KBC Ancora closes financial year 2022/2023 with a profit of EUR

298.9 million

Regulated information, Leuven, 1 September 2023 (17.40 hrs

CEST)

KBC Ancora closes financial year

2022/2023 with a profit of EUR 298.9 million

KBC Ancora recorded a profit for the

financial year 2022/2023 of EUR 298.9 million, equivalent to EUR

3.82 per share. In the previous financial year, KBC Ancora recorded

a profit of EUR 804.8 million thanks to the unusually high dividend

it received from KBC Group in that financial

year.The result in the second half of the

financial year 2022/2023 was EUR

227.6 million, or EUR 2.91 per share. KBC Ancora

distributed a gross interim dividend of EUR 3.31 per share on 8

June 2023 and, as announced, will not pay a final

dividend.

The Board of Directors of Almancora Société de

gestion, statutory director of KBC Ancora NV, hereby announces the

annual figures for the financial year ended 30 June 2023, subject

to the approval of the General Meeting of KBC Ancora Shareholders

to be held on 27 October 2023.

Abridged financial summaries and

notes1

Results for the financial

year

|

|

Financial yeartotal(x EUR

1,000) |

2022/2023per share(in EUR) |

Financial

yeartotal(x EUR 1,000) |

2021/2022per share(in EUR) |

| Income |

310,951 |

3.97 |

821,713 |

10.49 |

|

Operating income |

18 |

0.00 |

39 |

0.00 |

|

Recurring financial income |

310,932 |

3.97 |

821,674 |

10.49 |

| Expenses |

12,081 |

0.15 |

16,884 |

0.22 |

|

Operating costs |

3,043 |

0.04 |

3,265 |

0.04 |

|

Financial expenses |

9,038 |

0.12 |

13,619 |

0.17 |

| Result after

taxes |

298,869 |

3.82 |

804,828 |

10.28 |

| Number of shares in

issue* |

|

78,301,314 |

|

78,301,314 |

| Number of dividend-entitled

shares in issue at balance sheet date |

|

77,011,844 |

|

78,184,128 |

* No instruments have been issued which could

lead to

dilution.

KBC Ancora recorded a profit of EUR 298.9

million in the financial year 2022/2023, compared with a profit of

EUR 804.8 million in the previous financial year. Income (EUR 311.0

million) consisted almost entirely of dividends received on the

participating interest in KBC Group (EUR 310.1 million). Expenses

(EUR 12.1 million) mainly comprised operating costs (EUR 3.0

million) and financial costs (EUR 9.0 million).

Developments in the last six months of

the financial year 2022/2023

Participating interest in KBC Group, net debt

position and net asset value

KBC Ancora did not buy or sell any KBC Group

shares in the second half of the financial year, and holds

77,516,380 KBC Group shares.

Under the share repurchase programme launched on

10 June 2022, KBC Ancora purchased an additional 338,915 KBC Ancora

shares on the stock exchange in the second half of the financial

year, for a total amount of EUR 15.8 million. The share repurchase

programme was completed on 13 March 2023. In total, KBC Ancora

purchased 1,289,470 KBC Ancora shares for a total amount of EUR

50.0 million. The available reserves required to finance the

repurchase programme were accrued as part of the dividend policy

that has been in force since August 2019.

The net asset value of the KBC Ancora share

corresponds to 1.007 times2 the price of the KBC Group share, less

the net debt3 per (dividend-entitled) share. KBC Ancora’s net debt

position as at 30 June 2023 stood at EUR 2.20 per

(dividend-entitled) share.

Based on the price of the KBC Group share on 30

June 2023 (EUR 63.92), the net asset value of one KBC Ancora share

amounted to EUR 62.14, and the KBC Ancora share (EUR 41.88) was

trading at a discount of 32.6% to its net asset value.

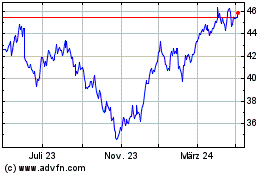

The following charts illustrate the movements in

the price of the KBC Group and KBC Ancora shares and the discount

of the KBC Ancora share to its net asset value.

|

Trend in KBC Group and KBC Ancora share price

(July 2022 – June 2023) |

Trend in discount of KBC Ancora share to

its net asset value (July 2022 – June 2023) |

|

|

|

Appointments at the statutory director Almancora

Société de gestion

Marc De Ceuster was appointed as a part-time

Managing Director of Almancora Société de gestion on 28 April 2023.

He succeeded Katelijn Callewaert with effect from 18 May 2023, as

she had reached the age limit set in the Articles of Association,

and joins Franky Depickere who is a full-time Managing Director of

Almancora Société de gestion. Paul Demyttenaere was appointed as an

independent director, succeeding Marc De Ceuster. He also became

Chairman of the Board of Directors. Jos Peeters's term of office as

a director came to an end and he was succeeded by Mathilde Remy as

representative of the Cera members.

