- Q3 and year to date 20191 net revenue of $24.8 million and

$64.1 million, respectively, and Q3 net loss and net income from

continuing operations of $10.2 million and $12.9 million,

respectively

- Q3 and year to date gross margin, which includes the impact

of fair value adjustments was ($0.2 million) and $59.5 million,

respectively. Excluding the impact of non-cash fair value

adjustments, the Q3 and year to date adjusted gross margin was

$12.3 million or 50%, and $37.1 million or 58%2,

respectively.

- Q3 adjusted EBITDA of $7.7 million, or 31%2, which was

positive for the fourth consecutive quarter and year to date

adjusted EBITDA of $27.8 million, or 43%2

- Significant growth expected for fiscal 2020 as edibles and

derivative products legalized, the number of cannabis retail stores

expand, Organigram’s harvested amounts expected to increase

materially, and further economies of scale expected to be

realized

- All Phase 4A growing rooms received Health Canada licensing

approval bringing current licensed target production capacity to

61,000 kg/yr

- Phase 4B to add 28,000 kg/yr of target production capacity:

17 of the 33 Phase 4B grow rooms submitted for licensing in June

2019 with the remaining 16 grow rooms expected to be submitted in

September 2019

- Phase 4C (29 grow rooms) is expected to be completed by end

of calendar 2019 to increase target production capacity by 24,000

kg/yr to 113,000 kg/yr3

- Announced partnerships for vaporizer pens with PAX Labs Inc.

and the Feather Company Ltd., as well as to produce

cannabis-infused chocolates and powdered beverage products

Organigram Holdings Inc. (NASDAQ: OGI) (TSX VENTURE: OGI), the

parent company of Organigram Inc. (the “Company” or “Organigram”),

a leading licensed producer of cannabis, is pleased to announce its

results for the third quarter ended May 31, 2019 (“Q3” or “Q3

2019”).

“We continued to report strong sales in our third quarter and

now have distribution in all ten provinces. In our fiscal year to

date, we have generated strong operating and financial results,

placing us among the leaders in the Canadian industry. While we saw

a temporary reduction in yield per plant in Q3 due to temporary

changes in growing protocols, not only have our yields returned to

historical levels, but we have seen a meaningful increase in

average cannabinoid levels in harvests to date in Q4” said Greg

Engel, Chief Executive Officer.

“We have seen adult recreational cannabis sales highly correlate

to the presence of physical retail stores based on a comparison of

the provinces in Canada. The Canadian market is positioned to grow

significantly with more retail stores opening – particularly in the

two most populous provinces of Ontario and Quebec - and the

upcoming legalization and availability of edibles and derivative

products. We expect to remain a national market leader by

maintaining our track record of meeting supply commitments and

delivering high-quality product to our customers. Our experienced

team continues to de-risk our edibles and derivative strategy in

order to be ready to launch the most popular cannabis product forms

upon legalization.”

Organigram remains committed to achieving growth in a fiscally

prudent manner. The Company believes that economies of scale will

be achieved as its cultivation ramps up in calendar 2019 without a

commensurate increase in staff and that increased revenues and

profitability can be driven with the ability to roll-out exciting

new product forms related to “Rec 2.0”.

“We are very excited for fiscal 2020 which should build upon an

already successful 2019. By the first half of fiscal 2020, we

expect to benefit from record harvests of high-quality indoor-grown

dried flower, the sale of a variety of vape pen products as well as

our initial edible product forms. The Canadian market will be much

more mature from a distribution and retail perspective with Ontario

anticipated to have three-times the current number of stores by

October 2019 and Quebec planning to more than double its retail

presence by March 2020 and with Alberta continuing to grow its

already leading number of retail distribution points.”

Key Operating and Financial Metrics for the Third Quarter of

Fiscal 2019

- Q3 2019 net revenue of $24.8 million represented sales from

approximately 3,926 kg of dried flower and approximately 5,090 L of

oil compared to Q2 2019 net revenue of $26.9 million. Q3 net

revenue reflected significant sales growth from Alberta and

Atlantic Canada offset by the timing of shipments to Quebec that

occurred subsequent to quarter-end, a large pipeline fill in Q2

2019 for Ontario in advance of opening retail stores that was not

fully matched by reorders in Q3 and fewer reorders from British

Columbia in Q3 (as demand for legal products remains generally

under indexed in that province). Retail allocations have also been

capped in Ontario to ensure continuity of supply for the existing

25 retailers. Another large pipeline for Ontario is expected in

advance of 50 new stores being eligible for opening on October 8,

2019.

