DigitalBridge Group, Inc. (NYSE: DBRG) and subsidiaries

(collectively, “DigitalBridge,” or the “Company”) today announced

financial results for the first quarter ended March 31, 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230503005323/en/

"We made steady progress during the

quarter on our key strategic priorities for 2023, putting us on

track to achieve our capital formation and corporate simplification

goals," said Marc Ganzi, CEO of DigitalBridge. "We see increasingly

compelling opportunities to deploy capital in a more rational

market environment as well as supporting the continued growth of

our portfolio companies as they build next generation networks to

meet growing demand for connectivity and compute." (Graphic:

Business Wire)

A First Quarter 2023 Earnings Presentation and a Supplemental

Financial Report are available in the Events & Presentations

and Financial Information sections, respectively, of the

Shareholders tab on the Company’s website at www.digitalbridge.com.

This information has also been furnished to the U.S. Securities and

Exchange Commission in a Current Report on Form 8-K.

"We made steady progress during the quarter on our key strategic

priorities for 2023, putting us on track to achieve our capital

formation and corporate simplification goals," said Marc Ganzi, CEO

of DigitalBridge. "We see increasingly compelling opportunities to

deploy capital in a more rational market environment as well as

supporting the continued growth of our portfolio companies as they

build next generation networks to meet growing demand for

connectivity and compute."

The Company reported first quarter 2023 total revenues of $250

million, GAAP net loss attributable to common stockholders of

$(212) million, or $(1.34) per share, and Distributable Earnings of

$(3) million, or $(0.02) per share.

Common and Preferred Dividends

On April 27, 2023, the Company’s Board of Directors declared a

cash dividend of $0.01 per common share to be paid on July 17, 2023

to shareholders of record at the close of business on June 30,

2023; and declared cash dividends with respect to each series of

the Company’s cumulative redeemable perpetual preferred stock in

accordance with the terms of such series, as follows: Series H

preferred stock: $0.4453125 per share; Series I preferred stock:

$0.446875 per share; and Series J preferred stock: $0.4453125 per

share, which will be paid on July 17, 2023 to the respective

stockholders of record on July 11, 2023.

First Quarter 2023 Conference Call

The Company will conduct an earnings conference call and

presentation to discuss the First Quarter 2023 financial results on

Wednesday, May 3, 2023, at 10:00 a.m. Eastern Time (ET). The

earnings presentation will be broadcast live over the Internet and

a webcast link can be accessed on the Shareholders section of the

Company’s website at ir.digitalbridge.com/events. To participate in

the event by telephone, please dial (877) 407-4018 ten minutes

prior to the start time (to allow time for registration).

International callers should dial (201) 689-8471.

For those unable to participate during the live call, a replay

will be available starting May 3, 2023, at 3:00 p.m. ET. To access

the replay, dial (844) 512-2921 (U.S.), and use passcode 13737618.

International callers should dial (412) 317-6671 and enter the same

conference ID number.

About DigitalBridge Group, Inc.

DigitalBridge (NYSE: DBRG) is a leading global digital

infrastructure firm. With a heritage of over 25 years investing in

and operating businesses across the digital ecosystem including

cell towers, data centers, fiber, small cells, and edge

infrastructure, the DigitalBridge team manages a $69 billion

portfolio of digital infrastructure assets on behalf of its limited

partners and shareholders. Headquartered in Boca Raton,

DigitalBridge has key offices in New York, Los Angeles, London,

Luxembourg and Singapore. For more information, visit:

www.digitalbridge.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” or “potential” or the negative of these

words and phrases or similar words or phrases which are predictions

of or indicate future events or trends and which do not relate

solely to historical matters. You can also identify forward-looking

statements by discussions of strategy, plans or intentions.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and contingencies, many of which are

