false000182014400018201442025-01-232025-01-230001820144us-gaap:CommonStockMember2025-01-232025-01-230001820144us-gaap:WarrantMember2025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 23, 2025

________________________

Grindr Inc.

(Exact name of registrant as specified in its charter)

________________________

Commission file number 001-39714

________________________

| | | | | | | | |

| Delaware | | 92-1079067 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

| | |

PO Box 69176, 750 N. San Vicente Blvd., Suite RE 1400, West Hollywood, California | | 90069 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(310) 776-6680

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | GRND | New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | GRND.WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

In conjunction with the redemption of the outstanding warrants of Grindr Inc. (the “Company”), which is discussed in more detail in Item 8.01 of this Current Report on Form 8-K, the Company is announcing that it anticipates meeting or exceeding previously issued guidance for the fiscal year ended December 31, 2024, as most recently set forth in the Company’s shareholder letter as Exhibit 99.2 to the Company’s Current Report on Form 8-K filed on November 7, 2024. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information contained herein is being furnished under “Item 2.02 Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933 (the “Securities Act”), nor shall it be deemed incorporated by reference in any filing with the Securities and Exchange Commission made by us, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 8.01 Other Items.

On January 23, 2025, the Company (f/k/a Tiga Acquisition Corp.) provided notice to the holders of its outstanding Warrants (as defined below) that it will redeem the Warrants at a redemption price of $0.10 per warrant at 5:00 p.m. New York City time on February 24, 2025 (the “Redemption Date”). Holders of the warrants may instead elect to exercise their warrants until 5:00 p.m., New York City time, on the Redemption Date.

As of the date of the announcement, the Company’s outstanding warrants consist of (i) 18,560,000 warrants issued pursuant to that certain Private Placement Warrants Purchase Agreement, dated as of November 23, 2020, by and between the Company and Tiga Sponsor LLC (“Sponsor”), (ii) 2,500,000 forward purchase warrants and 2,500,000 backstop warrants issued pursuant to that certain Amended and Restated Forward Purchase Agreement, dated May 9, 2022, by and between the Company and Sponsor, and (iii) 13,799,825 warrants issued as part of the units in the Company’s initial public offering (clauses (i), (ii) and (iii), collectively, the “Warrants”). All of the Warrants are governed by that certain Warrant Agreement, by and between the Company and Continental Stock Transfer & Trust Company, as warrant agent, dated as of November 23, 2020, as amended on November 17, 2022 (as amended, the “Warrant Agreement”). The Warrants are exercisable for shares of the Company’s common stock, $0.0001 par value per share.

Each Warrant holder may exercise its warrants until 5:00 p.m., New York City time, on the Redemption Date. In connection with the redemption, Warrant holders may elect to (i) exercise their Warrants for cash, at an exercise price of $11.50 per share of the Company’s common stock, or (ii) exercise their Warrants on a “cashless basis” in accordance with subsection 6.1.2 of the Warrant Agreement, in which case, the holder will receive a number of shares of the Company’s common stock to be determined in accordance with the terms of the Warrant Agreement and based on the Redemption Date and the volume-weighted average price of the Company’s common stock during the ten trading days immediately following January 23, 2025, the date on which the redemption notice is delivered to holders of Warrants. In no event will the number of shares of common stock issued in connection with an exercise on a cashless basis in accordance with subsection 6.1.2 of the Warrant Agreement exceed 0.361 shares of common stock per Warrant. Any Warrants that remain unexercised as of 5:00 p.m., New York City time, on the Redemption Date, will be void and no longer exercisable, and the holders of those Warrants will be entitled to receive $0.10 per Warrant.

The public warrants are listed on the New York Stock Exchange under the ticker symbol “GRND.WS.” The Company understands from the New York Stock Exchange that, as a result of the redemption, the Warrants will cease to be listed on the New York Stock Exchange, effective at the close of trading on February 21, 2025, which is the trading day prior to the Redemption Date.

A copy of the Notice of Redemption delivered by the Company is filed as Exhibit 99.2 hereto and is incorporated herein by reference.

