Interim Financial Report 2022/2023

Regulated information, Leuven, 27 January 2023 (17.40 hrs

CET)

Interim Financial Report 2022/2023

KBC Ancora

recorded a profit of EUR 71.3 million in the first half of

the financial year 2022/2023. This compared with a profit of EUR

223.9 million in the same period in the previous financial year.

The difference is attributable principally to the fact that KBC

Group, in line with its dividend policy, distributed an interim

dividend of EUR 1.00 per KBC Group share in November 2022 in

respect of its financial year 2022. In November 2021, KBC Group

decided to distribute both an interim dividend of EUR 1.0 per share

in respect of the financial year 2021 and an additional dividend of

EUR 2.0 per share in respect of the financial year

2020.

Abridged financial summaries and

notes1

Results for the first half of financial

year 2022/2023

|

|

1H FY(x EUR 1,000) |

2022/2023per share(in EUR) |

1H FY(x EUR 1,000) |

2021/2022per share(in EUR) |

| Income |

77,523 |

0.99 |

232,576 |

2.97 |

|

Operating income |

7 |

0.00 |

27 |

0.00 |

|

Recurring financial incomeDividends from financial fixed

assets |

77,516 |

0.99 |

232,549 |

2.97 |

| Expenses |

-6,214 |

-0.08 |

-8,667 |

-0.11 |

|

Operating costs |

-1,578 |

-0.02 |

-1,733 |

-0.02 |

|

Financial expenses |

-4,636 |

-0.06 |

-6,934 |

-0.09 |

| Result after

taxes |

71,309 |

0.91 |

223,910 |

2.86 |

| Distribution of interim

dividend |

0 |

0.00 |

180,093 |

2.30 |

| Number of shares in

issue* |

|

78,301,314 |

|

78,301,314 |

| Number of shares with dividend

entitlement at balance sheet date |

|

77,350,759 |

|

78,184,128 |

* No instruments have been issued which could

lead to

dilution.

KBC Ancora recorded a profit of EUR 71.3 million

in the first six months of the current financial year, equivalent

to EUR 0.91 per share, compared with a profit of EUR 223.9 million

in the same period in the previous financial year.

Income consisted principally of dividend

received on the participating interest in KBC Group (EUR 77.5

million). Expenses were made up mainly of interest charges on debt

(EUR 4.6 million), operating costs (EUR 1.3 million) and tax on

securities accounts (EUR 0.3 million).

Balance sheet at 31 December

2022

| (x EUR 1,000) |

31.12.2022 |

*30.06.2022 |

| BALANCE SHEET

TOTAL |

3,756,143 |

3,680,265 |

| Assets |

|

|

| Fixed

assets |

3,599,979 |

3,599,979 |

| Current

assets |

156,164 |

80,287 |

|

Liabilities |

|

|

| Equity |

3,507,628 |

3,436,319 |

| Contribution |

2,021,871 |

2,021,871 |

| Unavailable reserves |

1,312,315 |

1,282,494 |

| Available reserves |

101,890 |

131,711 |

| Profit (loss) carried

forward |

243 |

243 |

| Result for the period |

71,309 |

n/a |

|

Creditors |

248,515 |

243,947 |

| Amounts falling due after more

than one year |

243,000 |

243,000 |

| Amounts falling due within one

year |

222 |

190 |

| Accrued expense and deferred

income |

5,294 |

756 |

* The balance sheet at 30 June 2022 is shown

after appropriation of the

result.

The balance sheet total at 31 December 2022

stood at EUR 3.8 billion, an increase of EUR 75.9 million compared

with the end of the financial year 2021/2022.

The number of shares held by KBC Ancora in KBC

Group remained unchanged at 77,516,380. The book value of these

shares amounted to (the historical book value of) EUR 46.44 per

share. The stock price of the KBC Group share stood at EUR 60.08 on

31 December 2022, while the IFRS equity value amounted to EUR 44.5

per KBC Group share on 30 September 2022.

