Revenue Up by 24.3% and Adjusted Net Loss

Ratio1 Improved by 9.6ppt YoY for First Quarter 2022

OneConnect Financial Technology Co., Ltd. (“OneConnect” or the

“Company”) (NYSE: OCFT), a leading technology-as-a-service provider

for financial institutions in China, today announced its unaudited

financial results for the first quarter ended March 31, 2022.

First Quarter 2022 Financial Highlights

- Revenue increased 24.3% year-over-year to RMB1,019 million from

RMB820 million.

- Gross margin was 34.3% as compared to 34.0% same period of the

prior year; non-IFRS gross margin was 38.8%, as compared to 43.5%

same period of the prior year.

- Operating loss was RMB355 million, as compared to RMB346

million same period of the prior year. Excluding the impact of

listing expenses in connection with the Company’s proposed listing

in Hong Kong, adjusted loss from operations1 amounted to RMB318

million, compared with RMB346 million for the same period in the

prior year. Adjusted operating loss margin narrowed to 31.2% from

42.2% same period of the prior year.

- Net loss attributable to shareholders was RMB318 million, as

compared to RMB305 million same period of the prior year. Net loss

ratio narrowed to 31.2% compared to 37.2% same period of the prior

year. Adjusted net loss to shareholders for the first quarter of

2022 amounted to RMB281 million, as compared to RMB305 million same

period of the prior year. Adjusted net loss ratio narrowed to 27.6%

from 37.2%.

- Net loss per ADS, basic and diluted, was RMB-0.86 as compared

to RMB-0.83 same period of the prior year.

In RMB’000, except percentages and per ADS

amounts

Three Months Ended

March 31

YoY

2022

2021

Revenue

Revenue from Ping An Group

548,682

435,851

25.9%

Revenue from Lufax

129,100

75,105

71.9%

Revenue from third-party

customers2

341,156

308,809

10.5%

Total

1,018,938

819,765

24.3%

Gross profit

349,031

278,555

Gross margin

34.3%

34.0%

Non-IFRS gross margin

38.8%

43.5%

Operating loss

354,895

346,130

Adjusted operating loss1

318,409

346,130

Operating margin

34.8%

42.2%

Adjusted operating margin1

31.2%

42.2%

Net loss to shareholders

317,585

304,732

Net loss ratio

31.2%

37.2%

Adjusted Net loss ratio1

27.6%

37.2%

Net loss per ADS3, basic and diluted

-0.86

-0.83

1 Adjusted operation loss and adjusted net loss ratio excludes

listing expense RMB 36.5 million in 2022Q1 in connection with the

Company’s proposed listing in Hong Kong. 2 Third-party customers

refer to each customer with revenue contribution of less than 5% of

our total revenue in the relevant period. These customers are a key

focus of the Company’s diversification strategy. 3 Each ADS

represents three ordinary shares

Chairman, CEO and CFO Comments

“I am delighted to announce that we achieved strong financial

results in Q1 notwithstanding impact from Covid outbreaks. We

sustained a revenue growth rate of 24.3% and at the same time,

narrowed adjusted net loss ratio by double digits,” said Mr. Ye

Wangchun, Chairman of the Board. “We continued to implement our 2nd

stage strategy of deepening customer engagement to focus on serving

premium-plus customer and product integration in Q1, resulting in a

growth in the number of premium-plus customers. Admittedly, this

year will feature higher uncertainties from the macro environment,

we, nevertheless, see strong demands from our FI customers for

digital transformation. In addition, we have also seen favorable

regulatory development, including the FinTech Development Plan

(2022-2025), the Guidance on Digital Transformation of Banking and

Insurance Sectors, highlighting the strategic importance of digital

transformation. We remain fully confident in the potential and

outlook of the FinTech industry.”

Mr. Shen Chongfeng, Chief Executive Officer, commented

“Benefitting from ongoing execution of our 2nd stage strategy,

integrated products in banking solution have successfully expanded

large joint-stock bank customer base. As we sell more products to

these customers, we are able to increase their value and improve

contribution from premium-plus customers. Products in our

relatively new solution-Gamma platform - core systems and AI

customer service products - also demonstrated strong momentum,

gaining more market share. We will continue to reinforce product

integration and customer upgrade in 2022, to further solidify our

position and fulfill our mission of supporting financial

institutions to grow efficiently.”

