DENTSPLY SIRONA Inc. (“Dentsply Sirona” or “the Company”) (Nasdaq:

XRAY) today is providing a business update.

As previously disclosed, the Audit and Finance

Committee of the Company’s Board of Directors (the “Audit

Committee”) is conducting an internal investigation regarding

certain financial reporting matters. The investigation is ongoing

and therefore the Company expects that it will not be in a position

to file its Quarterly Report on Form 10-Q for the period ended June

30, 2022, (the “Second Quarter 10-Q”) by the August 9, 2022,

deadline.

Select Preliminary Second Quarter 2022

Results

The Company’s operational performance improved sequentially in

the quarter with net sales and adjusted EPS expected to be above

preliminary first quarter 2022 results. While net sales declined

year-over-year due to the unfavorable impact of foreign exchange,

the business delivered organic sales growth driven by solid

European regional performance and demand in strategic areas of the

business, most notably, CAD/CAM, Equipment & Instruments, and

Restorative and Preventive Consumables.

As anticipated, in the second quarter, the Company saw

normalizing dealer inventory levels in the U.S. as well as realized

benefits from recent product launches and pricing adjustments. The

Company continued to experience macro headwinds including ongoing

supply shortages and softness in sales in China due to

COVID-related shutdowns.

As a result, Dentsply Sirona expects to report second quarter

2022 net sales of greater than $1,005 million. Additionally,

diluted EPS is expected to be at or above $0.26 and adjusted

EPS at or above $0.60.

The second quarter gross margin and adjusted EPS were favorably

impacted by the timing of certain expenses which will be reflected

in the third and fourth quarters.

For the full year 2022 outlook, the Company’s assumptions

outlined on May 10, 2022, remain intact with the exception of

foreign exchange. Management expects to provide an updated full

year 2022 outlook after filing its Quarterly Report on Form 10-Q

for the quarter ended March 31, 2022 (the “First Quarter 10-Q”) and

the Second Quarter 10-Q (collectively with the First Quarter 10-Q,

the “Quarterly Reports”).

Consistent with the Company’s commitment to return cash to

shareholders, Dentsply Sirona's Board of Directors declared a

quarterly cash dividend of $0.125 per share of common stock, an

indicated annual rate of $0.50 per share. The dividend is payable

October 14, 2022, to holders of record as of September 30,

2022.

Investigation Update

The Audit Committee continues to work diligently with

independent counsel and advisors to complete its previously

announced investigation as soon as possible. However, the Company

cannot predict the duration or outcome of the investigation. Due to

the pendency of the investigation, the Company has not yet filed

its First Quarter 10-Q and does not believe it will file its Second

Quarter 10-Q on a timely basis. In the course of the investigation,

the Company has also evaluated certain other accounting practices.

As a result of this review, the Company anticipates certain

adjustments will be made to the previously announced preliminary

first quarter financial results, and the Company is currently

evaluating whether fiscal year 2021 reported financial results also

require adjustments.

The Company will work to finalize its financial statements and

review of internal controls and procedures, including the

evaluation of any deficiencies in internal controls over financial

reporting, as soon as practicable.

As previously disclosed, the Company has voluntarily contacted

the SEC to advise it that an internal investigation is underway,

and the Audit Committee intends to provide additional information

to the SEC as its investigation proceeds. The Company intends to

fully cooperate with the SEC regarding this matter.

Nasdaq Compliance Update

On May 18, 2022, the Company announced it received a written

notification from The Nasdaq Stock Market (“Nasdaq”) on May 12,

2022, indicating that the Company is no longer in compliance with

Nasdaq Listing Rules because the Company had not timely filed its

First Quarter 10-Q. In response to the notification and pursuant to

the Nasdaq Listing Rules, the Company submitted a plan to regain

compliance and it targeted filing the Quarterly Reports by August

14, 2022. The Nasdaq staff granted the Company an extension of time

through August 14, 2022, in which to file the Quarterly Reports.

The Company has notified Nasdaq that it no longer expects that it

will be able to file the Quarterly Reports by August 14, 2022, and

will submit an updated compliance plan to Nasdaq. If Nasdaq accepts

the updated plan to be submitted by the Company, Nasdaq can grant

an extension of time for shares of the Company’s common stock to

remain listed for up to 180 calendar days from the First Quarter

10-Q’s original filing deadline to regain compliance, which would

be November 7, 2022.

