Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Mai 2024 - 6:11PM

Edgar (US Regulatory)

Nuveen

Real

Asset

Income

and

Growth

Fund

Portfolio

of

Investments

March

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

LONG-TERM

INVESTMENTS

-

135.2%

(96.2%

of

Total

Investments)

X

–

CORPORATE

BONDS

-

36

.5

%

(

26

.0

%

of

Total

Investments)

X

134,973,864

Capital

Goods

-

1.2%

$

1,600

Advanced

Drainage

Systems

Inc,

144A

6.375%

6/15/30

$

1,608,280

1,080

Chart

Industries

Inc,

144A

7.500%

1/01/30

1,121,522

885

EMRLD

Borrower

LP

/

Emerald

Co-Issuer

Inc,

144A

6.625%

12/15/30

893,490

790

Trinity

Industries

Inc,

144A

7.750%

7/15/28

811,261

Total

Capital

Goods

4,434,553

Commercial

&

Professional

Services

-

1.2%

1,085

Clean

Harbors

Inc,

144A

4.875%

7/15/27

1,052,452

280

GFL

Environmental

Inc,

144A

6.750%

1/15/31

286,948

1,155

Republic

Services

Inc

5.000%

12/15/33

1,147,123

1,915

Waste

Management

Inc

4.875%

2/15/34

1,901,899

Total

Commercial

&

Professional

Services

4,388,422

Consumer

Discretionary

Distribution

&

Retail

-

0.1%

545

LCM

Investments

Holdings

II

LLC,

144A

4.875%

5/01/29

500,927

Total

Consumer

Discretionary

Distribution

&

Retail

500,927

Consumer

Services

-

1.2%

300

EUR

Accor

SA,

Reg

S

7.250%

4/11/72

355,753

1,500

Churchill

Downs

Inc,

144A

5.750%

4/01/30

1,447,952

1,645

Hilton

Domestic

Operating

Co

Inc,

144A

5.875%

4/01/29

1,647,729

615

Hilton

Grand

Vacations

Borrower

Escrow

LLC

/

Hilton

Grand

Vacations

Borrower

Esc,

144A

6.625%

1/15/32

617,483

550

Scientific

Games

International

Inc,

144A

7.500%

9/01/31

571,947

Total

Consumer

Services

4,640,864

Energy

-

7.7%

790

Archrock

Partners

LP

/

Archrock

Partners

Finance

Corp,

144A

6.250%

4/01/28

781,655

1,530

Cheniere

Energy

Partners

LP

4.500%

10/01/29

1,456,173

510

CNX

Midstream

Partners

LP,

144A

4.750%

4/15/30

454,548

765

Delek

Logistics

Partners

LP

/

Delek

Logistics

Finance

Corp,

144A

8.625%

3/15/29

781,194

915

Energy

Transfer

LP

5.550%

5/15/34

917,787

395

EQM

Midstream

Partners

LP,

144A

7.500%

6/01/30

422,233

450

EQM

Midstream

Partners

LP

5.500%

7/15/28

443,826

525

EQM

Midstream

Partners

LP,

144A

4.750%

1/15/31

488,227

695

EQM

Midstream

Partners

LP,

144A

6.375%

4/01/29

700,104

205

EQM

Midstream

Partners

LP,

144A

7.500%

6/01/27

210,206

515

CAD

Gibson

Energy

Inc

5.250%

12/22/80

334,797

1,000

Global

Partners

LP

/

GLP

Finance

Corp,

144A

8.250%

1/15/32

1,037,044

670

CAD

Keyera

Corp

6.875%

6/13/79

484,549

1,110

CAD

Keyera

Corp

5.950%

3/10/81

748,765

1,560

Kinetik

Holdings

LP,

144A

5.875%

6/15/30

1,525,877

1,000

Kodiak

Gas

Services

LLC,

144A

7.250%

2/15/29

1,018,588

2,165

MPLX

LP

5.000%

3/01/33

2,101,675

1,965

MPLX

LP

5.650%

3/01/53

1,922,019

435

NGL

Energy

Operating

LLC

/

NGL

Energy

Finance

Corp,

144A

8.375%

2/15/32

445,922

325

NGL

Energy

Partners

LP,

144A

8.125%

2/15/29

332,859

1,205

ONEOK

Inc

6.100%

11/15/32

1,262,471

915

PBF

Holding

Co

LLC

/

PBF

Finance

Corp,

144A

7.875%

9/15/30

949,100

1,784

CAD

Pembina

Pipeline

Corp

4.800%

1/25/81

1,134,263

Nuveen

Real

Asset

Income

and

Growth

Fund

(continued)

Portfolio

of

Investments

March

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Energy

(continued)

$

355

(b)

Plains

All

American

Pipeline

LP

(TSFR3M

reference

rate

+

4.372%

spread)

9.679%

11/15/72

$

352,755

1,360

Sabine

Pass

Liquefaction

LLC

5.000%

3/15/27

1,356,023

1,305

Targa

Resources

Corp

6.125%

3/15/33

1,361,470

195

CAD

Transcanada

Trust

4.200%

3/04/81

122,470

575

USA

Compression

Partners

LP

/

USA

Compression

Finance

Corp,

144A

7.125%

3/15/29

582,162

2,000

Venture

Global

Calcasieu

Pass

LLC,

144A

6.250%

1/15/30

2,012,126

1,390

Venture

Global

LNG

Inc,

144A

9.500%

2/01/29

1,498,230

1,150

Williams

Cos

Inc/The

4.900%

3/15/29

1,142,385

Total

Energy

28,381,503

Equity

Real

Estate

Investment

Trusts

(REITs)

