Ethereum Faces Network Shakeup: These Key Trends Point to Market Shifts

30 September 2024 - 10:30PM

NEWSBTC

Ethereum, the second-largest cryptocurrency by market cap, has

recently shown signs of a shifting market sentiment and momentum,

according to an analysis by a CryptoQuant analyst named Percival.

The analyst disclosed that various market conditions and

technological developments have impacted Ethereum’s momentum and

have led to mixed views on its future growth trajectory. Related

Reading: Ethereum Price Trims Gains: Is the Rally Losing Steam?

Ethereum’s Market Sees Shift Percival, highlighted that Ethereum

has faced a decline in activity due to the rise of other

blockchains with greater accessibility, more advanced technology,

and faster update cycles. According to the analyst, “the positive

Momentum sentiment is far below expectations.” So far, the open

interest in Ethereum futures—a measure of capital flowing into

derivative contracts—reached $9.2 billion, with a notable inflow of

$2.12 billion in August 2024. This represents a 30% rise but pales

compared to the $6 billion inflow observed between April and May,

reflecting only half of that previous momentum. Another major

observation of the analysis was the “Coinbase Premium Gap,”

indicating the differential between the price of Ethereum on

Coinbase and other global exchanges. A slowdown in selling pressure

from US-based investors suggests a possible positive shift in

market sentiment. However, the market is still waiting for a

significant influx of capital to drive a strong rally for Ethereum.

The analyst pointed out that any future price recovery would depend

on substantial investment inflows, which have yet to materialize.

Furthermore, after the Federal Open Market Committee’s (FOMC)

announcements, Ethereum’s gas fees surged, hinting at a possible

shift of capital from traditional treasuries into decentralized

finance (DeFi). The analyst mentioned an instance: the DeFi lending

platform Aave, which operates on the ETH network, has seen a

moderate rise in fee collection, from $42 million in March to $43

million in August. Ethereum Network Lags Behind While Percival

noted that from an economic perspective, Ethereum needs to revert

to its max fee pass gas mean, aligning its growth with its

intrinsic value, the analyst also suggests that Ethereum currently

faces several internal gaps. Although the technology ecosystem

around Ethereum is expanding, the network seems to be lagging

behind the competition, according to Percival. The CryptoQuant

analyst reveals that this disconnect between Ethereum’s

capabilities and its technological rivals has led to a significant

shortfall in investment. Moreover, the limited inflow of small

capital and lack of consistent use suggest that even minor

investments are not being sustained over time. Related Reading:

Ethereum Taker Buy/Sell Ratio Is Rising Again — What It Means For

ETH Price The analyst’s take is further validated by the fact that

Ethereum’s network has faced increased competition from alternative

blockchains like Solana, Binance Smart Chain, and others that boast

higher transaction speeds and lower fees. This has, to some extent,

diverted attention and investment from Ethereum to these newer

ecosystems. Featured image created with DALL-E, Chart from

TradingView

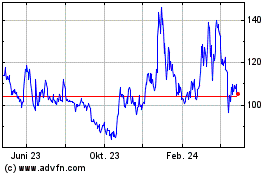

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

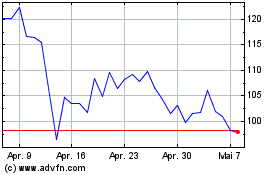

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024