Healthcare Realty Trust Incorporated (NYSE:HR) today announced

results for the fourth quarter ended December 31, 2023. The

Company reported net income (loss) attributable to common

stockholders of $(40.5) million, or $(0.11) per diluted common

share, for the quarter ended December 31, 2023. Normalized FFO

for the three months ended December 31, 2023 totaled $150.7

million, or $0.39 per diluted common share.

The following applies to all same store disclosures reported in

this press release. Subsequent to its merger with Healthcare Trust

of America ("Legacy HTA") on July 20, 2022, the Company began

reporting combined same store results in the third quarter of 2022,

which are now referred to as Merger Combined Same Store. Merger

Combined Same Store includes the Company’s same store properties,

including Legacy HTA properties, that were owned for the full

comparative period, and that meet all elements of the Company’s

same store criteria. The Company presents the combined companies’

same store portfolios to provide an understanding of the operating

performance and growth potential of the combined company.

RESULTS

- Net (loss) income attributable to common stockholders for the

three months ended December 31, 2023 was $(40.5) million or $(0.11)

per diluted common share. Net (loss) income attributable to common

stockholders for the year ended December 31, 2023 was $(278.3)

million or $(0.74) per diluted common share.

- Normalized FFO per share totaled

$0.39 and $1.57 for the three months and year ended December 31,

2023, respectively.

MERGER COMBINED SAME STORE

- Merger Combined Same Store cash NOI for the fourth quarter

increased 2.7% over the prior year, and 2.8% for the year ended

December 31, 2023.

- Fourth quarter

predictive growth measures in the Merger Combined Same Store

portfolio include:

- Average in-place

rent increases of 2.8%

- Future annual contractual increases

of 2.9% for leases commencing in the quarter.

- Weighted average MOB cash leasing

spreads of 3.3% on 607,000 square feet renewed:

- 3% (<0% spread)

- 6% (0-3%)

- 76% (3-4%)

- 16% (>4%)

- Tenant retention of 78.2%

MULTI-TENANT OCCUPANCY AND ABSORPTION

- During the quarter, the multi-tenant

portfolio had sequential occupancy improvement of 175,000 square

feet, or 53 basis points.

| |

4Q 2023 |

|

(in thousands, except % and bps) |

NOVEMBER 2023 PROJECTION |

ACTUAL |

|

Total multi-tenant SF |

33,552 |

33,371 |

| Starting occupancy |

85.1% |

84.7% |

| Absorption (SF) |

120-180 |

175 |

| Ending occupancy |

85.4-85.6% |

85.2% |

| Change in occupancy (bps) |

+ 30-50 |

+ 53 |

| |

- Total multi-tenant square feet

changes from the November 2023 projection to 4Q 2023 actual include

the sale of properties comprising 287,000 square feet offset by a

106,000 square feet development completion.

- The multi-tenant portfolio leased

percentage was 87.3% at December 31, which was 210 basis points

greater than occupancy.

- The multi-tenant

Legacy HTA portfolio leased percentage was 85.5%, which was 230

basis points greater than occupancy.

- An updated multi-tenant occupancy

and NOI bridge can be found on page 21 of the Investor

Presentation.

LEASING

- Portfolio leasing activity that

commenced in the fourth quarter totaled 1,224,000 square feet

related to 340 leases:

- 703,000 square feet of renewals

- 508,000 square feet of new and

13,000 square feet of expansion leases

- The Company executed new leases

totaling 425,000 square feet in the quarter that will commence in

future periods.

DISPOSITIONS

- During the fourth quarter, the Company sold 27 properties

totaling $338 million.

- Additional dispositions in 2023 totaled 36 properties for $656

million at an average cap rate of 6.6%. These dispositions

generated proceeds of $597 million and $59 million of seller

financing.

- The 2023 additional dispositions do not include the January

2023 dispositions of $112 million to repay the balance on the asset

sale term loan.

- The 2023 total dispositions improved the quality and growth

profile of the portfolio as seen through the following

characteristics:

- 34% non-MOB

- 54% off campus MOB

- 63% single-tenant

- 1.9% average in-place

escalators

BALANCE SHEET

- Net debt to adjusted EBITDA was 6.4 times at the end of the

quarter.

- During the fourth quarter, the Company executed interest rate

swaps totaling $275 million. In January 2024, $200 million of

interest rate swaps expired.

