UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number 001-35463

Taro Pharmaceutical Industries Ltd.

(Translation of Registrant’s name into English)

14 Hakitor Street, Haifa Bay 2624761, Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

CONTENTS

Entry into Definitive Merger Agreement

Taro Pharmaceutical Industries Ltd. (“Taro”

or the “Company”) announced today that it has entered into a merger agreement (the “Merger Agreement”)

with Sun Pharmaceutical Industries Ltd. (“Sun Pharma”), the Company’s controlling shareholder, and certain affiliates

of Sun Pharma, pursuant to which Sun Pharma has agreed to acquire all of the outstanding ordinary shares, par value 0.0001 New Israeli

Shekels per share, of the Company (“ordinary shares”), not already held by Sun Pharma or its affiliates, for a purchase

price of US$43.00 per ordinary share in cash without interest.

Pursuant to the Merger Agreement, Taro will merge

with a company that is controlled by Sun Pharma (the “Merger”). Upon completion of the Merger, Taro will become a privately-held

company and an indirect wholly-owned subsidiary of Sun Pharma, and its ordinary shares will no longer be listed on the New York Stock

Exchange (“NYSE”).

The Merger

Agreement provides each of Taro and Sun Pharma with certain termination rights under certain circumstances, in each case without requiring

payment of a termination fee.

The Merger Agreement was approved by Taro’s

board of directors (the “Board”) following the approvals and recommendations of a special committee (which had been

formed by the Board to consider the proposed Merger and was composed solely of independent directors, under the criteria set forth in

Section 303A.02 of the NYSE Listed Company Manual, who were also non-affiliated directors under the definition provided in the Israeli

Companies Law, 5759-1999) and the audit committee of the Board.

The

Merger is currently expected to close in the first half of 2024, subject to various closing conditions. Sun Pharma has agreed

to vote its shares in favor of the Merger, and has indicated that it is not willing to sell its shares to a third party or support any

alternative transaction to the Merger.

Copies

of the joint press release and Merger Agreement are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated by reference

herein.

Forward-Looking Statements

This Report of Foreign

Private Issuer on Form 6-K (this “Form 6-K”), including the press release attached hereto as Exhibit 99.1, contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements

include, but are not limited to, the anticipated timing of the closing of the Merger and statements regarding the funding and consummation

of the Merger. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident”

and similar statements. Statements that are not historical or current facts, including statements about beliefs and expectations, are

forward-looking statements. Forward-looking statements involve factors, risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in these forward-looking statements. Such factors, risks and uncertainties include the possibility

that the Merger will not occur on the timeline anticipated, or at all, if events arise that result in the termination of the Merger Agreement,

or if one or more of the various closing conditions to the Merger are not satisfied or waived, or if the regulatory review process takes

longer than anticipated and other risks and uncertainties discussed in documents furnished to or filed with the Securities and Exchange

Commission (the “SEC”) by the Company as well as the Schedule 13E-3

and the proxy statement to be filed by the Company. All information provided in this Form 6-K is as of the date hereof, and the Company

undertakes no duty to update such information, except as required under applicable law.

Further information on these

and other factors is included in filings the Company makes with the SEC from time to time, including in “Item 3.D. Risk Factors”

in the Company’s most recent Annual Report on Form 20-F, as well as the Schedule 13E-3 (which will include the proxy statement)

to be filed by the Company. These documents are available (or will be available when filed) on the SEC Filings section of the Investor

Relations section of the Company’s website at: https://taro.gcs-web.com/.

Additional Information about the Merger

and Where to Find It

In connection with

the proposed Merger, Taro will prepare and mail to its shareholders a proxy statement that will include a copy of the Merger Agreement.

In addition, in connection with the Merger, Taro and certain other participants in the Merger will prepare and disseminate to Taro’s

shareholders a Schedule 13E-3 Transaction Statement that will include Taro’s proxy statement (the “Schedule 13E-3”).

The Schedule 13E-3 will be filed with the SEC. INVESTORS AND SHAREHOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE SCHEDULE

13E-3 AND OTHER MATERIALS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TARO, THE MERGER,

AND RELATED MATTERS. Shareholders also will be able to obtain these documents, as well as other filings containing information about

Taro, the Merger and related matters, without charge from the SEC’s website (http://www.sec.gov)

and Taro’s website (http://www.taro.com).

Participants in the Solicitation

Taro and its directors and certain of its executive

officers and other employees may be deemed to be participants in the solicitation of proxies from Taro’s shareholders with respect

to the proposed Merger. Information regarding the persons who may be considered “participants” in the solicitation of proxies

will be set forth in the Schedule 13E-3 and proxy statement when filed with the SEC.

This Form 6-K is neither

a solicitation of proxy, an offer to purchase nor a solicitation of an offer to sell any securities, and it is not a substitute for any

proxy statement or other materials that may be filed with or furnished to the SEC should the proposed Merger proceed.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

TARO PHARMACEUTICAL

INDUSTRIES LTD. |

| |

|

|

| |

|

|

| |

By: |

/s/

Uday Baldota |

| |

Name: |

Uday Baldota |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

Date: January 17,

2024 |

Exhibit 99.1

Taro Announces Merger Agreement with Sun Pharma

Agreed Price of US$43.00 per Share to Deliver

48% Premium to Unaffected Price on May 25, 2023

Mumbai, India and New York, USA January 17,

2024 – Sun Pharmaceutical Industries Limited (Reuters: SUN.BO, Bloomberg: SUNP IN, NSE: SUNPHARMA, BSE: 524715) (together with

its subsidiaries and/or associates referred as “Sun Pharma”) and Taro Pharmaceutical Industries Ltd. (NYSE: TARO) (“Taro”

or the “Company”) today announced that they have entered into a definitive merger agreement in which Sun Pharma, Taro’s

controlling shareholder, has agreed to acquire all of the outstanding ordinary shares of Taro other than the shares already held by Sun

Pharma or its affiliates for US$43.00 per share in cash without interest.

Dilip Shanghvi, Managing Director of Sun Pharma,

said, “Over the years, with Sun Pharma’s strategic interventions, Taro has remained a key player in the generic dermatology

market in a challenging environment. Post completion of the merger, the combined entity will firmly move forward, leveraging its global

strengths and capabilities to better serve the needs of patients and healthcare professionals.”

Uday Baldota, Chief Executive Officer

of Taro, said, “Taro is committed to delivering high quality products to our patients and customers around the world. This merger

will further enable us compete effectively in our products and markets.”

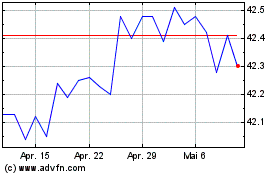

The US$43.00 per share purchase price

represents a 48% premium over the closing price of US$28.97 per share on May 25, 2023, the last trading day before Sun Pharma first

submitted its non-binding proposal to Taro, and a premium of 58% to the volume-weighted average price of the shares during the 60

days prior to and including May 25, 2023. The purchase price also represents a 13% increase over the initial proposed purchase price

of US$38.00 per share as proposed on May 26, 2023.

The merger agreement was unanimously recommended

by the Special Committee, which was formed by Taro’s Board of Directors to consider Sun Pharma’s proposal. Following a comprehensive

evaluation of the proposal with assistance from independent financial and legal advisors, the Special Committee determined that the merger

agreement and the per share merger consideration are fair and in the best interests of Taro and its minority shareholders.

Upon receiving the unanimous recommendation of

the Special Committee, and following unanimous approval by Taro’s Audit Committee, Taro’s Board and the Board of Directors

of Sun Pharma unanimously approved the definitive merger agreement.

The merger is subject to various closing conditions.

These include, among other conditions, the approval of the merger by the affirmative vote of shareholders representing at least 75% of

the voting power of the Company's shares present and voting in person or by proxy at a meeting of the Company’s shareholders, including

at least a majority of the voting power of such shares held by holders other than Sun Pharma and its affiliates or any other holders having

a personal interest (under the Israeli Companies Law) in the merger and voting thereon. Sun Pharma has agreed to vote its shares in favor

of the merger, and has indicated that it is not willing to sell its shares to a third party or support any alternative transaction to

the merger.

