Rush Street Interactive, Inc. (NYSE: RSI) (“RSI”), a leading online

casino and sports betting company in the United States and the rest

of the Americas, today announced financial results for the third

quarter ended September 30, 2024.

Third Quarter 2024 and

Recent Highlights

- Revenue was $232.1 million during

the third quarter of 2024, an increase of 37%, compared to $169.9

million during the third quarter of 2023.

- Net income during the third quarter

of 2024 was $3.2 million, compared to a net loss of $13.4 million

during the third quarter of 2023.

- Adjusted EBITDA1 was $23.4 million

during the third quarter of 2024, compared to $4.1 million during

the third quarter of 2023.

- Adjusted advertising and promotions

expense1 was $38.6 million during the third quarter of 2024, an

increase of 13% compared to $34.1 million during the third quarter

of 2023.

- Monthly Active Users (“MAU”) in the

United States and Canada were approximately 168,000, up 28%

year-over-year. MAUs in Latin America (which includes Mexico) were

approximately 329,000, up 122% year-over-year.

- Average Revenue per Monthly Active

User (“ARPMAU”) in the United States and Canada was $388 during the

third quarter of 2024, up 4% year-over-year. ARPMAU in Latin

America was $39, compared to $43 last year.

- As of September 30, 2024,

unrestricted cash and cash equivalents increased to $216 million

from $194 million as of June 30, 2024.

- On October 24, 2024, RSI’s Board of

Directors authorized the repurchase of an aggregate of up to $50

million of RSI’s Class A common stock.2

Richard Schwartz, Chief Executive Officer of

RSI, said, “We are excited to report that we have achieved another

quarter of exceptional performance, setting new quarterly records

in both revenue and adjusted EBITDA. Our third quarter revenue

surged by 37% year-over-year, and our adjusted EBITDA increased

more than fivefold from the same period last year. These record

results highlight the effectiveness of our strategic initiatives

and ability to execute. Our focus on innovation to attract and

retain high-value players continues to drive significant growth and

profitability.”

“Our strategy has yielded broad based growth and

success across all of our geographies and products. We’ve

accelerated player growth for another consecutive quarter, acquired

significantly more players with much greater marketing efficiency,

all the while increasing our player values. This

combination sets us up well for continued strong

performance.”

“In addition to these strong results, we are

pleased to announce a share repurchase authorization of up to $50

million. This move reflects our confidence in the company’s future

and our commitment to enhancing shareholder value. Our cash

generation and strong balance sheet provides us with the option to

make this strategic investment. We remain on a clear

path to becoming a leader in online gaming across the Americas, and

are dedicated to delivering exceptional value to our customers and

shareholders.”

Guidance

RSI expects revenue for the full year ending

December 31, 2024 to be between $900 and $920 million, increasing

the midpoint by $30 million compared to the prior guidance. At the

midpoint of the range, revenue of $910 million represents 32%

year-over-year growth when compared to $691 million of revenue for

2023.

RSI expects Adjusted EBITDA1 for the full year

ending December 31, 2024 to be between $82 and $86 million,

increasing the midpoint by $16 million compared to the prior

guidance. At the midpoint of the range, Adjusted EBITDA of $84

million compares to $8.2 million of Adjusted EBITDA for 2023.

These guidance ranges are based on certain

assumptions, including that (i) only operations in live

jurisdictions as of today’s date are included, and (ii) RSI

continues to operate in markets in which it is live today.

Earnings Conference Call and Webcast

DetailsRSI will host a conference call and audio webcast

today at 6:00 p.m. Eastern Time (5:00 p.m. Central Time), during

which management will discuss third quarter results and provide

commentary on business performance and its current outlook for

2024. A question-and-answer session will follow the prepared

remarks.

The conference call may be accessed by dialing

1-833-470-1428 (Toll Free) or 1-404-975-4839 (Local) or, for

international callers, 1-929-526-1599. The conference call access

code is 550436.

A live audio webcast of the earnings conference

call may be accessed on RSI’s website at

ir.rushstreetinteractive.com, along with a copy of this press

release and an investor slide presentation. The audio webcast and

investor slide presentation will be available on RSI’s investor

relations website until at least November 30, 2024.