Current assets increased by EUR 75.9 million,

due to a combination of an increase of EUR 29.8 million in treasury

shares to EUR 34.2 million and a rise in cash at bank and in hand

of EUR 46.1 million to EUR 122.0 million.

Equity increased by EUR 71.3 million, being the

result for the first six months of the current financial year. In

view of the progress of the share repurchase programme, an amount

of EUR 29.8 million was transferred from the available reserves to

an unavailable reserve for treasury shares. Debt increased by EUR

4.6 million, principally due to the pro rata application of

interest charges in respect of the first six months of the

financial year.

Interim report on the first six months

of the current financial year 2022/2023

Notes on the first half of the current

financial year 2022/2023

Results for the first six months of the

financial year 2022/2023

KBC Ancora recorded a profit of EUR 71.3 million

in the first six months of the current financial year, compared

with a profit of EUR 223.9 million in the same period in the

previous financial year.

This result was influenced principally by the

following factors:

- An interim

dividend of EUR 1.00 per KBC Group share in respect of the

financial year 2022. In the same period in the previous financial

year, KBC Group distributed a dividend of EUR 1.00 per KBC Group

share in respect of the financial year 2021, plus an additional

dividend of EUR 2.00 per KBC share in respect of the financial year

2020.

- Interest charges

amounting to EUR 4.6 million, EUR 2.4 million less than in the same

period in the previous year owing to the repayment of loans

totalling EUR 100 million in May 2022.

- Operating expenses amounting to EUR

1.6 million, EUR 0.2 million less than in the same period in the

previous financial year. The operating expenses consisted primarily

of costs incurred under the cost-sharing agreement with Cera (EUR

1.0 million). In addition, there were the usual costs such as

listing fees and management expenses. There was also a tax

liability of EUR 0.3 million on the securities accounts in the

first half of the financial year.

Participating interest in KBC Group, net debt

position and net asset value

The number of KBC Group shares in portfolio

remained unchanged during the past six months at 77,516,380.

Under the share repurchase programme launched on

10 June 2022 (to a total amount of EUR 50 million), KBC Ancora

purchased 833,369 KBC Ancora shares on the stock exchange during

the first half of the current accounting year, for a total amount

of EUR 29.8 million. At year-end 2022, KBC Ancora had repurchased

950,555 shares for a total amount of EUR 34.2 million.

The net asset value of the KBC Ancora share

corresponds to 1.002 times2 the price of the KBC Group share, less

the net debt3 per share. KBC Ancora’s net debt position at 31

December 2022 stood at EUR 1.64 per share.

Based on the stock price of the KBC Group share

on 31 December 2022 (EUR 60.08), the net asset value of one KBC

Ancora share amounted to EUR 58.57, and the KBC Ancora share (EUR

42.12) was trading at a discount of 28.1% to the net asset

value.

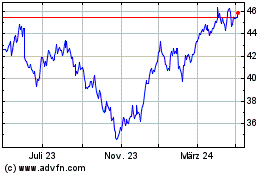

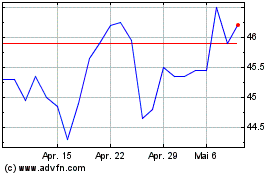

The following charts illustrate the movements in

the price of the KBC Group and KBC Ancora shares and the discount

of the KBC Ancora share to its net asset value.

|

Trend in KBC Group and KBC Ancora

share price (January – December

2022) |

Trend in discount of KBC Ancora

share to its net asset value (January – December

2022) |

|

|

|

Appointments at the statutory director,

Almancora Société de gestion

Franky Depickere was reappointed as an A

director (executive director) on the Board of Directors of

Almancora Société de gestion, statutory director of KBC Ancora, in

November 2022.

Principal risks and uncertainties in the

remaining months of the financial year

Certain risk factors could have an impact on the

value of the assets held by KBC Ancora and on its ability to

distribute a dividend. Reference is made in this regard to the

description of the risks in the most recent annual report (page

19).