None of this Current Report on Form 8-K, the press release attached as Exhibit 99.1, nor the Notice of Redemption attached as Exhibit 99.2 constitutes an offer to sell or the solicitation of an offer to buy any securities of the Company, and the foregoing shall not constitute an offer, solicitation or sale in any jurisdiction in which such offering, solicitation or sale would be unlawful.

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, including statements regarding the Company’s expected financial

results for the year ended December 31, 2024, the expected Redemption Date of the Warrants, and the delisting of the Warrants on the trading day prior to the Redemption Date. These forward-looking statements may be identified by their use of terms and phrases such as “anticipate,” “believe,” “continue,” “enable,” “expect,” “plan,” “will,” and other similar terms and phrases. The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements, including those factors contained in the “Risk Factors” section of our filings with the Securities and Exchange Commission. It is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Current Report on Form 8-K. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur. The Company assumes no obligation to, and does not currently intend to, update any such forward-looking statements, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated January 23, 2025 |

| | Notice of Redemption dated January 23, 2025 |

| 104 | | Cover Page Interactive Data File, formatted in inline XBRL (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 23, 2025

| | | | | | | | |

| | | GRINDR INC. |

| | | |

| | | By: |

| | | |

| | | /s/ Vandana Mehta-Krantz |

| | | Vandana Mehta-Krantz |

| | | Chief Financial Officer |

Exhibit 99.1

Grindr Inc. Expects to Beat 2024 Revenue Outlook and Announces Redemption of Warrants

Company Projects Full-Year 2024 Revenue of $343–$345 Million and Reaffirms

Adjusted EBITDA Margin of 42% or Greater

Announces Redemption of Public Warrants and Private Placement Warrants

LOS ANGELES, CA – January 23, 2025 – Grindr Inc. (NYSE: GRND) (“Grindr” or the “Company”), the Global Gayborhood in Your PocketTM, today announced that it is providing notice to holders of its outstanding public warrants and private placement warrants (collectively, the “warrants”) that it will redeem the warrants at a redemption price of $0.10 per warrant at 5:00 p.m. New York City time on February 24, 2025 (the “Redemption Date”). Holders of the warrants may instead elect to exercise their warrants until 5:00 p.m. New York City time on the Redemption Date. At the time of this press release, Grindr has 18,799,825 public warrants and 18,560,000 private placement warrants outstanding.

Redemption of Outstanding Warrants

Pursuant to the terms of the warrant agreement, Grindr is entitled to redeem all, but not less than all, of the outstanding warrants at a redemption price of $0.10 per warrant if the last reported sales price of its common stock, for any 20 trading days within the 30 trading-day period ending on the third trading day prior to the date on which the notice of redemption is given, equals or exceeds $10.00 per share and is less than $18.00 per share. This share price condition was met as of January 17, 2025, three trading days prior to the redemption notice being provided on January 23, 2025.

At the Company’s request, the warrant agent is delivering a notice of redemption to each of the registered holders of the warrants on behalf of the Company.

If a holder of warrants does not wish for its warrants to be redeemed, such holder may exercise its warrants until 5:00 p.m., New York City time, on the Redemption Date. In connection with the redemption, warrant holders may elect to (i) exercise their warrants for cash, at an exercise price of $11.50 per share of the Company’s common stock; or (ii) exercise their warrants on a “cashless basis” in accordance with subsection 6.1.2 of the warrant agreement, in which case, the holder will receive a number of shares of the Company’s common stock to be determined in accordance with the terms of the warrant agreement and based on the Redemption Date and the volume-weighted average price of the Company’s common stock during the ten trading days immediately following January 23, 2025, the date on which the redemption notice was sent to holders of warrants. In no event will the number of shares of common stock issued in connection with an exercise on a cashless basis in accordance with subsection 6.1.2 of the warrant agreement exceed 0.361 shares of common stock per warrant. Any warrants that remain unexercised as of 5:00 p.m., New York City time, on the Redemption Date, will be void and no longer exercisable, and the holders of those warrants will be entitled to receive $0.10 per warrant.

Holders of warrants in “street name” should immediately contact their broker to determine their broker’s procedure for exercising their warrants since the process to exercise is voluntary.