About Rush Street

InteractiveRSI is a trusted online gaming and sports

entertainment company focused on markets in the United States,

Canada and Latin America. Through its brands, BetRivers,

PlaySugarHouse and RushBet, RSI was an early entrant in many

regulated jurisdictions. It currently offers real-money mobile and

online operations in fifteen U.S. states: New Jersey, Pennsylvania,

Indiana, Colorado, Illinois, Iowa, Michigan, Virginia, West

Virginia, Arizona, New York, Louisiana, Maryland, Ohio and

Delaware, as well as in the regulated international markets of

Colombia, Ontario (Canada), Mexico and Peru. RSI offers, through

its proprietary online gaming platform, some of the most popular

online casino games and sports betting options in the United

States. Founded in 2012 in Chicago by gaming industry veterans, RSI

was named the EGR North America Awards Customer Services Operator

of the Year five years in a row (2020-2024), the 2022 EGR North

America Awards Operator of the Year and Social Gaming Operator of

the Year, and the 2021 SBC Latinoamérica Awards Sportsbook Operator

of the Year. RSI was the first U.S.-based online casino and sports

betting operator to receive RG Check iGaming Accreditation from the

Responsible Gaming Council. For more information, visit

www.rushstreetinteractive.com.

Non-GAAP Financial MeasuresIn

addition to providing financial measurements based on accounting

principles generally accepted in the United States (“GAAP”), this

press release includes certain financial measures that are not

prepared in accordance with GAAP, including Adjusted EBITDA,

Adjusted Operating Costs and Expenses, Adjusted Earnings (Loss) Per

Share, Adjusted Net Income (Loss) and Adjusted Weighted Average

Common Shares Outstanding, each of which is a non-GAAP performance

measure that RSI uses to supplement its results presented in

accordance with GAAP. A reconciliation of each such non-GAAP

financial measure to the most directly comparable GAAP financial

measure can be found below. RSI believes that presentation of these

non-GAAP financial measures provides useful information to

investors regarding RSI’s results of operations and operating

performance, as they are similar to measures reported by its public

competitors and are regularly used by securities analysts,

institutional investors and other interested parties in analyzing

operating performance and prospects. These non-GAAP financial

measures are not intended to be considered in isolation or as a

substitute for any GAAP financial measures and, as calculated, may

not be comparable to other similarly titled measures of performance

of other companies in other industries or within the same

industry.

By providing full year 2024 Adjusted EBITDA

guidance, RSI provided its expectation of a forward-looking

non-GAAP financial measure. Information reconciling full year 2024

Adjusted EBITDA to its most directly comparable GAAP financial

measure, net income (loss), is unavailable to RSI without

unreasonable effort due to, among other things, the inherent

difficulty in forecasting and quantifying the comparable GAAP

measure and the applicable adjustments and other amounts that would

be necessary for such a reconciliation, and certain of these

amounts are outside of RSI’s control and may be subject to high

variability or complexity. Preparation of such reconciliations

would also require a forward-looking balance sheet, statement of

operations and statement of cash flows, prepared in accordance with

GAAP, and such forward-looking financial statements are unavailable

to RSI without unreasonable effort. RSI provides a range for its

Adjusted EBITDA forecast that it believes will be achieved;

however, RSI cannot provide any assurance that it can predict all

of the components of the Adjusted EBITDA calculation. RSI provides

a forecast for Adjusted EBITDA because it believes that Adjusted

EBITDA, when viewed with RSI’s results calculated in accordance

with GAAP, provides useful information for the reasons noted

herein. However, Adjusted EBITDA is not a measure of financial

performance or liquidity under GAAP and, accordingly, should not be

considered as an alternative to net income (loss) or cash flow from

operating activities or as an indicator of operating performance or

liquidity.

RSI defines Adjusted EBITDA as net income (loss)

before interest, income taxes, depreciation and amortization,

share-based compensation, adjustments for certain one-time or

non-recurring items and other adjustments. Adjusted EBITDA excludes

certain expenses that are required in accordance with GAAP because

certain expenses are either non-cash (i.e., depreciation and

amortization, and share-based compensation) or are not related to

our underlying business performance (i.e., interest income or

expense).

RSI defines Adjusted Operating Costs and

Expenses as RSI’s GAAP operating costs and expenses adjusted to

exclude the impacts of share-based compensation, certain one-time

or non-recurring items and other adjustments. Adjusted Operating

Costs and Expenses excludes certain expenses that are required in

accordance with GAAP because certain expenses are either non-cash

(i.e., share-based compensation) or are not related to our

underlying business performance.