-

9.7%

2,070

Agree

LP

4.800%

10/01/32

1,958,234

735

Alexandria

Real

Estate

Equities

Inc

5.625%

5/15/54

723,242

1,105

Alexandria

Real

Estate

Equities

Inc

5.250%

5/15/36

1,084,493

1,520

American

Homes

4

Rent

LP

5.500%

2/01/34

1,515,426

1,075

American

Tower

Corp

5.500%

3/15/28

1,084,002

1,075

American

Tower

Corp

5.650%

3/15/33

1,091,818

1,975

AvalonBay

Communities

Inc

5.000%

2/15/33

1,956,526

565

CTR

Partnership

LP

/

CareTrust

Capital

Corp,

144A

3.875%

6/30/28

523,251

1,960

Essex

Portfolio

LP

5.500%

4/01/34

1,962,170

1,250

Extra

Space

Storage

LP

5.700%

4/01/28

1,272,409

1,150

Extra

Space

Storage

LP

5.900%

1/15/31

1,189,791

1,900

Federal

Realty

OP

LP

5.375%

5/01/28

1,905,389

865

GLP

Capital

LP

/

GLP

Financing

II

Inc

6.750%

12/01/33

911,670

1,550

Goodman

US

Finance

Five

LLC,

144A

4.625%

5/04/32

1,419,676

1,460

HAT

Holdings

I

LLC

/

HAT

Holdings

II

LLC,

144A

8.000%

6/15/27

1,522,342

300

Iron

Mountain

Inc,

144A

4.500%

2/15/31

270,671

385

Iron

Mountain

Inc,

144A

7.000%

2/15/29

392,337

850

Iron

Mountain

Information

Management

Services

Inc,

144A

5.000%

7/15/32

776,280

505

Kilroy

Realty

LP

6.250%

1/15/36

493,293

3,030

Kimco

Realty

OP

LLC

4.600%

2/01/33

2,868,307

1,235

Kite

Realty

Group

LP

5.500%

3/01/34

1,227,204

2,745

Prologis

LP

5.000%

3/15/34

2,728,734

1,625

Prologis

Targeted

US

Logistics

Fund

LP,

144A

5.500%

4/01/34

1,635,205

3,000

RHP

Hotel

Properties

LP

/

RHP

Finance

Corp,

144A

6.500%

4/01/32

3,010,125

660

Scentre

Group

Trust

2,

144A

5.125%

9/24/80

609,948

1,740

Welltower

OP

LLC

3.850%

6/15/32

1,573,982

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

35,706,525

Financial

Services

-

0.8%

1,150

Hunt

Cos

Inc,

144A

5.250%

4/15/29

1,050,067

930

National

Rural

Utilities

Cooperative

Finance

Corp

7.125%

9/15/53

964,601

585

Starwood

Property

Trust

Inc,

144A

7.250%

4/01/29

589,656

500

Starwood

Property

Trust

Inc,

144A

4.375%

1/15/27

470,325

Total

Financial

Services

3,074,649

Health

Care

Equipment

&

Services

-

0.7%

900

CHS/Community

Health

Systems

Inc,

144A

10.875%

1/15/32

927,019

935

Tenet

Healthcare

Corp

6.125%

6/15/30

932,855

725

Tenet

Healthcare

Corp

6.125%

10/01/28

722,402

Total

Health

Care

Equipment

&

Services

2,582,276

Media

&

Entertainment

-

1.3%

2,000

CCO

Holdings

LLC

/

CCO

Holdings

Capital

Corp

4.500%

5/01/32

1,607,188

750

CCO

Holdings

LLC

/

CCO

Holdings

Capital

Corp,

144A

6.375%

9/01/29

711,512

500

Lamar

Media

Corp

3.625%

1/15/31

438,715

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Media

&

Entertainment

(continued)

