→ Strong Axway performance and immediate SBS impact,

reaffirming Group’s full year targets → Successful launch of

SBS integration, with first synergies and shared opportunities

→ Parent entity to centralize corporate functions & services

for both Axway and SBS brands

Regulatory News:

While the company reached a historic milestone in its

development by adding the strengths of SBS to those of Axway

(Paris:AXW) only a few weeks ago, Q3 2024 proved to be a dynamic

quarter for the new combined entity. Contributions to this

performance have been positive from both Axway and SBS in its first

month within the consolidation scope.

Since the completion of the transaction in early September, the

companies have continued to operate autonomously. While the

business teams have remained focused on their respective projects,

several departments began to collaborate, marking the start of a

new corporate project aiming to generate synergies from joint

initiatives.

Buoyed by a dynamic third quarter, the new Group posted 9-month

revenue of €261.1m, up 7.1% organically and 21.5% overall. While Q4

will, as usual, be the most important and challenging period of the

year, the Group today confirms its annual targets for growth and

profitability.

Over the quarter, several important developments have taken

place:

- On the Axway side, several deals were concluded with customers

increasing their usage and upscaling their entitlements for the

company’s core solutions. The MFT offering in particular stood out

by repositioning itself as a benchmark in the North American

market, thanks to repeated contract wins against the best-known

competing solutions. In addition, Axway has, for the 9th time in

its history in 2024, been named a leader in the Gartner® Magic

Quadrant™ for API Management. At the same time, Axway's B2B

e-invoicing offering also began to gain traction, with the French

government approving Axway's PDP1 registration. Finally, Axway’s

NPS reached 52 at the end of the quarter, continuing its steady

improvement.

- On the SBS side, milestone deals were signed in Q3 for 2 banks

in the Benelux region to adopt new SBP Digital Core product, an

innovative and future-oriented offering to migrate the banks onto

SBS’ fully cloud-native, modular Core Banking Solution delivered in

SaaS mode. This milestone confirms SBS‘ leadership position in the

Benelux market as well as its ambition to become a pre-eminent

player in the European next-generation Core Banking Systems market.

Furthermore, another landmark deal was signed in France to migrate

a bank onto a new regulatory reporting product offered by SBS

through its SBP Regulatory & Reporting line. This deal

highlights SBS clear leadership position in the French market for

risk and regulatory reporting solutions. These achievements

demonstrate the success of SBS in renovating its offerings and in

delivering new technological solutions to the market in line with

its strategy to gradually shift its product portfolio towards SaaS

solutions and cloud technology.

Patrick Donovan, Axway's Chief Executive Officer, said:

“Having successfully completed the acquisition of SBS in early

September, I am delighted to see that the teams of both companies

have remained focused on their respective operations. Axway's

year-to-date performance is fully in line with our expectations,

and we are well on track to achieve our year-end targets. For SBS,

the first month under our operations has shown impressive growth

compared to last September, and the outlook for Q4 remains strong.

Maintaining business momentum during such a significant project is

often challenging, but leadership teams managed to stay on course

in terms of business growth and customer satisfaction. Regarding

the integration, we have initiated several workstreams over the

past 6 weeks, bringing together leaders from various functions to

create a new, cohesive organizational structure. Our goal is to

streamline functions such as Finance, Legal, HR, IT, and Purchasing

to optimize operations and support both Axway and SBS. This will

enable us to provide better internal services at a lower cost.

Additionally, we will leverage the expertise of both brands to

learn from each other, develop the best operational practices, and

create new offerings for our combined client base, ultimately

delivering greater value to our customers.”

_________________ 1 Partner Dematerialization Platform:

E-invoicing platform registered with the French authorities. A PDP

is authorized to provide all the functions required by the new

legislation for e-invoicing and e-reporting.

Comments on Q3 2024 Group’s Activity

Consolidated revenue 3rd Quarter 2024 (€m)

Q3 2024 Q3 2023Restated* Q3 2023Reported

TotalGrowth OrganicGrowth Axway Scope

78.3

69.0

69.4

12.8%

13.4%

SBS Scope (1 month)

34.3

28.9

-

-

18.8%

Intra-Group Operations

-0.1

0.0

-

-

-

Group's Revenue

112.4

97.8

69.4

62.1%

14.9%

* Revenue at 2024 scope and exchange rates

In Q3 2024, the Group’s total revenue reached €112.4m,

reflecting an organic growth of 14.9% and a total growth of 62.1%.