Mr. Luo Yongtao, Chief Financial Officer, commented, “With more

usage of our products by customers, revenue registered notable

growth, at 24.3% year-over-year, fastest among last three quarters.

Number of premium-plus customers, which is a key focus in our 2nd

stage strategy, increased by 16% to 74, compared to 64 the same

period of last year. In addition to high revenue growth, adjusted

net loss ratio further improved by 9.6 ppts year over year from

37.2% to 27.6%. Covid outbreaks in 2022 have indeed brought

uncertainties to the macro economy, but we remain unchanged in

focusing on growing 3rd party revenue and retaining a sustainable

growth. Meanwhile, our Q1 results reflect the effect of our

disciplined cost and expenses management, marking another milestone

in the path to profitability. We are ready to go further this

year.”

Recent Developments of the Company’s Share Repurchase

Program

In February 2022, the Company’s board of directors authorized a

share repurchase program under which the Company is authorized to

repurchase up to an aggregate of 2% of its outstanding ordinary

shares during a specific period. As of April 29th, the Company had

repurchased approximately 4.2 million ADSs for approximately US$5.9

million under this share repurchase program.

Revenue Breakdown

In RMB’000, except percentages

Three Months Ended

March 31

YoY

2022

2021

Implementation revenue

171,678

168,567

1.8%

Transaction-based and support

revenue

Business origination services

114,793

118,499

-3.1%

Risk management services

106,951

99,290

7.7%

Operation support services

255,208

212,237

20.2%

Cloud services platform

295,834

180,512

63.9%

Post-implementation support services

11,427

13,236

-13.7%

Others

63,047

27,424

129.9%

Total

847,260

651,198

30.1%

Total

1,018,938

819,765

24.3%

Revenue in the first quarter of 2022 rose 24.3% to RMB1,019

million from RMB820 million for the same period in the prior year.

Cloud services platform and operation support services were the key

drivers. Revenue from cloud services platform surged by 63.9%

year-over-year, majorly benefitting from on-going digital

transformation within in Ping An Group. Revenue from operation

support increased by 20.2%, benefiting from our gamma platform AI

customer service products roll out and other products. Others,

which included revenue from insurer ecosystem participants and

oversea business, increased 129.9%. Notwithstanding the travel

restrictions in major cities in response to the uptick in the

COVID-19 pandemic, implementation revenue increased from RMB169

million to RMB172million.

First Quarter 2022 Financial

Results

Revenue

Revenue in the first quarter of 2022 increased by 24.3% to

RMB1,019 million from RMB820 million for the same period in the

prior year, primarily driven by more demand for solutions in cloud

services platform, operation support services and other services to

insurer ecosystem participants and oversea business.

Cost of Revenue

Cost of revenue in the first quarter of 2022 was RMB670 million,

compared with RMB541 million for the same period in the prior year,

primarily driven by higher technology service fees and outsourcing

labor cost as we continued to expand our businesss.

Gross Profit

Gross profit increased by 25.3% to RMB349 million from RMB279

million for the same period in the prior year. Gross margin was

34.3%, compared with 34.0% in the prior year, slightly increased by

0.3ppt, primarily due to improved gross margin from mature

products, however, relatively new solutions showed lower gross

margin at initial stage, which offset such improvement. Non-IFRS

gross margin was 38.8%, compared with 43.5% in the prior year. For

a reconciliation of the Company’s IFRS and non-IFRS gross margin,

please refer to “Reconciliation of IFRS and Non-IFRS Results

(Unaudited).”

Operating Loss and Expenses

Total operating expenses for the first quarter of 2022 amounted

to RMB700 million, compared with RMB636 million for the same period

in the prior year. As a percentage of revenue, total operating

expenses decreased to 68.7% from 77.6%

- Research and Development expenses for the first quarter of 2022

rose to RMB363 million from RMB281 million, reflecting investment

put into enhancing existing solutions and innovations. As a

percentage of revenue, R&D expenses amounted to 35.6%, compared

with 34.3% in the prior year.

- Sales and Marketing expenses for the first quarter of 2022

decreased to RMB109 million, compared with RMB167 million in the

prior year, mainly due to a decrease in marketing and

telecommunication expenses. As a percentage of revenue, sales and

marketing expenses decreased to 10.7% from 20.4%.