Upon completion of the merger, currently expected

to close in the first half of 2024, Taro will become a privately held company and its shares will no longer be listed on the NYSE.

The Special Committee retained BofA

Securities, Inc. as its financial advisor, Goldfarb Gross Seligman & Co. as its Israeli counsel and Skadden, Arps, Slate,

Meagher & Flom LLP as its U.S. legal counsel, to assist it in its mandate. Herzog, Fox & Neeman is acting as Israeli legal

counsel to Sun Pharma and Davis Polk & Wardwell LLP is acting as U.S. legal counsel to Sun Pharma. Meitar is acting as Israeli

legal counsel to Taro and Shearman & Sterling LLP is acting as U.S. legal counsel to Taro.

Additional Information About the Merger

Taro will furnish to the U.S. Securities and Exchange

Commission (the “SEC”) a current report on Form 6-K regarding the merger, which will include as an exhibit thereto the merger

agreement. All parties desiring details regarding the merger are urged to review these documents, which will be available at the SEC’s

website (http://www.sec.gov) and Taro’s website (http://www.taro.com).

In connection with the proposed transaction, Taro

will prepare and mail to its shareholders a proxy statement that will include a copy of the merger agreement. In addition, in connection

with the merger, Taro and certain other participants in the merger will prepare and disseminate to Taro’s shareholders a Schedule

13E-3 Transaction Statement that will include Taro’s proxy statement (the “Schedule 13E-3”). The Schedule 13E-3 will

be filed with the SEC and is subject to its review. INVESTORS AND SHAREHOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE

SCHEDULE 13E-3 AND OTHER MATERIALS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TARO,

THE MERGER, AND RELATED MATTERS. Shareholders also will be able to obtain these documents, as well as other filings containing information

about Taro, the merger and related matters, without charge from the SEC’s website (http://www.sec.gov) and Taro’s website

(http://www.taro.com).

Sun Pharma will furnish the necessary details of

the transaction as per the requirements under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Taro and its directors and certain of its executive

officers and other employees may be deemed to be participants in the solicitation of proxies from Taro’s shareholders with respect

to the proposed merger. Information regarding the persons who may be considered “participants” in the solicitation of proxies

will be set forth in the Schedule 13E-3 and proxy statement when filed with the SEC.

This announcement is neither a solicitation of

proxy, an offer to purchase nor a solicitation of an offer to sell any securities, and it is not a substitute for any proxy statement

or other materials that may be filed with or furnished to the SEC should the proposed merger proceed.

About Sun Pharmaceutical Industries Limited

(CIN - L24230GJ1993PLC019050)

Sun

Pharma is the world’s fourth largest specialty generics company with presence in Specialty, Generics and Consumer Healthcare products.

It is the largest pharmaceutical company in India and is a leading generic company in the US as well as Global Emerging Markets. Sun’s

high growth Global Specialty portfolio spans innovative products in dermatology, ophthalmology, and onco-dermatology and accounts for

over 16% of company sales. The company’s vertically integrated operations deliver high-quality medicines, trusted by physicians

and consumers in over 100 countries. Its manufacturing facilities are spread across six continents. Sun Pharma is proud of its multi-cultural

workforce drawn from over 50 nations. For further information, please visit www.sunpharma.com and follow us on “X” @SunPharma_Live

About Taro Pharmaceutical Industries Ltd. (NYSE:

TARO)

Taro Pharmaceutical Industries Ltd. is a multinational,

science-based pharmaceutical company dedicated to meeting the needs of its customers through the discovery, development, manufacturing

and marketing of the highest quality healthcare products. For further information on Taro Pharmaceutical Industries Ltd., please visit

the Company’s website at www.taro.com

Forward-Looking

Statements

This announcement contains forward-looking statements,

including, but not limited to, the anticipated timing of closing the transaction and statements regarding the funding and consummation

of the transactions. These forward-looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,”

“confident” and similar statements. Statements that are not historical or current facts, including statements about beliefs

and expectations, are forward-looking statements. Forward-looking statements involve factors, risks and uncertainties that could cause

actual results to differ materially from those expressed or implied in these forward-looking statements. Such factors, risks and uncertainties

include the possibility that the merger will not occur on the timeline anticipated, or at all, if events arise that result in the termination

of the Agreement, or if one or more of the various closing conditions to the merger are not satisfied or waived, or if the regulatory

review process takes longer than anticipated and other risks and uncertainties discussed in documents filed with the SEC by the Company

as well as the Schedule 13E-3 and the proxy statement to be filed by the Company. All information provided in this press release is as

of the date of the press release, and the Company undertakes no duty to update such information, except as required under applicable law.

Further information on these and other factors

is included in filings the Company makes with the SEC from time to time, including the section titled “Risk Factors” in the

Company’s most recent Form 20-F, as well as the Form 6-K and Schedule 13E-3 (which will include the proxy statement) to be filed

by the Company. These documents are available (or will be available when filed) on the SEC Filings section of the Investor Relations section

of the Company’s website at: https://taro.gcs-web.com/.

Investor Relations Contacts

Sun Pharmaceutical Industries Limited

Investor Contact:

Dr. Abhishek Sharma

Tel: +91 22 4324 4324, Xtn 2929

Tel Direct: +91 22 4324 2929

Mobile: +91 98196 86016

E-mail: abhi.sharma@sunpharma.com

Media Contact:

Gaurav Chugh

Tel: +91 22 4324 4324, Xtn 5373

Tel Direct: +91 22 4324 5373

Mobile: +91 98104 71414

E-mail: gaurav.chugh@sunpharma.com

Media Contact (US):

Janet Metz

Mobile +1 609-389-3044

E mail: janet.metz@sunpharma.com

Taro Pharmaceutical Industries Ltd.

Contact:

William J. Coote

VP, CFO

(914) 345-9001

William.Coote@taro.com

Exhibit 99.2

EXECUTION VERSION

AGREEMENT OF MERGER

This

Agreement of Merger is made and entered into as of January 17, 2024 by and among Sun

Pharmaceutical Industries Ltd., a corporation organized under the laws of India (“Parent”), Alkaloida

Chemical Company ZRT (f/k/a Alkaloida Chemical Company Exclusive Group Limited) (“Alkaloida”), a corporation

organized under the laws of Hungary and under the control of Parent, The Taro Development Corporation,

a corporation organized under the laws of New York and under the control of Parent (“TDC”), Sun

Pharma Holdings, a corporation organized under the laws of Mauritius and a direct wholly owned subsidiary of Parent (“SPH”),

Libra Merger Ltd., an Israeli company under the control of Parent and a direct wholly

owned subsidiary of Alkaloida, TDC and SPH (“Merger Sub”), and Taro Pharmaceutical

Industries Ltd., an Israeli company (the “Company”). Certain capitalized terms used but not defined in this

Agreement are defined in Exhibit A hereto.

Recitals

A.

(i) Parent beneficially owns, within the meaning of Rule 13d-3 of the Exchange Act, and Alkaloida, TDC and SPH hold, 29,497,813

Company Ordinary Shares, representing approximately 78.5% of the issued and outstanding Company Ordinary Shares as of the date hereof,

and (ii) Alkaloida holds 2,600 Company Founder Shares, representing 100% of the outstanding Company Founder Shares as of the date hereof,

with the shares in clauses (i) and (ii) representing approximately 85.7% of the outstanding voting rights in the Company in the aggregate.

B.

Parent, Alkaloida, TDC, SPH, Merger Sub, and the Company intend to effect a merger of Merger Sub with and into the Company in accordance

with this Agreement and the applicable provisions of Sections 314 through 327 of the Companies Law (the “Merger”).