Barring unforeseen circumstances, the current

share repurchase programme will be completed in the second half of

the financial year 2022/2023. This implies a further investment of

EUR 15.8 million.

KBC Ancora's expenses in the second half of the

current financial year (2022/2023) will consist principally of

interest charges plus the usual limited operating expenses. KBC

Ancora estimates the total expenses for the full financial year

2022/2023 at approximately EUR 12.5 million.

KBC Group reported a net result of EUR 2.05

billion for the first nine months of 2022. KBC Group will announce

its annual result for the financial year 2022 on 9 February

2023.

Partly dependent on the decisions taken by KBC

Group regarding the distribution in the first half of 2023 of a

final dividend in respect of the financial year 2022, the Board of

Directors of Almancora Société de gestion, statutory director of

KBC Ancora, will take a decision at the end of May 2023 on whether

to distribute an interim dividend in June 2023 in respect of the

financial year 2022/2023, in line with its dividend policy. That

policy sets out the intention to pay out 90% of the recurring

result available for distribution in the form of an (interim)

dividend (i.e. after adjustment for any exceptional results and

after mandatory formation of the legal reserve).

Declaration by the responsible

individuals

“We, the members of the Board of Directors of

Almancora Société de gestion, statutory director of KBC Ancora SA,

hereby jointly declare that, in so far as we are aware:

a) the abridged financial

summaries, drawn up in accordance with the applicable standards for

financial statements, present a true and fair picture of the

capital position, financial position and results of KBC Ancora;

b) the interim financial report

presents a true and fair view of the key events and principal

transactions with affiliated parties during the first six months of

the current financial year and of their impact on the abridged

financial summaries, as well as a description of the principal

risks and uncertainties during the remaining months of the

financial year.”

Information on the external

audit

The statutory auditor has reviewed the abridged

interim financial information and accompanying notes. The auditor's

report is appended to this interim report.

---------------------------------

KBC Ancora is

a listed company which holds 18.6% of the shares in KBC Group and

which together with Cera, MRBB and the Other Permanent Shareholders

is responsible for the shareholder stability and further

development of the KBC group. As core shareholders of KBC Group,

these parties have signed a shareholder agreement to this

effect.

Financial calendar:1 September

2023 (17.40 hrs

CEST) Annual press

release for the financial year 2022/202326 September 2023 (17.40

CEST) Annual Report

2022/2023 available27 October

2023 General Meeting

of Shareholders

This press release is available in Dutch, French

and English on the website www.kbcancora.be.

