How High Can XRP Price Realistically Go After Gensler’s Resignation?

26 November 2024 - 11:30AM

NEWSBTC

The resignation of Gary Gensler as the Chair of the US Securities

and Exchange Commission (SEC), effective January 20th -the same day

President-elect Donald Trump is set to be inaugurated – is set to

be a monumental day for the XRP community. In his latest video,

crypto analyst Rodney (@cryptojourneyrs) shared an analysis of the

price potential in the post-Gensler era. At the time of his

analysis, XRP was trading at $1.43, reflecting a remarkable 172%

increase over the past month. The market capitalization had soared

to $81 billion, accompanied by $22 billion in daily trading volume.

“XRP is starting to return to its normal spot in crypto, being one

of the dominant altcoins,” Rodney remarked. Why XRP Is Poised To

Surge Higher In his video, Rodney suggests that Trump’s promise to

fire Gensler on his first day in office may have influenced

Gensler’s decision to resign preemptively. “Gary Gensler is going

to be stepping down from his role as the chair of the SEC January

20th, the same day Trump is going to be inaugurated,” Rodney

stated. “Trump promised to fire Gary Gensler on day one, so I think

Gary Gensler wanted to go out on his shield and resign on his own.”

Related Reading: XRP Analyst Sets $2 Target If It Holds Key Level –

Can It Reach Multi-Year Highs? Reflecting on the SEC’s lawsuit

against Ripple, Rodney noted the significant impact it had on the

price and market perception. “When the SEC sued Ripple, [XRP] price

dipped 50%. This was one of many lawsuits that the SEC and Gary

Gensler filed against many different crypto projects. It seemed

like they were trying to regulate the space out of existence,”

Rodney stated. He pointed out that despite the legal challenges,

XRP remained a top cryptocurrency. “Even through all the BS, XRP

has still been a top crypto and it really hasn’t fallen out of the

top 10 in many years,” he said. Rodney also discussed Ripple’s

partial victory against the SEC in July 2023, which set a

significant precedent in the crypto industry. However, he expressed

surprise that the price did not react more positively at the time.

“When we heard about that news of them partially beating the SEC,

XRP started to pump to around $0.67 but then promptly dipped down

to about $0.50 and didn’t really do anything,” he observed. “It

wasn’t moving with the cryptocurrency market at all… It was a

running joke that it was kind of our favorite stablecoin.” Turning

to the political landscape, Rodney explained: “Donald Trump

actually ended up destroying Kamala Harris and is going to be the

next president of the United States,” he stated. He emphasized

Trump’s pro-crypto stance, noting that he was “much more open about

supporting crypto” and was “the first president to purchase

anything with cryptocurrency.” Rodney highlighted the involvement

of various crypto projects in political campaigns, mentioning that

“many cryptocurrency products were funding both candidates’

campaigns behind the scenes.” Related Reading: XRP To Hit $40 In 3

Months But On This Condition – Analyst With the political shift,

Rodney expressed optimism about the future integration of

cryptocurrency into government systems. “Now more than ever, it

seems like cryptocurrency is going to be involved with our

government, and in my opinion, XRP is going to be up there with the

top projects,” he asserted. He elaborated on XRP’s core objectives,

stating, “What is XRP trying to do? They want to be used for

international money transfers […] They want to enable fast and

low-cost international money transfers and currency exchanges.” He

suggested that with supportive figures in government, XRP could

realize this potential. How High Can XRP Price Go? Rodney also

delved into his price predictions for XRP, considering various

market capitalization scenarios. If XRP were to achieve Ethereum’s

market cap of approximately $400 billion, it would result in a 4.9x

increase from its current price, bringing XRP to around $6.98.

“Say, for example, XRP becomes a part of our government and we

actually use it for its real utility. Everyone uses it, and it

magically got the same market cap size of Ethereum,” he speculated.

Imagining XRP reaching Bitcoin’s market cap of about $2 trillion,

he calculated a 24x increase, which would place XRP at

approximately $33. “Let’s fantasize a little crazier […] Say we

gave it Bitcoin’s market cap size that’s currently sitting around

$2 trillion,” he mused. He considered a $10 XRP, corresponding to a

$600 billion market cap, as a reasonable possibility. “I think that

a $10 XRP or an XRP with a $600 billion market cap size is

reasonable,” he concluded. However, Rodney acknowledged the

challenges inherent in these predictions, noting that “it would be

tough for any cryptocurrency project to hit those market cap sizes

because Bitcoin’s dominating the entire market right now.” At press

time, XRP traded at $1.40. Featured image created with DALL.E,

chart from TradingView.com

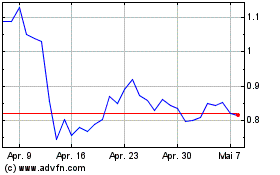

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024