- Q3 cash and “all-in” costs of cultivation of $0.95 and $1.29

per gram of dried flower harvested4, respectively, increased from

$0.65 and $0.95 per gram in Q2 2019 almost exclusively due to a

temporary decrease in yield per plant as a result of a change in

growing protocol. The Company reverted to proven growing methods

and yield has returned to previous levels toward the end of Q3 and

in Q4 (to date).

- Q3 adjusted gross margin decreased to $12.3 million or 50%5

from Q2 2019 adjusted gross margin of $16.0 million or 60%5 largely

due to production costs, the temporary decrease in yield per plant

and write-downs of legacy packaging materials that were replaced

with new, more consumer-friendly packaging. Q3 gross margin was

negative $0.2 million largely due to fair value changes in

biological assets and inventory sold.

- Adjusted EBITDA of $7.7 million, and adjusted EBITDA margin of

31%5, was positive for the fourth consecutive quarter.

- Q3 sales and marketing and general and administrative

(“SG&A”) expenses of $9.1 million6, or 37% of net revenue, and

year to date SG&A of $19.3 million6, or 30%, of net revenue

reflect management’s disciplined approach to overhead spending

despite being in a high growth period.

- Q3 net loss from continuing operations of $10.2 million or

$(0.07) per share on a diluted basis was largely due to non-cash

fair value changes to biological assets in inventory. Year to date,

net income from continuing operations was $12.9 million or $0.09

per share on a diluted basis.

Phase 4 Production Expansion

Construction of the Phase 4 expansion remains on schedule for

completion by the end of calendar 2019. The expansion is expected

to increase target production capacity to 113,000 kg per year, once

fully licensed and operational.

- Health Canada licensing approval was received for all the Phase

4A rooms during the quarter, bringing current total target licensed

production capacity to 61,000 kg per year.

- In June 2019, the Company submitted a license amendment to

Health Canada for the initial 17 rooms in Phase 4B, which

represents additional production capacity of approximately 14,000

kg per year. In anticipation of receiving licensing, the Company

has already begun cloning for these 17 rooms. The Company is on

track to submit the remaining 16 rooms in September 2019.

- The Phase 4 expansion remains in line with an estimated cost of

approximately $125 million and the Company spent $18.5 million on

this Phase in Q3 2019.

Phase 5 Expansion Under Refurbishment

- The Company is refurbishing 56,000 square feet within its

existing facility which is designed under European Union GMP

standards for additional extraction capacity, and its own

derivatives and edibles facility.

- The refurbishment remains on schedule to complete primary

construction by October 2019 and in line with an estimated cost of

approximately $48 million.

Adult-Use Recreational Launch 2.0 (“Rec 2.0”) – Derivative

and Edible Products

- Organigram’s production and product development teams have made

significant preparations to execute its strategy and plans for the

derivatives and edibles launch later in 2019. The Company has

chosen to initially focus on the two most popular product forms

based on US state sales data: vaporizer pens and edible products.

Estimates suggest vaporizer pens, alone, currently represent the

largest segment of derivative and edible products at about 23%7 of

cannabis sales based on form factor. Edibles, including

cannabis-infused beverages, are the next largest segment at about

13%7 of cannabis sales.

- The Company also has an exclusive consulting agreement with TGS

International LLC, a vertically integrated cannabis company and

proven market leader in Colorado8, to better understand demand for

certain derivative-based products, market share trends over

time.

- The Company intends to deploy a strategy aimed at product depth

as opposed to breadth to maintain its strong track record of

delivering on supply commitments, which is critical to building

brand equity. The Company expects to be ready to sell vaporizer pen

products when they are authorized for sale in December 2019 and has

plans to sell cannabis-infused chocolates and a variety of dried

powder formulation beverage products in early calendar 2020.

- Organigram is increasing production and extraction capacity

with the Phase 4 expansion and Phase 5 refurbishments of its

Moncton facility as well as the extraction agreement with

Valens.

- Phase 5 plans include vaporizer pen filling and automated

packaging, extraction by C02 and hydrocarbons as well as additional

equipment for a variety of formulations including short path

distillation for edibles and vaporizer pen products.

- The Company expects the construction of additional in-house

extraction capacity to be complete by the end of calendar 2019.

However, the Company has the capacity to fill vaporizer pens in its

existing facility ahead of the licensing of Phase 5 in order to be

ready to sell the products as soon as authorized for sale in

December 2019.