beyond the Company’s control, and may cause the Company’s actual

results to differ significantly from those expressed in any

forward-looking statement. Factors that might cause such a

difference include, without limitation, our ability to grow our

business by raising capital for our funds and the companies that we

manage; our position as an owner and investment manager of digital

infrastructure and our ability to manage any related conflicts of

interest; adverse changes in general economic and political

conditions, including those resulting from supply chain

difficulties, inflation, interest rate increases, a potential

economic slowdown or a recession; our exposure to business risks in

Europe, Asia and other foreign markets; our ability to obtain and

maintain financing arrangements, including securitizations, on

favorable or comparable terms or at all; the ability of our managed

companies to attract and retain key customers and to provide

reliable services without disruption; the reliance of our managed

companies on third-party suppliers for power, network connectivity

and certain other services; our ability to increase assets under

management ("AUM") and expand our existing and new investment

strategies; our ability to integrate and maintain consistent

standards and controls, including our ability to manage our

acquisitions in the digital infrastructure and investment

management industries effectively; our business and investment

strategy, including the ability of the businesses in which we have

significant investments to execute their business strategies;

performance of our investments relative to our expectations and the

impact on our actual return on invested equity, as well as the cash

provided by these investments and available for distribution; our

ability to deploy capital into new investments consistent with our

investment management strategies; the availability of, and

competition for, attractive investment opportunities and the

earnings profile of such new investments; our ability to achieve

any of the anticipated benefits of certain joint ventures,

including any ability for such ventures to create and/or distribute

new investment products; our expected hold period for our assets

and the impact of any changes in our expectations on the carrying

value of such assets; the general volatility of the securities

markets in which we participate; the market value of our assets;

interest rate mismatches between our assets and any borrowings used

to fund such assets; effects of hedging instruments on our assets;

the impact of economic conditions on third parties on which we

rely; the impact of any security incident or deficiency affecting

our systems or network or the system and network of any of our

managed companies or service providers; any litigation and

contractual claims against us and our affiliates, including

potential settlement and litigation of such claims; our levels of

leverage; the impact of legislative, regulatory and competitive

changes, including those related to privacy and data protection;

the impact of our transition from a real estate investment trust

("REIT") to a taxable C corporation for tax purposes, and the

related liability for corporate and other taxes; whether we will be

able to utilize existing tax attributes to offset taxable income to

the extent contemplated; our ability to maintain our exemption from

registration as an investment company under the Investment Company

Act of 1940, as amended (the “1940 Act”); changes in our board of

directors or management team, and availability of qualified

personnel; our ability to make or maintain distributions to our

stockholders; and our understanding of and ability to successfully

navigate the competitive landscape in which we and our managed

companies operate and other risks and uncertainties, including

those detailed in the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2022 under the heading “Risk

Factors,” as such factors may be updated from time to time in the

Company’s subsequent periodic filings with the U.S. Securities and

Exchange Commission (“SEC”). All forward-looking statements reflect

the Company’s good faith beliefs, assumptions and expectations, but

they are not guarantees of future performance. Additional

information about these and other factors can be found in the

Company’s reports filed from time to time with the SEC.

The Company cautions investors not to unduly rely on any

forward-looking statements. The forward-looking statements speak

only as of the date of this press release. The Company is under no

duty to update any of these forward-looking statements after the

date of this press release, nor to conform prior statements to

actual results or revised expectations, and the Company does not

intend to do so.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except per

share data)

March 31, 2023

December 31, 2022

(unaudited)

Assets

Cash and cash equivalents

$

668,524

$

918,254

Restricted cash

155,690

118,485

Investments

1,226,952

1,242,001

Real estate

5,964,807

5,921,298

Goodwill

907,937

761,368

Deferred leasing costs and intangible

assets

1,098,520

1,092,167

Other assets

642,451

654,050

Due from affiliates

67,285

45,360

Assets held for disposition

11,263

275,520

Total assets

$

10,743,429

$

11,028,503

Liabilities

Corporate debt

$

569,771

$

568,912

Non-recourse investment-level debt

4,752,050

4,587,228

Intangible liabilities

28,441

29,824

Other liabilities

1,133,568

1,272,096

Liabilities related to assets held for

disposition

374

380

Total liabilities

6,484,204

6,458,440

Commitments and contingencies

Redeemable noncontrolling

interests

107,413

100,574

Equity

Stockholders’ equity:

Preferred stock, $0.01 par value per

share; $827,711 and $827,779 liquidation preference; 250,000 shares

authorized; 33,108 and 33,111 shares issued and outstanding

800,303

800,355

Common stock, $0.04 par value per

share

Class A, 949,000 shares authorized;