KBC Ancora Investor Relations & Press contact: Jan

BergmansTel.: +32 (0)16 279672E-mail: jan.bergmans@kbcancora.be or

mailbox@kbcancora.beAppendix: Balance sheet and profit and

loss account with comparative figures

|

(x EUR 1,000) |

31.12.2022 |

*30.06.2022 |

|

BALANCE SHEET TOTAL |

3,756,143 |

3,680,265 |

|

|

|

|

|

Assets |

|

|

|

Fixed assets |

3,599,979 |

3,599,979 |

| Financial

fixed assets |

3,599,979 |

3,599,979 |

| Companies

with which there is a participatory relationship |

3,599,979 |

3,599,979 |

|

Participating interests |

3,599,979 |

3,599,979 |

|

Current assets |

156,164 |

80,287 |

|

Receivables due within one year |

2 |

6 |

| Trade

receivables |

2 |

6 |

|

Investments |

34,157 |

4,336 |

| Treasury

shares |

34,157 |

4,336 |

| Cash at

bank and in hand |

122,004 |

75,939 |

| Accrued

income and deferred expense |

1 |

5 |

|

|

|

|

|

Liabilities |

|

|

|

Equity |

3,507,628 |

3,436,319 |

|

Contribution |

2,021,871 |

2,021,871 |

| Issued

capital |

2,021,871 |

2,021,871 |

|

Reserves |

1,414,205 |

1,414,205 |

|

Unavailable reserves |

1,312,315 |

1,282,494 |

| Legal

reserve |

141,900 |

141,900 |

|

Unavailable reserve for treasury shares |

34,157 |

4,336 |

| Other

unavailable reserves |

1,136,257 |

1,136,257 |

| Available

reserves |

101,890 |

131,711 |

| Profit

(loss) carried forward |

243 |

243 |

|

Profit/loss for the period |

71,309 |

n/a |

|

Creditors |

248,515 |

243,947 |

| Amounts

falling due after more than one year |

243,000 |

243,000 |

| Financial

liabilities |

243,000 |

243,000 |

| Credit

institutions |

243,000 |

243,000 |

| Amounts

falling due within one year |

222 |

190 |

| Trade

creditors |

151 |

155 |

|

Suppliers |

151 |

155 |

| Other

creditors |

70 |

35 |

|

Accrued expense and deferred income |

5,294 |

756 |

* The balance sheet at 30 June 2022 is shown after appropriation

of the result.

|

(x EUR 1,000) |

01.07.2022-31.12.2022 |

01.07.2021-31.12.2021 |

|

|

|

|

|

Operating income |

7 |

27 |

| Other

operating income |

7 |

27 |

|

Operating costs |

1,578 |

1,733 |

| Services

and sundry goods |

1,273 |

1,332 |

| Other

operating costs |

305 |

400 |

|

Operating result |

-1,571 |

-1,705 |

|

|

|

|

|

Financial income |

77,516 |

232,549 |

| Recurring

financial income |

77,516 |

232,549 |

| Income

from financial fixed assets |

77,516 |

232,549 |

|

Financial expenses |

4,636 |

6,934 |

| Recurring

financial charges |

4,636 |

6,934 |

| Cost of

debt |

4,582 |

6,934 |

| Other

financial expenses |

54 |

0 |

|

Financial result |

72,880 |

225,615 |

|

|

|

|

|

Profit (loss) before tax |

71,309 |

223,910 |

|

|

|

|

|

Profit (loss) after tax |

71,309 |

223,910 |

Statutory auditor's report to the board

of directors of KBC Ancora NV on

the review of the condensed interim financial information as at 31

December 2022 and for the 6-month period then ended

FREE TRANSLATION OF A REPORT ORIGINALLY PREPARED IN DUTCH

Introduction

We have reviewed the accompanying interim

financial report 2022/2023, containing the condensed balance sheet

of KBC Ancora NV as at 31 December 2022, the condensed profit and

loss statement and notes (“the condensed interim financial

information”). The board of directors is responsible for the

preparation and presentation of this condensed interim financial

information in accordance with the financial reporting framework

applicable in Belgium for interim financial information. Our

responsibility is to express a conclusion on this condensed interim

financial information based on our review.

Scope of Review

We conducted our review in accordance with the

International Standard on Review Engagements 2410, “Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity”. A review of condensed interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing and consequently does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our

attention that causes us to believe that the accompanying condensed

interim financial information as at 31 December 2022 and for the

6-month period then ended is not prepared, in all material respects

in accordance with the financial reporting framework applicable in

Belgium for condensed interim financial information.

Zaventem, 27 January 2023

KPMG Bedrijfsrevisoren - Réviseurs

d’EntreprisesStatutory Auditorrepresented by

Kenneth VermeireBedrijfsrevisor / Réviseur

d’Entreprises

1 KBC Ancora's

reporting is based on Belgian GAAP.

See Appendix for

the balance sheet and profit and loss account.2

Number of KBC Group

shares in portfolio / (number of shares in issue – number of

treasury shares) = 77,516,380 / (78,301,314 – 950,555) = 1.002.3

Net debt is defined

here as total liabilities less total assets excluding financial

assets and excluding treasury shares.

KBC Ancora (EU:KBCA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

KBC Ancora (EU:KBCA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024