KKR Receives Support and Recommendation from FUJI SOFT for Second Tender Offer and Expects to Launch Tender Offer Next Week

15 November 2024 - 3:15PM

Business Wire

- FUJI SOFT Board unanimously resolved to recommend KKR’s tender

offer and oppose Bain Capital’s proposal

- Tender offer expected to launch middle of next week with price

of 9,451 yen per share; shareholders and share option holders who

tendered into first tender offer to be made whole if second tender

offer succeeds

KKR, a leading global investment firm, today announced that in

connection with its two-stage tender offer scheme (the “Tender

Offer”) for the common shares and share options of FUJI SOFT

INCORPORATED (TSE stock code 9749; “FUJI SOFT”) through FK Co.,

Ltd. (the “Offeror”), the Offeror, an entity owned by investment

funds managed by KKR, will conduct the Second Tender Offer at a

price of 9,451 yen per common share. KKR expects to commence the

Second Tender Offer as soon as the middle of next week.

The Board of Directors of FUJI SOFT resolved today to support

the Second Tender Offer and to recommend that shareholders and

share option holders of the Company tender their shares and share

options into it. The Board also resolved to oppose the proposal by

Bain Capital. Both resolutions were unanimous.

The Second Tender Offer follows the completion of the first

tender offer, through which KKR acquired 21,413,302 common shares

(voting rights ratio: 33.97%) and share options totaling 718,600

common shares on an as-converted basis to become FUJI SOFT’s

largest shareholder. The first tender offer received significant

support from advisors (komon), directors and officers of FUJI SOFT,

who tendered ~90% of their share options.

The Offeror raised the tender offer price per common share to

9,451 yen (and with respect to the share options, to 1,197,200 yen

per 5th Series Share Option, 1,059,800 yen per 6th Series Share

Option, and 293,200 yen per 7th Series Share Option) with the aim

of accelerating the privatization process as FUJI SOFT’s shares

have stayed above the price of the First Tender Offer. The price of

9,451 yen per share represents a premium of 125.8% over the simple

average closing price of FUJI SOFT’s stock for the 12 months prior

to October 2, 2023.1

All shareholders and share option holders who tendered into the

First Tender Offer will be made whole if the Second Tender Offer

succeeds and KKR achieves a 53.22% stake across both tender

offers.

Hiro Hirano, Deputy Executive Chairman of KKR Asia Pacific

and CEO of KKR Japan, said, "We are grateful to have FUJI

SOFT’s continued trust and recommendation for KKR’s Second Tender

Offer. We aim to complete the privatization swiftly so that we can

turn our focus to working closely with the company and its

employees to enhance its corporate value and long-term

success.”

***

This press release should be read in conjunction with the

release issued by the Offeror titled “Notice Regarding the

Commencement of Tender Offer for the Shares of FUJI SOFT

INCORPORATED (Securities Code: 9749) by FK Co., Ltd.”

The purpose of this press release is to publicly announce the

planned commencement of the Second Tender Offer and it has not been

prepared for the purpose of soliciting an offer to sell or purchase

in the Tender Offer. When making an application to tender, please

be sure to read the relevant Tender Offer Explanatory Statement for

the Tender Offer and make your own decision as a shareholder or

share option holder. This press release does not constitute, either

in whole or in part, a solicitation of an offer to sell or purchase

any securities, and the existence of this press release (or any

part thereof) or its distribution shall not be construed as a basis

for any agreement regarding the Tender Offer, nor shall it be

relied upon in concluding an agreement regarding the Tender

Offer.

The Tender Offer will be conducted in compliance with the

procedures and information disclosure standards set forth in

Japanese law, and those procedures and standards are not always the

same as the procedures and information disclosure standards in the

U.S. In particular, neither sections 13(e) or 14(d) of the U.S.

Securities Exchange Act of 1934 (as amended; the same shall apply

hereinafter) or the rules under these sections apply to the Tender

Offer; and therefore the Tender Offer will not be conducted in

accordance with those procedures and standards.

Unless otherwise specified, all procedures relating to the

Tender Offer are to be conducted entirely in Japanese. All or a

part of the documentation relating to the Tender Offer will be

prepared in English; however, if there is any discrepancy between

the English-language documents and the Japanese-language documents,

the Japanese-language documents shall prevail.

This press release includes statements that fall under

“forward-looking statements” as defined in section 27A of the U.S.

Securities Act of 1933, as amended, and section 21E of the

Securities Exchange Act of 1934. Due to known or unknown risks,

uncertainties or other factors, actual results may differ

materially from the predictions indicated by the statements that

are implicitly or explicitly forward-looking statements. Neither

the Offeror nor any of its affiliates guarantee that the

predictions indicated by the statements that are implicitly or

expressly forward-looking statements will materialize. The

forward-looking statements in this press release were prepared

based on information held by the Offeror as of today, and the

Offeror and its affiliates shall not be obliged to amend or revise

such statements to reflect future events or circumstances, except

as required by laws and regulations.

The Offeror, its financial advisors and the Tender Offer agent

(and their respective affiliates) may purchase the common shares

and share options of FUJI SOFT, by means other than the Tender

Offer, or conduct an act aimed at such purchases, for their own

account or for their client’s accounts, in the scope of their

ordinary business and to the extent permitted under financial

instrument exchange-related laws and regulations, and any other

applicable laws and regulations in Japan, in accordance with the

requirements of Rule 14e-5(b) of the U.S. Securities Exchange Act

of 1934. Such purchases may be conducted at the market price

through market transactions or at a price determined by

negotiations off-market. In the event that information regarding

such purchases is disclosed in Japan, such information will also be

disclosed on the English website of the person conducting such

purchases (or by any other method of public disclosure).

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

_________________________ 1 Figures represent the unaffected

FUJI SOFT share price based on the closing share price on October

2, 2023, the last full trading day immediately prior to the

speculative publication of media reports regarding the start of the

bidding process for a potential tender offer.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241115165652/en/

Media KKR Asia Pacific Wei Jun Ong +65 6922 5813

WeiJun.Ong@kkr.com

KKR (NYSE:KKR)

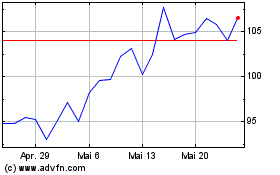

Historical Stock Chart

Von Dez 2024 bis Jan 2025

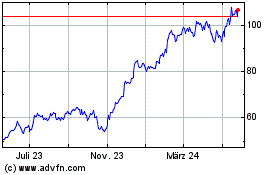

KKR (NYSE:KKR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025