161,834 and 159,763 shares issued and outstanding

6,473

6,390

Class B, 1,000 shares authorized; 166

shares issued and outstanding

7

7

Additional paid-in capital

7,823,722

7,818,068

Accumulated deficit

(7,176,706

)

(6,962,613

)

Accumulated other comprehensive income

(loss)

(1,478

)

(1,509

)

Total stockholders’ equity

1,452,321

1,660,698

Noncontrolling interests in investment

entities

2,650,893

2,743,896

Noncontrolling interests in Operating

Company

48,598

64,895

Total equity

4,151,812

4,469,489

Total liabilities, redeemable

noncontrolling interests and equity

$

10,743,429

$

11,028,503

Supplemental Schedule to

Consolidated Balance Sheets

(In thousands,

unaudited)

Investment Management

Operating

Corporate and Other

March 31, 2023

December 31, 2022

March 31, 2023

December 31, 2022

March 31, 2023

December 31, 2022

Assets

Cash and cash equivalents

$

56,943

$

39,563

$

65,097

$

65,975

$

546,484

$

812,716

Restricted cash

2,324

2,298

152,262

114,442

1,104

1,745

Investments

345,826

395,327

6,804

4,638

874,322

842,036

Real estate

—

—

5,964,807

5,921,298

—

—

Goodwill

444,817

298,248

463,120

463,120

—

—

Deferred leasing costs and intangible

assets

128,973

85,172

969,036

1,006,469

511

526

Other assets

15,966

13,356

581,848

573,229

44,637

67,465

Due from affiliates

61,455

41,458

—

—

5,830

3,902

$

1,056,304

$

875,422

$

8,202,974

$

8,149,171

$

1,472,888

$

1,728,390

Liabilities

Corporate debt

$

199,033

$

198,677

$

70,246

$

70,120

$

300,492

$

300,115

Non-recourse investment-level debt

—

—

4,751,701

4,586,765

349

463

Intangible liabilities

—

—

28,441

29,824

—

—

Other liabilities

218,712

342,696

721,319

725,236

193,537

204,164

$

417,745

$

541,373

$

5,571,707

$

5,411,945

$

494,378

$

504,742

Redeemable noncontrolling

interests

1,098

680

—

—

106,315

99,894

Noncontrolling interests in investment

entities (excluding assets held for disposition)

151,985

136,668

2,369,836

2,463,559

127,770

113,390

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per

share data, unaudited)

Three Months Ended March

31,

2023

2022

Revenues

Fee income

$

59,126

$

42,837

Carried interest allocation (reversal)

(54,756

)

(31,079

)

Principal investment income (loss)

3,562

6,454

Property operating income

230,927

202,511

Other income

11,301

12,111

Total revenues

250,160

232,834

Expenses

Property operating expense

97,126

84,003

Interest expense

67,196

44,030

Investment expense

5,751

9,565

Transaction-related costs

8,527

165

Depreciation and amortization

141,574

128,567

Compensation expense - cash and

equity-based

74,650

65,542

Compensation expense (reversal) - carried

interest and incentive fee

(36,831

)

(20,352

)

Administrative expenses

26,506

27,885

Total expenses

384,499

339,405

Other income (loss)

Other gain (loss), net

(142,745

)

(149,881

)

Income (loss) before income

taxes

(277,084

)

(256,452

)

Income tax benefit (expense)

(1,042

)

7,413

Income (loss) from continuing

operations

(278,126

)

(249,039

)

Income (loss) from discontinued

operations

(14,218

)

(94,645

)

Net income (loss)

(292,344

)

(343,684

)

Net income (loss) attributable to

noncontrolling interests:

Redeemable noncontrolling interests

6,943

(11,220

)

Investment entities

(84,828

)

(63,045

)

Operating Company

(16,662

)

(22,862

)

Net income (loss) attributable to

DigitalBridge Group, Inc.