Upon consummation of the Merger, Merger Sub will cease to exist, and the Company will become a direct wholly owned subsidiary of Alkaloida,

TDC and SPH.

C.

The board of directors of Merger Sub has (i) determined that, considering the financial position of the merging companies, no reasonable

concern exists that the Surviving Company (as defined in Section 1.1) will be unable to fulfill the obligations of Merger Sub to

its creditors and (ii) recommended that the sole shareholders of Merger Sub vote to approve this Agreement, the Merger and the other Contemplated

Transactions, and the respective boards of directors of Parent, Alkaloida, and Merger Sub have (a) determined that the Merger is advisable

and fair to and in the best interests of their respective companies and shareholders and (b) approved this Agreement, the Merger and the

other Contemplated Transactions.

D.

The board of directors of the Company (the “Board of Directors”) formed a special committee consisting of independent

members of the Board of Directors (the “Special Committee”) for the purpose of evaluating the Merger and the other

Contemplated Transactions and making a recommendation to the Board of Directors with respect thereto, and the Special Committee (i) determined

that the Merger is fair to, and in the best interests of, the Company and its shareholders (other than Parent and its Affiliates); (ii)

determined that considering the financial position of the Company and Merger Sub no reasonable concern exists that the Surviving Company

will be unable to fulfill the obligations of the Company to its creditors; (iii) recommended to authorize and approve the execution, delivery

and performance of this Agreement by the Company and to approve this Agreement, the Merger and the other Contemplated Transactions; (iv)

recommended to authorize and approve the execution and delivery of the Merger Proposal; and (v) recommended the approval of this Agreement,

the Merger and the other Contemplated Transactions by the holders of Company Ordinary Shares and to direct that this Agreement, the Merger

and the other Contemplated Transactions be submitted for consideration by the Company’s shareholders at the Company Shareholders’

Meetings (the “Special Committee Recommendation”).

E.

The audit committee of the Company (the “Audit Committee”) has determined that the Merger and the other Contemplated

Transactions are advisable and fair to and in the best interests of the Company and its shareholders and has recommended that the full

Board of Directors approve this Agreement, the Merger, and the other Contemplated Transactions.

F.

Upon the recommendation of the Special Committee and the Audit Committee, the Board of Directors (i) determined that the Merger

is advisable and fair and in the best interests of the Company and its shareholders; (ii) determined that, considering the financial position

of the Company and Merger Sub, no reasonable concern exists that the Surviving Company will be unable to fulfill the obligations of the

Company to its creditors; (iii) approved this Agreement, the Merger and the other Contemplated Transactions; (iv) authorized and approved

the execution and filing of the Merger Proposal (as such term is defined below); and (v) recommended to the shareholders of the Company

the approval and adoption of this Agreement, the Merger and the other Contemplated Transactions and directed that this Agreement, the

Merger and the other Contemplated Transactions be submitted for consideration by the Company’s shareholders at the Company Shareholders’

Meetings.

Agreement

The parties to this Agreement, intending to be

legally bound, agree as follows:

Section 1

Description of Transaction.

1.1. Merger of Merger Sub with and into the Company. Upon the terms and subject to the conditions set forth in this Agreement, at

the Effective Time, and in accordance with Sections 314 through 327 of the Companies Law, Merger Sub (as the target company (Chevrat

HaYa’ad)) shall be merged with and into the Company (as the absorbing company (HaChevra HaKoletet)). As a result of the

Merger, at the Effective Time, the separate existence of Merger Sub shall cease and the Company will continue as the surviving company

in the Merger (the “Surviving Company”).

1.2. Effect of the Merger. The Merger shall have the effects set forth in this Agreement and in the applicable provisions of the

Companies Law. Pursuant to, by virtue of, and simultaneously with, the Merger and without any further action on the part of Parent, Alkaloida,

TDC, SPH, Merger Sub, the Company or any shareholder of the Company, the Surviving Company will succeed to and assume all of the rights,

properties and obligations of Merger Sub and the Company in accordance with the Companies Law. Merger Sub will cease to exist and will

be stricken from the records of the Companies Registrar of the State of Israel, and the Surviving Company will become a private company

directly and wholly owned by Alkaloida, TDC and SPH, all as provided under the Companies Law.

1.3. Closing. The closing of the Merger and the consummation of the other Contemplated Transactions that are to be consummated at

the time of the Merger (the “Closing”) shall take place at Herzog, Fox & Neeman, Herzog Tower, 6 Yitzhak Sadeh,

Tel Aviv 6777506, Israel, or such other place as the parties shall agree, on a date to be designated by Parent and the Company (the “Closing

Date”), which shall be no later than the third business day after the satisfaction or, to the extent permitted by law, waiver

of the last to be satisfied or waived of the conditions set forth in Section 5 and Section 6 (other than those conditions which

by their nature are to be satisfied at the Closing).

1.4. Effective Time. Immediately prior to the anticipated Closing Date, the Company and Merger Sub shall notify the Companies Registrar

of the State of Israel (the “Companies Registrar”) that the conditions set forth in Section 5 and Section

6 have been satisfied or waived and request that the Companies Registrar issue a certificate evidencing the consummation of the Merger

in accordance with Section 323(5) of the Companies Law (the “Certificate of Merger”). The Merger shall become effective

upon the issuance of the Certificate of Merger in accordance with the Companies Law (the time the Merger becomes effective being the “Effective

Time”). For the avoidance of doubt, and notwithstanding any provision of this Agreement to the contrary, it is the intention

of the parties that the Merger shall be declared effective and the Certificate of Merger shall be issued concurrently with the Closing

but not before the Closing shall have taken place.

1.5. Articles of Association; Memorandum of Association; Directors. Unless otherwise determined by Parent prior to the Effective

Time, at the Effective Time:

(a)

the Articles of Association of the Surviving Company shall be the same as the Articles of Association of the Company in effect

at the Effective Time until thereafter amended in accordance with the Companies Law and such Articles of Association;

(b)

the Memorandum of Association of the Surviving Company shall be the same as the Memorandum of Association of the Company in effect

at the Effective Time until thereafter amended in accordance with the Companies Law and such Memorandum of Association; and

(c)

the directors of the Surviving Company immediately after the Effective Time shall be the respective individuals who are the directors

of Merger Sub immediately prior to the Effective Time, and the officers of the Company immediately prior to the Effective Time shall be

the officers of the Surviving Company, in each case until their respective successors are duly elected or appointed or until the earlier

of their death, resignation or removal.

1.6. Effect on Share Capital.

(a)

At the Effective Time, by virtue of, and simultaneously with, the Merger and without any further action on the part of Parent,

Alkaloida, TDC, SPH, Merger Sub, the Company or any shareholder of Parent, Alkaloida, TDC, SPH, Merger Sub, or the Company:

(i)

all Company Ordinary Shares held by Parent or any of its Affiliates (including the Acquired Corporations) (collectively, the “Excluded

Ordinary Shares”), and all Company Founder Shares held by Parent or any of its Affiliates (including the Acquired Corporations)

shall not be canceled or surrendered in the Merger and no consideration shall be delivered in exchange therefor;

(ii)

except as provided in clauses “(i)” above, and subject to Section 1.6(b), each Company Ordinary Share issued and

outstanding immediately prior to the Effective Time shall be automatically converted into the right to receive US$43.00 in cash, without

any interest thereon (the “Merger Consideration”) and shall be canceled and shall cease to exist; and

(iii)

each ordinary share, par value NIS 1.00 per share, of Merger Sub issued and outstanding immediately prior to the Effective Time

shall be canceled and shall cease to exist, and no consideration shall be delivered in exchange therefor.