Within the restated Q3 2023 figures, currency fluctuations had a

negative impact of €0.4m, while changes in the consolidation scope,

mainly due to the integration of SBS activities from September

2024, had a positive impact of €28.9m. Intra-Group eliminations

amounted to €0.1m for the period.

Comments on Axway Scope

Revenue by business line 3rd Quarter 2024 (€m)

Q3 2024 Q3 2023Restated* Q3 2023Reported

TotalGrowth OrganicGrowth Subscription

48.4

36.9

37.0

30.8%

31.2%

of which Axway Managed

12.8

11.8

11.9

7.7%

8.3%

of which Customer Managed

35.5

25.0

25.1

41.7%

42.1%

Maintenance

16.8

21.0

21.1

-20.4%

-19.9%

Subtotal - Renewable Contracts

65.2

57.8

58.1

12.1%

12.7%

License

4.1

2.6

2.7

54.4%

55.5%

Services

9.0

8.5

8.6

4.6%

5.4%

Axway Scope

78.3

69.0

69.4

12.8%

13.4%

* Revenue at 2024 scope and exchange rates

In Q3 2024, the Subscription activity continued to

perform strongly, achieving organic growth of 31.2% and

contributing €48.4m in revenue. Axway Managed offerings saw organic

revenue growth of 8.3% and represented approximately one-third of

total bookings. Meanwhile, Customer Managed offerings revenue grew

over 42%, reflecting the continuous trust and reliance of

customers. Upfront revenue from Customer Managed contracts signed

in Q3 represented €20.1m. The annual value of new subscription

contracts (ACV) signed in Q3 2024 totaled €11.8m. Bookings for the

quarter exceeded forecasts, with an increasingly high proportion of

Axway Managed offerings, confirming the relevance of the strategic

focus on cloud models to attract ever more new customers.

Maintenance experienced an organic decline of 19.9%,

which resulted in €16.8m revenue. The decrease was once again

attributable to the transition of customers to subscription models

last year, reflecting a move towards more sustainable revenue

streams for the company in the future. The Maintenance renewal rate

held at 94% over the quarter.

At the end of September 2024, Axway's Annual Recurring Revenue

(ARR) reached €235.3m, up 9.4% on a like-for-like basis, compared

to €215.1m at the end of September 2023. In Q3 2024, revenue from

renewable contracts represented 83% of total revenue.

In Q3 2024, the License activity reached a total revenue

of €4.1m, with an organic growth of 55.5%. This solid performance

reflects strong demand for one of the specialized products in

Axway's portfolio, not available through subscription, which

generated a new major signing in the US public sector.

Services recorded a total revenue of €9.0m in Q3 2024,

with an organic growth of 5.4%. This performance was driven by

successes in large-scale cloud migration projects across all

operating regions, reflecting the loyalty of our customers and

their high level of satisfaction.

Revenue by geographic area 3rd Quarter 2024

(€m) Q3 2024 Q3 2023Restated* Q3

2023Reported TotalGrowth OrganicGrowth France

16.1

19.7

19.7

-18.2%

-18.2%

Rest of Europe

17.6

15.8

15.7

12.3%

11.8%

Americas

40.3

29.4

29.8

35.3%

37.4%

Asia & Pacific

4.2

4.2

4.2

0.8%

0.0%

Axway Scope

78.3

69.0

69.4

12.8%

13.4%

* Revenue at 2024 scope and exchange rates

In Q3 2024, France achieved a total revenue of €16.1m,

down 18.2% organically, while the Subscription segment was facing a

particularly high comparison basis following the very strong

performance recorded in Q3 2023.

Rest of Europe showcased a robust performance in Q3 2024,

achieving total revenue of €17.6m, marking an organic growth of

11.8%. Over the quarter, Amplify APIM and B2B offerings experienced

high demand generating strong bookings.

The Americas region excelled in Q3 2024, with total

revenue reaching €40.3m, representing dynamic organic growth of

37.4%. This significant increase was due to the good performance of

the Subscription activity, which achieved organic growth rate of

almost 70% compared with Q3 2023. The region’s strategic

initiatives and customer-centric approach were pivotal in achieving

these results. The efforts and execution of the sales teams far

exceeded expectations in terms of revenue and bookings, thanks to

the signing of a number of major contracts.