(197,797

)

(246,557

)

Preferred stock dividends

14,676

15,759

Net income (loss) attributable to

common stockholders

$

(212,473

)

$

(262,316

)

Income (loss) per share—basic

Income (loss) from continuing operations

per share—basic

$

(1.25

)

$

(1.27

)

Net income (loss) attributable to common

stockholders per share—basic

$

(1.34

)

$

(1.84

)

Income (loss) per share—diluted

Income (loss) from continuing operations

per share—diluted

$

(1.25

)

$

(1.27

)

Net income (loss) attributable to common

stockholders per share—diluted

$

(1.34

)

$

(1.84

)

Weighted average number of

shares

Basic

158,446

142,485

Diluted

158,446

142,485

Supplemental Schedule to

Consolidated Statements of Operations

(In thousands,

unaudited)

Investment Management

Operating

Corporate and Other

Three Months Ended March

31,

Three Months Ended March

31,

Three Months Ended March

31,

2023

2022

2023

2022

2023

2022

Revenues

Fee income

$

60,098

$

43,637

$

—

$

—

$

(972

)

$

(800

)

Carried interest allocation

(54,756

)

(31,079

)

—

—

—

—

Principal investment income (loss)

318

17

—

—

3,244

6,437

Property operating income

—

—

230,927

202,511

—

—

Other income

1,169

1,256

737

11

9,395

10,844

Total revenues

6,829

13,831

231,664

202,522

11,667

16,481

Expenses

Property operating expense

—

—

97,126

84,003

—

—

Interest expense

2,603

2,502

59,984

36,184

4,609

5,344

Investment expense

536

1,140

5,203

8,016

12

409

Transaction-related costs

5,192

—

—

—

3,335

165

Depreciation and amortization

6,409

5,276

134,699

122,891

466

400

Compensation expense—cash and

equity-based

28,182

24,808

27,179

19,956

19,289

20,778

Compensation expense (reversal)—incentive

fee and carried interest

(36,831

)

(20,352

)

—

—

—

—

Administrative expenses

6,407

4,171

7,240

6,899

12,859

16,815

Total expenses

12,498

17,545

331,431

277,949

40,570

43,911

Other gains (losses), net

3,082

(3,055

)

1,769

956

(147,596

)

(147,782

)

Losses from continuing operations

before income taxes

(2,587

)

(6,769

)

(97,998

)

(74,471

)

(176,499

)

(175,212

)

Income tax benefit (expense)

(217

)

(2,374

)

56

330

(881

)

9,457

Loss from continuing operations

(2,804

)

(9,143

)

(97,942

)

(74,141

)

(177,380

)

(165,755

)

Income (loss) from continuing operations

attributable to noncontrolling interests:

Redeemable noncontrolling interests

418

(3,266

)

—

—

6,525

(7,954

)

Investment entities

(857

)

2,349

(86,254

)

(60,196

)

1,766

977

Operating Company

(167

)

(624

)

(899

)

(1,121

)

(14,522

)

(14,007

)

Loss from continuing operations

attributable to DigitalBridge Group, Inc.

$

(2,198

)

$

(7,602

)

$

(10,789

)

$

(12,824

)

$

(171,149

)

$

(144,771

)

Distributable Earnings

(DE)

(In thousands, except per

share data, unaudited)

Three Months Ended

March 31, 2023

March 31, 2022

Net income (loss) attributable to common

stockholders

$

(212,473

)

$

(262,316

)

Net income (loss) attributable to

noncontrolling common interests in Operating Company

(16,662

)

(22,862

)

Net income (loss) attributable to

common interests in Operating Company and common

stockholders

(229,135

)

(285,178

)

Adjustments for Distributable Earnings

(DE):

Transaction-related and restructuring

charges(1)

18,391

24,668

Other (gain) loss, net (excluding realized

gain or loss related to digital assets and fund investments in

Corporate and Other)

141,229

130,224

Unrealized carried interest (allocation)

reversal, net of associated compensation (expense) reversal

18,240

13,078

Compensation expense - equity-based

16,339

18,720

Depreciation and amortization

141,220

130,597

Straight-line rent revenue and expense

(1,727

)

(2,548

)

Amortization of acquired above- and

below-market lease values, net

26

(248

)

Impairment reversal (loss)

—

23,802

Non-revenue enhancing capital

expenditures

(8,564

)

(1,372

)