- As of December 31, 2023, including the effect of the expiration

of the January 2024 interest rate swap, variable rate debt was 8%.

This reflects an improvement from 13% as of December 31, 2022.

- As of December 31, 2023, the Company's line of credit balance

was fully repaid.

DIVIDEND

- A dividend of $0.31 per share was paid in November 2023. A

dividend of $0.31 per share will be paid on March 14, 2024 to

stockholders and OP unitholders of record on February 26,

2024.

EARNINGS CALL

- On Friday, February 16, 2024, at 11:00 a.m. Eastern Time,

Healthcare Realty Trust has scheduled a conference call to discuss

earnings results, quarterly activities, general operations of the

Company and industry trends.

- Simultaneously, a webcast of the conference call will be

available to interested parties at

https://investors.healthcarerealty.com/corporate-profile/webcasts

under the Investor Relations section. A webcast replay will be

available following the call at the same address.

- Live Conference Call Access Details:

- Domestic Dial-In Number: +1

404-975-4839 access code 926364;

- All Other Locations: +1 833-470-1428

access code 926364.

- Replay Information:

- Domestic Dial-In Number: +1

929-458-6194 access code 512784;

- All Other Locations: +1 866-813-9403

access code 512784.

GUIDANCE

- The Company's 2024 guidance range represents the in-place

portfolio as of February 16, 2024, and does not include any

assumptions for prospective acquisitions, joint venture seed

portfolios or other related balance sheet activities that have not

closed unless otherwise noted. The 2024 guidance range expectations

are as follows:

| |

ACTUAL |

EXPECTED 1Q 2024 |

EXPECTED 2024 |

| |

4Q 2023 |

|

2023 |

|

LOW |

|

HIGH |

|

LOW |

|

HIGH |

|

|

Earnings per share |

$(0.11 |

) |

$(0.74 |

) |

$(0.12 |

) |

$(0.11 |

) |

$(0.60 |

) |

$(0.10 |

) |

| NAREIT FFO

per share |

$0.36 |

|

$1.43 |

|

$0.35 |

|

$0.36 |

|

$1.42 |

|

$1.48 |

|

| Normalized

FFO per share |

$0.39 |

|

$1.57 |

|

$0.38 |

|

$0.39 |

|

$1.52 |

|

$1.58 |

|

| |

- The 2024 annual

guidance above includes the following significant changes from 2023

results (dollars in thousands, except per share data). Refer to

page 28 for additional guidance detail including operating metrics

and capital funding expectations.

|

4Q 2023 RUN-RATE NORMALIZED FFO

RECONCILIATION |

|

|

4Q 2023 |

|

DESCRIPTION |

|

4Q 2023 normalized FFO |

|

|

$150,730 |

|

|

|

Non-recurring items |

|

(4,730 |

) |

Property tax appeals/reductions and refunds |

| 4Q 2023 run-rate

normalized FFO |

|

$146,000 |

|

|

| |

|

|

|

|

| |

|

EXPECTED 2024 |

|

|

KEY ASSUMPTIONS |

|

LOW |

HIGH |

|

DESCRIPTION |

|

Annualized 4Q 2023 run-rate normalized FFO |

|

$584,000 |

|

$584,000 |

|

|

|

Multi-tenant cash NOI |

|

21,000 |

|

29,000 |

|

3.5% to 4.75% growth |

| Single-tenant cash NOI |

|

1,000 |

|

3,000 |

|

0.5% to 1.5% growth |

| Straight-line rent |

|

(2,000 |

) |

2,000 |

|

|

| Performance based

compensation |

|

(5,500 |

) |

(3,500 |

) |

Return to run-rate |

| Interest rate swap

maturity |

|

(6,500 |

) |

(6,500 |

) |

January 2024 expiration of

1.21% |

| Re/development and other

capital funding |

|

(7,500 |

) |

(5,500 |

) |

$150-$250 million of

dispositions |

|

Other |

|

— |

|

1,500 |

|

|

|

Expected normalized FFO |

|

$584,500 |

|

$604,000 |

|

|

| Expected

normalized FFO per share |

$1.52 |

|

$1.58 |

|

|

| |

The 2024 annual guidance range reflects the

Company's view of current and future market conditions, including

assumptions with respect to rental rates, occupancy levels,

interest rates, and operating and general and administrative

expenses. The Company's guidance does not contemplate impacts from

gains or losses from dispositions, potential impairments, or

debt extinguishment costs, if any. There can be no assurance that

the Company's actual results will not be materially higher or lower

than these expectations. If actual results vary from these

assumptions, the Company's expectations may change.