RSI defines Adjusted Earnings (Loss) Per Share

as Adjusted Net Income (Loss) divided by Adjusted Weighted Average

Common Shares Outstanding. Adjusted Net Income (Loss) is defined as

net income (loss) attributable to Rush Street Interactive, Inc. as

used in the diluted earnings (loss) per share calculations,

adjusted for the reallocation of net loss attributable to

non-controlling interests, share-based compensation, certain

one-time or non-recurring items and other adjustments. Adjusted

Weighted Average Common Shares Outstanding is defined as the

weighted average number of common shares outstanding as used in the

diluted earnings (loss) per share calculation, adjusted for the

assumed conversion of the non-controlling interest’s Rush Street

Interactive, LP Class A units to Class A common stock of RSI on a

one-to-one-basis, only in periods of Net Loss, and incremental

shares from assumed conversion of stock options and restricted

stock units when dilutive to Adjusted Net Income.

RSI includes these non-GAAP financial measures

because management uses them to evaluate RSI’s core operating

performance and trends and to make strategic decisions regarding

the allocation of capital and new investments. Management believes

that these non-GAAP financial measures provide investors with

useful information on RSI’s past financial and operating

performance, enable comparison of financial results from

period-to-period where certain items may vary independent of

business performance, and allow for greater transparency with

respect to metrics used by RSI’s management in operating our

business. Management also believes these non-GAAP financial

measures are useful in evaluating our operating performance

compared to that of other companies in our industry, as these

metrics generally eliminate the effects of certain items that may

vary from company to company for reasons unrelated to overall

operating performance.

Key Metrics RSI provides

certain key metrics, including Monthly Active Users (“MAUs”) and

ARPMAU, in this press release. RSI defines MAUs as the number of

unique users per month who have placed at least one real-money bet

across one or more of our online casino or online sports betting

offerings, and it defines ARPMAU as average revenue for the

applicable period divided by the average MAUs for the same

period.

The numbers RSI uses to calculate MAUs and

ARPMAU are based on internal RSI data. While these numbers are

based on what RSI believes to be reasonable judgments and estimates

of its customer base for the applicable period of measurement,

there are inherent challenges in measuring usage and engagement

with respect to RSI’s online offerings across its customer base.

Such challenges and limitations may also affect RSI’s understanding

of certain details of its business. In addition, RSI’s key metrics

and related estimates, including the definitions and calculations

of the same, may differ from estimates published by third parties

or from similarly-titled metrics of its competitors due to

differences in operations, offerings, methodology and access to

information. RSI regularly reviews, and may adjust its processes

for calculating, its internal metrics to improve their

accuracy.

Forward-Looking StatementsThis

press release includes "forward-looking statements" within the

meaning of the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. RSI's actual results may differ from

their expectations, estimates and projections and consequently, you

should not rely on these forward-looking statements as predictions

of future events. Words such as "expect," "estimate," "project,"

"budget," "forecast," "anticipate," "intend," "plan," "may,"

"will," "could," "should," "believes," "predicts," "potential,"

“propose”, "continue," and similar expressions are intended to

identify such forward-looking statements. These forward-looking

statements include, without limitation, statements regarding

revenue and Adjusted EBITDA guidance, RSI’s future results of

operations, financial condition, cash flows or profitability

(whether on a GAAP or non-GAAP basis), currency fluctuations, RSI’s

strategic plans and focus, anticipated launches or withdrawals of

RSI’s current or new offerings in existing or future jurisdictions,

player growth and engagement, product initiatives, outcomes of

current or future regulatory developments and the objectives of

management for future operations. These forward-looking statements

involve significant risks and uncertainties that could cause the

actual results to differ materially from the expected results. Most

of these factors are outside RSI's control and are difficult to

predict. Factors that may cause such differences include, without

limitation: changes in applicable laws or regulations; RSI’s

ability to manage and sustain growth; RSI’s ability to execute its

business plan, meet its projections and obtain relevant market

access and/or gaming licenses; unanticipated product or service

delays; general economic and market conditions impacting the demand

for RSI’s products and services; economic and market conditions in

the gaming, entertainment and leisure industry in the markets in

which RSI operates; the potential adverse effects of general

economic conditions, inflation and interest rates and unemployment

on RSI’s liquidity, operations and personnel; and other risks and

uncertainties indicated from time to time in RSI's filings with the

SEC. RSI cautions that the foregoing list of factors is not

exclusive. RSI cautions readers not to place undue reliance upon

any forward-looking statements, which speak only as of the date

made. RSI does not undertake or accept any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any such statement is based, except as required by

law.