$

2,230

VZ

Secured

Financing

BV,

144A

5.000%

1/15/32

$

1,914,686

Total

Media

&

Entertainment

4,672,101

Real

Estate

Management

&

Development

-

0.2%

725

EUR

Peach

Property

Finance

GmbH,

144A

4.375%

11/15/25

685,106

Total

Real

Estate

Management

&

Development

685,106

Telecommunication

Services

-

1.0%

1,150

Frontier

Communications

Holdings

LLC,

144A

6.000%

1/15/30

974,082

350

Frontier

Communications

Holdings

LLC,

144A

8.625%

3/15/31

357,465

705

Iliad

Holding

SASU,

144A

7.000%

10/15/28

697,747

635

Iliad

Holding

SASU,

144A

6.500%

10/15/26

629,052

980

T-Mobile

USA

Inc

4.800%

7/15/28

971,891

Total

Telecommunication

Services

3,630,237

Transportation

-

0.5%

1,000

Cargo

Aircraft

Management

Inc,

144A

4.750%

2/01/28

904,337

560

XPO

Inc,

144A

7.125%

6/01/31

574,380

500

XPO

Inc,

144A

6.250%

6/01/28

504,134

Total

Transportation

1,982,851

Utilities

-

10.9%

1,275

AEP

Transmission

Co

LLC

5.150%

4/01/34

1,270,516

1,425

CAD

AltaGas

Ltd

7.350%

8/17/82

1,062,993

1,305

CAD

AltaGas

Ltd

5.250%

1/11/82

829,215

1,995

Ameren

Illinois

Co

4.950%

6/01/33

1,974,495

745

Atlantica

Sustainable

Infrastructure

PLC,

144A

4.125%

6/15/28

684,538

810

Baltimore

Gas

and

Electric

Co

5.400%

6/01/53

805,601

500

Calpine

Corp,

144A

3.750%

3/01/31

437,856

1,570

CenterPoint

Energy

Houston

Electric

LLC

5.150%

3/01/34

1,581,371

925

Clearway

Energy

Operating

LLC,

144A

3.750%

2/15/31

793,918

1,530

Clearway

Energy

Operating

LLC,

144A

3.750%

1/15/32

1,286,245

985

CMS

Energy

Corp

3.750%

12/01/50

806,944

1,115

DTE

Electric

Co

5.200%

3/01/34

1,120,096

865

Duke

Energy

Carolinas

LLC

4.850%

1/15/34

850,325

1,170

Duke

Energy

Progress

LLC

5.100%

3/15/34

1,169,337

900

EUR

EDP

-

Energias

de

Portugal

SA,

Reg

S

5.943%

4/23/83

1,013,736

1,125

Ferrellgas

LP

/

Ferrellgas

Finance

Corp,

144A

5.875%

4/01/29

1,071,349

800

Ferrellgas

LP

/

Ferrellgas

Finance

Corp,

144A

5.375%

4/01/26

782,674

795

Florida

Power

&

Light

Co

4.800%

5/15/33

782,977

2,100

Georgia

Power

Co

5.250%

3/15/34

2,121,204

1,050

Georgia

Power

Co

5.004%

2/23/27

1,051,262

3,300

ITC

Holdings

Corp,

144A

4.950%

9/22/27

3,276,339

2,735

NextEra

Energy

Capital

Holdings

Inc

6.051%

3/01/25

2,745,404

440

NextEra

Energy

Operating

Partners

LP,

144A

7.250%

1/15/29

450,192

270

NextEra

Energy

Operating

Partners

LP,

144A

4.500%

9/15/27

252,710

1,210

GBP

NGG

Finance

PLC,

Reg

S

5.625%

6/18/73

1,511,887

795

NRG

Energy

Inc,

144A

7.000%

3/15/33

848,310

525

NRG

Energy

Inc,

144A

5.250%

6/15/29

501,907

183

NRG

Energy

Inc

6.625%

1/15/27

183,091

1,650

Pacific

Gas

and

Electric

Co

6.150%

1/15/33

1,700,721

650

Pattern

Energy

Operations

LP

/

Pattern

Energy

Operations

Inc,

144A

4.500%

8/15/28

605,894

155

PPL

Capital

Funding

Inc

8.236%

3/30/67

153,446

1,180

Public

Service

Enterprise

Group

Inc

5.850%

11/15/27

1,208,663

1,075

GBP

SSE

PLC,

Reg

S

3.740%

4/14/72

1,290,667

275

Superior

Plus

LP

/

Superior

General

Partner

Inc,

144A

4.500%

3/15/29

254,251

1,435

TerraForm

Power

Operating

LLC,

144A

4.750%

1/15/30

1,315,378

1,410

Vistra

Operations

Co

LLC,

144A

7.750%

10/15/31

1,476,665

Nuveen

Real

Asset

Income

and

Growth

Fund

(continued)

Portfolio

of

Investments

March

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Utilities

(continued)

$

1,010

WEC

Energy

Group

Inc

5.600%

9/12/26

$

1,021,673

Total

Utilities

40,293,850

Total

Corporate

Bonds

(cost

$136,852,763)

134,973,864

Shares

Description

(a)

Value

X

–

COMMON

STOCKS

-

31

.5

%

(

22

.4

%

of

Total

Investments)

X

116,423,295

Energy

-

11.9%

240,316

Enbridge

Inc

$

8,694,633

56,008

Energy

Transfer

LP

881,006

96,520

Enterprise

Products

Partners

LP

2,816,454

139,057

Gibson

Energy

Inc

2,367,321

43,774

Keyera

Corp

1,127,514

307,342

Kinder

Morgan

Inc

5,636,652

51,760

MPLX

LP

2,151,146

74,893

ONEOK

Inc

6,004,172

171,860

Pembina

Pipeline

Corp

6,065,945

19,098

Plains

GP

Holdings

LP,

Class

A

348,538

33,638

TC

Energy

Corp

1,351,927

163,113

Williams

Cos

Inc/The

6,356,514

Total

Energy

43,801,822

Financial

Services

-

0.2%

742,553

Sdcl

Energy

Efficiency

Income

Trust

PLC

555,213

Total

Financial

Services

555,213

Health

Care

Equipment

&

Services

-

0.8%

248,056

Chartwell

Retirement

Residences

2,263,462

71,221

Sienna

Senior

Living

Inc

705,611

Total

Health

Care

Equipment

&

Services

2,969,073

Real

Estate

Management

&

Development

-

0.6%

662,580

Capitaland

India

Trust

515,224

209,039

Hysan

Development

Co

Ltd

337,262

1,450,622

Sino

Land

Co

Ltd

1,508,098

Total

Real

Estate

Management

&

Development

2,360,584

Telecommunication

Services

-

0.7%

390,984

HKT

Trust

&

HKT

Ltd

456,195

14,604

Infrastrutture

Wireless

Italiane

SpA

165,726

3,378,969

NETLINK

NBN

TRUST

2,139,617

Total

Telecommunication

Services

2,761,538

Transportation

-

3.3%

6,942

Aena

SME

SA

1,367,251

33,082

(c)

