Bitcoin Bearish Case: Continued Rejection At $100,000 Increases Likelihood Of Breakdown

13 Januar 2025 - 12:00AM

NEWSBTC

Bitcoin has been faced with a challenging start to 2025 with a

rejection at the $100,000 mark. Notably, Bitcoin has been unable to

hold substantially above the $100,000 price level since it first

broke through in early December, and multiple breakouts have been

followed by rejections. The most recent rejection came last week

when the price peaked at $102,000 on Monday, only to reverse

sharply and fall to $92,000 by Thursday. Related Reading: Bitcoin

To Challenge Gold: Expert Sees US Taking The Lead This continued

tug-of-war has brought the bearish case for BTC into sharper focus,

with technical analysis highlighting a 50/50 chance of a further

drop or a bounce. $90,000: A Pivotal Support Zone Under Threat

Recent Bitcoin price action has significantly put the $90,000 price

point as the most notable support level for the bulls. Although the

crypto has largely held above the $90,000 support level even during

the recent corrections, the bearish outlook hinges on its ability

to defend this level. According to technical analysis by

crypto analyst EGRAG CRYPTO, Bitcoin has made five different

attempts to test a support trendline around $90,000, which further

reveals the importance of the level. This repeated retest increases

the chance of weakening the support strength and is gradually

making Bitcoin more vulnerable to a sharp decline. With this

in mind, the major task for Bitcoin bulls would be to hold above

the $90,000 and break resistance levels above $100,000 in order to

invalidate a bearish outlook. Should Bitcoin fall below $90,000, it

could cascade to a further price drop to the $87,000 range or even

lower. A fall below $87,000 could, in turn, cause a quick fall

through a $12,000 gap to reach $75,000. Resistance

Levels To Break: $103,000 To $108,500 As noted by EGRAG CRYPTO,

Bitcoin could continue to pose a bearish threat until it closes

above a few resistance levels. These resistance levels are situated

at $103,000, $106,400, and $108,500, and consistent daily closes

above these thresholds are required to confirm a bullish trend. The

third resistance of $108,500 is the most notable, as a break above

it would see Bitcoin trading at new all-time highs. According to

EGRAG CRYPTO, current technical indicators suggest that the chances

of a pump are low at the moment. For instance, Bitcoin has now lost

the support of the 21 EMA on the daily candlestick timeframe, and

sentiment is now in a neutral zone on the Fear and Greed Index.

Related Reading: Bitcoin Price Under Threat: $12,000 Void Opens Up

Possibility Of Crash Toward $75,000 As it stands, the biggest

factor that could see bullish momentum return to Bitcoin is the

upcoming inauguration of Donald Trump on January 20th and the

anticipated crypto-positive policies that during the new

administration. EGRAG CRYPTO notes that the event could either

trigger a short-term rally or exacerbate the ongoing decline. At

the time of writing, Bitcoin is trading at $94,400. Featured image

from Pexels, chart from TradingView

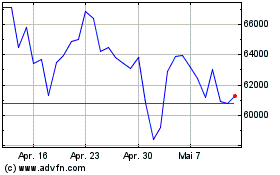

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025