- Reported net loss of $3.3 million and net income of $3.7

million for the three and nine months ended September 30, 2024,

respectively

- Adjusted EBITDA of $25.1 million and $87.3 million for the

three and nine months ended September 30, 2024, respectively

- Declares quarterly cash dividend of $0.005 per common unit

- On October 3, 2024, entered into a definitive agreement and

plan of merger with Martin Resource Management Corporation (“MRMC”)

whereby MRMC would acquire all outstanding common units of the

Partnership not already owned by MRMC and its subsidiaries

Martin Midstream Partners L.P. (Nasdaq: MMLP) (“MMLP” or the

“Partnership”) today announced its financial results for the third

quarter of 2024.

Bob Bondurant, President and Chief Executive Officer of Martin

Midstream GP LLC, the general partner of the Partnership (the

"General Partner"), stated, “I am pleased with the Partnership’s

third quarter financial results of $25.1 million in adjusted EBITDA

despite the slight miss of $1.3 million when compared to guidance

targeting $26.4 million in adjusted EBITDA. During the quarter, the

Partnership recorded an additional $1.4 million in expense, when

compared to guidance, related to our long-term incentive plans

which are tied to the fair market value of our common units. With

the exception of the Specialty Products division, financial results

were above guidance in all remaining segments when allowing for

this additional cost.”

“As we look to the coming months leading up to the potential

merger with MRMC, our team will remain dedicated to the execution

of our long-term strategy; and focused on enhancing the value we

provide to our customers, suppliers, and the communities where we

live and where our businesses operate.”

THIRD QUARTER 2024 OPERATING

RESULTS BY BUSINESS SEGMENT

Operating Income (Loss)

($M)

Credit Adjusted EBITDA

($M)

Adjusted EBITDA ($M)

Three Months Ended September

30,

2024

2023

2024

2023

2024

2023

(Amounts may not add or

recalculate due to rounding)

Business Segment:

Terminalling and Storage

$

2.7

$

3.1

$

8.4

$

8.2

$

8.4

$

8.2

Transportation

8.6

6.7

11.6

9.5

11.6

9.5

Sulfur Services

1.3

2.7

4.2

5.4

4.2

5.4

Specialty Products

3.9

6.0

4.6

6.8

4.6

6.8

Unallocated Selling, General and

Administrative Expense

(3.7

)

(3.8

)

(3.7

)

(3.8

)

(3.7

)

(3.8

)

$

12.7

$

14.7

$

25.1

$

26.2

$

25.1

$

26.2

Terminalling and storage adjusted EBITDA increased $0.2

million, primarily reflecting increased throughput at our shore

based terminals, offset by increased employee-related expenses.

Transportation adjusted EBITDA increased $2.1 million,

primarily reflecting higher day rates and utilization in our marine

division.

Sulfur services adjusted EBITDA decreased $1.2 million,

primarily reflecting decreased fertilizer volumes and margins,

offset by higher margins in our sulfur division.

Specialty products adjusted EBITDA decreased $2.2

million, primarily reflecting decreased margins in our lubricants

and grease divisions coupled with higher employee-related

expenses.

Unallocated selling, general, and administrative expense

decreased $0.1 million, reflecting reduced overhead expenses

allocated from MRMC.

CAPITALIZATION

September 30, 2024

December 31, 2023

($ in millions)

Debt Outstanding:

Revolving Credit Facility, Due February

2027 1

$

86.5

$

42.5

Finance lease obligations

0.1

—

11.50% Senior Secured Notes, Due February

2028

400.0

400.0

Total Debt Outstanding:

$

486.6

$

442.5

Summary Credit Metrics:

Revolving Credit Facility - Total

Capacity

$

150.0

$

175.0

Revolving Credit Facility - Available

Liquidity

$

54.4

$

109.0

Total Adjusted Leverage Ratio 2

4.14x

3.75x

Senior Leverage Ratio 2

0.74x

0.36x

Interest Coverage Ratio 2

2.23x

2.19x

1 The Partnership was in compliance with all debt covenants as

of September 30, 2024 and December 31, 2023. 2 As calculated under

the Partnership's revolving credit facility.