(b)

If any Company Ordinary Shares outstanding immediately prior to the Effective Time are unvested or are subject to a repurchase

option, risk of forfeiture or other condition under any applicable restricted stock purchase agreement or other Contract with the Company

or under which the Company has any rights, then the Merger Consideration payable in exchange for such Company Ordinary Shares will also

be unvested and subject to the same repurchase option, risk of forfeiture or other condition and need not be paid until such time as such

repurchase option, risk of forfeiture or other conditions lapses or otherwise terminates. Prior to the Effective Time, the Company shall

ensure that, from and after the Effective Time, Parent, Alkaloida, TDC and SPH are each entitled to exercise any such repurchase option

or other right set forth in any such restricted stock purchase agreement or other Contract.

1.7. Closing

of the Company’s Transfer Books. At the Effective Time: (a) all holders of certificates or book-entry shares representing Company

Ordinary Shares, other than Excluded Ordinary Shares, that were outstanding immediately prior to the Effective Time shall cease to have

any rights as shareholders of the Company (other than the right to receive the Merger Consideration pursuant to Section 1.6(a)(ii));

and (b) the share transfer books of the Company shall be closed with respect to all Company Ordinary Shares, other than the Excluded

Ordinary Shares, outstanding immediately prior to the Effective Time. No further transfer of any Company Ordinary Shares shall be made

on such share transfer books after the Effective Time. If, after the Effective Time, a valid certificate previously representing any

Company Ordinary Shares (other than Excluded Ordinary Shares) issued and outstanding immediately prior to the Effective Time (a “Company

Share Certificate”) is presented to the Paying Agent (as defined in Section 1.8) or to the Surviving Company or Parent,

such Company Share Certificate shall be canceled and shall be exchanged as provided in Section 1.8.

1.8. Exchange

of Certificates.

(a)

On or prior to the Closing Date, Parent shall select a reputable bank or trust company reasonably acceptable to the Company to

act as the paying agent in connection with the Merger (which will use a local Israeli nationally recognized sub-paying agent reasonably

acceptable to the Company (the “Israeli Paying Agent”)) (the “Paying Agent”). As of the Effective

Time, Alkaloida, TDC and SPH, in the pro rata proportions to their holdings of share capital in the Company, shall have deposited or caused

to be deposited with: (i) the Paying Agent, in trust for the benefit of the holders of Company Ordinary Shares (other than Excluded Ordinary

Shares) immediately prior to the Effective Time, cash in an amount equal to the aggregate consideration payable pursuant to Section 1.6(a),

other than the applicable portion thereof payable to holders of Company 102 Shares; and (ii) the Section 102 Trustee, the applicable portion

of the aggregate consideration payable to holders of Company 102 Shares hereunder. The cash amount so deposited with the Paying Agent

is referred to as the “Payment Fund.”

(b)

As soon as reasonably practicable following the Effective Time, Parent, Alkaloida, TDC, SPH and the Surviving Company will cause

the Paying Agent to mail to each holder of record of Company Share Certificates: (i) a letter of transmittal in customary form and containing

such provisions as Parent may reasonably specify and that the Company may reasonably approve prior to the Effective Time (including a

provision confirming that delivery of Company Share Certificates shall be effected, and risk of loss and title to Company Share Certificates

shall pass, only upon delivery of such Company Share Certificates to the Paying Agent); (ii) a request for a tax residency declaration

(including any required supporting documents), a Valid Tax Certificate, a duly executed IRS Form W-9 or applicable IRS Form W-8, and any

other information necessary for Parent, Alkaloida, TDC, SPH or the Israeli Paying Agent to determine whether any amounts need to be withheld

from the consideration payable to such Person pursuant to the terms of the Ordinance (in each case, to the extent required by and subject

to the terms of the Israeli Tax Ruling, if obtained), the Code or any other provision of U.S. state or local or non-U.S. applicable Legal

Requirement; and (iii) instructions for use in effecting the surrender of Company Share Certificates in exchange for the Merger Consideration

pursuant to such letter of transmittal. Upon surrender of a Company Share Certificate to the Paying Agent together with a duly executed

letter of transmittal and such other customary documents as may be reasonably required by the Paying Agent, Alkaloida, TDC, SPH or Parent

or upon receipt by the Paying Agent of an “agent’s message” in the case of book-entry shares of the Company other than

the Excluded Ordinary Shares (“Book-Entry Shares”), (A) the holder of such Company Share Certificate and/or Book-Entry

Shares shall be entitled to receive in exchange therefor the Merger Consideration multiplied by the number of Company Ordinary Shares

formerly represented by the Company Share Certificate and/or Book-Entry Shares (less any applicable Tax withholding); and (B) the Company

Share Certificate and/or Book-Entry Shares so surrendered shall be canceled. If any cash is to be paid to a Person other than the Person

in whose name the Company Share Certificate and/or Book-Entry Shares surrendered is registered, it shall be a condition of such payment

that the Company Share Certificate and/or Book-Entry Shares so surrendered shall be (in the case of Company Share Certificates) properly

endorsed (with such signature guarantees as may be required by the letter of transmittal) or otherwise in proper form for transfer, and

that the Person requesting payment shall: (1) pay to the Paying Agent any transfer or other Taxes (including any withholding Tax obligation)

required by reason of such payment to a Person other than the registered holder of the Company Share Certificate and/or Book-Entry Shares

surrendered; or (2) establish to the full satisfaction of Parent, Alkaloida, TDC and SPH that such tax has been paid or is not required

to be paid. The exchange procedures shall comply with such procedures as may be required by the Israeli Tax Ruling (as defined in Section

4.4(b)) if obtained, and shall permit Parent, Alkaloida, TDC and SPH (after consultation with the Company) to require holders

of Company Ordinary Shares to provide any information as is reasonably needed to comply with the Israeli Tax Ruling (or such other forms

or declaration as may be required under any applicable Tax law), all in accordance with the withholding rights pursuant to Section 1.9.

Until surrendered as contemplated by this Section 1.8(b), each Company Share Certificate and/or Book-Entry Shares shall be deemed,

from and after the Effective Time, to represent only the right to receive cash in an amount equal to the Merger Consideration multiplied

by the number of Company Ordinary Shares represented by such Company Share Certificate and/or Book-Entry Shares, without interest thereon

and subject to withholding Tax. If any Company Share Certificate shall have been lost, stolen or destroyed, Parent may, in its reasonable

discretion and as a condition precedent to the delivery of any Merger Consideration, require the owner of such lost, stolen or destroyed

Company Share Certificate to provide an appropriate affidavit and to deliver a bond in such sum as Parent may reasonably direct, as indemnity

against any claim that may be made against the Paying Agent, Parent, Alkaloida, TDC, SPH, the Surviving Company or any affiliated party

with respect to such Company Share Certificate.

(c)

Any portion of the Payment Fund that remains undistributed to holders of Company Share Certificates and/or Book-Entry Shares as

of nine months after the Closing Date shall be delivered by the Paying Agent to Alkaloida, TDC or SPH (as shall be instructed by Parent)

upon demand, and any holders of Company Share Certificates and/or Book-Entry Shares who have not theretofore surrendered their Company

Share Certificates in accordance with this Section 1.8 shall thereafter look only to Parent, Alkaloida, TDC or SPH for satisfaction

of their claims for Merger Consideration, without any interest thereon.

(d)

None of the Paying Agent, Parent, Alkaloida, TDC, SPH or the Surviving Company shall be liable to any holder or former holder of

Company Ordinary Shares or to any other Person with respect to any Merger Consideration delivered to any public official pursuant to any

applicable abandoned property law, escheat law or similar Legal Requirement.

(e)

Notwithstanding anything herein to the contrary, any Merger Consideration, payable in respect of Company 102 Shares shall be transferred

to the Section 102 Trustee, for the benefit of the beneficial owners thereof, and be released by the Section 102 Trustee to the beneficial

owners of such Company 102 Shares in accordance with the requirements of Section 102 of the Ordinance (including prior to Amendment No.

132 to the Ordinance) and any ruling obtained from the ITA, if obtained.