Result for the second half of the

financial year 2022/2023

|

|

2H FYtotal(x EUR 1,000) |

2022/2023per share(in EUR) |

2H FYtotal(x EUR 1,000) |

2021/2022per share(in EUR) |

| Income |

233,427 |

2.98 |

589,136 |

7.52 |

|

Operating income |

12 |

0.00 |

12 |

0.00 |

|

Recurring financial income |

233,416 |

2.98 |

589,124 |

7.52 |

| Expenses |

5,867 |

0.07 |

8,217 |

0.10 |

|

Operating costs |

1,465 |

0.02 |

1,532 |

0.02 |

|

Financial expenses |

4,402 |

0.06 |

6,685 |

0.09 |

| Result after

taxes |

227,560 |

2.91 |

580,919 |

7.42 |

| Number of shares in issue |

|

78,301,314 |

|

78,301,314 |

| Number of dividend-entitled

shares at balance sheet date |

|

77,011,844 |

|

78,184,128 |

KBC Ancora recorded a profit after tax of EUR

227.6 million in the second half of the year under review, or EUR

2.91 per share. In the same period in the previous financial year,

KBC Ancora recorded a profit of EUR 580.9 million.

Income amounted to EUR 233.4 million. KBC Ancora

received dividend income totalling EUR 232.5 million on its

participating interest in KBC Group as well as interest income of

EUR 0.9 million on term deposits. Over the same period in the

previous financial year, KBC Ancora received dividends amounting to

EUR 589.1 million on its participating interest in KBC Group.

Expenses in the second half-year (EUR 5.9

million) were EUR 2.4 million lower than a year earlier, and were

principally determined by the following factors:

- The operating

costs amounted to EUR 1.5 million, EUR 0.1 million less than in the

same period in the previous financial year. Of this total, EUR 1.0

million relates to costs incurred within the cost-sharing agreement

with Cera. Other costs relate among other things to dividend

distribution costs, costs incurred for the statutory director,

listing fees and taxes on securities accounts

- Cost of debt amounted to EUR 4.4

million, EUR 2.3 million less than in the previous financial year,

largely thanks to debt repayments of EUR 100 million (May 2022) and

- to a lesser extent - EUR 70 million (May 2023). This reduced the

interest charges by EUR 1.8 million in the second half of the year

under review. Additionally, KBC Ancora paid no negative interest in

the last six months of the financial year, compared with EUR 0.5

million in the same period in the previous financial year.

Balance sheet at 30 June

2023

| (x EUR 1,000) |

30.06.2023 |

30.06.2022 |

30.06.2021 |

| BALANCE SHEET

TOTAL |

3,654,085 |

3,680,265 |

3,664,327 |

| Assets |

|

|

|

| Fixed

assets |

3,599,979 |

3,599,979 |

3,599,979 |

| Financial fixed assets |

3,599,979 |

3,599,979 |

3,599,979 |

| Current

assets |

54,106 |

80,287 |

64,348 |

|

Liabilities |

|

|

|

| Equity |

3,480,279 |

3,436,319 |

3,319,759 |

| Contribution |

2,021,871 |

2,021,871 |

2,021,871 |

| Legal reserve |

156,844 |

141,900 |

101,659 |

| Unavailable reserve for

treasury shares |

50,000 |

4,336 |

0 |

| Other unavailable

reserves |

1,136,257 |

1,136,257 |

1,136,257 |

| Available reserves |

114,440 |

131,711 |

59,588 |

| Profit (loss) carried

forward |

867 |

243 |

383 |

|

Creditors |

173,806 |

243,947 |

344,568 |

| Amounts falling due after more

than one year |

100,000 |

243,000 |

243,000 |

| Amounts falling due within one

year |

73,223 |

190 |

100,244 |

| Accrued income and deferred

expense |

583 |

756 |

1,324 |

Total assets at 30 June 2023 stood at EUR 3.65

billion, a reduction of EUR 26.2 million compared with the previous

year.

The number of KBC Group shares in portfolio

remained unchanged in the year under review; at the balance sheet

date, KBC Ancora held a total of 77,516,380 KBC Group shares. The

book value of these shares stood at (the historical book value of)

EUR 46.44 per share. The stock market price of the KBC Group share

on the balance sheet date was EUR 63.92; the IFRS equity value

stood at EUR 51.20 per share on 30 June 2023.