Healthcare Realty (NYSE: HR) is a real estate investment trust

(REIT) that owns and operates medical outpatient buildings

primarily located around market-leading hospital campuses. The

Company selectively grows its portfolio through property

acquisition and development. As the first and largest REIT to

specialize in medical outpatient buildings, Healthcare Realty's

portfolio includes nearly 700 properties totaling over 40 million

square feet concentrated in 15 growth markets.

Additional information regarding the Company, including this

quarter's operations, can be found at www.healthcarerealty.com. In

addition to the historical information contained within, this press

release contains certain forward-looking statements with respect to

the Company. Forward-looking statements are statements that are not

descriptions of historical facts and include statements regarding

management’s intentions, beliefs, expectations, plans or

predictions of the future, within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Because such

statements include risks, uncertainties and contingencies, actual

results may differ materially and in adverse ways from those

expressed or implied by such forward-looking statements. These

risks, uncertainties and contingencies include, without limitation,

the following: the Company's expected results may not be achieved;

failure to realize the expected benefits of the Merger; significant

transaction costs and/or unknown or inestimable liabilities; the

risk that HTA’s business will not be integrated successfully or

that such integration may be more difficult, time-consuming or

costly than expected; risks related to future opportunities and

plans for the Company, including the uncertainty of expected future

financial performance and results of the Company; the possibility

that, if the Company does not achieve the perceived benefits of the

Merger as rapidly or to the extent anticipated by financial

analysts or investors, the market price of the Company’s common

stock could decline; general adverse economic and local real estate

conditions; changes in economic conditions generally and the real

estate market specifically; legislative and regulatory changes,

including changes to laws governing the taxation of REITs and

changes to laws governing the healthcare industry; the availability

of capital; changes in interest rates; competition in the real

estate industry; the supply and demand for operating properties in

the Company’s proposed market areas; changes in accounting

principles generally accepted in the US; policies and guidelines

applicable to REITs; the availability of properties to acquire; the

availability of financing; pandemics and other health concerns, and

the measures intended to prevent their spread, including the

currently ongoing COVID-19 pandemic; and the potential material

adverse effect these matters may have on the Company’s business,

results of operations, cash flows and financial condition.

Additional information concerning the Company and its business,

including additional factors that could materially and adversely

affect the Company’s financial results, include, without

limitation, the risks described under Part I, Item 1A - Risk

Factors, in the Company’s 2023 Annual Report on Form 10-K and in

its other filings with the SEC.