Athens

International

Airport

SA

303,369

615,637

Atlas

Arteria

Ltd

2,137,726

442,171

Aurizon

Holdings

Ltd

1,152,940

387,144

China

Merchants

Port

Holdings

Co

Ltd

464,213

517,885

Dalrymple

Bay

Infrastructure

Ltd

924,921

323,115

Enav

SpA

1,351,484

11,627

Grupo

Aeroportuario

del

Centro

Norte

SAB

de

CV,

ADR

919,580

8,535

Grupo

Aeroportuario

del

Pacifico

SAB

de

CV,

ADR

1,392,656

265,050

Transurban

Group

2,299,340

Total

Transportation

12,313,480

Shares

Description

(a)

Value

Utilities

-

14.0%

324,399

APA

Group

$

1,778,028

431

Canadian

Solar

Infrastructure

Fund

Inc

323,720

11,010

Canadian

Utilities

Ltd,

Class

A

250,754

323,747

CK

Infrastructure

Holdings

Ltd

1,896,144

64,330

Clearway

Energy

Inc,

Class

A

1,383,738

232,394

CLP

Holdings

Ltd

1,853,631

262,226

Contact

Energy

Ltd

1,356,100

53,854

Dominion

Energy

Inc

2,649,078

45,574

Duke

Energy

Corp

4,407,462

111,289

Enagas

SA

1,653,289

573,386

Enel

SpA

3,785,205

92,498

Engie

SA

1,550,021

22,361

Entergy

Corp

2,363,110

88,792

Evergy

Inc

4,739,717

1,462

Eversource

Energy

87,384

138,415

Italgas

SpA

806,374

86,117

National

Grid

PLC,

Sponsored

ADR

5,874,902

10,472

Northwestern

Energy

Group

Inc

533,339

78,482

OGE

Energy

Corp

2,691,933

45,765

Pennon

Group

PLC

374,011

17,654

Pinnacle

West

Capital

Corp

1,319,283

179,985

Power

Assets

Holdings

Ltd

1,054,460

136,009

Redeia

Corp

SA

2,323,176

332,506

REN

-

Redes

Energeticas

Nacionais

SGPS

SA

789,755

971,950

Snam

SpA

4,589,259

6,198

Spire

Inc

380,371

170,007

Vector

Ltd

393,360

13,955

Veolia

Environnement

SA

453,981

Total

Utilities

51,661,585

Total

Common

Stocks

(cost

$103,562,989)

116,423,295

Shares

Description

(a)

Value

X

–

REAL

ESTATE

INVESTMENT

TRUST

COMMON

STOCKS

-

31

.4

%

(

22

.3

%

of

Total

Investments)

X

115,829,491

Data

Center

REITs

-

0.4%

55,518

Digital

Realty

Trust

Inc

$

1,309,114

Total

Data

Center

REITs

1,309,114

Diversified

REITs

-

2.0%

44,375

Armada

Hoffler

Properties

Inc

461,500

284,466

British

Land

Co

PLC/The

1,419,196

145,194

Charter

Hall

Long

Wale

REIT

361,196

22,824

Essential

Properties

Realty

Trust

Inc

608,488

381,050

Growthpoint

Properties

Australia

Ltd

630,592

40,843

ICADE

1,106,389

207,867

Mirvac

Group

319,494

5,228

Star

Asia

Investment

Corp

2,015,194

396

United

Urban

Investment

Corp

402,848

Total

Diversified

REITs

7,324,897

Health

Care

REITs

-

3.8%

60,913

American

Healthcare

REIT

Inc

898,467

2,644,592

Assura

PLC

1,411,659

73,689

CareTrust

REIT

Inc

1,795,801

29,080

Community

Healthcare

Trust

Inc

772,074

186,068

Healthcare

Realty

Trust

Inc

2,632,862

265,471

Healthpeak

Properties

Inc

4,977,582

Nuveen

Real

Asset

Income

and

Growth

Fund

(continued)

Portfolio

of

Investments

March

31,

2024

(Unaudited)

Shares

Description

(a)

Value

Health

Care

REITs

(continued)

50,872

Omega

Healthcare

Investors

Inc

$

1,611,116

Total

Health

Care

REITs

14,099,561

Hotel

&

Resort

REITs

-

0.7%

157,125

Apple

Hospitality

REIT

Inc

2,573,707

Total

Hotel

&

Resort

REITs

2,573,707

Industrial

REITs

-

6.6%

255,528

Dexus

Industria

REIT

514,196

192,078

Dream

Industrial

Real

Estate

Investment

Trust

1,868,952

482,362

FIBRA

Macquarie

Mexico,

144A

938,922

1,898,439

Frasers

Logistics

&

Commercial

Trust

1,489,954

469

GLP

J-Reit

393,021

983

LaSalle

Logiport

REIT

1,007,267

1,087,479

LondonMetric

Property

PLC

2,790,681

281,798

LXP

Industrial

Trust

2,541,818

1,459,976

Mapletree

Industrial

Trust

2,529,868

2,182,455

Mapletree

Logistics

Trust

2,359,668

373,742

Nexus

Industrial

REIT

2,110,757

939,584

TF

Administradora

Industrial

S

de

RL

de

CV

2,565,636

878,136

Tritax

Big

Box

REIT

PLC

1,745,858

1,167,372

Urban

Logistics

REIT

PLC

1,685,568

Total

Industrial

REITs

24,542,166

Mortgage

REITs

-

0.2%

18,900

Blackstone

Mortgage

Trust

Inc,

Class

A

376,299

17,236

Starwood

Property

Trust

Inc

350,408

Total

Mortgage

REITs

726,707

Multi-Family

Residential

REITs

-

1.4%

75,333

Apartment

Income

REIT

Corp

2,446,063

521

Daiwa

Securities

Living

Investments

Corp

361,984

16,706

Equity

Residential

1,054,316

1,768,627

(d)