RESULTS OF OPERATIONS

SUMMARY

(in millions, except per unit

amounts)

Period

Net Income

(Loss)

Net Income (Loss) Per

Unit

Adjusted EBITDA

Credit Adjusted EBITDA

Net Cash Provided by (Used in)

Operating Activities

Distributable Cash

Flow

Revenues

Three Months Ended September 30, 2024

$

(3.3

)

$

(0.08

)

$

25.1

$

25.1

$

(15.8

)

$

2.4

$

170.9

Three Months Ended September 30, 2023

$

3.7

$

0.09

$

26.2

$

26.2

$

7.3

$

5.0

$

176.7

Reconciliation of Net Income (Loss) to

Adjusted EBITDA and Credit Adjusted EBITDA

(in millions)

Transportation

Terminalling &

Storage

Sulfur Services

Specialty Products

SG&A

Interest Expense

3Q 2024 Actual

Net income (loss)

$

8.6

$

2.7

$

1.3

$

3.9

$

(5.1

)

$

(14.6

)

$

(3.3

)

Interest expense add back

–

–

–

–

–

14.6

14.6

Income tax expense

–

–

–

–

1.4

–

1.4

Operating Income (loss)

8.6

2.7

1.3

3.9

(3.7

)

–

12.7

Depreciation and amortization

3.2

5.7

2.9

0.8

–

–

12.6

Gain on sale or disposition of property,

plant, and equipment

(0.1

)

–

–

(0.1

)

–

–

(0.2

)

Unit-based compensation

–

–

–

–

–

–

–

Adjusted EBITDA

11.6

8.4

4.2

4.6

(3.7

)

–

25.1

Less: net income (loss) associated with

butane optimization business

–

–

–

–

–

–

–

Plus: lower of cost or net realizable

value and other non-cash adjustments

–

–

–

–

–

–

–

Credit Adjusted EBITDA

$

11.6

$

8.4

$

4.2

$

4.6

$

(3.7

)

$

–

$

25.1

EBITDA, adjusted EBITDA, Credit Adjusted EBITDA, distributable

cash flow and adjusted free cash flow are non-GAAP financial

measures which are explained in greater detail below under the

heading "Use of Non-GAAP Financial Information." The Partnership

has also included below tables entitled "Reconciliation of Net

Income (Loss) to EBITDA, Adjusted EBITDA, and Credit Adjusted

EBITDA” and “Reconciliation of Net Cash Provided by Operating

Activities to Adjusted EBITDA, Credit Adjusted EBITDA,

Distributable Cash Flow, and Adjusted Free Cash Flow” in order to

show the components of these non-GAAP financial measures and their

reconciliation to the most comparable GAAP measurement.

An attachment included in the Current Report on Form 8-K to

which this announcement is included contains a comparison of the

Partnership’s adjusted EBITDA for the third quarter 2024 to the

Partnership's adjusted EBITDA guidance for the third quarter

2024.

QUARTERLY CASH DISTRIBUTION

The Partnership has declared a quarterly cash distribution of

$0.005 per unit for the quarter ended September 30, 2024. The

distribution is payable on November 14, 2024, to common unitholders

of record as of the close of business on November 7, 2024. The

ex-dividend date for the cash distribution is November 7, 2024.

Qualified Notice to Nominees

This release is intended to serve as qualified notice under

Treasury Regulation Section 1.1446-4(b)(4) and (d). Brokers and

nominees should treat one hundred percent (100%) of MMLP’s

distributions to non-U.S. investors as being attributable to income

that is effectively connected with a United States trade or

business. Accordingly, MMLP’s distributions to non-U.S. investors

are subject to federal income tax withholding at the highest

applicable effective tax rate. For purposes of Treasury Regulation

section 1.1446(f)-4(c)(2)(iii), brokers and nominees should treat

one hundred percent (100%) of the distributions as being in excess

of cumulative net income for purposes of determining the amount to

withhold. Nominees, and not Martin Midstream Partners L.P.,

are treated as withholding agents responsible for any necessary

withholding on amounts received by them on behalf of foreign

investors.

MERGER AGREEMENT WITH MARTIN RESOURCE

MANAGEMENT CORPORATION

On October 3, 2024, the Partnership announced that it has

entered into a definitive agreement and plan of merger (“Merger

Agreement”) pursuant to which MRMC would acquire all of the

outstanding common units of MMLP not already owned by MRMC and its

subsidiaries (the “Public Common Units”). The Merger Agreement

follows the offer made by MRMC in May 2024 to acquire the Public

Common Units.

Investors' Conference Call

Date: Thursday, October 17, 2024 Time:

8:00 a.m. CT (please dial in by 7:55 a.m.) Dial In #:

(800) 715-9871 Conference ID: 8536096 Replay Dial In

# (800) 770-2030 – Conference ID: 8536096

A webcast of the conference call along with the Third Quarter

2024 Earnings Summary will also be available by visiting the Events

and Presentations section under Investor Relations on our website

at www.MMLP.com.

About Martin Midstream Partners

Martin Midstream Partners L.P., headquartered in Kilgore, Texas,

is a publicly traded limited partnership with a diverse set of

operations focused primarily in the Gulf Coast region of the United

States. MMLP’s primary business lines include: (1) terminalling,

processing, and storage services for petroleum products and

by-products; (2) land and marine transportation services for

petroleum products and by-products, chemicals, and specialty

products; (3) sulfur and sulfur-based products processing,

manufacturing, marketing and distribution; and (4) marketing,

distribution, and transportation services for natural gas liquids

and blending and packaging services for specialty lubricants and

grease. To learn more, visit www.MMLP.com. Follow Martin Midstream

Partners L.P. on LinkedIn, Facebook, and X (formerly known as

Twitter).