In the Asia & Pacific region, Q3 2024 saw stable

performance with total revenue of €4.2m. While the growth was

modest, the region maintained its activity level, demonstrating

resilience and effectiveness in its focus on customer

engagement.

Comments on SBS Scope

Revenue 3rd Quarter 2024 (€m) Q3 2024

Q3 2023Restated* Q3 2023Reported TotalGrowth

OrganicGrowth SBS Scope (1 month)

34.3

28.9

-

-

18.8%

* Revenue at 2024 scope and exchange rates

In Q3 2024, SBS achieved revenue of €34.3m, reflecting an

organic growth of 18.8%. Over the quarter, SBS was only

consolidated into the Group’s financials from the beginning of

September, meaning just one month of SBS’s performance is included

in these figures. At the time of 2024 annual results publication,

when more data will be available, a deeper analysis of SBS's

business will be provided.

Group’s Financial Position at September 30, 2024

At September 30, 2024, the Group had cash of €62.1m and net debt

of €236.0m.

As a reminder, over the summer Axway secured new credit

facilities of around €200m from partner banks, to partially finance

the acquisition of SBS.

Group’s 2024 Targets & Outlook

The consolidation of SBS is effective since September 1, 2024.

In 2024, the Group will integrate SBS acquired activities for the

last 4 months of the financial year.

Building on its strong nine-month performance, the Group

maintains its full-year 2024 targets, projecting revenue of

approximately €460m and an operating margin between 13% and

17%.

Furthermore, it has been decided to rename the parent company of

the new Group. This entity will be the listed company, overseeing

corporate functions and services for both Axway and SBS brands, as

well as future acquisitions. It is expected to be renamed

74Software, serving as the central holding across the software

house’s various brands. The name change will be submitted to a

shareholder vote at an extraordinary general meeting scheduled for

early December 2024.

Today, Thursday, October 24,

2024, 8.30 a.m. (UTC+2): Q3 2024 Revenue - Virtual Analyst

Conference

→ Virtual Conference

Registration: Click here - Please note that the meeting will

be held in English.

Financial Calendar Wednesday, February 26, 2025, after

market closing: Publication of 2024 Full-Year Results Wednesday,

February 26, 2025, 6:30 pm (UTC+1): 2024 Full-Year Results Virtual

Analyst Conference Monday, March 24, 2025: Filing of the 2024

Universal Registration Document Thursday, April 24, 2025, before

market opening: Publication of Q1 2025 Revenue Tuesday, May 20,

2025, 2:30 p.m. (UTC+2): Annual Shareholders' Meeting

Glossary and Alternative Performance Measures

ACV: Annual Contract Value – Annual

contract value of a subscription agreement. ARR: Annual Recurring Revenue – Expected annual

billing amounts from all active maintenance and subscription

agreements. Growth at constant exchange

rates: Growth in revenue between the period under review and

the prior period restated for exchange rate impacts. NPS: Net Promoter Score – Customer satisfaction

and recommendation indicator for a company. Organic growth: Growth in revenue between the

period under review and the prior period, restated for

consolidation scope and exchange rate impacts. Profit on operating activities: Profit from

recurring operations adjusted for the non-cash share-based payment

expense, as well as the amortization of allocated intangible

assets. Restated revenue: Revenue for

the prior year, adjusted for the consolidation scope and exchange

rates of the current year.

Disclaimer

This press release contains forward-looking statements that may

be subject to various risks and uncertainties concerning Axway’s

growth and profitability, notably in the event of future

acquisitions. Axway highlights that signature of contracts, which

represent investments for customers, are more significant in the

second half of the year and may therefore have a more or less

favorable impact on full-year performance. In addition, Axway notes

that potential acquisition(s) could also impact this financial

data. Furthermore, activity during the year and/or actual results

may differ from those described in this document as a result of a

number of risks and uncertainties set out in the 2023 Universal

Registration Document filed with the French Financial Markets

Authority (Autorité des Marchés Financiers, AMF) on March 25, 2024,

as well as in its amendment filed with the Autorité des Marchés

Financiers on July 22, 2024. The distribution of this document in

certain countries may be subject to prevailing laws and

regulations. Natural persons present in these countries and in

which this document is disseminated, published, or distributed,

should obtain information about such restrictions, and comply with

them.