Notice Regarding Preliminary Results

The Select Preliminary Second Quarter 2022 Results included

above in this press release are based upon preliminary financial

results. These preliminary financial results are based upon

information available to management as of the date of this press

release. The Company’s actual results may differ from these results

due to final adjustments and developments that may arise or

information that may become available between now and the time the

Company’s financial results for the three months period

ended June 30, 2022, are finalized, and included in the

Company’s Second Quarter 10-Q. During the course of the

Audit Committee’s investigation, the Company may identify items

that could cause its actual results to be different from these

preliminary financial results. The Company’s independent registered

public accounting firm has not audited, reviewed, compiled, or

performed any procedures with respect to the preliminary financial

results, nor has it expressed any opinion or any other form of

assurance on such results or their achievability, and assume no

responsibility for, and disclaim any association with, such

results.

About Dentsply Sirona

Dentsply Sirona is the world’s largest manufacturer of

professional dental products and technologies, with over a century

of innovation and service to the dental industry and patients

worldwide. Dentsply Sirona develops, manufactures, and markets a

comprehensive solutions offering including dental and oral health

products as well as other consumable medical devices under a strong

portfolio of world class brands. Dentsply Sirona’s products provide

innovative, high-quality and effective solutions to advance patient

care and deliver better and safer dental care. Dentsply Sirona’s

headquarters is located in Charlotte, North Carolina. The Company’s

shares are listed in the United States on Nasdaq under the symbol

XRAY. Visit www.dentsplysirona.com for more information about

Dentsply Sirona and its products.

Forward-Looking Statements

All statements in this press release that do not directly and

exclusively relate to historical facts constitute “forward-looking

statements.” These statements represent current expectations and

beliefs, including statements regarding the Audit Committee’s

ongoing internal investigation and the preliminary financial

information for the second quarter ending June 30, 2022, and no

assurance can be given that the results described in such

statements will be achieved. Such statements are subject to

numerous assumptions, risks, uncertainties and other factors that

could cause actual results to differ materially from those

described in such statements, many of which are outside of our

control. Furthermore, many of these risks and uncertainties are

currently amplified by and may continue to be amplified by or may,

in the future, be amplified by, the novel coronavirus (“COVID-19”)

pandemic and the impact of varying private and governmental

responses that affect our customers, employees, vendors and the

economies and communities where they operate. For a written

description of these factors, see the section titled “Risk Factors”

in Dentsply Sirona’s Annual Report on Form 10-K for the most recent

fiscal year. No assurance can be given that any expectation,

belief, goal or plan set forth in any forward-looking statement can

or will be achieved, and readers are cautioned not to place undue

reliance on such statements which speak only as of the date they

are made. The Company does not undertake any obligation to update

or release any revisions to any forward-looking statement or to

report any events or circumstances after the date of press release

or to reflect the occurrence of unanticipated events.

Non-GAAP Financial Measures

The Company has provided certain measures in this press release

that are not calculated in accordance with US GAAP and therefore

represent Non-GAAP measures. These Non-GAAP measures may differ

from those used by other companies and should not be considered in

isolation from, or as a substitute for, measures of financial

performance prepared in accordance with US GAAP. These Non-GAAP

measures are used by the Company to measure its performance and may

differ from those used by other companies.

Management believes that these Non-GAAP measures are helpful as

they provide another measure of the results of operations, and are

frequently used by investors and analysts to evaluate the Company’s

performance exclusive of certain items that impact the

comparability of results from period to period, and which may not

be indicative of past or future performance of the Company.

Organic SalesThe Company defines "organic sales" as the reported

net sales adjusted for: (1) net sales from acquired businesses

recorded prior to the first anniversary of the acquisition, (2) net

sales attributable to disposed businesses or discontinued product

lines in both the current and prior year periods, and (3) the

impact of foreign currency changes, which is calculated by

translating current period net sales using the comparable prior

period's currency exchange rates.