Home

Reit

PLC

2,232

85

Mid-America

Apartment

Communities

Inc

11,184

31,836

UDR

Inc

1,190,985

Total

Multi-Family

Residential

REITs

5,066,764

Office

REITs

-

2.4%

206,703

Abacus

Property

Group

168,314

61,613

Allied

Properties

Real

Estate

Investment

Trust

803,737

26,958

Boston

Properties

Inc

1,760,627

50,311

COPT

Defense

Properties

1,216,017

124

Daiwa

Office

Investment

Corp

482,826

8,407

Equity

Commonwealth

210,175

21,383

Gecina

SA

2,184,147

226

Kenedix

Office

Investment

Corp

240,214

46,911

NSI

NV

961,588

43,784

Postal

Realty

Trust

Inc,

Class

A

626,987

Total

Office

REITs

8,654,632

Other

Specialized

REITs

-

2.6%

85,462

Four

Corners

Property

Trust

Inc

2,091,255

115,854

Gaming

and

Leisure

Properties

Inc

5,337,394

75,854

VICI

Properties

Inc

2,259,691

Total

Other

Specialized

REITs

9,688,340

Real

Estate

Operating

Companies

-

0.5%

1,587,535

Sirius

Real

Estate

Ltd

1,962,631

Total

Real

Estate

Operating

Companies

1,962,631

Shares

Description

(a)

Value

Retail

REITs

-

9.0%

415

Acadia

Realty

Trust

$

7,059

9,949

Agree

Realty

Corp

568,287

15,632

Brixmor

Property

Group

Inc

366,570

399,080

Charter

Hall

Retail

REIT

964,749

122,686

Choice

Properties

Real

Estate

Investment

Trust

1,248,100

125,081

Crombie

Real

Estate

Investment

Trust

1,264,153

110,021

CT

Real

Estate

Investment

Trust

1,159,056

1,273,173

Fortune

Real

Estate

Investment

Trust

619,996

1,696,376

Frasers

Centrepoint

Trust

2,751,436

165,336

Kimco

Realty

Corp

3,242,239

332,185

Link

REIT

1,430,526

23,841

NNN

REIT

Inc

1,018,964

181,959

Primaris

Real

Estate

Investment

Trust

1,873,927

108,884

Realty

Income

Corp

5,890,624

67,997

RioCan

Real

Estate

Investment

Trust

927,175

6,469

Saul

Centers

Inc

248,992

99,065

Scentre

Group

218,787

35,356

Simon

Property

Group

Inc

5,532,861

1,101,128

Vicinity

Ltd

1,528,403

903,777

Waypoint

REIT

Ltd

1,501,374

45,831

Wereldhave

NV

713,475

Total

Retail

REITs

33,076,753

Self-Storage

REITs

-

0.7%

14,395

CubeSmart

650,942

12,588

Extra

Space

Storage

Inc

1,850,436

717

Public

Storage

207,973

Total

Self-Storage

REITs

2,709,351

Single-Family

Residential

REITs

-

0.3%

45,701

American

Homes

4

Rent

1,110,991

Total

Single-Family

Residential

REITs

1,110,991

Telecom

Tower

REITs

-

0.8%

28,195

Crown

Castle

Inc

2,983,877

Total

Telecom

Tower

REITs

2,983,877

Total

Real

Estate

Investment

Trust

Common

Stocks

(cost

$116,254,889)

115,829,491

Shares

Description

(a)

Coupon

Value

X

–

$25

PAR

(OR

SIMILAR)

RETAIL

PREFERRED

-

19

.2

%

(

13

.7

%

of

Total

Investments)

X

71,062,613

Energy

-

0.1%

11,711

NuStar

Energy

LP

11.234%

$

295,820

Total

Energy

295,820

Equity

Real

Estate

Investment

Trusts

(REITs)

-

11.8%

146,715

Agree

Realty

Corp

4.250%

2,602,724

80,447

American

Homes

4

Rent

5.875%

1,849,476

56,280

Armada

Hoffler

Properties

Inc

6.750%

1,239,848

99,054

Centerspace

6.625%

2,391,164

2,392

Chatham

Lodging

Trust

6.625%

52,122

33,798

DiamondRock

Hospitality

Co

8.250%

851,372

68,757

Digital

Realty

Trust

Inc

5.200%

1,507,154

59,594

Digital

Realty

Trust

Inc

5.250%

1,314,048

79,257

Federal

Realty

Investment

Trust

5.000%

1,739,691

81,585

Kimco

Realty

Corp

5.125%

1,866,665

98,615

Kimco

Realty

Corp

5.250%

2,258,284

13,513

Kimco

Realty

Corp

7.250%

761,592

2,301

Mid-America

Apartment

Communities

Inc

8.500%

128,370

54,508

National

Storage

Affiliates

Trust

6.000%

1,249,323

Nuveen

Real

Asset

Income

and

Growth

Fund

(continued)