Forward-Looking Statements

Statements about the Partnership’s outlook and all other

statements in this release other than historical facts are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements and all references to financial estimates rely on a

number of assumptions concerning future events and are subject to a

number of uncertainties, including (i) the effects of the continued

volatility of commodity prices and the related macroeconomic and

political environment, (ii) the ability of the parties to

consummate the transactions contemplated by the Merger Agreement in

the anticipated timeframe or at all, including MRMC’s ability to

fund the aggregate merger consideration; risks related to the

satisfaction or waiver of the conditions to closing the transaction

in the anticipated timeframe or at all; risks related to obtaining

the requisite regulatory approval and Partnership unitholder

approval; disruption from the transaction making it more difficult

to maintain business and operational relationships; significant

transaction costs associated with the transaction; and the risk of

litigation and/or regulatory actions related to the transaction,

(iii) uncertainties relating to the Partnership’s future cash flows

and operations, (iv) the Partnership’s ability to pay future

distributions, (v) future market conditions, (vi) current and

future governmental regulation, (vii) future taxation, and (viii)

other factors, many of which are outside its control, which could

cause actual results to differ materially from such statements.

While the Partnership believes that the assumptions concerning

future events are reasonable, it cautions that there are inherent

difficulties in anticipating or predicting certain important

factors. A discussion of these factors, including risks and

uncertainties, is set forth in the Partnership’s annual and

quarterly reports filed from time to time with the Securities and

Exchange Commission (the “SEC”). The Partnership disclaims any

intention or obligation to revise any forward-looking statements,

including financial estimates, whether as a result of new

information, future events, or otherwise except where required to

do so by law.

Use of Non-GAAP Financial Information

To assist management in assessing our business, we use the

following non-GAAP financial measures: earnings before interest,

taxes, and depreciation and amortization ("EBITDA"), adjusted

EBITDA (as defined below), Credit Adjusted EBITDA (as defined

below), distributable cash flow available to common unitholders

(“Distributable Cash Flow”), and free cash flow after growth

capital expenditures and principal payments under finance lease

obligations ("Adjusted Free Cash Flow"). Our management uses a

variety of financial and operational measurements other than our

financial statements prepared in accordance with U.S. GAAP to

analyze our performance.

Certain items excluded from EBITDA and Adjusted EBITDA are

significant components in understanding and assessing an entity's

financial performance, such as cost of capital and historical costs

of depreciable assets.

EBITDA, Adjusted EBITDA and Credit Adjusted EBITDA. We define

Adjusted EBITDA as EBITDA before unit-based compensation expenses,

gains and losses on the disposition of property, plant and

equipment, impairment and other similar non-cash adjustments.

Adjusted EBITDA is used as a supplemental performance and liquidity

measure by our management and by external users of our financial

statements, such as investors, commercial banks, research analysts,

and others, to assess:

- the financial performance of our assets without regard to

financing methods, capital structure, or historical cost

basis;

- the ability of our assets to generate cash sufficient to pay

interest costs, support our indebtedness, and make cash

distributions to our unitholders; and

- our operating performance and return on capital as compared to

those of other companies in the midstream energy sector, without

regard to financing methods or capital structure.

We define Credit Adjusted EBITDA as Adjusted EBITDA excluding

net income (loss) and the lower of cost or net realizable value and

other non-cash adjustments associated with the butane optimization

business, which we exited during the second quarter of 2023. Credit

Adjusted EBITDA is used as a supplemental performance and liquidity

measure by our management and by external users of our financial

statements, such as investors, commercial banks, research analysts,

and others to provide additional information regarding the

calculation of, and compliance with, certain financial covenants in

the Partnership’s Third Amended and Restated Credit Agreement.

The GAAP measures most directly comparable to adjusted EBITDA

and Credit Adjusted EBITDA are net income (loss) and net cash

provided by (used in) operating activities. Adjusted EBITDA and

Credit Adjusted EBITDA should not be considered an alternative to,

or more meaningful than, net income (loss), operating income

(loss), net cash provided by (used in) operating activities, or any

other measure of financial performance presented in accordance with

GAAP. Adjusted EBITDA and Credit Adjusted EBITDA may not be

comparable to similarly titled measures of other companies because

other companies may not calculate Adjusted EBITDA in the same

manner.

Adjusted EBITDA does not include interest expense, income tax

expense, and depreciation and amortization. Because we have

borrowed money to finance our operations, interest expense is a

necessary element of our costs and our ability to generate cash

available for distribution. Because we have capital assets,

depreciation and amortization are also necessary elements of our

costs. Therefore, any measures that exclude these elements have

material limitations. To compensate for these limitations, we

believe that it is important to consider net income (loss) and net

cash provided by (used in) operating activities as determined under

GAAP, as well as adjusted EBITDA, to evaluate our overall

performance.

