Bitcoin Crashes: Here’s Where The Nearest On-Chain Support Is

20 Dezember 2024 - 12:30AM

NEWSBTC

Bitcoin has observed a plunge during the past day. Here’s the

nearest on-chain level that the asset would end up retesting if the

drawdown elongates. 1 Week To 1 Month Bitcoin Holders Have Their

Realized Price At $97,900 As pointed out by CryptoQuant author Axel

Adler Jr in a new post on X, the Realized Price of the 1-week

to 1-month-old BTC investors is the closest support for the asset

right now. Related Reading: Secret Bitcoin Driver: Exchanges

Receiving $40 Million USDT Fuel Per Day The “Realized Price” here

refers to an on-chain indicator that, in short, keeps track of the

cost basis or acquisition price of the average holder on the

Bitcoin network. When the metric’s value is lower than the spot

price of the cryptocurrency, it means the investors as a whole can

be considered to be holding a net amount of profit. On the other

hand, it being under the BTC value suggests the dominance of loss

in the market. In the context of the current topic, the Realized

Price of only a particular segment of the sector is of interest:

the 1-week to 1-month-old holders. This cohort includes the

addresses that have been holding their coins for at least one week

and, at most, one month. Now, here is the chart shared by the

analyst that shows how the Realized Price of this Bitcoin group has

changed over the past year: As displayed in the above graph, the

Realized Price of the 1-week to 1-month-old Bitcoin investors has

been climbing up alongside the price rally. This is naturally due

to the fact that the cohort’s cost basis has been getting repriced

to higher levels as new investors have been purchasing at the rally

highs. Currently, the indicator’s value sits at $97,900, so these

investors would be in profit at the current price. Earlier in the

past day, however, the asset came dangerously close to retesting

the level as its price saw a brief dip below $99,000. The 1 week to

1 month old investors make up a section of a larger cohort known as

the short-term holders (STHs). The STHs are broadly defined as the

holders who bought their coins within the past 155 days.

Statistically, the longer an investor holds onto their coins, the

less likely they become to sell. So, the STHs, and especially the

1-week to 1-month-old segment, would contain the holders with the

least amount of resolve in the sector, owing to their low holding

time. Because of how fickle they are, the STHs generally show some

kind of reaction whenever their average cost basis gets retested by

the Bitcoin price. This reaction may come in the form of buying

when the retest occurs from above, as these holders could believe

the decline to be just a ‘dip.’ As such, the Realized Price of the

1-week to 1-month-old STHs, which is below the current price, could

be looked at as a support level for the cryptocurrency. The level

has also already helped the asset out once this month. Related

Reading: Ethereum On-Chain Demand Should Sustain ETH Above $4,000,

IntoTheBlock Says So far, Bitcoin has been making a recovery from

the plummet, but should the bearish momentum return, the retest of

the line may be to watch for, considering the past pattern. BTC

Price At the time of writing, Bitcoin is trading at around

$102,200, down almost 3% in the last 24 hours. Featured image from

Dall-E, CryptoQuant.com, chart from TradingView.com

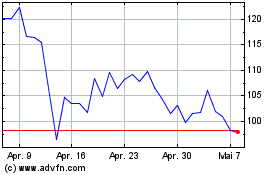

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

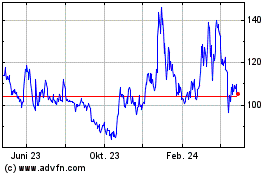

Quant (COIN:QNTUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024