Inside Trump’s Crypto Holdings: $6.9M Portfolio, With One Altcoin Ready For A Major Rally

26 November 2024 - 4:00AM

NEWSBTC

Recent data from market intelligence firm Arkham Intel reveals that

President-elect Donald Trump’s crypto portfolio has seen

significant gains, coinciding with a robust uptrend in crypto

prices following his election victory on November 5. Despite

Bitcoin (BTC) being at the center of Trump’s presidential campaign,

one notable asset among his holdings is Ethereum (ETH), of which he

owns nearly 496 coins. This altcoin has been the standout performer

among his investments, rising 38% over the past thirty days.

Trump’s Crypto Holdings Shine Crypto analyst Michael van de

Poppe pointed out a bullish divergence on Ethereum’s daily chart,

suggesting that the current market dynamics are ripe for further

growth. The analyst identified a key driver behind ETH’s

recent performance: a significant drop in government bond yields.

As these yields decline, van de Poppe suggests that investor

interest in riskier assets like Ethereum tends to increase,

propelling prices higher. Related Reading: Historic Bitcoin Buy:

MicroStrategy Adds 55,500 More BTC To Its Portfolio For $5.4

Billion Van de Poppe elaborated that the ongoing fluctuations in

the yield markets could significantly impact Ethereum’s trajectory.

With Labor Market Week approaching, he speculated that if economic

indicators are weak, the Federal Reserve might implement more rate

cuts. Such actions would likely lead to lower yields, further

boosting Ethereum’s price. Another analyst, Jesse Olson, echoed

this optimistic outlook, noting that Ethereum’s dominance over

Bitcoin is showing signs of a bullish divergence. His analysis

indicates that positive momentum could soon lead to significant

buying opportunities for ETH. As a result of these developments,

Trump’s crypto holdings have surged by nearly $1.6 million within

the past 24 hours, reflecting the positive market sentiment

surrounding Ethereum and other tokens in his portfolio. Major

Investment From TRON Founder In a related development, crypto

entrepreneur Justin Sun has emerged as a major investor in Trump’s

World Liberty Financial, committing $30 million to the

decentralized finance (DeFi) project. Sun, the founder of the

TRON cryptocurrency, declared his support for Trump’s vision of

turning the US into a blockchain hub. He noted, “TRON is committed

to making America great again and leading innovation,” highlighting

the project’s ambition to democratize financial services by

eliminating intermediaries. Related Reading: Ethereum Analyst

Predicts $3,700 Once ETH Breaks Through Resistance World Liberty

Financial, which was launched shortly after Trump survived a second

assassination attempt, aims to raise $300 million at a valuation of

$1.5 billion. However, the project has recently revealed that

its WLF token offerings are primarily being marketed offshore, with

only $30 million set aside for US investors. Once this threshold is

met, the US offering will close, despite having a substantial

amount of tokens still available for sale. Trump is also reportedly

in discussions for the acquisition of the digital asset marketplace

Bakkt Holdings Inc. through Trump Media & Technology Group

Corp., which he controls. At the time of writing, ETH was trading

at $3,435, up 2.4% for the 24-hour period. Featured image from CFR,

chart from TradingView.com

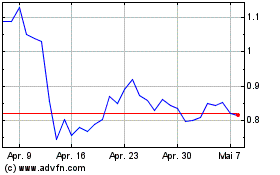

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024