Distributable Cash Flow. We define Distributable Cash Flow as

Net Cash Provided by (Used in) Operating Activities less cash

received (plus cash paid) for closed commodity derivative positions

included in Accumulated Other Comprehensive Income (Loss), plus

changes in operating assets and liabilities which (provided) used

cash, less maintenance capital expenditures and plant turnaround

costs. Distributable Cash Flow is a significant performance measure

used by our management and by external users of our financial

statements, such as investors, commercial banks and research

analysts, to compare basic cash flows generated by us to the cash

distributions we expect to pay unitholders. Distributable Cash Flow

is also an important financial measure for our unitholders since it

serves as an indicator of our success in providing a cash return on

investment. Specifically, this financial measure indicates to

investors whether or not we are generating cash flow at a level

that can sustain or support an increase in our quarterly

distribution rates. Distributable Cash Flow is also a quantitative

standard used throughout the investment community with respect to

publicly-traded partnerships because the value of a unit of such an

entity is generally determined by the unit's yield, which in turn

is based on the amount of cash distributions the entity pays to a

unitholder.

Adjusted Free Cash Flow. We define Adjusted Free Cash Flow as

Distributable Cash Flow less growth capital expenditures and

principal payments under finance lease obligations. Adjusted Free

Cash Flow is a significant performance measure used by our

management and by external users of our financial statements and

represents how much cash flow a business generates during a

specified time period after accounting for all capital

expenditures, including expenditures for growth and maintenance

capital projects. We believe that Adjusted Free Cash Flow is

important to investors, lenders, commercial banks and research

analysts since it reflects the amount of cash available for

reducing debt, investing in additional capital projects, paying

distributions, and similar matters. Our calculation of Adjusted

Free Cash Flow may or may not be comparable to similarly titled

measures used by other entities.

The GAAP measure most directly comparable to Distributable Cash

Flow and Adjusted Free Cash Flow is Net Cash Provided by (Used in)

Operating Activities. Distributable Cash Flow and Adjusted Free

Cash Flow should not be considered alternatives to, or more

meaningful than, Net Income (Loss), Operating Income (Loss), Net

Cash Provided by (Used in) Operating Activities, or any other

measure of liquidity presented in accordance with GAAP.

Distributable Cash Flow and Adjusted Free Cash Flow have important

limitations because they exclude some items that affect Net Income

(Loss), Operating Income (Loss), and Net Cash Provided by (Used in)

Operating Activities. Distributable Cash Flow and Adjusted Free

Cash Flow may not be comparable to similarly titled measures of

other companies because other companies may not calculate these

non-GAAP metrics in the same manner. To compensate for these

limitations, we believe that it is important to consider Net Cash

Provided by (Used in) Operating Activities determined under GAAP,

as well as Distributable Cash Flow and Adjusted Free Cash Flow, to

evaluate our overall liquidity.

MMLP-F

MARTIN MIDSTREAM PARTNERS

L.P.

CONSOLIDATED AND CONDENSED

BALANCE SHEETS

(Dollars in thousands)

September 30, 2024

December 31, 2023

(Unaudited)

(Audited)

Assets

Cash

$

56

$

54

Accounts and other receivables, less

allowance for doubtful accounts of $704 and $530, respectively

70,041

53,293

Inventories

43,037

43,822

Due from affiliates

23,522

7,924

Other current assets

12,156

9,220

Total current assets

148,812

114,313

Property, plant and equipment, at cost

948,185

918,786

Accumulated depreciation

(640,407

)

(612,993

)

Property, plant and equipment, net

307,778

305,793

Goodwill

16,671

16,671

Right-of-use assets

61,521

60,359

Investment in DSM Semichem LLC

7,624

—

Deferred income taxes, net

10,043

10,200

Other assets, net

2,308

2,039

Total assets

$

554,757

$

509,375

Liabilities and Partners’

Capital (Deficit)

Current installments of long-term debt and

finance lease obligations

$

14

$

—

Trade and other accounts payable

60,995

51,653

Product exchange payables

—

426

Due to affiliates

1,388

6,334

Income taxes payable

1,315

652

Other accrued liabilities

31,157

41,499

Total current liabilities

94,869

100,564

Long-term debt, net

469,269

421,173

Finance lease obligations

58

—

Operating lease liabilities

44,549

45,684

Other long-term obligations

7,354

6,578

Total liabilities

616,099

573,999

Commitments and contingencies

Partners’ capital (deficit)

(61,342

)

(64,624

)

Total liabilities and partners' capital

(deficit)

$

554,757

$

509,375

MARTIN MIDSTREAM PARTNERS

L.P.