1.9. Withholding

Rights

(a)

Each of the Paying Agent, the Israeli Paying Agent, the Section 102 Trustee, Parent, Alkaloida, TDC, SPH and the Surviving Company

shall be entitled to deduct and withhold from any consideration payable pursuant to this Agreement to any holder or former holder of Company

Ordinary Shares (other than Excluded Ordinary Shares) such amounts that are required to be deducted or withheld therefrom or in connection

therewith under the Code, under the Ordinance, or under any provision of U.S. state or local or non-U.S. tax law or under any other applicable

Legal Requirement; provided, that, (i) with respect to any withholding under Israeli Legal Requirements, the Paying Agent, the Israeli

Paying Agent, Parent, Alkaloida, TDC, SPH and the Surviving Company shall act in accordance with (A) the Israeli Tax Ruling, if obtained,

or (B) a Valid Tax Certificate and (ii) absent a change in law after the date of this Agreement, there shall not be any withholding on

account of U.S. federal income taxes, other than U.S. backup withholding in the case of a holder that does not provide a duly executed

IRS Form W-9 or IRS Form W-8, as applicable, claiming a complete exemption from backup withholding. To the extent such amounts are so

deducted or withheld, such amounts shall be treated for all purposes under this Agreement as having been paid to the Person to whom such

amounts would otherwise have been paid and the Paying Agent or Israeli Paying Agent shall furnish as promptly as practicable such Person

with a documentation evidencing such Tax withholding or deduction. Any withholding made in NIS with respect to payments made hereunder

in U.S. Dollars shall be calculated based on a conversion rate determined by the Paying Agent, the Israeli Paying Agent or any other payor

of consideration on the date the withholding is actually made from any recipient, and any currency conversion commissions will be deducted

from payments to be made to the applicable payment recipient.

(b)

Notwithstanding anything else in this Agreement but subject to clause (d), and in accordance with the Paying Agent undertaking

provided by the Israeli Paying Agent to Parent as required under Section 6.2.4.3 of the Income Tax Circular 19/2018 (Transaction for Sale

of Rights in a Corporation that includes Consideration that will be transferred to the Seller at Future Dates) (the “Paying Agent

Undertaking”), with respect to Israeli Taxes, any consideration payable to each holder or former holder of Company Ordinary

Shares (other than Company 102 Shares) shall be retained by the Paying Agent for the benefit of such payment recipient for a period of

up to 180 days from the Closing Date or an earlier date required in writing by such payment recipient (the “Withholding Drop

Date”), during which time, unless otherwise requested in writing by the ITA, no payments shall be made by the Paying Agent to

such payment recipient and no amounts for Israeli Taxes shall be withheld from the payments deliverable pursuant to this Agreement, except

as provided below and during which time, such payment recipient may obtain a Valid Tax Certificate. If a payment recipient delivers, no

later than three Business Days prior to the Withholding Drop Date a Valid Tax Certificate to the Paying Agent, then the deduction and

withholding of any Israeli Taxes shall be made only in accordance with the provisions of such Valid Tax Certificate and the balance of

the payment that is not withheld shall be paid to such payment recipient. If such payment recipient (i) does not provide the Paying Agent

with a Valid Tax Certificate by no later than three Business Days before the Withholding Drop Date, or (ii) submits a written request

with the Paying Agent to release its portion of the consideration prior to the Withholding Drop Date and fails to submit a Valid Tax Certificate

no later than three Business Days before such time, then the amount to be withheld from such payment recipient’s portion of the

consideration shall be calculated in accordance with the applicable withholding rate as determined by the Israeli Paying Agent which amount

shall be calculated in NIS based on the US$:NIS exchange rate determined by the Israeli Paying Agent on the date the withholding is actually

made from such recipient, and the Paying Agent will pay to such recipient the balance of the payment due to such recipient that is not

so withheld.

(c)

Notwithstanding anything to the contrary herein, any payments made to holders of any Company 102 Shares will be subject to deduction

or withholding of Israeli Tax under the Ordinance on the sixteenth day of the calendar month following the month during which the Closing

Date occurs, in accordance with the applicable provisions of the Ordinance and any tax ruling obtained by the Company.

(d)

Notwithstanding anything to the contrary in this Agreement, if the Israeli Tax Ruling is obtained and delivered to Parent, then

the provisions of the Israeli Tax Ruling shall apply, prevail and govern and all applicable withholding procedures with respect to any

recipients shall be made in accordance with the provisions of such ruling, as the case may be.

1.10. Further

Action. If, at any time after the Effective Time, any further action is determined by Parent or the Surviving Company to be necessary

or desirable to carry out the purposes of this Agreement or to vest the Surviving Company with full right, title and possession of and

to all rights and property of Merger Sub and the Company, the officers and directors of the Surviving Company, Parent, Alkaloida, TDC

and SPH shall be fully authorized (in the name of Merger Sub, in the name of the Company and otherwise) to take such action.

Section 2

Representations and Warranties of the Company

Except as set forth in the

SEC Reports, the Company represents and warrants to Parent, Alkaloida, TDC, SPH and Merger Sub as follows:

2.

2.1. Due Organization; Qualification to do Business.

(a)

Each of the Acquired Corporations is a corporation duly organized and validly existing and, in jurisdictions that recognize the

concept, is in good standing under the laws of the jurisdiction of its incorporation and has all necessary power and authority to: (i)

conduct its business in the manner in which its business is currently being conducted; and (ii) own, lease, operate and use its properties

and assets in the manner in which its properties and assets are currently owned, leased, operated and used, except, in the case of each

of clauses “(i)” and “(ii)” of this sentence, as would not have and would not reasonably be expected to have or

result in a Company Material Adverse Effect.

(b)

Each of the Acquired Corporations (in jurisdictions that recognize the following concepts) is qualified or licensed to do business

as a foreign corporation, and is in good standing, under the laws of all jurisdictions where the character of the properties and assets

owned, leased or operated by it or where the nature of its business requires such qualification, except where the failure to be so qualified

or in good standing would not have and would not reasonably be expected to have or result in a Company Material Adverse Effect.

2.2. Organizational Documents. The Company’s Articles of Association and Memorandum of Association are in full force and effect.

Neither the Company nor any of the Company’s Subsidiaries is in violation of any of the provisions of its Articles of Association,

Memorandum of Association or equivalent organizational documents.

2.3. Capitalization; Rights to Acquire Stock.

(a)

As of the date of this Agreement, the authorized share capital of the Company consists of: (i) 200,000,000 Company Ordinary Shares,

of which, 45,116,262 Company Ordinary Shares are issued and outstanding, which includes 7,531,631 treasury shares; and (ii) 2,600 Company

Founder Shares, all of which are issued and outstanding. None of the Company Ordinary Shares were subject to issuance pursuant to Company

Options granted and outstanding under the Company Option Plans.

(b)

All of the issued and outstanding share capital of the Company has been duly authorized and validly issued and is fully paid and

nonassessable. None of the outstanding share capital of the Company is entitled or subject to any preemptive right, right of participation,

right of maintenance or any similar right. None of the outstanding share capital of the Company is subject to any right of first refusal

in favor of any of the Acquired Corporations. There is no Company Contract relating to the voting or registration of, or restricting any

Person from purchasing, selling, pledging or otherwise disposing of (or from granting any option or similar right with respect to), any

share capital of the Company. None of the Acquired Corporations is under any obligation, or is bound by any Contract pursuant to which

it may become obligated, to repurchase, redeem or otherwise acquire any outstanding share capital or other securities of the Company.

(c)

There are no preemptive or other outstanding rights, options, warrants, conversion rights, stock appreciation rights, redemption

rights, repurchase rights, agreements, arrangements, calls, commitments or rights of any kind that obligate the Acquired Corporations

to issue or to sell any shares of share capital or other securities of any of the Acquired Corporations or any securities or obligations

convertible or exchangeable into or exercisable for, valued by reference to, or giving any Person a right to subscribe for or acquire,

any securities of any of the Acquired Corporations, and no securities or obligations evidencing such rights are authorized, issued or

outstanding.