Adjusted Operating Income (Loss) and MarginAdjusted operating

income (loss) is computed by excluding the following items from

operating income:

(1) Business combination related

costs and fair value adjustments. These adjustments include costs

related to consummating and integrating acquired businesses, as

well as net gains and losses related to the disposed businesses. In

addition, this category includes the post-acquisition roll-off of

fair value adjustments recorded related to business combinations,

except for amortization expense of purchased intangible assets

noted below. Although the Company is regularly engaged in

activities to find and act on opportunities for strategic growth

and enhancement of product offerings, the costs associated with

these activities may vary significantly between periods based on

the timing, size and complexity of acquisitions and as such may not

be indicative of past and future performance of the Company.

(2) Restructuring program related

costs and other costs. These adjustments include costs related to

the implementation of restructuring initiatives, including but not

limited to, severance costs, facility closure costs, lease and

contract termination costs, and related professional service costs

associated with specific restructuring initiatives. Other costs

include legal settlements, asset impairments, executive separation

costs, and changes in accounting principle recorded within the

period. The Company is continually seeking to take actions that

could enhance its efficiency, consequently restructuring charges

may recur but are subject to significant fluctuations from period

to period due to the varying levels of restructuring activity and

the inherent imprecision in the estimates used to recognize the

impairment of assets, and as such may not be indicative of past and

future performance of the Company.

(3) Amortization of purchased

intangible assets. This adjustment excludes the periodic

amortization expense related to purchased intangible assets, which

are recorded at fair value in purchase accounting. Although these

costs contribute to revenue generation and will recur in future

periods, their amounts are significantly impacted by the timing and

size of acquisitions, and as such may not be indicative of the

future performance of the Company.

(4) Fair value and credit risk

adjustments. These adjustments include the non-cash mark-to-market

changes in fair value associated with pension assets and

obligations and equity-method investments. Although these

adjustments are recurring in nature, they are subject to

significant fluctuations from period to period due to changes in

the underlying assumptions and market conditions. The non-service

component of pension expense is a recurring item, however it is

subject to significant fluctuations from period to period due to

changes in actuarial assumptions, interest rates, plan changes,

settlements, curtailments, and other changes in facts and

circumstances. As such, these items may not be indicative of past

and future performance of the Company.

Adjusted operating margin is calculated by dividing adjusted

operating income by net sales.

Adjusted Net Income (Loss)

Adjusted net income (loss) consists of the reported net income

(loss) in accordance with US GAAP, adjusted to exclude the items

identified above, the related income tax impacts, and discrete

income tax adjustments such as: final settlement of income tax

audits, discrete tax items resulting from the implementation of

restructuring initiatives and the vesting and exercise of employee

share-based compensation, any difference between the interim and

annual effective tax rate, and adjustments relating to prior

periods.

These adjustments are irregular in timing, and the variability

in amounts may not be indicative of past and future performance of

the Company and therefore are excluded for comparability

purposes.

Adjusted Earnings (Loss) Per Diluted ShareAdjusted earnings

(loss) (EPS) per diluted share is computed by dividing adjusted net

income (losses) attributable to Dentsply Sirona shareholders by the

diluted weighted average number of common shares outstanding.

Contact Information

Investors:Andrea DaleyVP, Investor

Relations+1-704-805-1293InvestorRelations@dentsplysirona.com

Press:Marion Par-WeixlbergerVP, Corporate Communications and

PR+43 676 848414588marion.parweixlberger@dentsplysirona.com

DENTSPLY SIRONA INC. AND

SUBSIDIARIES(unaudited)

A reconciliation of preliminary GAAP diluted EPS to Adjusted EPS

for the three months ended June 30, 2022, is as follows:

|

|

|

|

Per DilutedCommon Share |

|

|

|

|

|

| Net income

attributable to Dentsply Sirona |

|

$ |

≥ 0.26 |

|

Amortization of purchased intangible assets |

|

|

0.18 |

|

Restructuring program related costs and other costs |

|

|

0.13 |

|

Fair value and credit risk adjustments |

|

|

0.04 |

|

Income tax related adjustments |

|

|

(0.01) |

| Adjusted net

income |

|

$ |

≥ 0.60 |

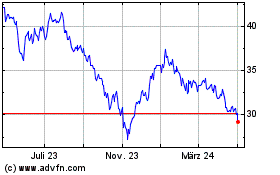

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

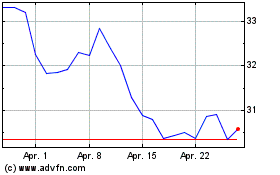

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024