|

Consolidated Balance Sheets |

|

DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

|

ASSETS |

|

|

|

|

|

|

|

4Q 2023 |

3Q 2023 |

2Q 2023 |

1Q 2023 |

4Q 2022 |

| Real estate properties |

|

|

|

|

|

| Land |

$1,343,265 |

|

$1,387,821 |

|

$1,424,453 |

|

$1,412,805 |

|

$1,439,798 |

|

|

Buildings and improvements |

|

10,881,373 |

|

|

11,004,195 |

|

|

11,188,821 |

|

|

11,196,297 |

|

|

11,332,037 |

|

| Lease intangibles |

|

836,302 |

|

|

890,273 |

|

|

922,029 |

|

|

929,008 |

|

|

959,998 |

|

| Personal property |

|

12,718 |

|

|

12,686 |

|

|

12,615 |

|

|

11,945 |

|

|

11,907 |

|

| Investment in financing

receivables, net |

|

122,602 |

|

|

120,975 |

|

|

121,315 |

|

|

120,692 |

|

|

120,236 |

|

| Financing lease right-of-use

assets |

|

82,209 |

|

|

82,613 |

|

|

83,016 |

|

|

83,420 |

|

|

83,824 |

|

| Construction in progress |

|

60,727 |

|

|

85,644 |

|

|

53,311 |

|

|

42,615 |

|

|

35,560 |

|

| Land

held for development |

|

59,871 |

|

|

59,871 |

|

|

78,411 |

|

|

69,575 |

|

|

74,265 |

|

|

Total real estate investments |

|

13,399,067 |

|

|

13,644,078 |

|

|

13,883,971 |

|

|

13,866,357 |

|

|

14,057,625 |

|

| Less

accumulated depreciation and amortization |

|

(2,226,853 |

) |

|

(2,093,952 |

) |

|

(1,983,944 |

) |

|

(1,810,093 |

) |

|

(1,645,271 |

) |

|

Total real estate investments, net |

|

11,172,214 |

|

|

11,550,126 |

|

|

11,900,027 |

|

|

12,056,264 |

|

|

12,412,354 |

|

| Cash and cash equivalents |

|

25,699 |

|

|

24,668 |

|

|

35,904 |

|

|

49,941 |

|

|

60,961 |

|

| Assets held for sale, net |

|

8,834 |

|

|

57,638 |

|

|

151 |

|

|

3,579 |

|

|

18,893 |

|

| Operating lease right-of-use

assets |

|

275,975 |

|

|

323,759 |

|

|

333,224 |

|

|

336,112 |

|

|

336,983 |

|

| Investments in unconsolidated

joint ventures |

|

311,511 |

|

|

325,453 |

|

|

327,245 |

|

|

327,746 |

|

|

327,248 |

|

| Other

assets, net and goodwill |

|

842,898 |

|

|

822,084 |

|

|

797,796 |

|

|

795,242 |

|

|

693,192 |

|

|

Total assets |

$12,637,131 |

|

$13,103,728 |

|

$13,394,347 |

|

$13,568,884 |

|

$13,849,631 |

|

| |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

4Q 2023 |

3Q 2023 |

2Q 2023 |

1Q 2023 |

4Q 2022 |

| Liabilities |

|

|

|

|

|

| Notes and bonds payable |

$4,994,859 |

|

$5,227,413 |

|

$5,340,272 |

|

$5,361,699 |

|

$5,351,827 |

|

| Accounts payable and accrued

liabilities |

|

211,994 |

|

|

204,947 |

|

|

196,147 |

|

|

155,210 |

|

|

244,033 |

|

| Liabilities of properties held

for sale |

|

295 |

|

|

3,814 |

|

|

222 |

|

|

277 |

|

|

437 |

|

| Operating lease

liabilities |

|

229,714 |

|

|

273,319 |

|

|

278,479 |

|

|

279,637 |

|

|

279,895 |

|

| Financing lease

liabilities |

|

74,503 |

|

|

74,087 |

|

|

73,629 |

|

|

73,193 |

|

|

72,939 |

|

| Other

liabilities |

|

202,984 |

|

|

211,365 |

|

|

219,694 |

|

|

232,029 |

|

|

218,668 |

|

|

Total liabilities |

|

5,714,349 |

|

|

5,994,945 |

|

|

6,108,443 |

|

|

6,102,045 |

|

|

6,167,799 |

|

| |

|

|

|

|

|

| Redeemable non-controlling

interests |

|

3,868 |

|

|

3,195 |

|

|

2,487 |

|

|

2,000 |

|

|

2,014 |

|

| |

|

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

| Preferred stock, $0.01 par

value; 200,000 shares authorized |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Common stock, $0.01 par value;

1,000,000 shares authorized |

|

3,810 |

|

|

3,809 |

|

|

3,808 |

|

|

3,808 |

|

|

3,806 |

|

| Additional paid-in

capital |

|

9,602,592 |

|

|

9,597,629 |

|

|

9,595,033 |

|

|

9,591,194 |

|

|

9,587,637 |

|

| Accumulated other

comprehensive (loss) income |

|

(10,741 |

) |

|

17,079 |

|

|

9,328 |

|

|

(8,554 |

) |

|

2,140 |

|

| Cumulative net income

attributable to common stockholders |

|

1,028,794 |

|

|

1,069,327 |

|

|

1,137,171 |

|

|

1,219,930 |

|

|

1,307,055 |

|

|

Cumulative dividends |

|

(3,801,793 |

) |

|

(3,684,144 |

) |

|

(3,565,941 |

) |

|

(3,447,750 |

) |

|

(3,329,562 |

) |

|

Total stockholders' equity |

|

6,822,662 |

|

|

7,003,700 |

|

|

7,179,399 |

|

|

7,358,628 |

|

|

7,571,076 |

|

|

Non-controlling interest |

|

96,252 |

|

|

101,888 |

|

|

104,018 |

|

|

106,211 |

|

|

108,742 |

|

|

Total Equity |

|

6,918,914 |

|

|

7,105,588 |

|

|

7,283,417 |

|

|

7,464,839 |

|

|

7,679,818 |

|

|

Total liabilities and stockholders' equity |

$12,637,131 |

|

$13,103,728 |

|

$13,394,347 |

|

$13,568,884 |

|

$13,849,631 |

|

|

Consolidated Statements of Income |

|

DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

|

|

|

|

|

|

|

|

THREE MONTHS ENDED DECEMBER 31, |

TWELVE MONTHS ENDED DECEMBER 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenues |

|

|

|

|

| Rental income |

$322,076 |

|

$329,399 |

|

$1,309,184 |

|

$907,451 |

|

| Interest income |

|

4,422 |

|

|

4,227 |

|

|

17,134 |

|

|

11,480 |

|

| Other

operating |

|

3,943 |

|

|

4,436 |

|

|

17,451 |

|

|

13,706 |

|

|

|

|

330,441 |

|

|

338,062 |

|

|

1,343,769 |

|

|

932,637 |

|

| Expenses |

|

|

|

|

| Property operating |

|

121,362 |

|

|

117,009 |

|

|

500,437 |

|

|

344,038 |

|

| General and

administrative |

|

14,609 |

|

|

14,417 |

|

|

58,405 |

|

|

52,734 |

|

|

Normalizing items 1 |

|

(1,445 |

) |

|

— |

|

|

(1,720 |

) |

|

— |

|

|

Normalized general and administrative |

|

13,164 |

|

|

14,417 |

|

|

56,685 |

|

|

52,734 |

|

| Acquisition and pursuit costs

2 |

|

301 |

|

|

92 |

|

|

2,026 |

|

|

3,229 |

|

| Merger-related costs |

|

1,414 |

|

|

10,777 |

|

|

(1,952 |

) |

|

103,380 |

|

|

Depreciation and amortization |

|

180,049 |

|

|

185,275 |

|

|

730,709 |

|

|

453,082 |

|

|

|

|

317,735 |

|

|

327,570 |

|

|

1,289,625 |

|

|

956,463 |

|

| Other income (expense) |

|

|

|

|

| Interest expense before

merger-related fair value |

|

(52,387 |

) |

|

(52,464 |

) |

|

(215,699 |

) |

|

(125,443 |

) |

|

Merger-related fair value adjustment |

|

(10,800 |

) |

|

(11,979 |

) |

|

(42,885 |

) |

|

(21,248 |

) |

|

Interest expense |

|

(63,187 |

) |

|

(64,443 |

) |

|

(258,584 |

) |

|

(146,691 |

) |

| Gain on sales of real estate

properties |

|

20,573 |

|

|

73,083 |

|

|

77,546 |

|

|

270,271 |

|

| Gain (loss) on extinguishment

of debt |

|

— |

|

|

119 |

|

|

62 |

|

|

(2,401 |

) |

| Impairment of real estate

assets and credit loss reserves |

|

(11,403 |

) |

|

(54,452 |

) |

|

(154,912 |

) |

|

(54,427 |

) |

| Equity (loss) gain from

unconsolidated joint ventures |

|

(430 |

) |

|

89 |

|

|

(1,682 |

) |

|

(687 |

) |

|

Interest and other income (expense), net |

|

65 |

|

|

(1,168 |

) |

|

1,343 |

|

|

(1,546 |

) |

|

|

|

(54,382 |

) |

|

(46,772 |

) |

|

(336,227 |

) |

|

64,519 |

|

|

Net (loss) income |

$(41,676 |

) |

$(36,280 |

) |

$(282,083 |

) |

$40,693 |

|

| Net

loss (income) attributable to non-controlling interests |

|

1,143 |

|

|

516 |

|

|

3,822 |

|

|

204 |

|

|

Net (loss) income attributable to common stockholders |

$(40,533 |

) |

$(35,764 |

) |

$(278,261 |

) |

$40,897 |

|

| |

|

|

|

|

| |

|

|

|

|

| Basic earnings per common

share |

$(0.11 |

) |

$(0.10 |

) |

$(0.74 |

) |

$0.15 |

|

| Diluted earnings per common

share |

$(0.11 |

) |

$(0.10 |

) |

$(0.74 |

) |

$0.15 |

|

| |

|

|

|

|

| Weighted average common shares

outstanding - basic |

|

379,044 |

|

|

378,617 |

|

|

378,928 |

|

|

252,356 |

|

| Weighted average common shares

outstanding - diluted 3 |

|

379,044 |

|

|

378,617 |

|

|

378,928 |

|

|

253,873 |

|

| |

1 4Q 2023 normalizing items include severance costs and YTD 2023

includes severance costs and non-routine legal costs.