Current assets fell by EUR 26.2 million compared

with a year earlier, to EUR 54.1 million. On the one hand, the cash

position reduced by EUR 75.7 million, while on the other hand

current investments increased by EUR 49.6 million due to the

repurchase of shares during the year under review (EUR 45.7

million) and term deposits (EUR 3.9 million). As a result of the

share repurchase programme in the year under review, an amount of

EUR 45.7 million was also transferred from the available reserves

to the unavailable reserve for treasury shares.

Debt (EUR 173.8 million, including financial

debt of EUR 173 million) reduced by EUR 70.1 million compared with

the position at the balance sheet date in the previous financial

year, largely due to the partial early repayment of EUR 70 million

in May 2023 on a loan which matures in May 2024.

After addition of the result carried forward

from the previous financial year (EUR 0.2 million), the result

available for appropriation amounted to EUR 299.1 million. The

following appropriation of profit will be proposed to the General

Meeting of Shareholders to be held on 27 October 2023:

- addition of EUR 14.9 million (5% of

the profit for the financial year) to the legal reserve;

- addition of EUR

28.4 million to the available reserves. This represents 10% of the

recurring result, after formation of the legal reserve;

- dividend amounting

to EUR 254.9 million. This amount represents the interim dividend

of EUR 3.31 per share that was distributed to shareholders on 8

June 2023, and is equal to 90% of the recurring result available

for distribution, after formation of the legal reserve.

- carry-forward of

the balance of EUR 0.9 million, or EUR 0.01 per share, to the next

financial year.

Notes on anticipated developments in the

financial year 2023/2024

As announced in the press release on 13 March

2023 following completion of the share repurchase programme, KBC

Ancora will invite the Extraordinary General Meeting of

Shareholders on 27 October 2023 to approve a proposal to cancel

these treasury shares.

During the course of the financial year

2023/2024, KBC Ancora will make the necessary preparations and take

the requisite decisions in relation to a loan totalling EUR 73

million which matures in May 2024. The cash position accrued at

that time will be addressed for this purpose, with due observance

of the usual dividend policy.

Costs within the cost-sharing agreement with

Cera are expected to amount to approximately EUR 2.2 million. Total

interest charges for the financial year 2023/2024 are estimated at

approximately EUR 6.8 million. Other operating costs are likely to

be around EUR 1.0 million.

In its press release of 10 August 2023, KBC

Group reaffirmed its intention, in line with its dividend policy,

to distribute an interim dividend of EUR 1.00 per share in November

2023, as an advance payment on the total dividend in respect of the

financial year 2023. Barring exceptional or unforeseen

circumstances, KBC Group's dividend policy is to aim for a dividend

payout ratio (including the coupon on the outstanding Additional

Tier-1 instruments) of at least 50% of the consolidated profit.

The anticipated income and expenses detailed

above could enable KBC Ancora to close the financial year 2023/2024

with a positive result for appropriation and, barring unforeseen

circumstances, to distribute an interim dividend in June 2024, in

line with its dividend policy.

Information on the external audit of the

annual accounting data

The audit procedures by KPMG Réviseurs

d’entreprises, represented by Kenneth Vermeire, had not yet been

fully completed at the time of writing. More specifically, the

ESEF-related XHTML version of the annual report has yet to be

generated and audited by the auditor. At the date of this press

release, no findings had emerged which would lead to any

qualification of the audit opinion. This press release was also

reviewed by the auditor and contains no obvious inconsistencies

compared with the draft financial statements.

---------------------------------

KBC Ancora is a listed company

which holds 18.6% of the shares in KBC Group and which together

with Cera, MRBB and the Other Permanent Shareholders is responsible

for the shareholder stability and further development of the KBC

group. As core shareholders of KBC Group, these parties have signed

a shareholder agreement to this effect.

Financial calendar:26 September

2023 Annual Report

2022/2023 available and notice of Annual General Meeting

of

Shareholders27 October

2023 Ordinary and

Extraordinary General Meeting of Shareholders26 January

2024 Interim

financial report 2023/202430 August

2024 Annual press

release for the financial year 2023/2024

This press release is available in Dutch, French

and English on the website www.kbcancora.be.KBC Ancora Investor

Relations & Press contact: Jan BergmansTel.: +32 (0)16 27 96

72E-mail: jan.bergmans@kbcancora.be or mailbox@kbcancora.be

1 KBC Ancora's

reporting is based on Belgian GAAP.2

Number of KBC Group

shares in portfolio / (number of shares issued – number of

repurchased shares) = 77,516,380 / (78,301,314 – 1,289,470) =

1.0073 Net debt is

defined here as total liabilities less total assets excluding

financial fixed assets and excluding the treasury shares.

KBC Ancora (EU:KBCA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

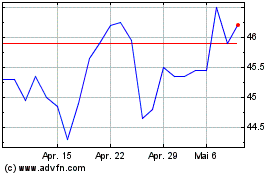

KBC Ancora (EU:KBCA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025