Gildan Activewear Inc. (GIL: TSX and NYSE) (“Gildan” or

the “Company”) announced today that it has priced an inaugural

offering of C$700 million aggregate principal amount of senior

unsecured notes in two series (the “Notes”), consisting of

C$500 million aggregate principal amount of 4.362% senior

unsecured notes, Series 1, due 2029 (the “2029 Notes”) and

C$200 million aggregate principal amount of 4.711% senior

unsecured notes, Series 2, due 2031 (the “2031 Notes”).

The 2029 Notes will be issued at par and bear

interest at a rate of 4.362% per annum, payable semi-annually until

maturity on May 22 and November 22 of each year,

commencing on May 22, 2025. The 2031 Notes

will be issued at par and bear interest at a rate of 4.711% per

annum, payable semi-annually until maturity on May 22 and

November 22 of each year, commencing on

May 22, 2025.

The Company intends to use the net proceeds of

the offering for the repayment of indebtedness outstanding under

its credit facilities and other general corporate purposes.

The Notes are being offered through an agency

syndicate consisting of BMO Capital Markets, CIBC Capital Markets

and Scotiabank, as joint bookrunners, along with J.P. Morgan, TD

Securities, BofA Securities and RBC Capital Markets, as

co-managers. The offering is expected to close on or about November

22, 2024, subject to customary closing conditions.

The Notes will be senior unsecured obligations

of the Company, will rank pari passu to all existing and future

senior unsecured and unsubordinated indebtedness of the Company.

The Notes have been assigned a provisional rating of BBB, with a

stable trend, by DBRS Limited, and are being offered in Canada on a

private placement basis in reliance upon exemptions from the

prospectus requirements under applicable securities

legislation.

The Notes have not been and will not be

qualified for sale to the public under applicable securities laws

in Canada and, accordingly, any offer and sale of the Notes in

Canada will be made on a basis which is exempt from the prospectus

requirements of such securities laws. The Notes have not been and

will not be registered under the United States Securities Act of

1933, as amended (the “U.S. Securities Act”), or any state

securities law, or the securities laws of any other jurisdiction,

and may not be offered or sold in the United States or its

territories or possessions or to, or for the account or benefit of,

U.S. persons (as such terms are defined in Regulation S under the

U.S. Securities Act).

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any offer to sell or a solicitation of an offer to buy the Notes in

any jurisdiction where it is unlawful to do so.

Caution Concerning Forward-Looking

Statements

Certain statements included in this press

release constitute “forward-looking statements” within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995 and

Canadian securities legislation and regulations and are subject to

important risks, uncertainties, and assumptions. This

forward-looking information includes, amongst others, statements

relating to the timing and completion of the proposed offering of

the Notes, the expected use of the net proceeds of the offering,

the credit ratings assigned, and any other future events or

developments described herein. Forward-looking statements generally

can be identified by the use of conditional or forward-looking

terminology such as “may,” “will,” “expect,” “intend,” “estimate,”

“project,” “assume,” “anticipate,” “plan,” “foresee,” “believe,” or

“continue,” or the negatives of these terms or variations of them

or similar terminology. Refer to the Company’s filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the risks described under the

“Financial risk management”, “Critical accounting estimates and

judgments,” and “Risks and uncertainties” sections of the Company’s

most recent Management’s Discussion and Analysis for the year ended

December 31, 2023 (“FY2023 MD&A”) for a discussion of the

various factors that may affect these forward-looking statements.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout such document.

Forward-looking information is inherently

uncertain and the results or events predicted in such

forward-looking information may differ materially from actual

results or events. Material factors, which could cause actual

results or events to differ materially from a conclusion, forecast,

or projection in such forward-looking information, include, but are

not limited to changes in general economic, financial or

geopolitical conditions globally or in one or more of the markets

Gildan serves, including the pricing and inflationary environment,

and Gildan’s ability to implement its growth strategies and plans,

as well as those factors listed in the FY2023 MD&A under the

“Risks and uncertainties” section and “Caution regarding

forward-looking statements” sections. These factors may cause the

Company’s actual performance in future periods to differ materially

from any estimates or projections of future performance expressed

or implied by the forward-looking statements included in this press

release. There can be no assurance that the expectations

represented by the Company’s forward-looking statements will prove

to be correct. The purpose of the forward-looking statements is to

provide the reader with a description of management’s expectations

regarding the proposed offering of Notes and other future events

and may not be appropriate for other purposes. Furthermore, unless

otherwise stated, the forward-looking statements contained in this

press release are made as of the date of this press release, and

Gildan does not undertake any obligation to update publicly or to

revise any of the included forward-looking statements, whether as a

result of new information, future events, or otherwise unless

required by applicable legislation or regulation. The

forward-looking statements contained in this press release are

expressly qualified by this cautionary statement.

About Gildan

Gildan is a leading manufacturer of everyday

basic apparel. The Company’s product offering includes activewear,

underwear and socks, sold to a broad range of customers, including

wholesale distributors, screenprinters or embellishers, as well as

to retailers that sell to consumers through their physical stores

and/or e-commerce platforms and to global lifestyle brand

companies. The Company markets its products in North America,

Europe, Asia Pacific, and Latin America, under a diversified

portfolio of Company-owned brands including Gildan®, American

Apparel®, Comfort Colors®, GOLDTOE® and Peds®.

Gildan owns and operates vertically integrated,

large-scale manufacturing facilities which are primarily located in

Central America, the Caribbean, North America, and Bangladesh.

Gildan operates with a strong commitment to industry-leading

labour, environmental and governance practices throughout its

supply chain in accordance with its comprehensive ESG program

embedded in the Company's long-term business strategy. More

information about the Company and its ESG practices and initiatives

can be found at www.gildancorp.com.

For further information:

|

Investor Inquiries |

Media Inquiries |

| Jessy Hayem,

CFA Senior

Vice-President, Head of Investor Relationsand Global Communications

(514)

744-8511 jhayem@gildan.com |

Genevieve Gosselin Director, Global Communications and Corporate

Marketing (514) 343-8814 communications@gildan.com |

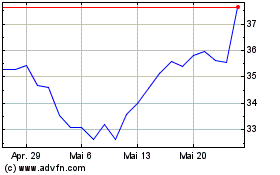

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

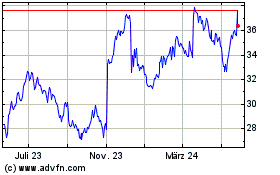

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024