investors.healthcarerealty.com.

The Company announced the completion of $209 million of asset sales since June 2023 bringing year-to-date dispositions to $318 million. The Company affirmed its 2023 dispositions guidance of $350 to $450 million and narrowed its expected cap rate range to 6.5% to 7.0%. The Company expects to sell additional properties under contract for approximately $71 million by year-end. The Company also has properties totaling $239 million under letter of intent to sell with closings expected to be completed in fourth quarter 2023 and first quarter 2024. In aggregate, these closed and expected dispositions totaling over $600 million will enhance the quality and growth profile of the Company by increasing portfolio exposure to higher-growth, multi-tenant, on-campus medical outpatient buildings. Proceeds from these sales are expected to fund development obligations and repay floating rate debt.

Healthcare Realty signed a record volume of new leases totaling 447,000 square feet in the third quarter, improving from 376,000 in the second quarter and 240,000 in the first quarter. New leasing momentum for the legacy HTA properties was particularly strong, representing 62% of activity year-to-date, while comprising approximately one-half of the multi-tenant portfolio. New signed leases at the legacy HTA properties totaled 269,000 square feet in the third quarter, up from 244,000 in the second quarter and 150,000 in the first quarter. Occupancy is expected to be flat for the third quarter 2023, but is expected to increase in 2024 based on the new leasing described above.

“We are pleased to report positive momentum on Healthcare Realty’s top two priorities – new leasing activity and asset sales. Strong new leasing momentum in 2023, especially in the third quarter, strengthens our ability to deliver occupancy gains in 2024,” commented Todd Meredith, President and CEO. “Progress on asset sales will reduce variable rate debt, lower our leverage, and improve the quality of our portfolio.”

Healthcare Realty (NYSE: HR) is a real estate investment trust (REIT) that owns and operates medical outpatient buildings primarily located around market-leading hospital campuses. The Company selectively grows its portfolio through property acquisition and development. As the first and largest REIT to specialize in medical outpatient buildings, Healthcare Realty's portfolio includes more than 700 properties totaling over 40 million square feet concentrated in 15 growth markets.

Additional information regarding the Company can be found at www.healthcarerealty.com.

In addition to the historical information contained within, the matters discussed in this press release may contain forward-looking statements that involve risks and uncertainties. These risks are discussed in filings with the Securities and Exchange Commission by Healthcare Realty Trust, including its Annual Report on Form 10-K for the year ended December 31, 2022 under the heading “Risk Factors,” and as updated in its Quarterly Reports on Form 10-Q filed thereafter. Forward-looking statements represent the Company’s judgment as of the date of this release. The Company disclaims any obligation to update forward-looking statements.

v3.23.3

Cover Page

|

Oct. 05, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 05, 2023

|

| Entity Registrant Name |

Healthcare Realty Trust Incorporated

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-35568

|

| Entity Tax Identification Number |

20-4738467

|

| Entity Address, Address Line One |

3310 West End Avenue, Suite 700

|

| Entity Address, City or Town |

Nashville,

|

| Entity Address, State or Province |

TN

|

| Entity Address, Postal Zip Code |

37203

|

| City Area Code |

(615)

|

| Local Phone Number |

269-8175

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

HR

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001360604

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

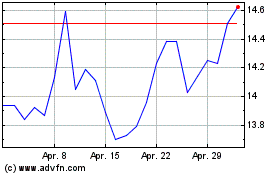

Healthcare Realty (NYSE:HR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

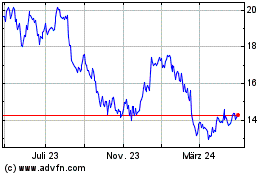

Healthcare Realty (NYSE:HR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024