The public warrants are listed on the New York Stock Exchange under the ticker symbol “GRND.WS.” Grindr understands from the New York Stock Exchange that, as a result of the redemption of the outstanding warrants, the warrants will cease to be listed on the New York Stock Exchange, effective at the close of trading on February 21, 2025, which is the trading day prior to the Redemption Date.

None of Grindr, its board of directors or employees have made or are making any representation or recommendation to any warrant holder as to whether or not to exercise or refrain from exercising any warrants.

The shares of common stock underlying the warrants have been registered by Grindr under the Securities Act of 1933, as amended, and are covered by a registration statement filed with, and declared effective by, the Securities and Exchange Commission (Registration No. 333-268782).

Questions concerning redemption and exercise of the warrants can be directed to Continental Stock Transfer & Trust Company, by mail at One State Street, 30th Floor, New York, NY 10004-1571, or by telephone at 800-509-5586. For a copy of the notice of redemption sent to the holders of the warrants and a prospectus relating to the shares of common stock issuable upon exercise of the warrants, please send an email request to IR@grindr.com or visit our website at https://investors.grindr.com/overview/default.aspx.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities of Grindr, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful.

Updated Financial Outlook

Grindr also announced today that it expects full year 2024 revenue growth to exceed the Company’s previously provided outlook of at least 29% revenue growth year-over-year. Grindr now expects full year 2024 revenue to be between $343 and $345 million, representing revenue growth of 32%-33% year-over-year. Grindr also announced today that it reaffirms its previously provided outlook for Adjusted EBITDA margin of 42% or greater for full year 2024.

The increase in revenue growth versus the financial outlook was driven by a combination of outperformance in Grindr’s direct ad sales business, which significantly exceeded expectations in December 2024, and continued strength on the direct revenue side (subscriptions and add ons). Financial results for the fourth quarter and full year 2024 are expected to be reported in March 2025.

Forward Looking Statements

This press release contains statements that may constitute forward-looking statements within the meaning of the federal securities laws and within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify these forward-looking statements by the use of terminology such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “goal,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “upcoming,” “will” or the negative version of these words or other comparable words or phrases. These forward-looking statements include, among others, statements regarding the Company’s expected revenue growth and Adjusted EBITDA margin for full year 2024, the delisting of the warrants on the trading day prior to the Redemption Date, and its expected reporting of financial results for the fourth quarter and full year 2024 in March 2025. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are not guarantees of future performance and are subject to risks and uncertainties that may cause actual results to differ materially from expectations discussed in the forward-looking statements. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including those discussed in the section titled “Risk Factors” in annual reports on Form 10-K and quarterly reports on Form 10-Q that we file with the Securities and Exchange Commission from time to time. Any forward-looking statement speaks only as of the date on which it is made, and you should not place undue reliance on forward-looking statements. Except to the extent required by applicable law, we are under no obligation (and expressly disclaim any such obligation) to update or revise our forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures

We use Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP measures, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may differ from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Adjusted EBITDA adjusts for the impact of items that we do not consider indicative of the operational performance of our business. We define Adjusted EBITDA as net income (loss) excluding income tax provision (benefit); interest expense, net; depreciation and amortization; stock-based compensation expense; transaction-related costs; gain (loss) in fair value of warrant liability; and severance expense, litigation-related costs, and other items, in each case that are unrelated to our core ongoing business operations. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA for a period by revenue for the same period. We exclude the above items as some are non-cash in nature and others may not be representative of normal operating results. While we believe that Adjusted EBITDA and Adjusted EBITDA Margin are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with GAAP.

At this time, we are not able to estimate our expected net income (loss) or net income (loss) margin for the full year ended December 31, 2024, or to reconcile the guidance provided for Adjusted EBITDA margin to net income (loss) margin for the full year 2024 without unreasonable efforts due to the variability and complexity of the charges excluded from Adjusted EBITDA. Accordingly, we are relying on the forward-looking exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude these reconciliations. The variability of the charges, including stock-based compensation and income tax provision (benefit), could have a significant and potentially unpredictable impact on our GAAP financial results.

Trademarks

This press release may contain trademarks of Grindr. Solely for convenience, trademarks referred to in this press release may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that Grindr will not assert, to the fullest extent under applicable law, its rights to these trademarks.