CONSOLIDATED AND CONDENSED

STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in thousands, except

per unit amounts)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenues:

Terminalling and storage *

$

22,562

$

22,202

$

67,454

$

64,744

Transportation *

56,506

55,223

172,489

165,696

Sulfur services

3,477

3,358

10,431

10,073

Product sales: *

Specialty products

67,206

66,695

200,819

277,836

Sulfur services

21,183

29,219

85,102

98,513

88,389

95,914

285,921

376,349

Total revenues

170,934

176,697

536,295

616,862

Costs and expenses:

Cost of products sold: (excluding

depreciation and amortization)

Specialty products *

58,409

56,298

173,192

245,863

Sulfur services *

12,545

19,461

52,178

66,932

Terminalling and storage *

23

23

65

54

70,977

75,782

225,435

312,849

Expenses:

Operating expenses *

62,363

64,375

191,655

187,857

Selling, general and administrative *

12,494

10,424

32,108

30,043

Depreciation and amortization

12,608

12,223

37,944

37,671

Total costs and expenses

158,442

162,804

487,142

568,420

Gain on disposition or sale of property,

plant and equipment

159

811

1,320

1,096

Operating income

12,651

14,704

50,473

49,538

Other income (expense):

Interest expense, net

(14,592

)

(14,994

)

(42,811

)

(45,914

)

Loss on extinguishment of debt

—

—

—

(5,121

)

Equity in earnings (loss) of DSM Semichem

LLC

(314

)

—

(314

)

—

Other, net

2

17

20

50

Total other expense

(14,904

)

(14,977

)

(43,105

)

(50,985

)

Net income (loss) before taxes

(2,253

)

(273

)

7,368

(1,447

)

Income tax expense

(1,066

)

(788

)

(3,634

)

(3,619

)

Net income (loss)

(3,319

)

(1,061

)

3,734

(5,066

)

Less general partner's interest in net

income (loss)

66

21

(75

)

101

Less income (loss) allocable to unvested

restricted units

14

4

(14

)

16

Limited partners' interest in net income

(loss)

$

(3,239

)

$

(1,036

)

$

3,645

$

(4,949

)

Net income (loss) per unit attributable to

limited partners - basic and diluted

$

(0.08

)

$

(0.03

)

$

0.09

$

(0.13

)

Weighted average limited partner units -

basic

38,832,222

38,772,266

38,831,064

38,771,451

Weighted average limited partner units -

diluted

38,832,222

38,772,266

38,909,976

38,771,451

*Related Party Transactions Shown

Below

MARTIN MIDSTREAM PARTNERS

L.P.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(Dollars in thousands, except

per unit amounts)

*Related Party Transactions Included

Above

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenues:*

Terminalling and storage

$

17,785

$

18,542

$

54,412

$

54,121

Transportation

7,975

7,426

24,894

20,214

Product Sales

91

122

343

8,544

Costs and expenses:*

Cost of products sold: (excluding

depreciation and amortization)

Specialty products

8,401

9,896

23,342

27,324

Sulfur services

3,014

2,787

8,926

8,139

Terminalling and storage

23

23

65

54

Expenses:

Operating expenses

26,153

25,606

79,077

74,491

Selling, general and administrative

12,215

8,477

27,716

23,549

MARTIN MIDSTREAM PARTNERS

L.P.

CONSOLIDATED AND CONDENSED

STATEMENTS OF CAPITAL (DEFICIT)

(Unaudited)

(Dollars in thousands)

Partners’ Capital

(Deficit)

Common Limited

General Partner Amount

Units

Amount

Total

Balances - June 30, 2024

39,001,086

$

(59,557

)

$

1,691

$

(57,866

)

Net loss

—

(3,253

)

(66

)

(3,319

)

Cash distributions

—

(195

)

(4

)

(199

)

Unit-based compensation

—

42

—

42

Balances - September 30, 2024

39,001,086

(62,963

)

1,621

(61,342

)

Balances - December 31, 2023

38,914,806

$

(66,182

)

$

1,558

$

(64,624

)

Net income

—

3,659

75

3,734

Issuance of restricted units

86,280

—

—

—

Cash distributions

—

(585

)

(12

)

(597

)

Unit-based compensation

—

145

—

145

Balances - September 30, 2024

39,001,086

$

(62,963

)

$

1,621

$

(61,342

)

Partners’ Capital

(Deficit)

Common Limited

General Partner Amount

Units

Amount

Total

Balances - June 30, 2023

38,914,806

$

(65,334

)

$

1,577

$

(63,757

)

Net loss

—

(1,040

)

(21

)

(1,061

)

Cash distributions

—

(194

)

(4

)

(198

)

Unit-based compensation

—

37

—

37

Balances - September 30, 2023

38,914,806

(66,531

)

1,552

(64,979

)

Balances - December 31, 2022

38,850,750

$

(61,110

)

$

1,665

$

(59,445

)

Net loss

—

(4,965

)

(101

)

(5,066

)

Issuance of restricted units

64,056

—

—

—

Cash distributions

—

(583

)

(12

)

(595

)

Unit-based compensation

—

127

—

127

Balances - September 30, 2023

38,914,806

$

(66,531

)

$

1,552

$

(64,979

)

MARTIN MIDSTREAM PARTNERS

L.P.