Media Contacts:Lisa

Johnsonlisa@lisajohnsoncommunications.com

Investor

Contact:ir@rushstreetinteractive.com

|

Rush Street Interactive, Inc.Condensed

Consolidated Statements of Operations(Unaudited and in

thousands, except per share data) |

| |

|

|

|

|

| |

|

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Revenue |

|

$ |

232,109 |

|

$ |

169,887 |

|

|

$ |

669,916 |

|

$ |

497,310 |

|

| |

|

|

|

|

|

|

|

|

| Operating costs and

expenses |

|

|

|

|

|

|

|

|

|

Costs of revenue |

|

|

151,414 |

|

|

116,159 |

|

|

|

440,414 |

|

|

333,166 |

|

|

Advertising and promotions |

|

|

39,252 |

|

|

34,620 |

|

|

|

114,600 |

|

|

125,525 |

|

|

General and administrative |

|

|

26,508 |

|

|

22,409 |

|

|

|

79,582 |

|

|

64,559 |

|

|

Depreciation and amortization |

|

|

8,471 |

|

|

8,401 |

|

|

|

23,127 |

|

|

22,144 |

|

| Total operating costs and

expenses |

|

|

225,645 |

|

|

181,589 |

|

|

|

657,723 |

|

|

545,394 |

|

| Income (loss) from

operations |

|

|

6,464 |

|

|

(11,702 |

) |

|

|

12,193 |

|

|

(48,084 |

) |

| |

|

|

|

|

|

|

|

|

| Other

income |

|

|

|

|

|

|

|

|

|

Interest income, net |

|

|

2,049 |

|

|

762 |

|

|

|

5,525 |

|

|

1,430 |

|

| Income (loss) before

income taxes |

|

|

8,513 |

|

|

(10,940 |

) |

|

|

17,718 |

|

|

(46,654 |

) |

| |

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

5,274 |

|

|

2,426 |

|

|

|

16,970 |

|

|

7,946 |

|

| Net income

(loss) |

|

|

3,239 |

|

|

(13,366 |

) |

|

|

748 |

|

|

(54,600 |

) |

| Net income (loss) attributable

to non-controlling interests |

|

|

2,049 |

|

|

(9,187 |

) |

|

|

385 |

|

|

(38,022 |

) |

| Net income (loss)

attributable to Rush Street Interactive, Inc. |

|

$ |

1,190 |

|

$ |

(4,179 |

) |

|

$ |

363 |

|

$ |

(16,578 |

) |

| |

|

|

|

|

|

|

|

|

| Earnings (loss) per common

share attributable to Rush Street Interactive, Inc. –

basic |

|

$ |

0.01 |

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

$ |

(0.25 |

) |

| Weighted average common shares

outstanding – basic |

|

|

82,847,325 |

|

|

69,698,787 |

|

|

|

79,652,992 |

|

|

67,465,694 |

|

| Earnings (loss) per common

share attributable to Rush Street Interactive, Inc. –

diluted |

|

$ |

0.01 |

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

$ |

(0.25 |

) |

| Weighted average common shares

outstanding – diluted |

|

|

233,118,670 |

|

|

69,698,787 |

|

|

|

230,235,179 |

|

|

67,465,694 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rush Street Interactive, Inc.Condensed

Consolidated Statements of Comprehensive Income

(Loss)(Unaudited and in thousands) |

| |

|

|

|

|

| |

|

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

| Net income

(loss) |

|

$ |

3,239 |

|

|

$ |

(13,366 |

) |

|

$ |

748 |

|

|

$ |

(54,600 |

) |

| |

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss) |

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustment |

|

|

(148 |

) |

|

|

1,495 |

|

|

|

(3,781 |

) |

|

|

3,465 |

|

| Comprehensive income

(loss) |

|

|

3,091 |

|

|

|

(11,871 |

) |

|

|

(3,033 |

) |

|

|

(51,135 |

) |

| Comprehensive income (loss)