Portfolio

of

Investments

March

31,

2024

(Unaudited)

Shares

Description

(a)

Coupon

Value

Equity

Real

Estate

Investment

Trusts

(REITs)

(continued)

50,450

Pebblebrook

Hotel

Trust

6.300%

$

1,029,180

33,580

Pebblebrook

Hotel

Trust

5.700%

631,304

23,192

Pebblebrook

Hotel

Trust

6.375%

477,987

34,375

Public

Storage

4.125%

666,531

31,672

Public

Storage

4.700%

680,631

28,487

Public

Storage

5.600%

699,071

40,054

Public

Storage

3.900%

716,967

25,073

Public

Storage

5.150%

603,256

41,114

Public

Storage

3.875%

732,240

33,970

Public

Storage

3.950%

615,536

30,469

Public

Storage

5.050%

744,053

35,975

Public

Storage

4.750%

778,499

46,230

Public

Storage

4.100%

873,285

49,870

Public

Storage

4.000%

921,598

44,113

Public

Storage

4.625%

943,577

56,168

Public

Storage

4.000%

1,039,108

54,568

Public

Storage

4.875%

1,243,059

58,997

Realty

Income

Corp

6.000%

1,458,996

90,113

Rexford

Industrial

Realty

Inc

5.625%

1,944,639

30,274

Rexford

Industrial

Realty

Inc

5.875%

677,532

10,819

RLJ

Lodging

Trust

1.950%

264,957

16,844

Saul

Centers

Inc

6.125%

377,642

25,435

Saul

Centers

Inc

6.000%

543,292

72,849

SITE

Centers

Corp

6.375%

1,642,745

20,251

Summit

Hotel

Properties

Inc

5.875%

396,312

38,516

Summit

Hotel

Properties

Inc

6.250%

792,274

30,844

Sunstone

Hotel

Investors

Inc

6.125%

654,201

43,058

Sunstone

Hotel

Investors

Inc

5.700%

855,132

18,724

UMH

Properties

Inc

6.375%

423,537

9,192

Vornado

Realty

Trust

5.250%

138,615

33,112

Vornado

Realty

Trust

5.250%

506,614

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

43,884,203

Financial

Services

-

0.2%

25,426

Brookfield

Finance

Inc

4.625%

457,668

16,112

National

Rural

Utilities

Cooperative

Finance

Corp

5.500%

399,578

Total

Financial

Services

857,246

Real

Estate

-

0.1%

10,309

Brookfield

Property

Partners

LP

6.375%

148,553

Total

Real

Estate

148,553

Real

Estate

Management

&

Development

-

0.2%

35,153

Brookfield

Property

Partners

LP

5.750%

448,552

25,270

Brookfield

Property

Partners

LP

6.500%

398,002

Total

Real

Estate

Management

&

Development

846,554

Utilities

-

6.8%

25,854

BIP

Bermuda

Holdings

I

Ltd

5.125%

506,221

41,127

Brookfield

BRP

Holdings

Canada

Inc

4.625%

699,159

13,470

Brookfield

Infrastructure

Finance

ULC

5.000%

247,983

67,929

Brookfield

Infrastructure

Partners

LP

5.125%

1,232,232

20,719

Brookfield

Infrastructure

Partners

LP

5.000%

367,969

75,559

Brookfield

Renewable

Partners

LP

5.250%

1,377,441

35,357

CMS

Energy

Corp

5.875%

855,993

48,898

CMS

Energy

Corp

5.875%

1,211,204

29,190

CMS

Energy

Corp

5.625%

716,906

66,991

CMS

Energy

Corp

4.200%

1,362,597

46,327

DTE

Energy

Co

5.250%

1,146,593

69,721

DTE

Energy

Co

4.375%

1,419,520

Shares

Description

(a)

Coupon

Value

Utilities

(continued)

73,042

DTE

Energy

Co

4.375%

$

1,504,665

49,695

Duke

Energy

Corp

5.750%

1,234,921

43,179

Duke

Energy

Corp

5.625%

1,060,476

18,525

Entergy

Arkansas

LLC

4.875%

419,221

10,112

Entergy

Mississippi

LLC

4.900%

234,497

7,058

Entergy

New

Orleans

LLC

5.500%

169,816

15,944

Entergy

Texas

Inc

5.375%

398,759

45,803

Georgia

Power

Co

5.000%

1,128,586

13,860

NextEra

Energy

Capital

Holdings

Inc

5.650%

341,510

90,803

Sempra

5.750%

2,173,824

37,425

Southern

Co/The

5.250%

912,796

76,576

Southern

Co/The

4.950%

1,760,482

88,549

Southern

Co/The

4.200%

1,783,377

30,923

Spire

Inc

5.900%

763,489

Total

Utilities

25,030,237

Total

$25

Par

(or

similar)

Retail

Preferred

(cost

$78,111,238)

71,062,613

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

$1,000

PAR

(OR

SIMILAR)

INSTITUTIONAL

PREFERRED

-

14

.1

%

(

10

.1

%

of

Total

Investments)