- General and Administrative expenses for the first quarter of

2022 amounted to RMB211 million, compared with RMB180 million in

the prior year, primarily due to cost disciplines. As a percentage

of revenue, general and administrative expenses decreased to 20.7%

from 22.0%. After excluding listing expense in connection with the

Company’s proposed listing in Hong Kong, adjusted general and

administrative expenses as a percentage of revenue for the first

quarter of 2022 was 17.2%.

- Net impairment losses on financial and contract assets for the

first quarter of 2022 totaled RMB17 million, compared with RMB7

million for the same period in the prior year, reflecting enhanced

periodic review and management efforts in trade receivables and

contract assets. As a percentage of revenue, net impairment losses

were 1.7%, versus 0.9% in the prior year.

Loss from operations for the first quarter of 2022 amounted to

RMB355 million, compared with RMB346 million for the same period in

the prior year. Operating loss margin decreased to 34.8% from 42.2%

in the prior year. After excluding the listing expenses in

connection with the Company’s proposed listing in Hong Kong,

adjusted loss from operations for the first quarter of 2022

amounted to RMB318 million, compared with RMB346 million for the

same period in the prior year. Adjusted operating loss margin

narrowed to 31.2% from 42.2% in the prior year.

Net Loss

Net loss attributable to OneConnect’s shareholders totaled

RMB318 million for the first quarter of 2022, versus RMB305 million

for the same period in the prior year. Net loss attributable to

OneConnect’s shareholders per basic and diluted ADS amounted to

RMB-0.86, versus RMB-0.83 for the same period in the prior year.

Weighted average number of ADSs for the first quarter was

370,012,917.

Cash Flow

For the first quarter of 2022, net cash used in operating

activities was RMB1,119 million. Net cash generated from in

investing activities was RMB1550 million. Net cash used in

financing activities was RMB557 million.

Conference Call Information

Date/Time

Wednesday, May 25, 2022 at 9:00 p.m., U.S.

Eastern Time

Thursday, May 26, 2022 at 9:00 a.m.,

Beijing Time

Online

registration

https://www.incommglobalevents.com/registration/q4inc/10962/oneconnect-financial-technology-co-ltd-1q22-earnings-release/

An archived recording and the transcript of the conference call

will be available at OneConnect’s investor relations website at

ir.ocft.com.

About OneConnect

OneConnect Financial Technology Co. Ltd. is a

technology-as-a-service provider for financial institutions. The

Company integrates extensive financial services industry expertise

with market-leading technology to provide technology applications

and technology-enabled business services to financial institutions.

The integrated solutions and platform the Company provides include

digital retail banking solution, digital commercial banking

solution, digital insurance solution and Gamma Platform, which is a

technology infrastructural platform for financial institutions. The

Company’s solutions enable its customers’ digital transformations,

which help them improve efficiency, enhance service quality, and

reduce costs and risks.

The Company has established long-term cooperation relationships

with financial institutions to address their needs of digital

transformation. The Company has also expanded its services to other

participants in the value chain to support the digital

transformation of financial services eco-system. In addition, the

Company has successfully exported its technology solutions to

overseas financial institutions.

For more information, please visit ir.ocft.com.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements constitute “forward-looking” statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as

amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be

identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident”

and similar statements. Such statements are based upon management’s

current expectations and current market and operating conditions

and relate to events that involve known or unknown risks,

uncertainties and other factors, all of which are difficult to

predict and many of which are beyond the Company’s control.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: the

Company’s limited operating history in the technology-as-a-service

for financial institutions industry; its ability to achieve or

sustain profitability; the tightening of laws, regulations or

standards in the financial services industry; the Company’s ability

to comply with the evolving regulatory requirements in the PRC and

other jurisdictions where it operates; its ability to maintain and

enlarge the customer base or strengthen customer engagement; its

ability to maintain its relationship with Ping An Group, which is

its strategic partner, most important customer and largest

supplier; its ability to compete effectively to serve China’s

financial institutions; the effectiveness of its technologies, its

ability to maintain and improve technology infrastructure and

security measures; its ability to protect its intellectual property

and proprietary rights; risks of defaults by borrowers under the

loans for which the Company provided credit enhancement under its

legacy credit management business; its ability to maintain or

expand relationship with its business partners and the failure of

its partners to perform in accordance with expectations; its

ability to protect or promote its brand and reputation; its ability

to timely implement and deploy its solutions; its ability to obtain

additional capital when desired; disruptions in the financial

markets and business and economic conditions; the Company’s ability

to pursue and achieve optimal results from acquisition or expansion

opportunities; the duration of the COVID-19 outbreak and its

potential impact on the Company’s business and financial

performance; and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in the Company’s filings with the SEC. All information

provided in this press release and in the attachments is as of the

date of this press release, and the Company undertakes no

obligation to update any forward-looking statement, except as

required under applicable law.