About Grindr Inc.

With more than 14.5 million average monthly active users, Grindr has grown to become the Global Gayborhood in Your PocketTM, on a mission to make a world where the lives of our global community are free, equal, and just. Available in 190 countries and territories, Grindr is often the primary way for its users to connect, express themselves, and discover the world around them. Since 2015 Grindr for Equality has advanced human rights, health, and safety for millions of LGBTQ+ people in partnership with organizations in every region of the world. Grindr has offices in West Hollywood, the Bay Area, Chicago, and New York. The Grindr app is available on the App Store and Google Play.

Investors:

IR@grindr.com

Media:

Press@grindr.com

Exhibit 99.2

January 23, 2025

NOTICE OF REDEMPTION OF ALL OUTSTANDING PUBLIC WARRANTS (CUSIP 39854F119) AND PRIVATE PLACEMENT WARRANTS

Dear Warrant Holder:

Grindr Inc. (f/k/a Tiga Acquisition Corp.) (the “Company”) hereby gives notice that it is redeeming, at 5:00 p.m. New York City time on February 24, 2025 (the “Redemption Date”), in each case for a redemption price of $0.10 per Warrant (as defined below), all of its outstanding Warrants that were issued under that certain Warrant Agreement, dated as of November 23, 2020, as amended by that certain First Amendment to Warrant Agreement, dated as of November 17, 2022 (as amended, the “Warrant Agreement”), by and between the Company and Continental Stock Transfer & Trust Company, as warrant agent (the “Warrant Agent”).

The Warrants consist of (i) 18,560,000 warrants (the “Private Placement Warrants”) issued pursuant to that certain Private Placement Warrants Purchase Agreement, dated as of November 23, 2020, by and between the Company and Tiga Sponsor LLC (the “Sponsor”), (ii) 2,500,000 forward purchase warrants and 2,500,000 backstop warrants (collectively, the “Forward Purchase Warrants”) issued pursuant to that certain Amended and Restated Forward Purchase Agreement, dated May 9, 2022, by and between the Company and Sponsor, and (iii) 13,799,825 warrants (together with the Private Placement Warrants and the Forward Purchase Warrants, the “Warrants”), issued as part of the units in the initial public offering of the Company’s equity securities The Warrants are exercisable for shares of the Company’s common stock, $0.0001 par value per share (the “Common Stock”).

Continental Stock Transfer & Trust Company acts as warrant agent with respect to the Warrants.

Under the terms of the Warrant Agreement, the Company is entitled to redeem all, but not less than all, of the outstanding Warrants (including the Private Placement Warrants in accordance with clause (ii) of Section 6.1.2 of the Warrant Agreement) at a redemption price of $0.10 per Warrant if the last reported sales price per share of Common Stock for any twenty trading days within the thirty-day trading period ending on the third trading day prior to the date on which a notice of redemption is given (the “Reference Value”) equals or exceeds $10.00 per share and the Reference Value is less than $18.00 per share. At the direction of the Company, the Warrant Agent is delivering this notice of redemption (this “Notice of Redemption”) to each of the registered holders of the outstanding Warrants.

The Warrants may be exercised by the holders thereof until 5:00 p.m. New York City time on the Redemption Date to purchase fully paid and non-assessable shares of Common Stock underlying such Warrants. At any time after this Notice of Redemption has been delivered and prior to 5:00 p.m. New York City time on the Redemption Date, Warrant holders exercising warrants in connection with the redemption may elect to (i) exercise their Warrants for cash, at an exercise price of $11.50 per share of Common Stock (the “Cash Exercise Price”) or (ii) exercise their Warrants on a “cashless basis” in accordance with subsection 6.1.2 of the Warrant Agreement, in which case the holder will receive a number of shares of Common Stock to be determined in accordance with the terms of the Warrant Agreement and based on the Redemption Date and the volume weighted average price (the “Redemption Fair Market Value”) of the Common Stock during the ten trading days immediately following the date on which this Notice of Redemption is sent to registered holders of Warrants. The Company will provide holders the Redemption Fair Market Value no later than one business day after such ten-trading day period ends. In no event will the number of shares of Common Stock issued in connection with an exercise on a cashless basis in accordance with subsection 6.1.2 of the Warrant Agreement exceed 0.361 shares of Common Stock per Warrant. If any holder of Warrants would, after taking into account all of such holder’s Warrants exercised at one time, be entitled to receive a fractional interest in a share of Common Stock, the number of shares of Common Stock the holder will be entitled to receive will be rounded down to the nearest whole number of shares of Common Stock.

