KKR Releases 2025 Global Macro Outlook

19 Dezember 2024 - 1:00PM

Business Wire

Henry McVey: The Glass is Still Half Full for

Investors

KKR, a leading global investment firm, today released its 2025

Global Macro Outlook by Henry McVey, CIO of KKR’s Balance Sheet and

Head of Global Macro and Asset Allocation (GMAA).

McVey and his team retain a Glass Half Full mentality heading

into 2025, though they believe the bar is now higher to achieve

strong absolute returns. They also note that while investors should

expect lower returns and more volatility, the combination of

stronger U.S. productivity, favorable technicals, robust nominal

earnings growth, and lack of net issuance elicit confidence that

more gains lie ahead for investors in 2025.

Against this backdrop, McVey and his team suggest that investors

own more assets that are linked to nominal GDP, such as

Infrastructure, Real Estate and Asset-Based Finance. They are also

positive on investments linked to domestic consumption stories,

control positions where operational improvements can drive robust

growth, investments that stand to benefit from political changes,

and the private sector, which is positioned to benefit from the

general desire for “less government” amid rising deficits.

The following key points underpin the team’s latest

thinking:

- Recent election outcomes around the world put an exclamation

point on our Regime Change thesis for investing, which is driven by

bigger deficits, heightened geopolitics, a messy energy transition,

and stickier U.S. inflation.

- We envision a blurring of economics and national security

across all regions, likely encouraging political leaders to develop

ways to expand investment, including increased savings, more

private sector involvement, and a focus on driving down the cost of

capital.

- We are experiencing an asynchronous recovery. For the first

time, the ECB is cutting earlier and faster than the Fed this

cycle, while in Asia, the Bank of Japan is raising rates. At the

same time, Chinese bonds now yield less than those of Japan.

- We finally believe that the more aggressive GDP and EPS growth

estimates for the U.S. by the sell-side to start the year will set

a higher bar for an 'upside surprise' in 2025. In this context, we

think earnings growth now matters more than multiple

expansion.

- U.S. productivity is surging, elevating both earnings and

growth. This backdrop should give a boost to the U.S. dollar as

well as U.S. equity and credit markets again in 2025.

- We are focused on currency volatility, as tariff wars and big

fiscal imbalances could create volatility shocks that differ from

recent cycles.

- We are below consensus on our near-term outlook for oil. At the

same time, however, as AI scales, we believe energy security will

become even more entwined with national security.

McVey and his team also identify the following key mega-themes

that can serve as compelling investment opportunities in today’s

more complicated environment:

- Improved Capital Efficiency – We’re seeing more

companies shift from capital heavy to capital light. This playbook

opens a major opportunity for credit providers to make a compelling

economic rent by providing an ‘off ramp’ for the assets being

sold.

- Private Sector Market Share Gainers – We believe the

combination of rising deficits and the desire for ‘less’ government

will lead to a larger private sector role in key growth markets.

Areas such as digital infrastructure, space exploration, retirement

savings, and defense are likely to see outcomes shaped by increased

private investment.

- Worker Retraining/Productivity – We think the

opportunity set for lifelong learning and worker retraining may be

as large as it has ever been amid rapid technological changes and

post-COVID educational disengagement.

- Security of Everything – We remain maximum bullish on

this theme. Against a background of rising geopolitical tensions,

cyberattacks, and shifting global supply chains, there is demand

for resiliency in key inputs such as energy, data, transportation,

and pharmaceuticals.

- Intra-Asia – We think Asia is becoming more

Asia-centric, with increased trade within the region versus with

developed markets in the West; we also see more countries in the

region participating in Asia’s global growth engine. We’re focused

on key areas including transportation assets, subsea cables,

security, data/data centers, and energy transmission.

- Demographic Challenges to Retirement Security – We are

bullish on domestic retirement savings, especially as the

working-age population is peaking in many parts of the world and

more governments begin to appreciate the importance of keeping

local flows in their own markets.

- AI/Energy Infrastructure — For AI to scale, massive

investment will be required in the picks and shovels as well as the

energy infrastructure required to support growth. We also expect

more global expansion linked to AI in the coming years, especially

in Asia.

In addition to these insights and themes, the report details the

GMAA team’s updated views on the geopolitical landscape, global

economic forecasts, capital markets, interest rates, commodities,

and asset allocation.

Links to access this report in full as well as an archive of

Henry McVey's previous publications follow:

- To read the latest Insights, click here.

- For an archive of previous publications please visit

https://www.kkr.com/insights.

About Henry McVey

Henry H. McVey joined KKR in 2011 and is Head of the Global

Macro, Balance Sheet and Risk team. Mr. McVey also serves as Chief

Investment Officer for the Firm’s Balance Sheet, oversees Firmwide

Market Risk at KKR, and co-heads KKR’s Strategic Partnership

Initiative. As part of these roles, he sits on the Firm’s Global

Operating Committee and the Risk & Operations Committee. Prior

to joining KKR, Mr. McVey was a Managing Director, Lead Portfolio

Manager and Head of Global Macro and Asset Allocation at Morgan

Stanley Investment Management (MSIM). Learn more about Mr. McVey

here.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at

www.kkr.com. For additional information about Global

Atlantic Financial Group, please visit Global Atlantic Financial

Group’s website at www.globalatlantic.com.

The views expressed in the report and summarized herein are the

personal views of Henry McVey of KKR and do not necessarily reflect

the views of KKR or the strategies and products that KKR manages or

offers. Nothing contained herein constitutes investment, legal, tax

or other advice nor is it to be relied on in making an investment

decision or any other decision. This release is prepared solely for

information purposes and should not be viewed as a current, past or

future recommendation or a solicitation of an offer to buy or sell

any securities or to adopt any investment strategy. This release

contains forward-looking statements, which are based on beliefs,

assumptions and expectations that may change as a result of many

possible events or factors. If a change occurs, actual results may

vary materially from those expressed in the forward-looking

statements. All forward-looking statements speak only as of the

date such statements are made, and neither KKR nor Mr. McVey

assumes any duty to update such statements except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219077338/en/

Media: Julia Kosygina or Lauren McCranie 212-750-8300

media@kkr.com

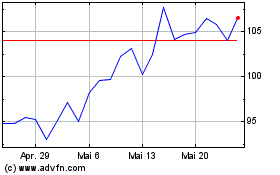

KKR (NYSE:KKR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

KKR (NYSE:KKR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024