- During the quarter, the Company announced a $15 million

investment commitment in a high speed, high capacity, fully

automated production line with the ability to produce up to 4

million kilograms of chocolate edibles. The investment will provide

the Company with a state-of-the-art chocolate molding line and a

fully integrated packaging line that includes advanced engineering,

robotics, high-speed labeling and automated carton packing.

Organigram expects to take delivery of the equipment in the fall of

2019 and complete installation and commissioning in time for

initial sales shipments in early calendar 2020.

- In addition, Phase 5 will include a powdered drink mixing and

packaging line to support the Company’s plan to launch a variety of

dried powder formulation beverage products in early calendar

2020.

- In June 2019, Organigram announced two innovative partnerships

with two vaporizer hardwareand technology companies to offer

vaporizer pens to all its provincial partners. The Company was

selected as one of the four Canadian launch partners of PAX Era,

the premium closed loop vaporizer solution created by PAX Labs,

Inc. (“PAX”) a leading consumer technology brand in the design and

development of premium vaporizers for dry flower and concentrates.

Organigram will produce and fill Edison Cannabis Company-branded

pods specifically for the PAX Era platform. The Company also signed

an agreement with Feather Company Ltd. (“Feather”) for an exclusive

Canadian license to Feather’s proprietary vaporizer pen technology.

The disposable vaporizer pen as well as a 5/10 thread cartridges

will complement the partnership with PAX.

- As previously announced, Organigram has developed a proprietary

nano-emulsification technology that is anticipated to provide an

initial onset of the effects of the cannabinoids within 10 to 15

minutes. The emulsion process developed by the Organigram team

generates micro-particles that are very small and uniform (size of

20 nanometers), translating to an absorption and onset of effect

that is rapid, reliable and controlled. The nano-emulsion

technology is stable to temperature variations, mechanical

disturbance, salinity, pH and sweeteners. The Company’s researchers

have also recently developed a way to transform this emulsification

system into a solid form, turning it into a dissolvable powder.

This shelf-stable, thermally-stable, water-soluble and palatable

cannabinoid nano-emulsion formulation is expected to provide an

initial onset of effect within 10 to 15 minutes if used in any

beverage. The powdered formulation will offer consumers a measured

dose of cannabinoids which they can then add to the beverage of

their choice, while also offering the discretion, portability and

shelf life expected of a dry formulation.

Outlook

- The Company believes the best near-term growth opportunity

remains Canada. The Canadian market is positioned for significant

growth with additional retail store planned openings and the

legalization of edible and derivative products.

- The U.S. and International markets, particularly the

cannabidiol (“CBD”) market, also represent significant

opportunities and the Company expects to further participate in

these markets in due course and in compliance with applicable

law.

- The Company expects to be a national leader in Rec 2.0 as

retailers and provincial distributors are likely to increasingly

move to producers, like Organigram, with a strong track record of

delivering on supply commitments. The Company continues to de-risk

its Rec 2.0 strategy with reputable supplier arrangements, state of

the art technology, increased capacity and deep expertise to ensure

it is ready to launch the most popular cannabis product forms in

the edibles and derivative market upon legalization.

- To date in fiscal year 2019, the Company has captured strong

market share and generated strong operating and financial results

and focused on running its business to generate sustainable return

on investment for shareholders in both the near-term and long-term.

Although Q3 2019 results were impacted by a temporary decline in

yield per plant, yields returned to previous levels toward the end

of Q3 and into Q4 2019 (to date). The Company expects higher yields

and increased efficiencies and economies of scale to decrease cost

of cultivation in Q4 fiscal 2019 and Q1 fiscal 2020.

- Just as importantly, the Company’s average cannabinoid content

continues to increase, and the Company has identified what it views

as an optimal combination of high yields and high cannabinoid

content. In addition, labour costs are not expected to increase

commensurate with production, processing and sales volume, which

should translate to further economies of scale.

Balance Sheet

- As at May 31, 2019, Organigram has $87.8 million in cash and

short-term investments and has generated adjusted EBITDA of $27.8

million9 year to date and has been EBITDA positive in each of the

last four quarters.

- The Company converted the principal amount outstanding of the

remaining debentures and eliminated a $49.3 million current

liability from its balance sheet.

- Organigram closed a debt financing in the aggregate amount of

approximately $140 million at attractive rates, which includes both

a term loan to finance the Company’s ongoing expansion plans and

revolving debt for general working capital and corporate purposes.

Included in the facility is an uncommitted option to increase the

term loan and/or revolving debt by an incremental $35 million to a

total of $175 million, subject to agreement by BMO and satisfaction

of certain legal and business conditions.