2 Includes third party and travel costs related to the pursuit

of acquisitions and developments.

3 Potential common shares are not included in the computation of

diluted earnings per share when a loss exists, as the effect would

be an antidilutive per share amount. As a result, the Company's OP

totaling 3,966,365 units was not included.

|

Reconciliation of FFO, Normalized FFO and FAD

1,2,3 |

|

DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA |

|

|

|

|

|

|

|

|

THREE MONTHS ENDED DECEMBER 31, |

TWELVE MONTHS ENDED DECEMBER 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net (loss) income attributable

to common stockholders |

$(40,533 |

) |

$(35,764 |

) |

$(278,261 |

) |

$40,897 |

|

| Net loss attributable to

common stockholders/diluted share 3 |

$(0.11 |

) |

$(0.10 |

) |

$(0.74 |

) |

$0.15 |

|

| |

|

|

|

|

| Gain on sales of real estate

assets |

|

(20,573 |

) |

|

(73,083 |

) |

|

(77,546 |

) |

|

(270,271 |

) |

| Impairments of real estate

assets |

|

11,403 |

|

|

54,452 |

|

|

149,717 |

|

|

54,427 |

|

| Real estate depreciation and

amortization |

|

182,272 |

|

|

186,658 |

|

|

738,526 |

|

|

459,211 |

|

| Non-controlling loss from

partnership units |

|

(491 |

) |

|

(382 |

) |

|

(3,426 |

) |

|

(5 |

) |

|

Unconsolidated JV depreciation and amortization |

|

4,442 |

|

|

4,020 |

|

|

18,116 |

|

|

12,722 |

|

|

FFO adjustments |

$177,053 |

|

$171,665 |

|

$825,387 |

|

$256,084 |

|

| FFO

adjustments per common share - diluted |

$0.46 |

|

$0.45 |

|

$2.15 |

|

$1.01 |

|

|

FFO |

$136,520 |

|

$135,901 |

|

$547,126 |

|

$296,981 |

|

| FFO per common share -

diluted |

$0.36 |

|

$0.35 |

|

$1.43 |

|

$1.17 |

|

| |

|

|

|

|

| Acquisition and pursuit

costs |

|

301 |

|

|

92 |

|

|

2,026 |

|

|

3,229 |

|

| Merger-related costs |

|

1,414 |

|

|

10,777 |

|

|

(1,952 |

) |

|

103,380 |

|

| Lease intangible

amortization |

|

261 |

|

|

137 |

|

|

860 |

|

|

1,028 |

|

| Non-routine legal

costs/forfeited earnest money received |

|

(100 |

) |

|

194 |

|

|

175 |

|

|

771 |

|

| Debt financing costs |

|

— |

|

|

625 |

|

|

(62 |

) |

|

3,145 |

|

| Severance costs |

|

1,445 |

|

|

— |

|

|

1,445 |

|

|

— |

|

| Allowance for credit losses

4 |

|

— |

|

|

— |

|

|

8,599 |

|

|

— |

|

| Merger-related fair value

adjustment |

|

10,800 |

|

|

11,979 |

|

|

42,885 |

|

|

21,248 |

|

|

Unconsolidated JV normalizing items 5 |

|

89 |

|

|

96 |

|

|

389 |

|

|

330 |

|

|

Normalized FFO adjustments |

$14,210 |

|

$23,900 |

|

$54,365 |

|

$133,131 |

|

|

Normalized FFO adjustments per common share - diluted |

$0.04 |

|

$0.06 |

|

$0.14 |

|

$0.52 |

|

|

Normalized FFO |

$150,730 |

|

$159,801 |

|

$601,491 |

|

$430,112 |

|

| Normalized FFO per common

share - diluted |

$0.39 |

|

$0.42 |

|

$1.57 |

|

$1.69 |

|

| |

|

|

|

|

| Non-real estate depreciation

and amortization |

|

685 |

|

|

624 |

|

|

2,566 |

|

|

2,217 |

|

| Non-cash interest

amortization, net 6 |

|

1,265 |

|

|

2,284 |

|

|

4,968 |

|

|

5,129 |

|

| Rent reserves, net |

|

1,404 |

|

|

(100 |

) |

|

3,163 |

|

|

516 |

|

| Straight-line rent income,

net |

|

(7,872 |

) |

|

(9,873 |

) |

|

(32,592 |

) |

|

(20,124 |

) |

| Stock-based compensation |

|

3,566 |

|

|

3,573 |

|

|

13,791 |

|

|

14,294 |

|

|

Unconsolidated JV non-cash items 7 |

|

(206 |

) |

|

(316 |

) |

|

(1,034 |

) |

|

(1,206 |

) |

|

Normalized FFO adjusted for non-cash items |

|

149,572 |

|

|

155,993 |

|

|

592,353 |

|

|

430,938 |

|

|

2nd generation TI |

|

(18,715 |

) |

|

(13,523 |

) |

|

(66,081 |

) |

|

(33,620 |

) |

|

Leasing commissions paid |

|

(14,978 |

) |

|

(7,404 |

) |

|

(36,391 |

) |

|

(22,929 |

) |

|

Capital expenditures |

|

(17,393 |

) |

|

(25,669 |

) |

|

(49,343 |

) |

|

(48,913 |

) |

|