attributable to non-controlling interests |

|

|

1,956 |

|

|

|

(8,161 |

) |

|

|

(2,049 |

) |

|

|

(35,621 |

) |

| Comprehensive income

(loss) attributable to Rush Street

Interactive, Inc. |

|

$ |

1,135 |

|

|

$ |

(3,710 |

) |

|

$ |

(984 |

) |

|

$ |

(15,514 |

) |

|

Rush Street Interactive,

Inc.Reconciliations of GAAP to Non-GAAP Financial

Measures(Unaudited and in thousands) |

| Adjusted

EBITDA: |

| |

|

|

|

|

| |

|

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

($ in thousands) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income

(loss) |

|

$ |

3,239 |

|

|

$ |

(13,366 |

) |

|

$ |

748 |

|

|

$ |

(54,600 |

) |

| |

|

|

|

|

|

|

|

|

| Interest income, net |

|

|

(2,049 |

) |

|

|

(762 |

) |

|

|

(5,525 |

) |

|

|

(1,430 |

) |

| Income tax expense |

|

|

5,274 |

|

|

|

2,426 |

|

|

|

16,970 |

|

|

|

7,946 |

|

| Depreciation and

amortization |

|

|

8,471 |

|

|

|

8,401 |

|

|

|

23,127 |

|

|

|

22,144 |

|

| Share-based compensation

expense |

|

|

8,458 |

|

|

|

7,402 |

|

|

|

26,574 |

|

|

|

22,595 |

|

| Adjusted

EBITDA |

|

$ |

23,393 |

|

|

$ |

4,101 |

|

|

$ |

61,894 |

|

|

$ |

(3,345 |

) |

| Adjusted

Operating Costs and Expenses: |

| |

|

|

|

|

| |

|

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP operating costs

and expenses: |

|

|

|

|

|

|

|

|

| Costs of revenue |

|

$ |

151,414 |

|

|

$ |

116,159 |

|

|

$ |

440,414 |

|

|

$ |

333,166 |

|

| Advertising and

promotions |

|

|

39,252 |

|

|

|

34,620 |

|

|

|

114,600 |

|

|

|

125,525 |

|

| General and

administrative |

|

|

26,508 |

|

|

|

22,409 |

|

|

|

79,582 |

|

|

|

64,559 |

|

| Depreciation and

amortization |

|

|

8,471 |

|

|

|

8,401 |

|

|

|

23,127 |

|

|

|

22,144 |

|

| Total operating costs

and expenses |

|

$ |

225,645 |

|

|

$ |

181,589 |

|

|

$ |

657,723 |

|

|

$ |

545,394 |

|

| |

|

|

|

|

|

|

|

|

| Non-GAAP operating

cost and expense adjustments: |

|

|

|

|

|

|

|

|

| Costs of revenue1 |

|

$ |

(295 |

) |

|

$ |

(269 |

) |

|

$ |

(860 |

) |

|

$ |

(795 |

) |

| Advertising and

promotions1 |

|

|

(606 |

) |

|

|

(565 |

) |

|

|

(1,866 |

) |

|

|

(1,660 |

) |

| General and

administrative1 |

|

|

(7,557 |

) |

|

|

(6,568 |

) |

|

|

(23,848 |

) |

|

|

(20,140 |

) |

| Depreciation and

amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Total non-GAAP

operating cost and expense adjustments |

|

$ |

(8,458 |

) |

|

$ |

(7,402 |

) |

|

$ |

(26,574 |

) |

|

$ |

(22,595 |

) |

| |

|

|

|

|

|

|

|

|

| Adjusted operating

costs and expenses: |

|

|

|

|

|

|

|

|

| Costs of revenue |

|

$ |

151,119 |

|

|

$ |

115,890 |

|

|

$ |

439,554 |

|

|

$ |

332,371 |

|

| Advertising and

promotions |

|

|

38,646 |

|

|

|

34,055 |

|

|

|

112,734 |

|

|

|

123,865 |

|

| General and

administrative |

|

|

18,951 |

|

|

|

15,841 |

|

|

|

55,734 |

|

|

|

44,419 |

|

| Depreciation and

amortization |

|

|

8,471 |

|

|

|

8,401 |

|

|

|

23,127 |

|

|

|

22,144 |

|

| Total adjusted

operating costs and expenses |

|

$ |

217,187 |

|

|

$ |

174,187 |

|

|

$ |

631,149 |

|

|

$ |

522,799 |

|

- Non-GAAP Operating Costs and

Expense Adjustments include Share-based compensation expense.