X

52,220,364

Energy

-

5.9%

$

2,810

Enbridge

Inc

6.000%

1/15/77

$

2,746,590

2,305

Enbridge

Inc

5.500%

7/15/77

2,185,119

1,530

Enbridge

Inc

6.250%

3/01/78

1,489,120

1,380

Enbridge

Inc

5.750%

7/15/80

1,306,030

1,260

Enbridge

Inc

7.625%

1/15/83

1,293,079

930

Enbridge

Inc

8.500%

1/15/84

1,010,478

1,184

(b)

Energy

Transfer

LP

(TSFR3M

reference

rate

+

3.279%

spread)

8.586%

11/01/66

1,075,446

580

Energy

Transfer

LP

8.000%

5/15/54

608,345

595

Energy

Transfer

LP

6.500%

N/A

(e)

583,184

2,920

Enterprise

Products

Operating

LLC

5.250%

8/16/77

2,770,805

2,060

Enterprise

Products

Operating

LLC

5.375%

2/15/78

1,919,859

780

CAD

Inter

Pipeline

Ltd/AB

6.625%

11/19/79

546,176

1,843

Transcanada

Trust

5.875%

8/15/76

1,790,720

1,194

Transcanada

Trust

5.500%

9/15/79

1,097,833

1,145

Transcanada

Trust

5.600%

3/07/82

1,045,273

300

Transcanada

Trust

5.300%

3/15/77

280,642

Total

Energy

21,748,699

Financial

Services

-

0.4%

375

National

Rural

Utilities

Cooperative

Finance

Corp

5.250%

4/20/46

365,191

1,340

Transcanada

Trust

5.625%

5/20/75

1,305,793

Total

Financial

Services

1,670,984

Transportation

-

0.6%

999

BNSF

Funding

Trust

I

6.613%

12/15/55

990,959

940

Royal

Capital

BV,

Reg

S

4.875%

N/A

(e)

934,125

Total

Transportation

1,925,084

Utilities

-

7.2%

625

CAD

AltaGas

Ltd

8.900%

11/10/83

489,812

1,840

American

Electric

Power

Co

Inc

3.875%

2/15/62

1,653,504

675

CAD

Capital

Power

Corp

7.950%

9/09/82

498,565

1,750

CMS

Energy

Corp

4.750%

6/01/50

1,611,766

995

ComEd

Financing

III

6.350%

3/15/33

1,002,636

1,345

Dominion

Energy

Inc

5.750%

10/01/54

1,336,646

Nuveen

Real

Asset

Income

and

Growth

Fund

(continued)

Portfolio

of

Investments

March

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Utilities

(continued)

$

1,460

Dominion

Energy

Inc

4.650%

N/A

(e)

$

1,429,083

1,585

Dominion

Energy

Inc

4.350%

N/A

(e)

1,483,824

2,490

Duke

Energy

Corp

4.875%

N/A

(e)

2,468,290

1,375

Edison

International

5.000%

N/A

(e)

1,302,678

870

Edison

International

5.375%

N/A

(e)

841,889

900

GBP

Electricite

de

France

SA,

Reg

S

5.875%

N/A

(e)

1,067,779

2,048

Emera

Inc

6.750%

6/15/76

2,022,654

825

NextEra

Energy

Capital

Holdings

Inc

3.800%

3/15/82

748,466

2,540

NextEra

Energy

Capital

Holdings

Inc

5.650%

5/01/79

2,429,327

1,265

Sempra

6.875%

10/01/54

1,278,205

2,075

Sempra

4.875%

N/A

(e)

2,030,271

1,625

Sempra

4.125%

4/01/52

1,499,137

465

(b)

Southern

California

Edison

Co

(3-Month

LIBOR

reference

rate

+

4.461%

spread)

4.516%

N/A

(e)

464,942

1,265

Southern

Co/The

4.000%

1/15/51

1,216,123

Total

Utilities

26,875,597

Total

$1,000

Par

(or

similar)

Institutional

Preferred

(cost

$53,400,351)

52,220,364

Shares

Description

(a)

Coupon

Value

X

–

CONVERTIBLE

PREFERRED

SECURITIES

-

1

.7

%

(

1

.2

%

of

Total

Investments)

X

6,170,900

Equity

Real

Estate

Investment

Trusts

(REITs)

-

0.9%

8,595

LXP

Industrial

Trust

6.500%

$

398,550

52,737

Regency

Centers

Corp

5.875%

1,237,210

64,868

Regency

Centers

Corp

6.250%

1,568,508

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

3,204,268

Utilities

-

0.8%

9,047

Algonquin

Power

&

Utilities

Corp

7.750%

193,968

55,856

NextEra

Energy

Inc

6.926%

2,174,474

22,463

SCE

Trust

VII

7.500%

598,190

Total

Utilities

2,966,632

Total

Convertible

Preferred

Securities

(cost

$6,972,094)

6,170,900

Shares

Description

(a)

Value

X

–

INVESTMENT

COMPANIES

-

0.6%

(0.4%

of

Total

Investments)

X

2,047,188

264,268

Greencoat

UK

Wind

PLC/Funds

$

464,456

258,228

JLEN

Environmental

Assets

Group

Ltd

Foresight

Group

Holdings

305,059

311,957

Renewables

Infrastructure

Group

Ltd/The

396,612

637,305

Sequoia

Economic

Infrastructure

Income

Fund

Ltd

651,402

197,352

Starwood

European

Real

Estate

Finance

Ltd

229,659

Total

Investment

Companies

(cost

$2,254,787)