About Axway

Axway enables enterprises to securely open everything by

integrating and moving data across a complex world of new and old

technologies. Axway’s API-driven B2B integration and MFT software,

refined over 20 years, complements Axway Amplify, an open API

management platform that makes APIs easier to discover and reuse

across multiple teams, vendors, and cloud environments. Axway has

helped over 11,000 businesses unlock the full value of their

existing digital ecosystems to create brilliant experiences,

innovate new services, and reach new markets.

About SBS

SBS is a global financial technology company that is helping

banks and the financial services industry to reimagine how to

operate in an increasingly digital world. SBS is a trusted partner

of more than 1,500 financial institutions and large-scale lenders

in 80 countries worldwide. Its cloud platform offers clients a

composable architecture to digitize operations, ranging from

banking, lending, compliance, to payments, and consumer and asset

finance. SBS is recognized as a Top 10 European Fintech company by

IDC and as a leader in Omdia’s Universe: Digital Banking

Platforms.

Appendices (1/1)

Axway Scope

Revenue by business line YTD - 9 Months 2024

(€m)

9M 2024

9M 2023Restated* 9M 2023Reported TotalGrowth

OrganicGrowth Subscription

141.6

115.8

115.7

22.4%

22.2%

of which Axway Managed

38.8

34.4

34.2

13.5%

12.5%

of which Customer Managed

102.8

81.4

81.5

26.2%

26.3%

Maintenance

51.4

65.6

65.7

-21.7%

-21.6%

Subtotal - Renewable Contracts

193.0

181.4

181.4

6.4%

6.4%

License

6.7

5.6

5.7

19.1%

19.5%

Services

27.1

27.8

27.8

-2.3%

-2.3%

Axway Scope

226.9

214.9

214.8

5.6%

5.6%

* Revenue at 2024 scope and exchange rates

Revenue by geographic

area YTD - 9 Months 2024 (€m)

9M 2024

9M 2023Restated* 9M 2023Reported TotalGrowth

OrganicGrowth France

57.8

65.2

65.1

-11.3%

-11.4%

Rest of Europe

56.3

51.9

51.3

9.6%

8.5%

Americas

100.5

86.6

87.1

15.5%

16.1%

Asia & Pacific

12.3

11.2

11.3

9.4%

10.0%

Axway Scope

226.9

214.9

214.8

5.6%

5.6%

* Revenue at 2024 scope and exchange rates

SBS Scope

Revenue YTD - 9 Months 2024 (€m)

9M 2024

9M 2023Restated* 9M 2023Reported TotalGrowth

OrganicGrowth SBS Scope (1 month)

34.3

28.9

-

-

18.8%

* Revenue at 2024 scope and exchange rates

Group Scope

Consolidated revenue YTD - 9 Months 2024 (€m)

9M 2024

9M 2023Restated* 9M 2023Reported TotalGrowth

OrganicGrowth Axway Scope

226.9

214.9

214.8

5.6%

5.6%

SBS Scope (1 month)

34.3

28.9

-

-

18.8%

Intra-Group Operations

-0.1

0.0

-

-

-

Group's Revenue

261.1

243.7

214.8

21.5%

7.1%

* Revenue at 2024 scope and exchange rates

Impact on revenue of

changes in scope and exchange rates YTD - 9 months

2024 (€m)

9M 2024

9M 2023

Growth Revenue

261.1

214.8

21.5%

Changes in exchange rates

-0.4

Revenue at constant exchange rates

261.1

214.5

21.7%

Changes in scope +29.2

Revenue at constant scope and exchange

rates

261.1

243.7

7.1%

Changes in exchange rates YTD - 9 months 2024For

1€ Average rate9M 2024 Average rate9M 2023

Change US Dollar

1.087

1.083

- 0.4%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023211239/en/

Investor Relations: Arthur Carli – +33 (0)1 47 17 24 65 –

acarli@axway.com

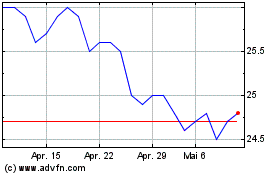

Axway Software (EU:AXW)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Axway Software (EU:AXW)

Historical Stock Chart

Von Jan 2024 bis Jan 2025