Bitcoin Exchange Reserves Hit Record Low, Could $120K Be on the Horizon?

19 Dezember 2024 - 7:30AM

NEWSBTC

Bitcoin has seen continuous bullish momentum in recent weeks

resulting in the asset’s consistent new highs. According to recent

analysis, this momentum appears to not just be random as it comes

amid major moves behind the scenes. Particularly, recent data

indicates that Bitcoin reserves have dropped to a historic low of

2.4 million, signaling a “supply shock” that has coincided with a

surge in Bitcoin’s price. This reduction in exchange reserves,

coupled with strong demand, has created a bullish environment that

could set the stage for further price increases. Related Reading:

Bitcoin’s Price Momentum Shifts As Spot Market Outpaces Futures –

Here’s What It Means A Supply Shock In The Making A CryptoQuant

analyst known as Kripto Baykus shared the outlook on Bitcoin’s

exchange reserve hitting historic low in a post on the QuickTake

platform. In the post, Baykus highlighted that the year began with

Bitcoin reserves at approximately 3 million on exchanges. However,

a steady decline throughout 2024 has led to the current levels,

reflecting a clear shift in investor behaviour. Institutional

investors, in particular, have embraced long-term holding

strategies, pulling their assets off exchanges, Baykus noted. The

analyst added: This shift is particularly evident among

institutional investors, who have increasingly embraced the “hodl”

approach, demonstrating strong confidence in Bitcoin’s future

potential. Meanwhile, Bitcoin’s price has mirrored this movement,

starting the year at around $40,000 and accelerating in November to

surpass $100,000, eventually reaching a new peak above $104,000.

Baykus wrote: The limited supply of Bitcoin, combined with

shrinking reserves, is seen as a strong bullish signal for the

market. Investors are pricing in the effects of the supply shock,

and if the trend persists, Bitcoin is likely to break further

records in late 2024 and into 2025. Bitcoin Current Demand Stance

In addition to supply-related trends, another CryptoQuant analyst

known as Yonsei Dent has recently turned to the Coinbase Premium

Index to offer insights into Bitcoin’s demand in North America.

This metric tracks activity on Coinbase, one of the largest

exchanges in the region, and has traditionally been used to predict

short-term price movements. However, over the past two weeks, a

divergence between the Coinbase Premium Index and Bitcoin’s price

has raised concerns. Dent pointed out that despite Bitcoin’s price

rising from $94,000 to $106,000 during this period, the Coinbase

Premium has declined. This suggests that the recent price surge may

not have been driven by US.-based demand, raising questions about

the medium-term momentum of Bitcoin’s rally. Related Reading:

Bitcoin’s Next Big Move? Key Metric Reveals When to Cash In Profits

Dent noted: If this price surge has not been supported by

U.S.-based demand, it could indicate underlying weakness in

medium-term upward momentum. Investors should remain cautious and

monitor this development closely. Featured image created with

DALL-E, Chart from TradingView

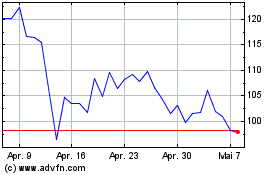

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

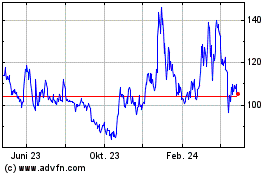

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024