Use of Unaudited Non-IFRS Financial Measures

The unaudited consolidated financial information is prepared in

accordance with International Financial Reporting Standards (IFRS).

Non-IFRS measures are used in gross profit and gross margin,

adjusted to exclude non-cash items, which consist of amortization

of intangible assets recognized in cost of revenue, depreciation of

property and equipment recognized in cost of revenue, and

share-based compensation expenses recognized in cost of revenue.

OneConnect’s management regularly review non-IFRS gross profit and

non-IFRS gross margin to assess the performance of our business. By

excluding non-cash items, these financial metrics allow

OneConnect’s management to evaluate the cash conversion of one

dollar revenue on gross profit. OneConnect uses these non-IFRS

financial to evaluate its ongoing operations and for internal

planning and forecasting purposes. OneConnect believes that

non-IFRS financial information, when taken collectively, is helpful

to investors because it provides consistency and comparability with

past financial performance, facilitates period-to-period

comparisons of results of operations, and assists in comparisons

with other companies, many of which use similar financial

information. OneConnect also believes that presentation of the

non-IFRS financial measures provides useful information to its

investors regarding its results of operations because it allows

investors greater transparency to the information used by

OneConnect’s management in its financial and operational decision

making so that investors can see through the eyes of the

OneConnect’s management regarding important financial metrics that

the management uses to run the business as well as allowing

investors to better understand OneConnect’s performance. However,

non-IFRS financial information is presented for supplemental

informational purposes only, and should not be considered a

substitute for financial information presented in accordance with

IFRS, and may be different from similarly-titled non-IFRS measures

used by other companies. In light of the foregoing limitations, you

should not consider non-IFRS financial measure in isolation from or

as an alternative to the financial measure prepared in accordance

with IFRS. Whenever OneConnect uses a non-IFRS financial measure, a

reconciliation is provided to the most closely applicable financial

measure stated in accordance with IFRS. You are encouraged to

review the related IFRS financial measures and the reconciliation

of these non-IFRS financial measures to their most directly

comparable IFRS financial measures. For more information on

non-IFRS financial measures, please see the table captioned

“Reconciliations of IFRS and non-IFRS results (Unaudited)” set

forth at the end of this press release.

ONECONNECT

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

(Unaudited)

Three Months Ended March

31

2022

2021

RMB'000

RMB'000

Revenue

1,018,938

819,765

Cost of revenue

-669,907

-541,210

Gross profit

349,031

278,555

Research and development

expenses

-363,013

-281,299

Selling and marketing

expenses

-108,907

-167,054

General and administrative

expenses

-211,301

-180,457

Net impairment losses on

financial and contract assets

-17,214

-7,104

Other income, gains or

loss-net

-3,491

11,229

Operating loss

-354,895

-346,130

Finance income

2,446

18,157

Finance costs

-12,124

-26,235

Finance costs – net

-9,678

-8,078

Share of losses of associate and

joint venture

11,537

4,547

Loss before income tax

-353,036

-349,661

Income tax benefit

20,728

26,871

Loss for the period

-332,308

-322,790

Loss attributable to:

- Owners of the Company

-317,585

-304,732

- Non-controlling interests

-14,723

-18,058

Other comprehensive income, net

of tax

Items that may be subsequently

reclassified to profit or loss

- Foreign currency translation

differences

-23,193

50,099

- Changes in the fair value of

debt instruments at fair value through other comprehensive

income

12,523

1

Total comprehensive loss for

the period

-342,978

-272,690

Total comprehensive loss

attributable to:

- Owners of the Company

-328,255

-254,632

- Non-controlling interests

-14,723

-18,058

Loss per ADS attributable to

owners of the Company

(expressed in RMB per

share)