CONSOLIDATED AND CONDENSED

STATEMENTS OF CASH FLOWS

(Unaudited)

(Dollars in thousands)

Nine Months Ended

September 30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

3,734

$

(5,066

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

37,944

37,671

Amortization of deferred debt issuance

costs

2,311

3,206

Amortization of debt discount

1,800

1,600

Deferred income tax expense

157

2,322

Gain on disposition or sale of property,

plant and equipment, net

(1,320

)

(1,096

)

Loss on extinguishment of debt

—

5,121

Equity in (earnings) loss of DSM Semichem

LLC

314

—

Non cash unit-based compensation

145

127

Change in current assets and liabilities,

excluding effects of acquisitions and dispositions:

Accounts and other receivables

(16,748

)

19,190

Inventories

591

68,099

Due from affiliates

(15,598

)

5,914

Other current assets

(373

)

5,282

Trade and other accounts payable

9,867

(24,709

)

Product exchange payables

(426

)

743

Due to affiliates

(4,946

)

(804

)

Income taxes payable

663

(204

)

Other accrued liabilities

(12,632

)

(10,311

)

Change in other non-current assets and

liabilities

701

(1,020

)

Net cash provided by operating

activities

6,184

106,065

Cash flows from investing activities:

Payments for property, plant and

equipment

(34,058

)

(25,294

)

Payments for plant turnaround costs

(9,599

)

(2,367

)

Investment in DSM Semichem LLC

(6,938

)

—

Proceeds from sale of property, plant and

equipment

953

5,183

Net cash used in investing activities

(49,642

)

(22,478

)

Cash flows from financing activities:

Payments of long-term debt

(173,000

)

(579,197

)

Payments under finance lease

obligations

(5

)

(9

)

Proceeds from long-term debt

217,077

510,489

Payment of debt issuance costs

(15

)

(14,266

)

Cash distributions paid

(597

)

(595

)

Net cash provided by (used in) financing

activities

43,460

(83,578

)

Net increase in cash

2

9

Cash at beginning of period

54

45

Cash at end of period

$

56

$

54

Non-cash additions to property, plant and

equipment

$

2,418

$

2,369

Non-cash contribution of land to DSM

Semichem LLC

$

1,000

$

—

MARTIN MIDSTREAM PARTNERS

L.P.

SEGMENT OPERATING

INCOME

(Unaudited)

(Dollars and volumes in

thousands, except BBL per day)

Terminalling and Storage

Segment

Comparative Results of

Operations for the Three Months Ended September 30, 2024 and

2023

Three Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands, except BBL per

day)

Revenues

$

24,414

$

23,973

$

441

2

%

Cost of products sold

23

23

—

—

%

Operating expenses

14,857

15,078

(221

)

(1

)%

Selling, general and administrative

expenses

1,130

628

502

80

%

Depreciation and amortization

5,695

5,102

593

12

%

2,709

3,142

(433

)

(14

)%

Loss on disposition or sale of property,

plant and equipment

(34

)

(35

)

1

3

%

Operating income

$

2,675

$

3,107

$

(432

)

(14

)%

Shore-based throughput volumes

(gallons)

42,242

40,655

1,587

4

%

Smackover refinery throughput volumes

(guaranteed minimum BBL per day)

6,500

6,500

—

—

%

Comparative Results of

Operations for the Nine Months Ended September 30, 2024 and

2023

Nine Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands, except BBL per

day)

Revenues

$

73,101

$

71,798

$

1,303

2

%

Cost of products sold

65

54

11

20

%

Operating expenses

45,414

43,318

2,096

5

%

Selling, general and administrative

expenses

2,232

1,510

722

48

%

Depreciation and amortization

16,819

15,896

923

6

%

8,571

11,020

(2,449

)

(22

)%

Gain (loss) on disposition or sale of

property, plant and equipment

1,063

(359

)

1,422

396

%

Operating income

$

9,634

$

10,661

$

(1,027

)

(10

)%

Shore-based throughput volumes

(gallons)

130,502

126,438

4,064

3

%

Smackover refinery throughput volumes

(guaranteed minimum) (BBL per day)

6,500

6,500

—

—

%

Transportation Segment

Comparative Results of

Operations for the Three Months Ended September 30, 2024 and

2023

Three Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands)

Revenues

$

60,196

$

58,541

$

1,655

3

%

Operating expenses

45,138

46,465

(1,327

)