Total maintenance capex |

|

(51,086 |

) |

|

(46,596 |

) |

|

(151,815 |

) |

|

(105,462 |

) |

|

FAD |

$98,486 |

|

$109,397 |

|

$440,538 |

|

$325,476 |

|

| Quarterly/annual

dividends |

$118,897 |

|

$119,323 |

|

$477,239 |

|

$285,774 |

|

| FFO wtd avg common

shares outstanding - diluted 8 |

|

383,326 |

|

|

383,228 |

|

|

383,381 |

|

|

254,622 |

|

|

|

1 Funds from operations (“FFO”) and FFO per share are operating

performance measures adopted by NAREIT. NAREIT defines FFO as “net

income (computed in accordance with GAAP) excluding depreciation

and amortization related to real estate, gains and losses from the

sale of certain real estate assets, gains and losses from change in

control, and impairment write-downs of certain real assets and

investments in entities when the impairment is directly

attributable to decreases in the value of depreciable real estate

held by the entity.”

2 FFO, Normalized FFO and Funds Available for Distribution

("FAD") do not represent cash generated from operating activities

determined in accordance with GAAP and is not necessarily

indicative of cash available to fund cash needs. FFO, Normalized

FFO and FAD should not be considered alternatives to net income

attributable to common stockholders as indicators of the Company's

operating performance or as alternatives to cash flow as measures

of liquidity.

3 Potential common shares are not included in the computation of

diluted earnings per share when a loss exists, as the effect would

be an antidilutive per share amount.

4 In Q1 2023, allowance for credit losses included a $5.2

million credit allowance for a mezzanine loan included in

"Impairment of real estate and credit loss reserves" on the

Statement of Income and $3.4 million reserve included in “Rental

Income” on the Statement of Income for previously deferred rent and

straight line rent for three skilled nursing facilities.

5 Includes the Company's proportionate share of normalizing

items related to unconsolidated joint ventures such as lease

intangibles and acquisition and pursuit costs.

6 Includes the amortization of deferred financing costs,

discounts and premiums, and non-cash financing receivable

amortization.

7 Includes the Company's proportionate share of straight-line

rent, net and rent reserves, net related to unconsolidated joint

ventures.

8 The Company utilizes the treasury stock method, which includes

the dilutive effect of nonvested share-based awards outstanding of

308,389 for the three months ended December 31, 2023. Also includes

the diluted impact of 3,966,365 OP units outstanding.

|

Reconciliation of Non-GAAP Measures |

|

DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA - UNAUDITED |

| |

Management considers funds from operations ("FFO"), FFO per

share, normalized FFO, normalized FFO per share, funds available

for distribution ("FAD") to be useful non-GAAP measures of the

Company's operating performance. A non-GAAP financial measure is

generally defined as one that purports to measure historical

financial performance, financial position or cash flows, but

excludes or includes amounts that would not be so adjusted in the

most comparable measure determined in accordance with GAAP. Set

forth below are descriptions of the non-GAAP financial measures

management considers relevant to the Company's business and useful

to investors.

The non-GAAP financial measures presented herein are not

necessarily identical to those presented by other real estate

companies due to the fact that not all real estate companies use

the same definitions. These measures should not be considered as

alternatives to net income (determined in accordance with GAAP), as

indicators of the Company's financial performance, or as

alternatives to cash flow from operating activities (determined in

accordance with GAAP) as measures of the Company's liquidity, nor

are these measures necessarily indicative of sufficient cash flow

to fund all of the Company's needs.

