BlackRock Ethereum Holdings Surpass 1.2 Million ETH Amidst Strong Institutional Adoption – Details

26 Januar 2025 - 12:30AM

NEWSBTC

Ethereum (ETH) declined by 5.68% in the last week in line with the

majority of the crypto market. The prominent altcoin currently

trades around $3,290 as investors await the crypto bull run’s

return to form. On the other hand, rising institutional adoption

provides a positive development for the Ethereum community. Related

Reading: Justin Sun’s Grand Strategy For Ethereum Price: $10,000

Target BlackRock’s ETHA Lead Spot ETF Market With 1.2 Million ETH

According to a recent X post by Burak Kesmeci, Ethereum is

currently experiencing a surge in institutional adoption as

evidenced by developments in the Spot ETF Market. Kesmeci

highlights that BlackRock’s ETHA accounts for the majority of this

demand with net assets of 1.2009 ETH valued at over $3.19 billion.

According to data from SoSoValue, this record is largely

unsurprising as ETHA has experienced the highest net cumulative

inflows of $3.97 billion in the Ethereum Spot ETF market.

Fidelity’s FETH occupies second place with 432,750 ETH

valued at around $1.46 billion. Bitwise’s ETHW and VanEck’s ETHV

follow with holdings of 105,974 ETH and 45,766 ETH, respectively.

Meanwhile, all other Ethereum Spot ETFs except the Grayscale ETHE

have accumulated at least 7,000 ETH since their launch in July

2024. A rise in institutional demand of Ethereum as Indicated by

the data above indicates strong confidence in the asset’s long-term

profitability. While Ethereum Spot ETFs may not replicate the

performance of Bitcoin counterparts, the institutional demand these

funds command could enhance ETH market stability and liquidity,

paving the way for broader regulatory acceptance and mainstream

adoption. Related Reading: Ethereum Consolidates But Open

Interest Points to Potential Breakout Short Transactions Dominate

Ethereum Market In other news, bearish sentiments currently prove

dominant in the ETH market as dominated by a higher proportion of

short-term transactions to long transactions. According to Kesmeci,

short orders represent 57% of all Ethereum futures trades

indicating that the majority of traders are betting the altcoin to

experience a further price decline. This negative development is

particularly observed on the Bitmex and Bitfinex exchanges.

At the time of writing, Ethereum trades at $3,297 after 0.17% loss

in the last 24 hours. Meanwhile, the asset’s trading volume has

dipped by 24.24% and is now valued at $25.36 billion. Based on its

daily trading chart, Ethereum appears to be consolidating despite

recent losses. With any price rally, the altcoin could reach around

$3,700, moving past which would spur a return to around $4,000. On

the other hand, another fall in Ethereum’s price could result in a

slump to around $3,100, which lies its next significant support

level. With a market cap of $396.85 billion, ETH retains its

position as the largest altcoin and second-largest cryptocurrency

in the world. Featured image from Freepik, chart from

Tradingview

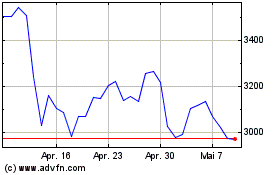

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025