(3

)%

Selling, general and administrative

expenses

3,423

2,571

852

33

%

Depreciation and amortization

3,182

3,674

(492

)

(13

)%

8,453

5,831

2,622

45

%

Gain on disposition or sale of property,

plant and equipment

130

846

(716

)

(85

)%

Operating income

$

8,583

$

6,677

$

1,906

29

%

Comparative Results of

Operations for the Nine Months Ended September 30, 2024 and

2023

Nine Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands)

Revenues

$

183,705

$

178,875

$

4,830

3

%

Operating expenses

139,562

136,940

2,622

2

%

Selling, general and administrative

expenses

8,150

7,101

1,049

15

%

Depreciation and amortization

10,039

11,196

(1,157

)

(10

)%

$

25,954

$

23,638

$

2,316

10

%

Gain on disposition or sale of property,

plant and equipment

496

1,497

(1,001

)

(67

)%

Operating income

$

26,450

$

25,135

$

1,315

5

%

Sulfur Services Segment

Comparative Results of

Operations for the Three Months Ended September 30, 2024 and

2023

Three Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands)

Revenues:

Services

$

3,477

$

3,358

$

119

4

%

Products

21,183

29,219

(8,036

)

(28

)%

Total revenues

24,660

32,577

(7,917

)

(24

)%

Cost of products sold

15,292

21,972

(6,680

)

(30

)%

Operating expenses

3,089

3,510

(421

)

(12

)%

Selling, general and administrative

expenses

2,091

1,713

378

22

%

Depreciation and amortization

2,937

2,639

298

11

%

1,251

2,743

(1,492

)

(54

)%

Gain on disposition or sale of property,

plant and equipment

3

—

3

Operating income

$

1,254

$

2,743

$

(1,489

)

(54

)%

Sulfur (long tons)

113

155

(42

)

(27

)%

Fertilizer (long tons)

29

58

(29

)

(50

)%

Total sulfur services volumes (long

tons)

142

213

(71

)

(33

)%

Comparative Results of

Operations for the Nine Months Ended September 30, 2024 and

2023

Nine Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands)

Revenues:

Services

$

10,431

$

10,073

$

358

4

%

Products

85,103

98,513

(13,410

)

(14

)%

Total revenues

95,534

108,586

(13,052

)

(12

)%

Cost of products sold

60,246

74,062

(13,816

)

(19

)%

Operating expenses

8,773

9,595

(822

)

(9

)%

Selling, general and administrative

expenses

5,111

4,292

819

19

%

Depreciation and amortization

8,697

8,072

625

8

%

12,707

12,565

142

1

%

Gain (loss) on disposition or sale of

property, plant and equipment

(305

)

17

(322

)

(1,894

)%

Operating income

$

12,402

$

12,582

$

(180

)

(1

)%

Sulfur (long tons)

296

352

(56

)

(16

)%

Fertilizer (long tons)

165

192

(27

)

(14

)%

Total sulfur services volumes (long

tons)

461

544

(83

)

(15

)%

Specialty Products Segment

Comparative Results of

Operations for the Three Months Ended September 30, 2024 and

2023

Three Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands)

Products revenues

$

67,225

$

66,720

$

505

1

%

Cost of products sold

60,445

58,177

2,268

4

%

Operating expenses

30

23

7

30

%

Selling, general and administrative

expenses

2,135

1,698

437

26

%

Depreciation and amortization

794

808

(14

)

(2

)%

3,821

6,014

(2,193

)

(36

)%

Gain on disposition or sale of property,

plant and equipment

60

—

60

Operating income

$

3,881

$

6,014

$

(2,133

)

(35

)%

NGL sales volumes (Bbls)

582

509

73

14

%

Other specialty products volumes

(Bbls)

91

106

(15

)

(14

)%

Total specialty products volumes

(Bbls)

673

615

58

9

%

Comparative Results of

Operations for the Nine Months Ended September 30, 2024 and

2023

Nine Months Ended September

30,

Variance

Percent Change

2024

2023

(In thousands)

Products revenues

$

200,888

$

277,895

$

(77,007

)

(28

)%

Cost of products sold

179,800

256,898

(77,098

)

(30

)%

Operating expenses

81

55

26

47

%

Selling, general and administrative

expenses

5,300

5,287

13

—

%

Depreciation and amortization

2,389

2,507

(118

)

(5

)%

13,318

13,148

170

1

%

Gain (loss) on disposition or sale of

property, plant and equipment

66

(59

)

125

212

%

Operating income

$

13,384

$

13,089

$

295

2

%

NGL sales volumes (Bbls)

1,744

3,027

(1,283

)

(42

)%

Other specialty products volumes

(Bbls)

263

280

(17

)

(6

)%

Total specialty products volumes

(Bbls)

2,007

3,307

(1,300

)