|

Rush Street Interactive,

Inc.Reconciliations of GAAP to Non-GAAP Financial

Measures(Unaudited and in thousands, except share and per

share data) |

| Adjusted

Net Income (Loss), Adjusted Weighted Average Common Shares

Outstanding and Adjusted Earnings (Loss) Per Share: |

| |

|

|

|

|

| |

|

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

| Adjusted net income

(loss) |

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to Rush Street Interactive, Inc. – basic |

|

$ |

1,190 |

|

$ |

(4,179 |

) |

|

$ |

363 |

|

$ |

(16,578 |

) |

| Effect of diluted

securities: |

|

|

|

|

|

|

|

|

|

Increase to net income attributable to non-controlling

interests |

|

|

2,049 |

|

|

— |

|

|

|

385 |

|

|

— |

|

| Net income (loss)

attributable to Rush Street Interactive, Inc. –

diluted |

|

$ |

3,239 |

|

$ |

(4,179 |

) |

|

$ |

748 |

|

$ |

(16,578 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

Net loss attributable to non-controlling interests(1) |

|

|

— |

|

|

(9,187 |

) |

|

|

— |

|

|

(38,022 |

) |

|

Share-based compensation expense |

|

|

8,458 |

|

|

7,402 |

|

|

|

26,574 |

|

|

22,595 |

|

| Adjusted net income

(loss) |

|

$ |

11,697 |

|

$ |

(5,964 |

) |

|

$ |

27,322 |

|

$ |

(32,005 |

) |

| |

|

|

|

|

|

|

|

|

| Adjusted

weighted-average common shares outstanding |

|

|

|

|

|

|

|

|

| Weighted-average common shares

outstanding – basic |

|

|

82,847,325 |

|

|

69,698,787 |

|

|

|

79,652,992 |

|

|

67,465,694 |

|

| Effect of diluted

securities: |

|

|

|

|

|

|

|

|

|

Assumed conversion of RSILP Units to Class A Common Shares |

|

|

142,687,546 |

|

|

— |

|

|

|

144,940,579 |

|

|

— |

|

|

Incremental shares from assumed conversion of stock options and

restricted stock units |

|

|

7,583,799 |

|

|

— |

|

|

|

5,641,608 |

|

|

— |

|

| Weighted-average

common shares outstanding - diluted |

|

|

233,118,670 |

|

|

69,698,787 |

|

|

|

230,235,179 |

|

|

67,465,694 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

Assumed conversion of RSILP Units to Class A Common Shares(1) |

|

|

— |

|

|

152,319,724 |

|

|

|

— |

|

|

154,196,531 |

|

| Adjusted

weighted-average common shares outstanding |

|

|

233,118,670 |

|

|

222,018,511 |

|

|

|

230,235,179 |

|

|

221,662,225 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted earnings

(loss) per share |

|

|

|

|

|

|

|

|

| Earnings (loss) per common

share attributable to Rush Street Interactive, Inc. – basic |

|

$ |

0.01 |

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

$ |

(0.25 |

) |

| Earnings (loss) per common

share attributable to Rush Street Interactive, Inc. – diluted |

|

$ |

0.01 |

|

$ |

(0.06 |

) |

|

$ |

0.00 |

|

$ |

(0.25 |

) |

| Adjusted Earnings (loss) per

share |

|

$ |

0.05 |

|

$ |

(0.03 |

) |

|

$ |

0.12 |

|

$ |

(0.14 |

) |

1 Adjusted net income (loss) includes the

reallocation of net loss attributable to non-controlling interests

that is not otherwise included in net income (loss) attributable to

Rush Street Interactive, Inc. - diluted. Adjusted weighted-average

common shares outstanding includes the assumed conversion of

weighted-average RSILP units to Class A Common Shares that is not

otherwise included in Weighted-average common shares outstanding -

diluted.

1 This is a non-GAAP financial measure. Please

see “Non-GAAP Financial Measures” for more information about this

non-GAAP financial measure and “Reconciliations of GAAP to Non-GAAP

Financial Measures” for any applicable reconciliation of the most

comparable measure calculated in accordance with GAAP to this

non-GAAP financial measure.2 RSI is authorized to repurchase shares

of its Class A common stock from time to time through open market

purchases, privately negotiated transactions or other transactions

in accordance with applicable securities laws. The timing and

amount of repurchases depends on several factors, including market

and business conditions, the trading price of RSI’s Class A Common

Stock and the nature of other investment opportunities. This

repurchase program does not require RSI to acquire any specific

number or amount of Class A common stock and may be limited,

amended or terminated at any time.

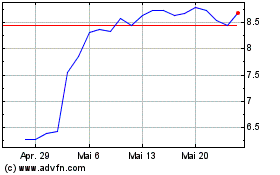

Rush Street Interactive (NYSE:RSI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Rush Street Interactive (NYSE:RSI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024