The Warrants and Common Stock are listed on the New York Stock Exchange (the “NYSE”) under the symbols “GRND.WS” and “GRND,” respectively. We understand from the NYSE that February 21, 2025, the trading day prior to the Redemption Date, will be the last day on which the Warrants will be traded on the NYSE.

The CUSIP number appearing herein has been included solely for the convenience of the holders of the Warrants. No representation is made as to the correctness or accuracy of the CUSIP number either as printed on the Warrants or as contained in this Notice of Redemption. Any redemption of the Warrants shall not be affected by any defect in or omission of such identification number.

TERMS OF REDEMPTION; CESSATION OF RIGHTS

The rights of the Warrant holders to exercise their Warrants will terminate immediately prior to 5:00 p.m. New York City time on the Redemption Date. Any Warrants that remain unexercised at 5:00 p.m. New York City time on the Redemption Date will be void and no longer exercisable and their holders will have no rights with respect to those Warrants, except to receive the Redemption Price or as otherwise described in this notice for holders who hold their Warrants in “street name.” We encourage you to consult with your broker, financial advisor, and/or tax advisor to consider whether or not to exercise your Warrants.

The Company is exercising this right to redeem the Warrants pursuant to Section 6.1.2 of the Warrant Agreement. Pursuant to such provision, the Company has the right to redeem all, but not less than all, of the outstanding Warrants if the Reference Value equals or exceeds $10.00 per share, and if the Reference Value is less than $18.00 per share, the Private Placement Warrants are also concurrently called for redemption on the same terms as the outstanding Warrants.

The last sales price of the Common Stock has equaled or exceeded $10.00 per share and was less than $18.00 per share on each of twenty trading days within the thirty-day trading period ending on January 17, 2025 (the third trading day prior to the date of this Notice of Redemption).

EXERCISE PROCEDURE

Warrant holders have until 5:00 p.m. New York City time on the Redemption Date to exercise their Warrants to purchase Common Stock. Payment upon exercise of the Warrants in connection with the redemption may be made either (i) in cash, at the Cash Exercise Price, or (ii) on a “cashless basis” in accordance with subsection 6.1.2 of the Warrant Agreement, in which case the holder will receive a number of shares of Common Stock to be determined in accordance with the terms of the Warrant Agreement and based on the Redemption Date and the Redemption Fair Market Value. The Company will notify holders as to the Redemption Fair Market Value no later than one business day after the relevant ten-trading day period ends. In no event will the number of shares of Common Stock issued in connection with an exercise on a cashless basis in accordance with subsection 6.1.2 of the Warrant Agreement exceed 0.361 shares of Common Stock per Warrant. If any holder of Warrants would, after taking into account all of such holder’s Warrants exercised at one time, be entitled to receive a fractional interest in a share of Common Stock, the number of shares of Common Stock the holder will be entitled to receive will be rounded down to the nearest whole number of shares of Common Stock.

Holders who hold their Warrants in “street name” should immediately contact their broker to determine their broker’s procedure for exercising their Warrants. The act of exercising is VOLUNTARY, meaning holders must instruct their brokers to submit their Warrants for exercise.

Persons who are holders of record of their Warrants may exercise their Warrants in connection with the redemption by sending (i) a properly completed and executed “Election to Purchase” (the form of which is attached hereto as Annex A) to the Warrant Agent’s address set forth below, indicating, among other things, the number of Warrants being exercised and whether such Warrants are being exercised for cash or on a cashless basis; and (ii) if exercised for cash, payment in full of the Cash Exercise Price (and any and all applicable taxes) via wire transfer or other method of payment permitted by the Warrant Agreement.