FFO and FFO per share are operating performance measures adopted

by the National Association of Real Estate Investment Trusts, Inc.

(“NAREIT”). NAREIT defines FFO as “net income (computed in

accordance with GAAP) excluding depreciation and amortization

related to real estate, gains and losses from the sale of certain

real estate assets, gains and losses from change in control, and

impairment write-downs of certain real assets and investments in

entities when the impairment is directly attributable to decreases

in the value of depreciable real estate held by the entity.” The

Company defines Normalized FFO as FFO excluding acquisition-related

expenses, lease intangible amortization and other normalizing items

that are unusual and infrequent in nature. FAD is presented by

adding to Normalized FFO non-real estate depreciation and

amortization, deferred financing fees amortization, share-based

compensation expense and rent reserves, net; and subtracting

maintenance capital expenditures, including second generation

tenant improvements and leasing commissions paid and straight-line

rent income, net of expense. The Company's definition of these

terms may not be comparable to that of other real estate companies

as they may have different methodologies for computing these

amounts. FFO, Normalized FFO and FAD do not represent cash

generated from operating activities determined in accordance with

GAAP and are not necessarily indicative of cash available to fund

cash needs. FFO, Normalized FFO and FAD should not be considered an

alternative to net income as an indicator of the Company’s

operating performance or as an alternative to cash flow as a

measure of liquidity. FFO, Normalized FFO and FAD should be

reviewed in connection with GAAP financial measures.

Management believes FFO, FFO per share, Normalized FFO,

Normalized FFO per share, and FAD provide an understanding of the

operating performance of the Company’s properties without giving

effect to certain significant non-cash items, including

depreciation and amortization expense. Historical cost accounting

for real estate assets in accordance with GAAP assumes that the

value of real estate assets diminishes predictably over time.

However, real estate values instead have historically risen or

fallen with market conditions. The Company believes that by

excluding the effect of depreciation, amortization, gains or losses

from sales of real estate, and other normalizing items that are

unusual and infrequent, FFO, FFO per share, Normalized FFO,

Normalized FFO per share and FAD can facilitate comparisons of

operating performance between periods. The Company reports these

measures because they have been observed by management to be the

predominant measures used by the REIT industry and by industry

analysts to evaluate REITs and because these measures are

consistently reported, discussed, and compared by research analysts

in their notes and publications about REITs.

Merger Combined Cash NOI and Merger Combined Same Store Cash NOI

are key performance indicators. Management considers these to be

supplemental measures that allow investors, analysts and Company

management to measure unlevered property-level operating results.

The Company defines Merger Combined Cash NOI as rental income and

less property operating expenses. Merger Combined Cash NOI excludes

non-cash items such as above and below market lease intangibles,

straight-line rent, lease inducements, lease termination fees,

tenant improvement amortization and leasing commission

amortization. Merger Combined Cash NOI is historical and not

necessarily indicative of future results.

Merger Combined Same Store Cash NOI compares Merger Combined

Cash NOI for stabilized properties. Stabilized properties are

properties that have been included in operations for the duration

of the year-over-year comparison period presented. Accordingly,

stabilized properties exclude properties that were recently

acquired or disposed of, properties classified as held for sale,

properties undergoing redevelopment, and newly redeveloped or

developed properties.

The Company utilizes the redevelopment classification for

properties where management has approved a change in strategic

direction for such properties through the application of additional

resources including an amount of capital expenditures significantly

above routine maintenance and capital improvement expenditures.

Any recently acquired property will be included in the same

store pool once the Company has owned the property for eight full

quarters. Newly developed or redeveloped properties will be

included in the same store pool eight full quarters after

substantial completion.

Ron HubbardVice President, Investor RelationsP:

615.269.8290

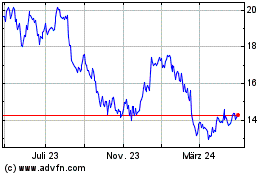

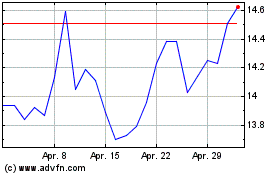

Healthcare Realty (NYSE:HR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Healthcare Realty (NYSE:HR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024