2.4. Authority; Binding Nature of Agreement.

(a)

The Company has the corporate right, power and authority to enter into, to deliver and to perform its obligations under this Agreement

and to consummate the Merger and the other Contemplated Transactions. The Board of Directors (at a meeting duly called and held), upon

the recommendation of the Special Committee and the approval of the Audit Committee, has: (a) determined that the Merger is fair to, and

in the best interests of, the Company and its shareholders; (b) determined that considering the financial position of the Company and

Merger Sub no reasonable concern exists that the Surviving Company will be unable to fulfill the obligations of the Company to its creditors;

(c) authorized and approved the execution, delivery and performance of this Agreement by the Company and approved this Agreement, the

Merger and the other Contemplated Transactions; (d) authorized and approved the execution and delivery of the Merger Proposal; and (e)

recommended the approval of this Agreement, the Merger and the other Contemplated Transactions by the holders of Company Ordinary Shares

and directed that this Agreement, the Merger and the other Contemplated Transactions be submitted for consideration by the Company’s

shareholders at the Company Shareholders’ Meetings (as defined in Section 4.2(c)) (the “Company Board Recommendation”).

Except for the Required Company Shareholder Vote (as defined in Section 2.5), no other corporate proceedings on the part of the Company

are necessary to authorize or permit the performance of its obligations under this Agreement and the consummation of the Merger and the

other Contemplated Transactions. This Agreement has been duly and validly executed and delivered by the Company and, assuming the due

authorization, execution and delivery of this Agreement by Parent, Alkaloida, TDC, SPH and Merger Sub, constitutes the legal, valid and

binding obligation of the Company, enforceable against the Company in accordance with its terms, subject to: (i) laws of general application

relating to bankruptcy, insolvency and the relief of debtors; and (ii) rules of law governing specific performance, injunctive relief

and other equitable remedies.

(b)

Except: (i) disclosure required under applicable Legal Requirements; (ii) as may be required by the Companies Law; and (iii) as

would not have a material adverse effect on the ability of the Company to consummate the Merger, no consent, approval, order or authorization

of, or registration, declaration or filing with, any Governmental Body is required by or with respect to the Company in connection with

the execution and delivery of this Agreement or the consummation of the Contemplated Transactions.

2.5. Vote Required. The: (a) affirmative vote of the holders of at least 75% of the voting power of the Company present (in person

or by proxy) and voting on such resolution at a meeting of such shareholders convened to approve the Merger, including at least a majority

of the voting power held by holders other than (A) Parent, Alkaloida, TDC, SPH, Merger Sub and their Affiliates and relatives and Persons

acting on their behalf or (B) any other holders having a personal interest in the Merger, present (in person or by proxy) and voting thereon

(collectively, the “Interested Shareholders”) (unless the total voting power of the Company held by holders other than

the Interested Shareholders and voting against the Merger does not exceed 2% of the total voting power of the Company); (b) affirmative

vote of the holders of at least 75% of the Company Ordinary Shares present (in person or by proxy) and voting on such resolution at a

meeting of such shareholders convened to approve the Merger; and (c) affirmative vote of the holders of at least 75% of the Company Founder

Shares present (in person or by proxy) and voting on such resolution at a meeting of such shareholders convened to approve the Merger;

are the only votes of the holders of any securities of the Company necessary to approve the Merger (collectively, the “Required

Company Shareholder Vote”). The quorum required for the Company Shareholders’ Meetings is three or more shareholders who

hold at least one-third of the total number of votes in the Company.

2.6. Non-Contravention. Assuming compliance with (and receipt of all required approvals under) the applicable provisions of the

Companies Law, neither (1) the execution or delivery of this Agreement by the Company, nor (2) the consummation of the Merger or any of

the other Contemplated Transactions, will or would reasonably be expected to, directly or indirectly (with or without notice or lapse

of time):

(a)

conflict with or result in a violation of: (i) any of the provisions of the Articles of Association or Memorandum of Association

of the Company or the charter or other organizational documents of any of the other Acquired Corporations; or (ii) any Legal Requirement;

or

(b)

result in a breach of, or result in a default under, any material Company Contract, or give any Person the right to: (i) declare

a default or exercise any remedy under any material Company Contract; (ii) accelerate the maturity or performance of any material Company

Contract; or (iii) cancel, terminate or modify any right, benefit, obligation or other term of any material Company Contract, except in

the case of clauses “(a)(ii)” and “(b)” of this sentence, as would not have and would not reasonably

be expected to have or result in a Company Material Adverse Effect.

2.7. Information Supplied. None of the information supplied or to be supplied by the Company for inclusion or incorporation by reference

in (a) the joint Rule 13e-3 Transaction Statement to be filed with the SEC in respect of the Merger (the “Schedule 13E-3”)

(insofar as it relates to the Company and the Company’s Subsidiaries) will, at the time such document is filed with the SEC, at

any time it is amended or supplemented or at the time it is first published, sent or given to the Company’s shareholders, contain

any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements

therein, in light of the circumstances under which they are made, not misleading, or (b) the Proxy Statement (insofar as it relates to

the Company and the Company’s Subsidiaries) will, at the date it (or any amendment or supplement thereto) is first published, sent

or given to shareholders of the Company, contain any untrue statement of a material fact or omit to state any material fact required to

be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they are made, not misleading.

The Schedule 13E-3 and the Proxy Statement will comply in all material respects with the Securities Laws, except that no representation

or warranty is made by the Company with respect to statements made or incorporated by reference therein based on information supplied

by Parent, Alkaloida, TDC, SPH or Merger Sub for inclusion or incorporation by reference therein.

2.8. Fairness Opinion. BofA Securities, Inc., financial advisor to the Special Committee, has delivered to the Special Committee

its oral opinion, to be confirmed by delivery of a written opinion as promptly as practicable after the execution of this Agreement, to

the effect that, as of the date of such opinion and based upon and subject to the various assumptions and limitations set forth therein,

the Merger Consideration to be received in the Merger by the holders of Company Ordinary Shares (other than the holders of the Excluded

Ordinary Shares) is fair, from a financial point of view, to such holders.

2.9. Financial Advisor. Except for BofA Securities, Inc., no broker, finder or investment banker

is entitled to any brokerage, finder’s or other fee or commission in connection with the Merger based upon arrangements made by

any of the Acquired Corporations.

Section 3

Representations and Warranties of Parent, Alkaloida, TDC, SPH and Merger Sub

Each of Parent, Alkaloida,

TDC, SPH and Merger Sub, jointly and severally, represents and warrants to the Company as follows:

3.1. Due Organization; Etc. Parent is a corporation duly incorporated, validly existing and in good standing under the laws of India.

Alkaloida is a corporation duly incorporated, validly existing and in good standing under the laws of Hungary. TDC is a corporation duly

incorporated, validly existing and in good standing under the laws of the State of New York. SPH is a corporation duly incorporated, validly

existing and in good standing under the laws of Mauritius. Merger Sub is a company duly incorporated and validly existing under the laws

of the State of Israel. Immediately prior to the Effective Time, Parent will own, directly or indirectly, of record and beneficially substantially

all outstanding shares of Merger Sub. Merger Sub was formed solely for the purpose of engaging in the acquisition of the Company, has

engaged in no other business activities other than those relating to the acquisition of the Company and is, and at the Effective Time

will be, debt-free.

3.2. Authority; Noncontravention.

(a)

Each of Parent, Alkaloida, TDC, SPH, and Merger Sub has the corporate right, power and authority to enter into and to perform its

respective obligations under this Agreement. The execution, delivery and performance by Parent, Alkaloida, TDC, SPH, and Merger Sub of

this Agreement have been duly authorized by all necessary action on the part of Parent, Alkaloida, TDC, SPH, and Merger Sub and their

respective boards of directors. The board of directors of Merger Sub has: (i) determined that the Merger is fair to, and in the best interests

of, Merger Sub and its shareholders, and that, considering the financial position of the Company and Merger Sub, no reasonable concern

exists that the Surviving Company will be unable to fulfill the obligations of Merger Sub to its creditors; (ii) authorized and approved

the execution and delivery of the Merger Proposal; and (iii) recommended that Alkaloida, TDC and SPH, as the sole shareholders of Merger

Sub, approve this Agreement, the Merger and the other Contemplated Transactions.