2,047,188

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

ASSET-BACKED

AND

MORTGAGE-BACKED

SECURITIES

-

0.2%

(0.1%

of

Total

Investments)

X

589,845

$

525

(b)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

reference

rate

+

4.329%

spread),

2019

MILE,

144A

9.655%

7/15/36

$

349,840

310

(b)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

reference

rate

+

2.829%

spread),

2019

MILE,

144A

8.155%

7/15/36

240,005

Total

Asset-Backed

and

Mortgage-Backed

Securities

(cost

$835,000)

589,845

Total

Long-Term

Investments

(cost

$498,244,111)

499,317,560

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

5.3% (3.8%

of

Total

Investments)

X

–

REPURCHASE

AGREEMENTS

-

5

.3

%

(

3

.8

%

of

Total

Investments)

X

19,689,216

$

19,225

(f)

Fixed

Income

Clearing

Corp

(FICC)

5.280%

4/01/24

$

19,225,000

464

(g)

Fixed

Income

Clearing

Corp

(FICC)

1.600%

4/01/24

464,216

Total

Repurchase

Agreements

(cost

$19,689,216)

19,689,216

Total

Short-Term

Investments

(cost

$19,689,216)

19,689,216

Total

Investments

(cost

$

517,933,327

)

-

140

.5

%

519,006,776

Borrowings

-

(41.1)%

(h),(i)

(

151,695,000

)

Other

Assets

&

Liabilities,

Net

- 0.6%

2,084,339

Net

Assets

Applicable

to

Common

Shares

-

100%

$

369,396,115

Futures

Contracts

-

Short

Description

Number

of

Contracts

Expiration

Date

Notional

Amount

Value

Unrealized

Appreciation

(Depreciation)

U.S.

Treasury

10-Year

Note

(10)

6/24

$

(

1,102,651

)

$

(

1,107,969

)

$

(

5,318

)

U.S.

Treasury

Long

Bond

(18)

6/24

(

2,139,233

)

(

2,167,875

)

(

28,642

)

U.S.

Treasury

Ultra

10-Year

Note

(190)

6/24

(

21,672,850

)

(

21,775,781

)

(

102,931

)

U.S.

Treasury

Ultra

Bond

(18)

6/24

(

2,349,079

)

(

2,322,000

)

27,079

Total

$(27,263,813)

$(27,373,625)

$(109,812)

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(j)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

$

112,400,000

Receive

SOFR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

4,309,522

$

4,309,522

Nuveen

Real

Asset

Income

and

Growth

Fund

(continued)

Portfolio

of

Investments

March

31,

2024

(Unaudited)

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Corporate

Bonds

$

–

$

134,973,864

$

–

$

134,973,864

Common

Stocks

79,070,645

37,352,650

–

116,423,295

Real

Estate

Investment

Trust

Common

Stocks

78,659,389

37,167,870

2,232

115,829,491

$25

Par

(or

similar)

Retail

Preferred

71,062,613

–

–

71,062,613

$1,000

Par

(or

similar)

Institutional

Preferred

–

52,220,364

–

52,220,364

Convertible

Preferred

Securities

6,170,900

–

–

6,170,900

Investment

Companies

1,650,576

396,612

–

2,047,188

Asset-Backed

and

Mortgage-Backed

Securities

–

589,845

–

589,845

Short-Term

Investments:

Repurchase

Agreements

–

19,689,216

–

19,689,216

Investments

in

Derivatives:

Interest

Rate

Swaps*

–

4,309,522

–

4,309,522

Futures

Contracts*

(

109,812

)

–

–

(

109,812

)

Total

$

236,504,311

$

286,699,943

$

2,232

$

523,206,486

*

Represents

net

unrealized

appreciation

(depreciation).

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(c)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(d)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(e)

Perpetual

security.

Maturity

date

is

not

applicable.

(f)

Agreement

with

Fixed

Income

Clearing

Corporation,

5.280%

dated

3/28/24

to

be

repurchased

at

$19,236,279

on

4/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.000%

and

maturity

date

11/15/45,

valued

at

$19,609,634.

(g)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.600%

dated

3/28/24

to

be

repurchased

at

$464,298

on

4/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

4.750%

and

maturity

date

2/15/41,

valued

at

$473,595.

(h)

Borrowings

as

a

percentage

of

Total

Investments

is

29.2%.

(i)

The

Fund

may

pledge

up

to

100%

of

its

eligible

investments

(excluding

any

investments

separately

pledged

as

collateral

for

specific

investments

in

derivatives,

when

applicable)

in

the

Portfolio

of

Investments

as

collateral

for

borrowings.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$278,479,585

have

been

pledged

as

collateral

for

borrowings.

(j)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

ADR

American

Depositary

Receipt

CAD

Canadian

Dollar

EUR

Euro

GBP

Pound

Sterling

LIBOR

London

Inter-Bank

Offered

Rate

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

REIT

Real

Estate

Investment

Trust

SOFR

Secured

Overnight

Financing

Rate

TSFR

1M

CME

Term

SOFR

1

Month

TSFR

3M

CME

Term

SOFR

3

Month

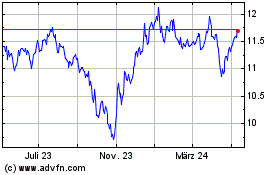

Nuveen Real Asset Income... (NYSE:JRI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Nuveen Real Asset Income... (NYSE:JRI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024