Wire instructions will be provided to the Depository Trust Company and will otherwise be provided upon request. Payment of the Cash Exercise Price may be made by wire transfer of immediately available funds or in certified check or bank draft payable to the Warrant Agent. If you wish to request information on how to wire funds to the Warrant Agent, please contact the Warrant Agent via email at compliance@continentalstock.com.

The properly completed and executed Election to Purchase and, if the applicable Warrants are exercised for cash, payment in full of the Cash Exercise Price must be received by the Warrant Agent prior to 5:00 p.m. New York City time on the Redemption Date. Subject to the following paragraph, any failure to deliver a properly completed and executed Election to Purchase or, if the applicable Warrants are exercised for cash, the payment in full of the Cash Exercise Price before such time will result in such holder’s Warrants being redeemed and not exercised.

WARRANTS HELD IN STREET NAME

For Warrant holders who hold their Warrants in “street name,” provided that a Notice of Guaranteed Delivery is received by the Warrant Agent by 5:00 p.m. New York City Time on the Redemption Date, broker-dealers shall have two business days from the Redemption Date, or 5:00 p.m. New York City Time on February 26, 2025, to deliver the Public Warrants to

the Warrant Agent. Any such Public Warrants received without the Election to Purchase or the Notice of Guaranteed Delivery having been duly executed and fully and properly completed will be deemed to have been delivered for redemption (at $0.10 per Warrant), and not for exercise.

PROSPECTUS

A prospectus (and the supplements thereto) covering the Common Stock issuable upon the exercise of the Warrants is included in a registration statement filed with, and declared effective by, the Securities and Exchange Commission (Registration No. 333-276210) (the “SEC”). The SEC also maintains an Internet website that contains a copy of the prospectus (and the supplements thereto) included in the registration statement. The address of this site is www.sec.gov. Alternatively, to obtain a copy of the prospectus (and the supplements thereto), please visit our website at https://investors.grindr.com/overview/default.aspx.

REDEMPTION PROCEDURE

Payment of the Redemption Price will be made by the Company after 5:00 p.m. New York City time on the Redemption Date. Those who hold their shares in “street name” should contact their broker to determine their broker’s procedure for redeeming their Warrants.

*********************************

Any holder of Warrants receiving a Notice of Redemption should consult with such holder’s own financial adviser, tax adviser and/or legal adviser to the extent such holder has any questions relating to its specific circumstances.

Any questions you may have about redemption and exercising your Warrants or the procedures thereof may be directed to the Company’s Warrant Agent, Continental Stock Transfer & Trust Company, at:

Continental Stock Transfer & Trust Company

One State Street, 30th Floor

New York, NY 10004-1574

Attention: Compliance Department

Telephone: 800-509-5586

Email: compliance@continentalstock.com

Sincerely,

| | | | | |

| By: | /s/ George Arison |

| Name: George Arison |

| Title: Chief Executive Officer |

Annex A

ELECTION TO PURCHASE

(To Be Executed Upon Exercise of Warrant)

The undersigned hereby irrevocably elects to exercise the right, represented by this Warrant Certificate, to receive the number of shares of common stock of Grindr Inc. (the “Company”), $0.0001 par value per share (the “Common Stock”), as set forth below in accordance with the terms of that certain Warrant Agreement, dated as of November 23, 2020, as amended by that certain First Amendment to Warrant Agreement, dated as of November 17, 2022 (as amended, the “Warrant Agreement”), by and between the Company (f/k/a Tiga Acquisition Corp.) and Continental Stock Transfer & Trust Company (the “Warrant Agent”), as warrant agent, and herewith tenders payment for such Common Stock in accordance with the terms of the Warrant Agreement, pursuant to (choose one of the following):

☐ Cash Exercise. Section 3.3.1(a) of the Warrant Agreement: in lawful money of the United States, in good certified check or good bank draft payable to the order of the Warrant Agent in the amount calculated as follows:

| | | | | | | | |

| (a) | ______________________ | The number of shares of Common Stock underlying the Warrants the undersigned is exercising pursuant to Section 3.3.1(a) of the Warrant Agreement. |

| (b) | $______________________ | The aggregate Exercise Price representing the product of the number of Common Stock underlying the Warrants ((a) above) multiplied by the $11.50 per share Exercise Price. |