(in $000s except for per share

amounts)

Q3-2019

Q3-2018

% Change

Gross revenue

$

30,361

$

3,435

784

%

Excise taxes

(5,611

)

-

n/m

Net revenue

24,750

3,435

621

%

Cost of sales and indirect production

12,473

1,791

596

%

Gross margin before fair value changes

12,277

1,644

647

%

Fair value changes to bio assets and

inventories

(12,456

)

10,066

(224

)%

Gross margin

(179

)

11,710

(102

)%

General and administrative

4,622

1,297

256

%

Sales and marketing

4,441

1,492

198

%

Share-based compensation (non-cash)

2,046

1,156

77

%

Total expenses

11,109

3,945

182

%

Income (loss) from continuing

operations

(11,288

)

7,765

(245

)%

Other expense (income)

1,140

3,679

(69

)%

Deferred income tax recovery

(2,248

)

-

n/m

Net income (loss) from continuing

operations

(10,180

)

4,086

(349

)%

Loss from discontinued operations

-

(1,266

)

(100

)%

Net income (loss)

$

(10,180

)

$

2,820

(461

)%

Net income (loss) from continuing

operations per common share, basic

$

(0.068

)

$

0.033

Net income (loss) from continuing

operations per common share, diluted

$

(0.068

)

$

0.030

(in $000 except for per share amounts)

May 31,

August 31,

%

2019

2018

Change

Cash and short-term investments

$

87,752

$

130,064

(33

)%

Biological assets

20,055

19,858

1

%

Inventories

94,183

44,969

109

%

Other current assets

30,481

8,323

266

%

Property, plant and equipment

180,595

98,639

83

%

Other non-current assets

14,923

714

1,990

%

Total assets

$

427,989

$

302,567

41

%

Current liabilities

$

25,674

$

11,250

128

%

Non-current liabilities

65,936

106,723

(38

)%

Total liabilities

91,610

117,973

(22

)%

Shareholders’ equity

336,379

184,594

82

%

Total liabilities and shareholders’

equity

$

427,989

$

302,567

41

%

Capital Structure

(in $000s)

May 31, 2019

August 31, 2018

Current and long-term debt

$

49,469

$

3,298

Convertible debentures

-

(112,982

)

Shareholders’ equity

336,379

184,594

Total debt and shareholders’ equity

$

385,848

$

283,758

(in 000s)

May 31, 2019

August 31, 2018

Outstanding shares

153,872

125,208

Options

8,051

7,710

Warrants

2,570

8,087

Restricted share units

845

145

Convertible debentures (converted at

$5.42)

-

20,845

Fully-diluted shares

165,338

161,995

During the quarter, approximately $53.7 million principal amount

of debentures were converted into common shares of the Company at a

conversion price of $5.42 per share, which extinguishes this

liability in full. During the quarter, approximately 3.3 million

warrants were exercised at a price of $4 per share for a cash

inflow of approximately $13.1 million. Subsequent to quarter-end,

all of the remaining warrants not exercised into common shares

prior to expiry on June 18, 2019 expired. Approximately 2.2 million

warrants ($8.9M of cash) were exercised and approximately 0.3

million expired for a nil balance outstanding.

Outstanding basic and fully diluted share count as at July 12,

2019 is as follows:

(in 000s)

July 12,

2019

Outstanding Shares

156,171

Options

8,408

Restricted share units

846

Fully-diluted shares

165,425

Third Quarter Fiscal 2019 Conference Call

The Company will host a conference call to discuss Q3 2019

earnings results. The details are as follows:

Date: July 15, 2019

Time: 8:00 a.m. Eastern Time

Toll Free (North America) Dial-In Number: 1-866-211-4093

International Dial-In Number: 647-689-6727

Webcast:

https://event.on24.com/wcc/r/2041734/0C9BEBE1006D6A654B289579CB38CA0F

A replay of the webcast will be available within 24 hours after

the conclusion of the call at https://www.organigram.ca/investors

and will be archived for a period of 90 days following the

call.

About Organigram Holdings Inc.

Organigram Holdings Inc. is a NASDAQ Global Select and TSX

Venture Exchange listed company whose wholly owned subsidiary,

Organigram Inc., is a licensed producer of cannabis and

cannabis-derived products in Canada.

Organigram is focused on producing high-quality, indoor-grown

cannabis for patients and adult recreational consumers in Canada,

as well as developing international business partnerships to extend

the Company's global footprint. Organigram has also developed a

portfolio of adult use recreational cannabis brands including The

Edison Cannabis Company, Ankr Organics, Trailer Park Buds and

Trailblazer. Organigram's primary facility is located in Moncton,

New Brunswick and the Company is regulated by the Cannabis Act

(Canada) and the Cannabis Regulations (Canada).