(b)

Except: (i) disclosure required under applicable Legal Requirements; (ii) as may be required by the Companies Law; and (iii) as

would not have a material adverse effect on the ability of Parent, Alkaloida, TDC or SPH, to consummate the Merger, no consent, approval,

order or authorization of, or registration, declaration or filing with, any Governmental Body is required by or with respect to Parent,

Alkaloida, TDC, SPH, or Merger Sub in connection with the execution and delivery of this Agreement or the consummation of the Contemplated

Transactions.

3.3. Binding Nature of Agreement. This Agreement has been duly and validly executed and delivered by each of Parent, Alkaloida,

TDC, SPH, and Merger Sub and, assuming the due authorization, execution and delivery of this Agreement by the Company, constitutes the

legal, valid and binding obligation of each of Parent, Alkaloida, TDC, SPH, and Merger Sub, enforceable against them in accordance with

its terms, subject to: (a) laws of general application relating to bankruptcy, insolvency and the relief of debtors; and (b) rules of

law governing specific performance, injunctive relief and other equitable remedies.

3.4. No Vote Required. No vote of the holders of common stock of Parent, Alkaloida. TDC, or SPH, is required to authorize the Merger.

3.5. Financing. As of the date of this Agreement and as of the Closing Date, Parent and Alkaloida have and will have sufficient

cash, available lines of credit or other sources of readily available funds to enable them to satisfy the obligations of Parent, Alkaloida,

TDC, SPH, and Merger Sub under this Agreement, including the obligation to pay all amounts required to be paid as Merger Consideration

in the Merger.

3.6. Disclosure. None of the information with respect to Parent, Alkaloida, TDC, SPH, and Merger Sub supplied or to be supplied

by or on behalf of Parent, Alkaloida, TDC, SPH, or Merger Sub to the Company specifically for inclusion or incorporation by reference

in the Proxy Statement or Schedule 13E-3 will, in the case of the Proxy Statement, at the time the Proxy Statement (or any amendment thereof

or supplement thereto) is mailed to the shareholders of the Company or at the time of the Company Shareholders’ Meetings (or any

adjournment or postponement thereof) and, in the case of the Schedule 13E-3, at the time such document is filed with the SEC, at any time

it is amended or supplemented or at the time it is first published, sent or given to the Company’s shareholders, contain any untrue

statement of a material fact or omit to state any material fact required to be stated therein or necessary in order to make the statements

therein with respect to the information provided by Parent, Alkaloida, TDC, SPH, or Merger Sub, in the light of the circumstances under

which they are made, not misleading. Notwithstanding the foregoing, Parent, Alkaloida TDC, SPH, and Merger Sub make no representation

or warranty with respect to any information supplied by the Company or any of its Representatives that is contained or incorporated by

reference in the Proxy Statement or the Schedule 13E-3.

3.7. Share Ownership. As of the date hereof, none of Parent, Alkaloida, TDC, SPH, Merger Sub or their respective Affiliates (nor,

to the knowledge of Parent, Alkaloida. TDC, SPH, or Merger Sub, any of their respective directors, officers or employees, or any relatives

thereof) own or share ownership of, directly or indirectly, beneficially (as defined in Rule 13d-3 under the Exchange Act) or of record,

any Company Ordinary Shares, Company Founder Shares or securities that are convertible, exchangeable or exercisable into Company Ordinary

Shares or Company Founder Shares, and none of Parent, Alkaloida, TDC, SPH, Merger Sub or their respective Affiliates holds any rights

to acquire or vote any Company Ordinary Shares or Company Founder Shares, except pursuant to this Agreement and those Company Ordinary

Shares and Company Founder Shares as disclosed on the Schedule 13D/A filed with the SEC by Parent, Alkaloida, and their Affiliates on

December 11, 2023.

Section 4

Covenants of the Parties

4.1. Proxy Statement; Schedule 13E-3.

(a)

As promptly as practicable after the date of this Agreement, the Company shall prepare the Proxy Statement which shall be in form

and substance reasonably satisfactory to Parent. The Company shall: (i) cause the Proxy Statement to comply with Legal Requirements applicable

to it; (ii) provide Parent with a reasonable opportunity to review and comment on drafts of the Proxy Statement; and (iii) subject to

the reasonable approval of the Special Committee of the content of the Proxy Statement, cause the Proxy Statement to be mailed to the

Company’s shareholders as promptly as practicable (provided that, if applicable, such date shall follow the date on which the SEC

or its staff advises that it has no further comments on the Schedule 13E-3).

(b)

As promptly as practicable after the date of this Agreement, if applicable, the parties shall jointly prepare the Schedule 13E-3

relating to the Contemplated Transactions and the Company shall, subject to the reasonable approval of the Special Committee of the content

of the Schedule 13E-3, then promptly cause the Schedule 13E-3 to be filed with the SEC. The Company shall as soon as practicable notify

Parent of the receipt of any comments from the SEC with respect to the Schedule 13E-3 and any request by the SEC for any amendment to

the Schedule 13E-3 or for additional information, and will supply Parent with copies of all correspondence between the Company and any

of its Representatives, on the one hand, and the SEC or members of its staff, on the other hand, with respect to the Schedule 13E-3 or

the Contemplated Transactions. Each of the parties shall use its commercially reasonable efforts to resolve all SEC comments with respect

to the Schedule 13E-3 as promptly as practicable after receipt thereof.

(c)

If any event relating to any of the Acquired Corporations occurs, or if the Company becomes aware of any information that should

be disclosed in an amendment or supplement to the Proxy Statement or the Schedule 13E-3 (if applicable), then the Company shall promptly

inform Parent of such event or information and shall, in accordance with the procedures set forth in Section 4.1(a), if appropriate,

(i) cause such amendment or supplement to be mailed to the shareholders of the Company, and (ii) prepare and file with the SEC such amendment

or supplement as soon thereafter as is reasonably practicable. If Parent or Merger Sub becomes aware of any information that should be

disclosed in an amendment or supplement to the Proxy Statement or the Schedule 13E-3 (if applicable), then Parent or Merger Sub shall

promptly inform the Company of such information.

4.2. Merger Proposal; Company Shareholders’ Meetings.

(a)

Each of the Company, subject to the reasonable approval of the Special Committee of the content of the Merger Proposal, and Merger

Sub shall cause a merger proposal (in the Hebrew language) in form reasonably agreed upon by the parties (the “Merger Proposal”)

to be executed in accordance with Section 316 of the Companies Law, and each of the Company, subject to the reasonable approval of the

Special Committee relating to the logistics and other mechanical considerations regarding the delivery of the Merger Proposal, and Merger

Sub shall deliver the Merger Proposal to the Companies Registrar, within three days from the calling of the Company Shareholders’

Meetings, in accordance with Section 317(a) of the Companies Law (such submission date, the “Merger Proposal Submission Date”).

