Toncoin (TON) Rebounds Above $6: Is A Sustainable Rally In Sight?

25 November 2024 - 3:00PM

NEWSBTC

Toncoin (TON) has surged past the $6 mark, rekindling hopes for a

sustained bullish rally. After facing a challenging period of

bearish pressure, this recovery has sparked curiosity among

investors and traders alike. The key question is whether the bulls

have what it takes to maintain this momentum and push TON higher.

As Toncoin navigates a pivotal moment, this article aims to explore

its breakout above the $6 level, delving into the forces behind the

move and evaluating its potential to sustain its strength. By

analyzing key technical indicators and market dynamics, we will

provide insights into whether TON’s rally could evolve into a

long-term bullish trend. Indicators To Consider If Toncoin Can

Maintain Its Uptrend TON is demonstrating renewed positive

strength, rebounding above the $6 mark and signaling a notable

shift in market sentiment. Increased buying pressure has driven

further price growth, positioning TON on a stronger footing.

Significantly, the token has risen above the 100-day Simple Moving

Average (SMA) on the 4-hour chart, a key indicator that reinforces

the prevailing bullish trend. An examination of the 4-hour Relative

Strength Index (RSI) shows that the indicator has climbed to 60%

after declining to 53%, signaling a resurgence in buying pressure

and reflecting renewed upbeat momentum in the market. A break above

the 60% level would indicate strong overbought conditions,

suggesting robust demand and the possibility of more price gains.

Related Reading: Toncoin Sharpe Ratio Rising, Is TON Readying For

$8? Also, the daily chart reveals strong upward movement for

Toncoin, marked by a strong rejection wick as it recovers above the

$6 level. Trading above the crucial 100-day SMA reinforces the

positive trend, indicating sustained strength. As TON continues to

climb, it bolsters market confidence, setting the stage for growth

with the $7.2 resistance level as the next key target to watch,

which could determine whether the bullish move extends further. The

daily chart’s RSI at 80% implies robust upside momentum since

buyers are firmly in control and pushing Toncoin’s price higher.

This surge follows a brief pullback to 65%, which acted as a

cooling-off phase before renewed buying pressure kicked in. With

the RSI positioned above the critical 50% level, TON’s rally may

extend, triggering continued optimism in the market. Potential

Challenges Ahead For TON’s Rally Although TON’s recent rally above

$6 shows strong potential, several challenges could disrupt its

positive movement. Toncoin is nearing overbought conditions, as

reflected by its RSI, which may lead to resistance or a pullback.

If this occurs, the asset could decline below $6, possibly heading

toward the $4.6 support level and further downward. Related

Reading: Toncoin (TON) Climbs 20% – Here’s What’s Pushing The Price

Up However, if TON maintains its bullish momentum, it could reach

the $7.2 resistance level. A breakout above this mark could pave

the way for additional gains, potentially driving the price toward

its all-time high of $8.3. Featured image from Adobe Stock, chart

from Tradingview.com

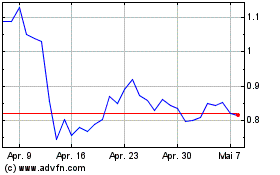

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024