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

This news release contains forward-looking information.

Forward-looking information, in general, can be identified by the

use of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “could”, “would”, “might”, “expect”, “intend”,

“estimate”, “anticipate”, “believe”, “plan”, “continue”, “budget”,

“schedule” or “forecast” or similar expressions suggesting future

outcomes or events. They include, but are not limited to,

statements with respect to expectations, projections or other

characterizations of future events or circumstances, and the

Company’s objectives, goals, strategies, beliefs, intentions,

plans, estimates, forecasts, projections and outlook, including

statements relating to the Company’s plans and objectives, or

estimates or predictions of actions of customers, suppliers,

partners, distributors, competitors or regulatory authorities; and,

statements regarding the Company’s future economic performance.

These statements are not historical facts but instead represent

management beliefs regarding future events, many of which, by their

nature are inherently uncertain and beyond management control.

Forward-looking information has been based on the Company’s current

expectations about future events.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual events to

differ materially from current expectations. Important factors -

including the the receipt of regulatory approvals or consents, the

completion of regulatory processes and registrations including for

new product forms, market demand and acceptance of new product

forms, unforeseen construction or delivery delays including of

equipment, competitive and industry conditions, customer buying

patterns and crop yields - that could cause actual results to

differ materially from the Company's expectations are disclosed in

the Company's documents filed from time to time under the Company’s

issuer profile on the Canadian Securities Administrators’ System

for Electronic Document Analysis and Retrieval (“SEDAR”) at

www.sedar.com and reports and other information filed with or

furnished to the United States Securities and Exchange Commission

(“SEC”) and available on the SEC’s Electronic Document Gathering

and Retrieval System (“EDGAR”) at www.sec.gov including the

Company’s Annual and Q3 MD&A and AIF. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this news release. The Company

disclaims any intention or obligation, except to the extent

required by law, to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

This news release refers to certain financial performance

measures that are not defined by and do not have a standardized

meaning under International Financial Reporting Standards (“IFRS”)

as issued by the International Accounting Standards Board. These

non-IFRS financial performance measures are defined in the

MD&A. Non-IFRS financial measures are used by management to

assess the financial and operational performance of the Company.

The Company believes that these non-IFRS financial measures, in

addition to conventional measures prepared in accordance with IFRS,

enable investors to evaluate the Company’s operating results,

underlying performance and prospects in a similar manner to the

Company’s management. As there are no standardized methods of

calculating these non-IFRS measures, the Company’s approaches may

differ from those used by others, and accordingly, the use of these

measures may not be directly comparable. Accordingly, these

non-IFRS measures are intended to provide additional information

and should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS.

1 Nine months ended May 31, 2019

2 Adjusted gross margin and adjusted EBITDA are non-IFRS

measures that are not defined by and do not have any standardized

meaning under IFRS; please see the Company’s Q3 2019 Management’s

Discussion and Analysis (“MD&A”) for definitions and

calculations.

3 Once fully licensed and operational. Several factors can cause

actual capacity to differ from estimates. Please see “Risks and

Uncertainties” in the Company’s Q3 MD&A.

4 Cash and “all-in” costs of cultivation per gram of dried

flower harvested are non-IFRS measures that are not defined by and

do not have any standardized meaning under IFRS; please see the

Company’s Q3 2019 MD&A for definitions and calculations. Cash

cost of cultivation excludes significant post-harvest costs

including but not limited to extraction, packaging and shipping

which need to be added to arrive at cost of sales when inventory is

sold. All-in cost of cultivation includes non-cash depreciation and

share compensation.

5 Non-IFRS measures

6 Excluding non-cash share-based compensation

7 QUICK TAKE - Cannabis - Cowen's THC Tracker: U.S. Brands -

Cowen and Company, March 29, 2019

8 The Company has no investment or ownership in any entity in

the United States nor does it provide any products or services to

entities in the United States.

9 Non-IFRS measure

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190715005219/en/

For Investor Relations enquiries, please contact: Amy Schwalm

Vice-President, Investor Relations amy.schwalm@organigram.ca

416-704-9057

For Media enquiries, please contact: Ray Gracewood Senior Vice

President, Marketing and Communications rgracewood@organigram.ca

(506) 645-1653

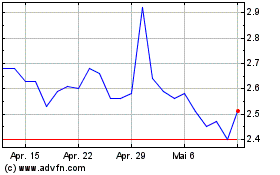

OrganiGram (TSX:OGI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

OrganiGram (TSX:OGI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024