The Company and Merger Sub shall cause a copy of the Merger Proposal to be delivered to each of their respective secured creditors, if

any, no later than three days after the Merger Proposal Submission Date, and each of their respective “Material Creditors”

(as such term is defined in the regulations promulgated under the Companies Law), if any, no later than four Business Days after the Merger

Proposal Submission Date. Promptly after the Company and Merger Sub shall have complied with the immediately preceding sentence and with

Sections 4.2(a)(i) and 4.2(a)(ii) below, but in any event no more than three Business Days following the date

on which such notice was sent to the creditors, the Company and Merger Sub shall inform the Companies Registrar, in accordance with Section

317(b) of the Companies Law, that notice was given to their respective creditors under Section 318 of the Companies Law and the regulations

promulgated thereunder. In addition to the foregoing, the Company and, if applicable, Merger Sub, shall:

(i)

publish a notice to its creditors, stating that a Merger Proposal was submitted to the Companies Registrar and that the creditors

may review the Merger Proposal at the office of the Companies Registrar, the Company’s registered offices or Merger Sub’s

registered offices, as applicable, and at such other locations as the Company or Merger Sub, as applicable, may determine, in (a) two

daily Hebrew newspapers that are widely distributed in Israel, on the Merger Proposal Submission Date, (b) a widely distributed newspaper

in the United States, no later than three Business Days following the Merger Proposal Submission Date, and (c) if required, in such other

manner as may be required by any applicable Law and regulations;

(ii) display in a prominent place at the Company’s premises a copy of the notice published in a daily Hebrew newspaper (as referred

to in Section 4.2(a)(i)), no later than three (3) Business Days following the Merger Proposal Submission Date; and

(iii) the Company or Merger Sub shall comply with the provisions of Section 1.4.

(b)

For the avoidance of doubt, completion of the statutory merger process and the request for issuance of a Certificate of Merger

from the Companies Registrar shall be subject to coordination by the parties and fulfillment or waiver of all of the conditions for Closing

set forth in Section 5 and Section 6, below. For purposes of this Section 4.2, “Business Day” shall have the

meaning set forth in the Merger Regulations.

(c)

The Company shall take all action necessary under all applicable Legal Requirements to call, give notice of and hold promptly:

(i) a meeting of the holders of Company Ordinary Shares and Company Founder Shares; (ii) a class meeting of the holders of the Company

Ordinary Shares, and (iii) a class meeting of the holders of Company Founder Shares; to vote on the approval of this Agreement, the Merger

and the other Contemplated Transactions (the “Company Shareholders’ Meetings”) (provided in each case that, if

applicable, any such meeting date shall follow the date on which the SEC or its staff advises that it has no further comments on the Schedule

13E-3). Subject to the notice requirements of the Companies Law and the Articles of Association of the Company, the Company Shareholders’

Meetings shall be held (on a date selected by the Company in consultation with Parent) as promptly as practicable after the date of this

Agreement, but no later than 40 days following the date on which the SEC or its staff advises that it has no further comments on the Schedule

13E-3. The Company shall ensure that all proxies solicited in connection with the Company Shareholders’ Meetings are solicited in

compliance with all applicable Legal Requirements. Within three days after the approval of the Merger by the shareholders of the Company,

if it has been approved, the Company shall deliver to the Companies Registrar its shareholder approval notice in accordance with Section

317(b) of the Companies Law informing the Companies Registrar that the Merger was approved by the shareholders of the Company at the Company

Shareholders’ Meetings. Parent, Alkaloida, TDC, SPH and their respective Affiliates shall vote or cause to be voted any and all

Company Ordinary Shares and Company Founder Shares beneficially owned by Parent, Alkaloida, TDC, SPH or their respective Affiliates or

with respect to which they have the power (by agreement, proxy or otherwise) to cause to be voted in favor of the approval and adoption

of this Agreement and the Contemplated Transactions at the Company Shareholders’ Meetings (and at any adjournments or postponements

thereof) and to cause their personal interest in such vote to be duly disclosed to the Company. The Company and the Special Committee

shall reasonably agree on the logistics and other mechanical considerations relating to the Company’s obligations to take all action

necessary under all applicable Legal Requirements to call, give notice of and hold promptly the Company Shareholders’ Meetings in

accordance with this Section 4.2(c).

(d)

Subject to Section 4.2(f), the Proxy Statement shall include a statement to the effect that the Board of Directors, upon recommendation

of the Special Committee and the approval of the Audit Committee, recommends that the Company’s shareholders vote to approve this

Agreement, the Merger and the other Contemplated Transactions at the Company Shareholders’ Meetings, and none of the Board of Directors,

Special Committee, or the Audit Committee shall withdraw or modify, or propose to withdraw or modify, in a manner adverse to Parent, Alkaloida,

TDC, SPH or Merger Sub, the respective approvals or recommendations by the Board of Directors, Special Committee, or the Audit Committee

of this Agreement, the Merger or any other Contemplated Transaction other than as permitted by Section 4.2(f).

(e)

Subject to Section 4.2(f), the Company shall (i) use its reasonable best efforts to solicit from holders of Company Ordinary Shares

proxies in favor of the approval of the Merger and the other Contemplated Transactions and (ii) call, notice, convene and hold the Company

Shareholders’ Meetings in compliance with all applicable Legal Requirements, including the Companies Law, the Company’s Memorandum

and Articles of Association, and the rules of the New York Stock Exchange. Notwithstanding clause “(i)” of the preceding sentence,

in the event of a Change in Recommendation, the Company shall disclose the fact of such Change in Recommendation in any solicitation made

by the Company to its shareholders. The Company may adjourn or postpone the meetings of holders of Company Ordinary Shares (1) if

and only to the extent necessary pursuant to applicable law, to provide any necessary supplement or amendment to the Proxy Statement to

the holders of Company Ordinary Shares in advance of a vote on this Agreement, the Merger and the other Contemplated Transactions; or

(2) if, as of the time for which a meeting of holders of Company Ordinary Shares is originally scheduled (as set forth in the Proxy

Statement), there are insufficient holders of Company Ordinary Shares represented (either in person or by proxy) to constitute a quorum

necessary to conduct the business of the meetings. The Company shall engage a proxy solicitor selected by the Special Committee and reasonably

approved by the Board of Directors, and the Company and the Special Committee shall reasonably agree on the logistics and other mechanical

considerations relating to the Company’s obligations relating to proxy solicitation and the Company’s obligation to call,

notice, convene and hold the Company Shareholders’ Meetings, each in accordance with this Section 4.2(e).

(f)

Notwithstanding anything to the contrary contained in Sections 4.2(d) or (e), at any time prior to the approval of this Agreement

by the Required Company Shareholder Vote, neither of the Company Board Recommendation nor the Special Committee Board Recommendation may

be withdrawn or modified in a manner adverse to Parent, Alkaloida, TDC, SPH and/or Merger Sub, unless in response to (i) the Company’s

receipt of an unsolicited bona fide Acquisition Proposal that did not result from a breach of Section

4.3(a) and that the Board of Directors or Special Committee determines in good faith, after consultation

with its outside legal counsel(s) and financial advisor(s), constitutes a Superior Proposal,

or (ii) material facts, events, changes or developments in circumstances arising after the date hereof that were not known or reasonably

foreseeable to the Board of Directors or the Special Committee as of or prior to the date hereof and do not relate to an Acquisition Proposal

or the receipt of any permit or approval from a Governmental Body with respect to the Company’s products currently under development

(an “Intervening Event”; it being understood that in no event will changes to the Company’s share price be construed

to be an Intervening Event (provided that the facts, events, changes or developments in circumstances giving rise to or contributing to

any such change may constitute an Intervening Event)), the Board of Directors, upon recommendation of the Special Committee, or the Special

Committee, respectively, determines, after taking into account the advice of its outside legal counsel(s) and financial advisor(s), that

the failure to withdraw or so modify the Company Board Recommendation or the Special Committee Board Recommendation, respectively, as

a result of the Superior Proposal or the Intervening Event, as applicable, would be inconsistent with the fiduciary obligations of the

Board of Directors or the Special Committee, respectively, under applicable law (in either case, a “Change in Recommendation”);

provided, however, that unless made later than the fifth business day preceding the Company Shareholders’ Meetings, no Change

in Recommendation may be made until after at least five business days following the receipt by Parent of notice from the Company advising

that the Board of Directors or Special Committee, as applicable, intends to take such action and the basis therefor, including reasonably

detailed information regarding the circumstances and details surrounding such action. Without derogating from the Company’s obligations

under Section 4.3(b), the Company shall notify Parent promptly of: (A) any withdrawal of or modification to the Company Board Recommendation