Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

03 Oktober 2024 - 11:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | Definitive Proxy Statement |

| |

| ☒ | Definitive Additional Materials |

| |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CACI INTERNATIONAL INC

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | | | | |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | 1 | | Title of each class of securities to which transaction applies: |

| | 2 | | Aggregate number of securities to which transaction applies: |

| | 3 | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4 | | Proposed maximum aggregate value of transaction: |

| | 5 | | Total fee paid: |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1 | | Amount Previously Paid: |

| | 2 | | Form, Schedule or Registration Statement No.: |

| | 3 | | Filing Party: |

| | 4 | | Date Filed: |

October 3, 2024

Dear Fellow Shareholders:

We write to you concerning CACI’s 2024 Annual Meeting of Shareholders to be held on October 17, 2024 (the “Annual Meeting”).

Institutional Shareholder Services Inc. (“ISS”) recently issued an advisory report regarding the 2024 Annual Meeting in which ISS expressed a concern about the independence of Ryan McCarthy, a director nominee, based on ISS’s internal independence assessment. ISS determined that Mr. McCarthy was not an independent director based on their standards because Mr. McCarthy provided consulting services to CACI, without considering any of the facts and circumstances related to the consulting arrangement. Those consulting services, in ISS’ view we assume, amounted to either the provision of professional services or a material relationship with the Company that, to ISS, automatically disqualified Mr. McCarthy from independent status. ISS reached this conclusion despite their previous determinations that Mr. McCarthy was independent in 2022 and 2023 – years in which the very same consulting arrangement was in force and disclosed in CACI’s Proxy Statements.

As a result of ISS’s new determination of Mr. McCarthy’s non-independence and ISS’s voting guidelines against non-independent directors serving on certain Board committees, ISS has recommended a vote “Against” Mr. McCarthy due to his service on CACI’s Audit and Risk Committee and Corporate Governance and Nominating Committee.

Consistent with ISS’s previous independence determinations, we believe that Mr. McCarthy has served and will continue to serve as an independent director since his election in 2021 and that shareholders should vote “FOR” his election at the 2024 Annual Meeting for the following reasons:

•The Board of Directors has annually reviewed the consulting relationship between Mr. McCarthy and CACI and determined that Mr. McCarthy was and remains independent pursuant to NYSE director independence standards.

•CACI has disclosed the compensation received by Mr. McCarthy pursuant to the consulting agreement since 2022 and ISS determined that Mr. McCarthy was independent and recommended shareholders vote “FOR” Mr. McCarthy in both 2022 and 2023. Since then, no material facts or disclosures have changed with respect to Mr. McCarthy’s compensation or independence.

•Mr. McCarthy was compensated at a market rate for the services provided to CACI and the compensation received in exchange for such professional services is not of the type or magnitude that would affect Mr. McCarthy’s ability to exercise his independent judgment and satisfy his fiduciary duties with respect to any matter before our Board or Committees.

•Mr. McCarthy has provided consulting services that far exceed the expectation and contributions for regular service as a Board member. He is, in short, a force multiplier. The consulting agreement with Mr. McCarthy allows senior CACI management to gain valuable insights in a manner apart from his role as a Director of CACI. The Company requests Mr. McCarthy to assist CACI in setting up meetings and explaining how we can ascertain information from the U.S. Army to support our priorities and performance with a primary customer. He provides background knowledge on the direction of Army programming and budgets that the Army is putting forward, provides the mission viability of the various technologies CACI is creating, and can articulate the perspective of the user. All of these influence our acquisition strategy and our pursuit engagements.

As the prior Secretary of the Army, he attends meetings and events that extend the reach of our client executives. As a result of his engagements across the Department of Defense, the intelligence community, the executive branch, and other independent agencies, CACI has a better understanding of future requirements in a manner that allows CACI to invest ahead of customer need to better serve the Army and other customers. The provision of knowledge allows CACI to be better informed of challenges across the department and various agencies, which is different and in addition to his role on the Board. He is in no way involved in program pursuit decisions, investment decisions, nor is he providing strategic direction for the corporation. His role on the Board committees he supports are clear and distinctly different and unrelated to his consulting role.

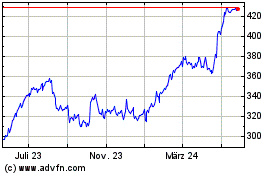

•Over the last year, CACI’s share price has increased from $313 to $507 (the closing price on 10/1/24.)

•Shareholders have strongly supported Mr. McCarthy’s election in previous years with shareholder support in excess of 99% and 89% in 2022 and 2023, respectively, with full knowledge of the consulting arrangement.

In consideration of the above, CACI has requested that ISS reconsider their independence determination and “Against” recommendation and issue an updated advisory report that recommends a “For” vote for Mr. McCarthy.

Notwithstanding ISS’s final determination, we strongly disagree with the presumptions underlying ISS’s most recent independence determination for Mr. McCarthy and we urge you to vote “FOR” his election to our Board at the 2024 Annual Meeting.

| | | | | | | | | | | | | | |

| | | Sincerely, |

| | | | |

| | | |

| | |

| | |

| | | Michael A. Daniels | |

| | | Chairman of the Board | |

CACI (NYSE:CACI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

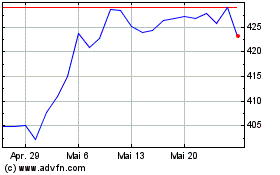

CACI (NYSE:CACI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024