- Basic and diluted

-0.86

-0.83

ONECONNECT

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

March 31

December 31

2022

2021

RMB'000

RMB'000

ASSETS

Non-current assets

Property and equipment

259,506

244,412

Intangible assets

653,232

687,194

Deferred tax assets

707,342

683,218

Financial assets measured at

amortized cost from Virtual bank

674

Investments accounted for using

the equity method

196,883

185,346

Financial assets at fair value

through other comprehensive income

735,926

640,501

Contract assets

145

868

Restricted cash

9,000

Total non-current

assets

2,562,034

2,442,213

Current assets

Financial assets at amortized

cost

3,515

Trade receivables

1,274,817

891,174

Contract assets

198,986

227,895

Prepayments and other

receivables

890,640

749,152

Financial assets measured at

amortized cost from Virtual bank

9,307

12,711

Financial assets at fair value

through profit or loss

917,561

2,071,653

Financial assets at fair value

through other comprehensive income

782,730

482,497

Restricted cash

475,314

1,060,427

Cash and cash equivalents

1,270,695

1,399,370

Total current assets

5,820,050

6,898,394

Total assets

8,382,084

9,340,607

EQUITY AND LIABILITIES

Equity

Share capital

78

78

Shares held for share option

scheme

-79,752

-80,102

Other reserves

10,513,082

10,512,631

Accumulated losses

-6,956,210

-6,638,625

Equity attributable to equity

owners of the Company

3,477,198

3,793,982

Non-controlling interests

26,377

41,100

Total equity

3,503,575

3,835,082

LIABILITIES

Non-current

liabilities

Trade and other payables

323,322

313,834

Contract liabilities

19,041

19,418

Deferred tax liabilities

8,347

9,861

Total non-current

liabilities

350,710

343,113

Current liabilities

Trade and other payables

2,107,183

2,137,099

Payroll and welfare payables

314,429

515,067

Contract liabilities

164,269

153,844

Short-term borrowings

294,829

815,260

Customer deposits

1,424,078

1,350,171

Derivative financial

liabilities

223,011

190,971

Total current

liabilities

4,527,799

5,162,412

Total liabilities

4,878,509

5,505,525

Total equity and

liabilities

8,382,084

9,340,607

ONECONNECT

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended March

31

2022

2021

RMB'000

RMB'000

Net cash generated from /

(used in) operating activities

-1,118,694

-460,783

Net cash generated from /

(used in) investing activities

1,550,267

1,028,447

Net cash generated from /

(used in) financing activities

-557,038

-1,264,659

Net increase /(decrease) in

cash and cash equivalents

-125,465

-696,995

Cash and cash equivalents at the

beginning of the period

1,399,370

3,055,194

Effects of exchange rate changes

on cash and cash equivalents

-3,210

2,681

Cash and cash equivalents at

the end of period

1,270,695

2,360,880

ONECONNECT

RECONCILIATION OF IFRS AND

NON-IFRS RESULTS

(Unaudited)

Three Months Ended March

31

2022

2021

RMB'000

RMB'000

Gross profit

349,031

278,555

Gross margin

34.3%

34.0%

Non-IFRS adjustment

Amortization of intangible assets

recognized in cost of revenue

44,436

76,746

Depreciation of property and

equipment recognized in cost of revenue

812

600

Share-based compensation expenses

recognized in cost of revenue

880

921

Non-IFRS Gross profit

395,159

356,822

Non-IFRS Gross margin

38.8%

43.5%

Three Months Ended March

31

2022

2021

RMB'000

RMB'000

Operating Loss

-354,895

-346,130

Operating loss margin

-34.8%

-42.2%

Net Loss to

shareholders

-317,585

-304,732

Net loss ratio

-31.2%

-37.2%

Adjustment

Listing expense in connection

with the Company’s proposed listing in Hong Kong

36,486

0

Adjusted Operating

Loss

-318,409

-346130

Adjusted Net Loss

-281,099

-304,732

Adjusted Operating loss

margin

-31.2%

-42.2%

Adjusted Net loss

ratio

-27.6%

-37.2%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220525005544/en/

Investor Relations: OCFT IR Team OCFT_IR@ocft.com

Media Relations: Amy Ding PUB_JRYZTPR@ocft.com

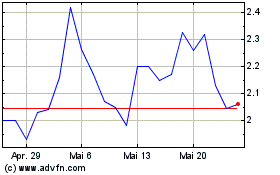

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025