Finance lease interest expense, debt

prepayment penalties and amortization of deferred financing costs,

debt premiums and discounts

15,523

98,465

Income tax effect on certain of the

foregoing adjustments

—

(589

)

Adjustments attributable to noncontrolling

interests in investment entities

(118,563

)

(132,237

)

DE from discontinued operations(4)

3,656

(22,446

)

After-tax DE

$

(3,365

)

$

(5,064

)

DE per common share / common OP

unit(2)

$

(0.02

)

$

(0.03

)

DE per common share / common OP

unit—diluted(2)(3)

$

(0.02

)

$

(0.03

)

Weighted average number of common OP units

outstanding used for DE per common share and OP unit(2)

173,127

157,248

Weighted average number of common OP units

outstanding used for DE per common share and OP unit—diluted

(2)(3)

173,127

157,248

_________

(1)

Restructuring charges primarily represent

costs and charges incurred as a result of corporate restructuring

and reorganization to implement the digital evolution. These costs

and charges include severance, retention, relocation, transition,

shareholder settlement and other related restructuring costs, which

are not reflective of the Company’s core operating performance.

(2)

Calculated based on weighted average shares outstanding including

participating securities and assuming the exchange of all common OP

units outstanding for common shares.

(3)

For the three months ended March 31, 2023 and March 31, 2022,

excluded from the calculation of diluted DE per share are Class A

common stock or OP units issuable in connection with performance

stock units, performance based restricted stock units and Wafra’s

warrants, of which the issuance and/or vesting are subject to the

performance of the Company's stock price or the achievement of

certain Company specific metrics, and the effect of adding back

interest expense associated with convertible senior notes and

weighted average dilutive common share equivalents for the assumed

conversion of the convertible senior notes as the effect of

including such interest expense and common share equivalents would

be antidilutive.

(4)

During the first quarter of 2023, the Company sold all of its

equity investment in BrightSpire Capital, Inc. (NYSE: BRSP). The

Company's investment in BRSP qualified as held for sale and

discontinued operations in March 2023. Accordingly, for all prior

periods presented, the equity method investment in BRSP is

presented as assets held for disposition on the consolidated

balance sheets and equity method earnings (loss) from BRSP is

presented as loss from discontinued operations on the consolidated

statements of operations. This change is reflected retrospectively.

Distributable Earnings (DE)

DE is an after-tax measure that differs from GAAP net income or

loss from continuing operations as a result of the following

adjustments, including adjustment for our share of similar items

recognized by our equity method investments, where applicable:

transaction-related costs; restructuring charges (primarily

severance and retention costs); realized and unrealized gains or

losses, except realized gains or losses related to digital assets,

including fund investments, in Corporate and Other; depreciation,

amortization and impairment charges; interest expense on finance

leases; debt prepayment penalties and amortization of deferred

financing costs, debt premiums and discounts; our share of

unrealized carried interest allocation, net of associated

compensation expense; equity-based compensation costs; effect of

straight-line lease income and expense; impairment of equity

investments directly attributable to decrease in value of

depreciable real estate held by the investee; non-revenue enhancing

capital expenditures necessary to maintain operating real estate;

and income tax effect on certain of the foregoing adjustments.

Income taxes included in DE reflect the benefit of deductions

arising from certain expenses that are excluded from the

calculation of DE, such as equity-based compensation, as these

deductions do decrease actual income tax paid or payable by the

Company in any one period There are no differences in the Company’s

measurement of DE and AFFO. Therefore, previously reported AFFO is

the equivalent to DE and prior period information has not been

recast. DE is presented on a reportable segment basis and for the

Company in total.

We believe that DE is a meaningful supplemental measure as it

reflects the ongoing operating performance of our core business by

generally excluding items that are non-core in nature and allows

for our operating results to be more comparable period-over-period

and relative to other companies in similar lines of business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230503005323/en/

Investor Contacts: Severin White Managing Director, Head

of Public Investor Relations severin.white@digitalbridge.com

212-547-2777

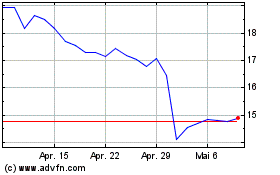

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024