☐ Cashless Exercise. Section 3.3.1(b)(i) or Section 3.3.1(c) of the Warrant Agreement, as applicable: as a “Make-Whole Exercise” on a “cashless basis” calculated as follows; provided that the undersigned understands and acknowledges that this method of exercise will not be available if at any point between the date of the Notice of Redemption and the Redemption Date the registration statement covering the issuance of the Common Stock issuable upon the exercise of the Warrants ceases to be effective or the prospectus relating to such shares of Common Stock ceases to be available:

| | | | | | | | |

| (a) | ______________________ | The number of shares of Common Stock underlying the Warrants the undersigned is exercising pursuant to Section 3.3.1(b)(i) or 3.3.1(c) of the Warrant Agreement. |

| (b) | Between 30-33 months | The number of months from the Redemption Date to the expiration date of the Warrants. |

| (c) | $_____________________ | The Redemption Fair Market Value, which is the volume weighted average price of the Common Stock during the ten trading days immediately following the date on which the Notice of Redemption was sent to registered holders of the Warrants, and therefore is not calculable as of this date. The Company will provide Warrant holders with the Redemption Fair Market Value no later than one business day after the ten trading day period described above |

| (d) | ______________________ | The ratio obtained using the values in (b) and (c) above by reference to the table in Section 6.1.2 of the Warrant Agreement. This ratio will be provided when the Company provides the Redemption Fair Market Value. |

| (e) | ______________________ | The number of shares of Common Stock issued on exercise of the Warrants pursuant to Section 3.3.1(b)(i) or 3.3.1(c) of the Warrant Agreement (i.e., (d) multiplied by (a) in this table). |

Terms used but not defined herein shall have the respective meanings given to them in the Warrant Agreement.

The undersigned requests that a certificate for such shares of Common Stock be registered in the name of:

| | |

(Please Type or Print Name)

|

(Social Security or Tax Identification Number)

|

| | | | | |

| whose address is and that such shares of Common Stock be delivered to | |

| (Please Type or Print Address) |

If said number of shares of Common Stock is less than all of the shares of Common Stock purchasable hereunder, the undersigned requests that a new Warrant Certificate representing the remaining balance of such shares of Common Stock be registered in the name of:

| | |

(Please Type or Print Name)

|

(Social Security or Tax Identification Number)

|

| | | | | |

| whose address is and that such Warrant Certificate be delivered to | |

| (Please Type or Print Address) |

| | | | | |

| whose address is | |

| (Please Type or Print Address) |

| | | | | | | | | | | |

| Dated: | | | (Signature)

|

| | | (Address)

|

| | | (Tax Identification Number) |

Guaranteed: _____________________________________

THE SIGNATURE(S) SHOULD BE GUARANTEED BY AN ELIGIBLE GUARANTOR INSTITUTION (BANKS, STOCKBROKERS, SAVINGS AND LOAN ASSOCIATIONS AND CREDIT UNIONS WITH MEMBERSHIP IN AN APPROVED SIGNATURE GUARANTEE MEDALLION PROGRAM, PURSUANT TO S.E.C. RULE 17Ad-15 UNDER THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED).

v3.24.4

Cover

|

Jan. 23, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 23, 2025

|

| Entity Registrant Name |

Grindr Inc.

|

| Entity File Number |

001-39714

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

92-1079067

|

| Entity Address, Address Line One |

PO Box 69176

|

| Entity Address, Address Line Two |

750 N. San Vicente Blvd.

|

| Entity Address, Address Line Three |

Suite RE 1400

|

| Entity Address, City or Town |

West Hollywood

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90069

|

| City Area Code |

310

|

| Local Phone Number |

776-6680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001820144

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GRND

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

GRND.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

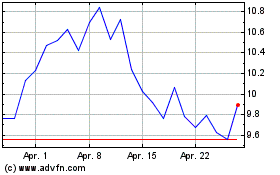

Grindr (NYSE:GRND)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Grindr (NYSE:GRND)

Historical Stock Chart

Von Jan 2024 bis Jan 2025