(39

)%

Unallocated Selling, General and Administrative

Expenses

Comparative Results of

Operations for the Three and Nine Months Ended September 30, 2024

and 2023

Three Months Ended September

30,

Variance

Percent Change

Nine Months Ended September

30,

Variance

Percent Change

2024

2023

2024

2023

(In thousands)

(In thousands)

Indirect selling, general and

administrative expenses

$

3,742

$

3,837

$

(95

)

(2

)%

$

11,397

$

11,929

$

(532

)

(4

)%

Non-GAAP Financial Measures

The following tables reconcile the non-GAAP financial

measurements used by management to our most directly comparable

GAAP measures for the three and nine months ended September 30,

2024 and 2023, which represents EBITDA, adjusted EBITDA, Credit

Adjusted EBITDA, distributable cash flow, and adjusted free cash

flow:

Reconciliation of Net Income

(Loss) to EBITDA, Adjusted EBITDA, and Credit Adjusted

EBITDA

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands)

(in thousands)

Net income (loss)

$

(3,319

)

$

(1,061

)

$

3,734

$

(5,066

)

Adjustments:

Interest expense

14,592

14,994

42,811

45,914

Income tax expense

1,066

788

3,634

3,619

Depreciation and amortization

12,608

12,223

37,944

37,671

EBITDA

24,947

26,944

88,123

82,138

Adjustments:

Gain on disposition or sale of property,

plant and equipment

(159

)

(811

)

(1,320

)

(1,096

)

Loss on extinguishment of debt

—

—

—

5,121

Equity in (earnings) loss of DSM Semichem

LLC

314

—

314

—

Lower of cost or net realizable value and

other non-cash adjustments

—

—

—

(12,850

)

Unit-based compensation

42

37

145

127

Adjusted EBITDA

$

25,144

$

26,170

$

87,262

$

73,440

Adjustments:

Less: net loss associated with butane

optimization business

—

—

—

2,255

Plus: lower of cost or net realizable

value and other non-cash adjustments

—

$

—

—

12,850

Credit Adjusted EBITDA

$

25,144

$

26,170

$

87,262

$

88,545

Reconciliation of Net Cash

Provided by Operating Activities to Adjusted EBITDA, Credit

Adjusted EBITDA,

Distributable Cash Flow, and

Adjusted Free Cash Flow

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(in thousands)

(in thousands)

Net cash provided by (used in)

operating activities

$

(15,753

)

$

7,291

$

6,184

$

106,065

Interest expense 1

13,220

13,623

38,700

41,108

Current income tax expense

935

333

3,477

1,297

Lower of cost or net realizable value and

other non-cash adjustments

—

—

—

(12,850

)

Changes in operating assets and

liabilities which (provided) used cash:

Accounts and other receivables,

inventories, and other current assets

22,489

(5,983

)

32,128

(98,485

)

Trade, accounts and other payables, and

other current liabilities

4,032

11,155

7,474

35,285

Other

221

(249

)

(701

)

1,020

Adjusted EBITDA

25,144

26,170

87,262

73,440

Adjustments:

Less: net loss associated with butane

optimization business

—

—

—

2,255

Plus: lower of cost or net realizable

value and other non-cash adjustments

—

—

—

12,850

Credit Adjusted EBITDA

25,144

26,170

87,262

88,545

Adjustments:

Interest expense

(14,592

)

(14,994

)

(42,811

)

(45,914

)

Income tax expense

(1,066

)

(788

)

(3,634

)

(3,619

)

Deferred income taxes

131

455

157

2,322

Amortization of debt discount

600

600

1,800

1,600

Amortization of deferred debt issuance

costs

772

771

2,311

3,206

Payments for plant turnaround costs

(2,894

)

(1,706

)

(9,599

)

(2,367

)

Maintenance capital expenditures

(5,738

)

(5,516

)

(17,949

)

(19,588

)

Distributable cash flow

2,357

4,992

17,537

24,185

Principal payments under finance lease

obligations

(4

)

—

(5

)

(9

)

Investment in DSM Semichem LLC

—

—

(6,938

)

—

Expansion capital expenditures

(3,903

)

(3,444

)

(15,584

)

(6,126

)

Adjusted free cash flow

$

(1,550

)

$

1,548

$

(4,990

)

$

18,050

1 Net of amortization of debt issuance costs and discount, which

are included in interest expense but not included in net cash

provided by (used in) operating activities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016537515/en/

Sharon Taylor - Executive Vice President & Chief Financial

Officer (877) 256-6644 ir@mmlp.com

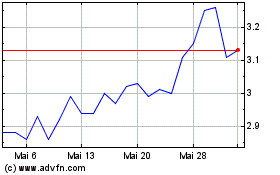

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Martin Midstream Partners (NASDAQ:MMLP)

Historical Stock Chart

Von Nov 2023 bis Nov 2024